Cruise vacation company Royal Caribbean (NYSE:RCL) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 29.2% year on year to $3.73 billion. It made a non-GAAP profit of $1.77 per share, improving from its loss of $0.23 per share in the same quarter last year.

Is now the time to buy Royal Caribbean? Find out by accessing our full research report, it's free.

Royal Caribbean (RCL) Q1 CY2024 Highlights:

- Revenue: $3.73 billion vs analyst estimates of $3.69 billion (1% beat)

- EPS (non-GAAP): $1.77 vs analyst estimates of $1.31 (35.2% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $2.70 at the midpoint, above analyst estimates of $2.36

- EPS (non-GAAP) Guidance for full year 2024 raised to $10.80 at the midpoint, above analyst estimates of $10.01 (previous guidance was $9.60 at the midpoint)

- Gross Margin (GAAP): 44.1%, up from 41.3% in the same quarter last year

- Free Cash Flow of $1.09 billion is up from -$1.45 billion in the previous quarter

- Passenger Cruise Days: 13.15 million

- Market Capitalization: $35.19 billion

"Wow, what a great start to the year! Demand for our leading brands and the incredible experiences they deliver continues to be very robust, resulting in outperformance in the first quarter, a further increase of full year earnings guidance, and 60% expected earnings growth year over year," said Jason Liberty, president and CEO, Royal Caribbean Group.

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

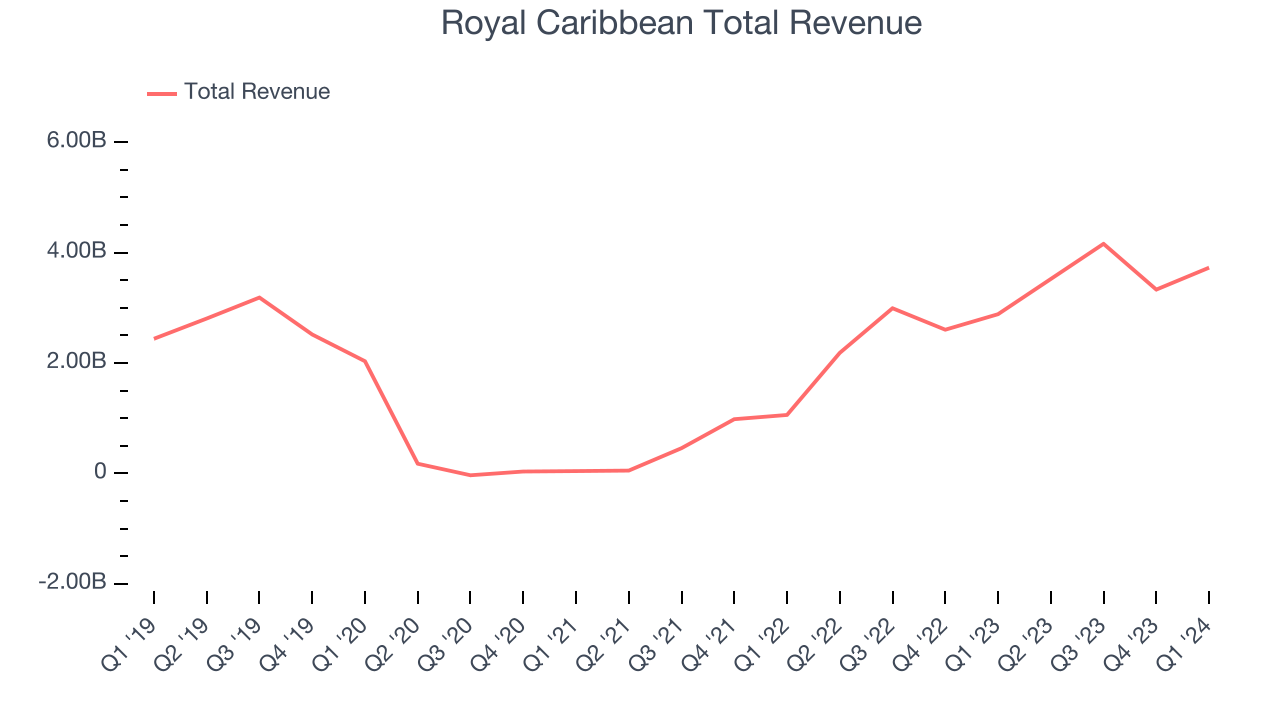

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Royal Caribbean's annualized revenue growth rate of 8.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Royal Caribbean's annualized revenue growth of 140% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Royal Caribbean's annualized revenue growth of 140% over the last two years is above its five-year trend, suggesting some bright spots.

