Cruise vacation company Royal Caribbean (NYSE:RCL) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 17.4% year on year to $4.89 billion. Its non-GAAP profit of $5.20 per share was 3.3% above analysts’ consensus estimates.

Is now the time to buy Royal Caribbean? Find out by accessing our full research report, it’s free.

Royal Caribbean (RCL) Q3 CY2024 Highlights:

- Revenue: $4.89 billion vs analyst estimates of $4.90 billion (in line)

- Adjusted EPS: $5.20 vs analyst estimates of $5.03 (3.3% beat)

- EBITDA: $2.15 billion vs analyst estimates of $2.05 billion (4.6% beat)

- Management raised its full-year Adjusted EPS guidance to $11.59 at the midpoint, a 1.7% increase

- Gross Margin (GAAP): 51.1%, up from 49.9% in the same quarter last year

- Operating Margin: 33.4%, up from 30.4% in the same quarter last year

- EBITDA Margin: 44%, up from 39.2% in the same quarter last year

- Free Cash Flow Margin: 11.5%, up from 9.1% in the same quarter last year

- Passenger Cruise Days: 14.79 million, up 1.61 million year on year

- Market Capitalization: $54.71 billion

"Our exceptional third quarter results and increased full year expectations reflect the robust demand for our differentiated vacation experiences," said Jason Liberty, president and CEO, Royal Caribbean Group.

Company Overview

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

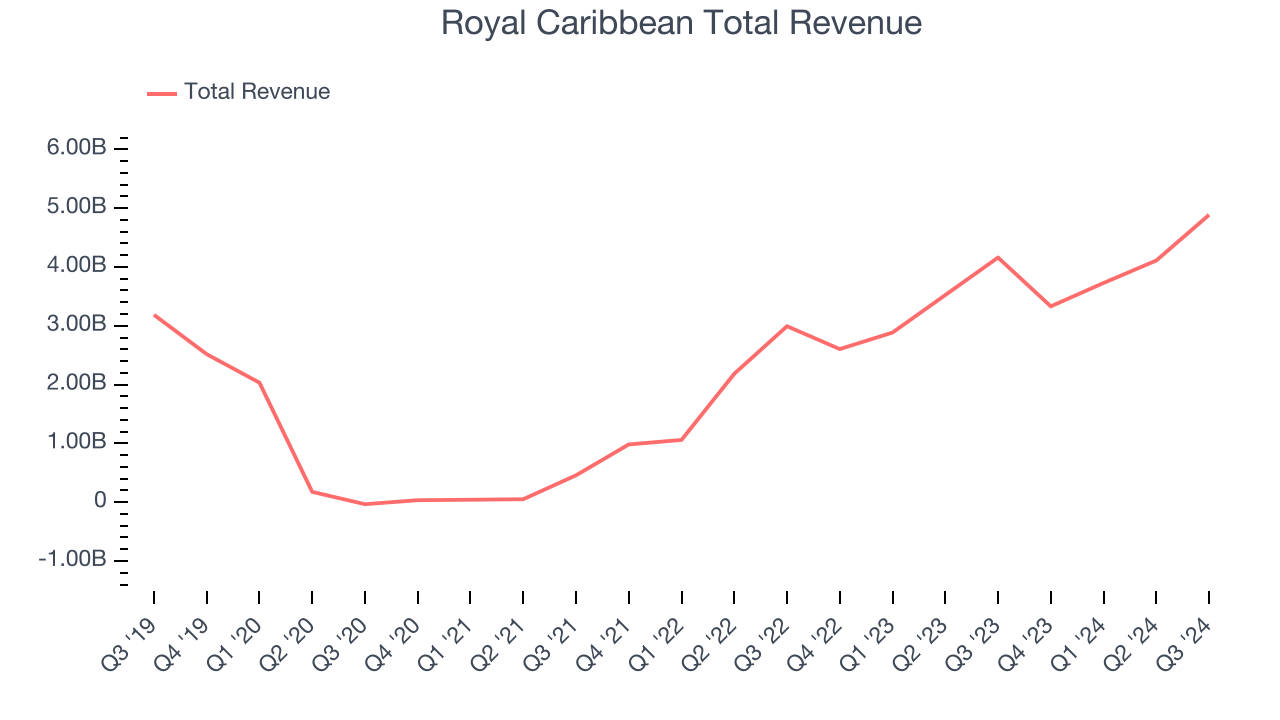

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Royal Caribbean’s sales grew at a sluggish 8.3% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Royal Caribbean’s annualized revenue growth of 49.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Royal Caribbean’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

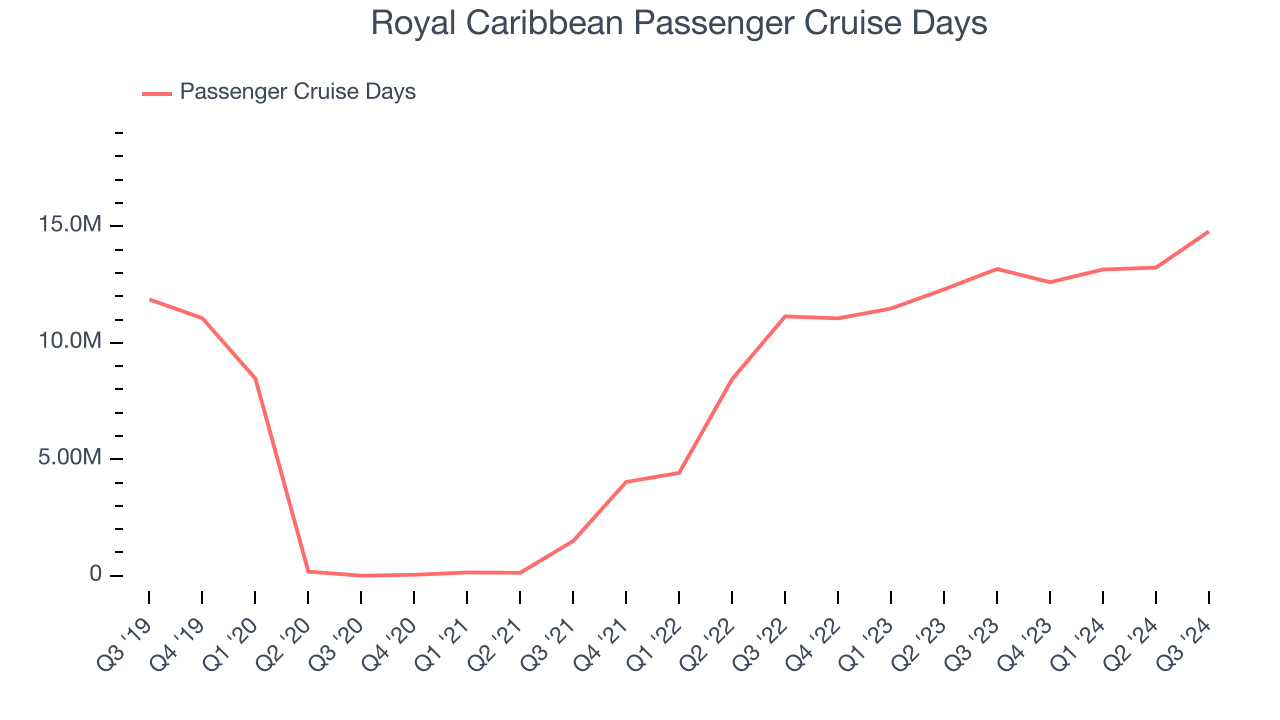

Royal Caribbean also discloses its number of passenger cruise days, which reached 14.79 million in the latest quarter. Over the last two years, Royal Caribbean’s passenger cruise days averaged 55.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Royal Caribbean’s year-on-year revenue growth was 17.4%, and its $4.89 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates the market believes its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

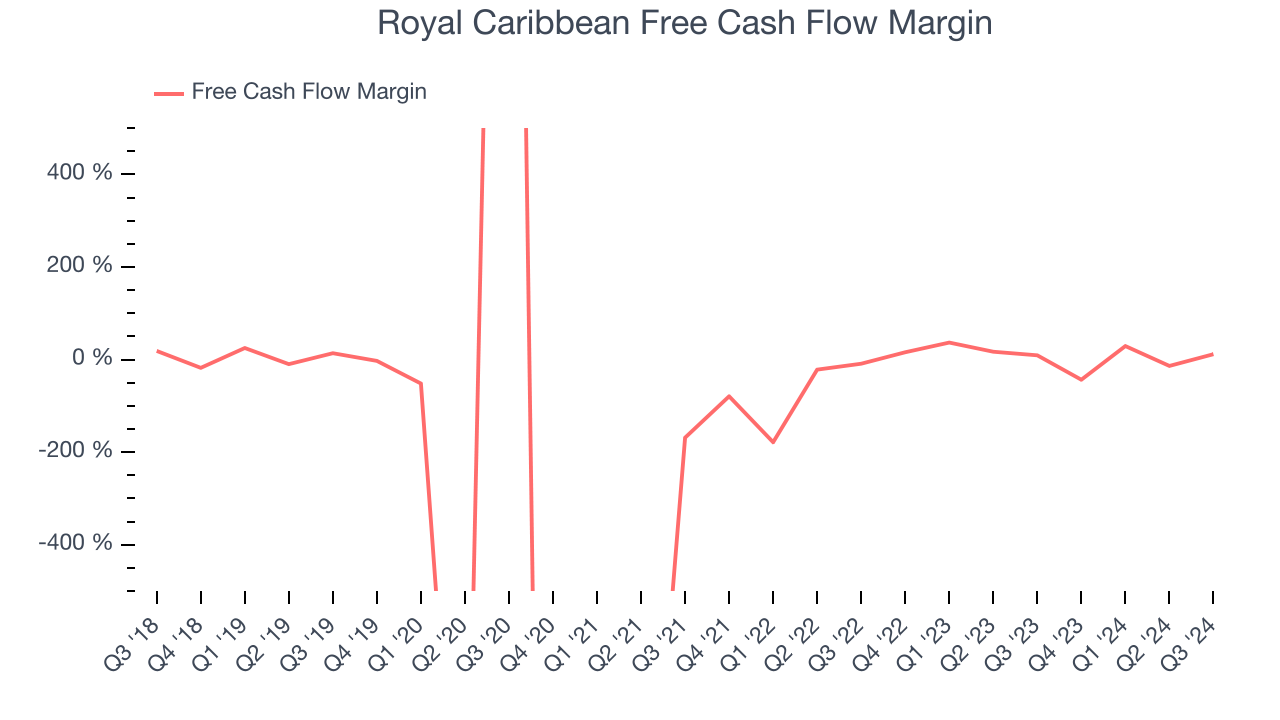

Royal Caribbean has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.1%, subpar for a consumer discretionary business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Royal Caribbean to make large cash investments in working capital and capital expenditures.

Royal Caribbean’s free cash flow clocked in at $563 million in Q3, equivalent to a 11.5% margin. This result was good as its margin was 2.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Royal Caribbean’s Q3 Results

It was good to see Royal Caribbean beat analysts’ EBITDA expectations this quarter. We were also happy its EPS narrowly outperformed Wall Street’s estimates. On the other hand, its EPS forecast for next quarter missed and its number of passenger cruise days fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4% to $195.46 immediately after reporting.

Is Royal Caribbean an attractive investment opportunity right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.