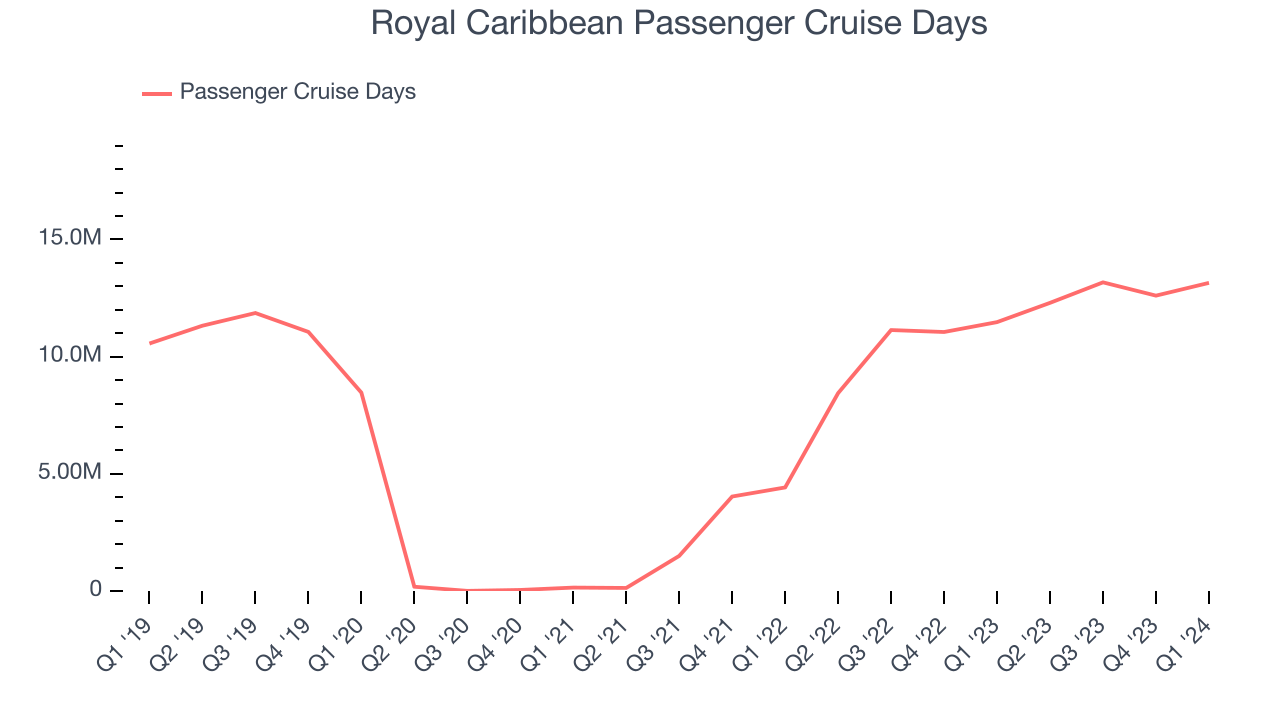

We can dig even further into the company's revenue dynamics by analyzing its number of passenger cruise days, which reached 13.15 million in the latest quarter. Over the last two years, Royal Caribbean's passenger cruise days grew massively as COVID impacted its base year numbers.

This quarter, Royal Caribbean reported remarkable year-on-year revenue growth of 29.2%, and its $3.73 billion of revenue topped Wall Street estimates by 1%. Looking ahead, Wall Street expects sales to grow 12.1% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Royal Caribbean has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.2%, subpar for a consumer discretionary business.

Royal Caribbean's free cash flow came in at $1.09 billion in Q1, equivalent to a 29.1% margin and in line with the same quarter last year.

Key Takeaways from Royal Caribbean's Q1 Results

We were impressed by how significantly Royal Caribbean blew past analysts' EPS expectations this quarter. We were also glad next quarter's earnings guidance exceeded Wall Street's estimates and full yea earnings guidance was raised to well above expectations. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 3.4% after reporting and currently trades at $141.39 per share.

Royal Caribbean may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.