Cruise vacation company Royal Caribbean (NYSE:RCL) announced better-than-expected results in Q1 CY2024, with revenue up 29.2% year on year to $3.73 billion. It made a non-GAAP profit of $1.77 per share, improving from its loss of $0.23 per share in the same quarter last year.

Royal Caribbean (RCL) Q1 CY2024 Highlights:

- Revenue: $3.73 billion vs analyst estimates of $3.69 billion (1% beat)

- EPS (non-GAAP): $1.77 vs analyst estimates of $1.31 (35.2% beat)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $2.70 at the midpoint, above analyst estimates of $2.36

- EPS (non-GAAP) Guidance for full year 2024 raised to $10.80 at the midpoint, above analyst estimates of $10.01 (previous guidance was $9.60 at the midpoint)

- Gross Margin (GAAP): 44.1%, up from 41.3% in the same quarter last year

- Free Cash Flow of $1.09 billion is up from -$1.45 billion in the previous quarter

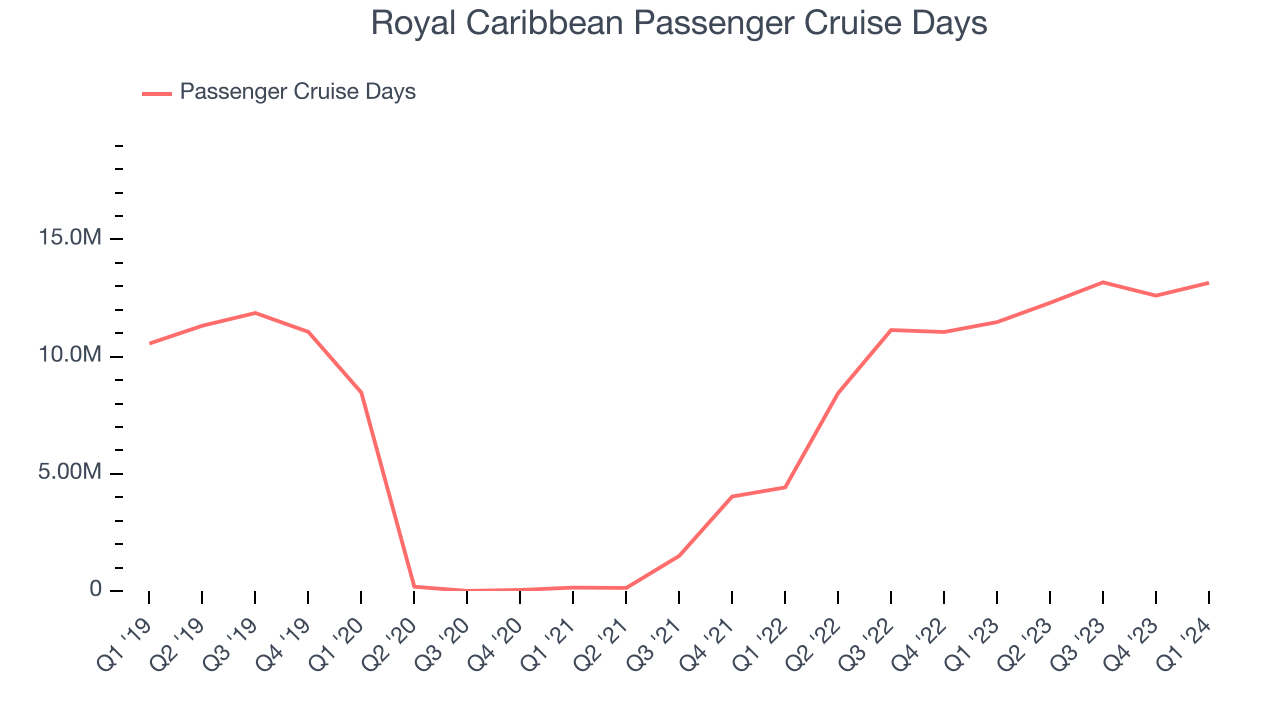

- Passenger Cruise Days: 13.15 million

- Market Capitalization: $35.19 billion

Established in 1968, Royal Caribbean Cruises (NYSE:RCL) is a global cruise vacation company renowned for its innovative and exciting cruise experiences.

With a fleet of more than 60 ships, Royal Caribbean offers a wide array of itineraries to destinations including the Caribbean, Alaska, Europe, South America, Asia, and Australia. The company operates through its various brands, most notably Royal Caribbean International, Celebrity Cruises, and Silversea Cruises.

Royal Caribbean International holds mega-ships and is known for features like robotic bartenders, massive water slides, skydiving simulators, and virtual balconies. Celebrity Cruises offers a more upscale and intimate experience, with an emphasis on fine dining, sophisticated ambiance, and exotic destinations. Silversea Cruises, acquired in 2018, extends Royal Caribbean's reach into the ultra-luxury and expedition cruise sectors.

The company has introduced many firsts at sea, including the first rock-climbing walls, ice-skating rinks, and the 360-degree Promenade on its ships, enhancing the onboard experience for guests. Most of Royal Caribbean's revenues are generated from passenger ticket sales. The balance comes from casino operations as well as onboard sales of food, beverage, retail shopping, and entertainment offerings like land excursions at port destinations.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Royal Caribbean's primary competitors include Carnival (NYSE:CCL), Norwegian Cruise Line (NYSE:NCLH), Disney Cruise Line (owned by Disney NYSE:DIS), and private companies Viking Cruises and MSC Cruises.Sales Growth

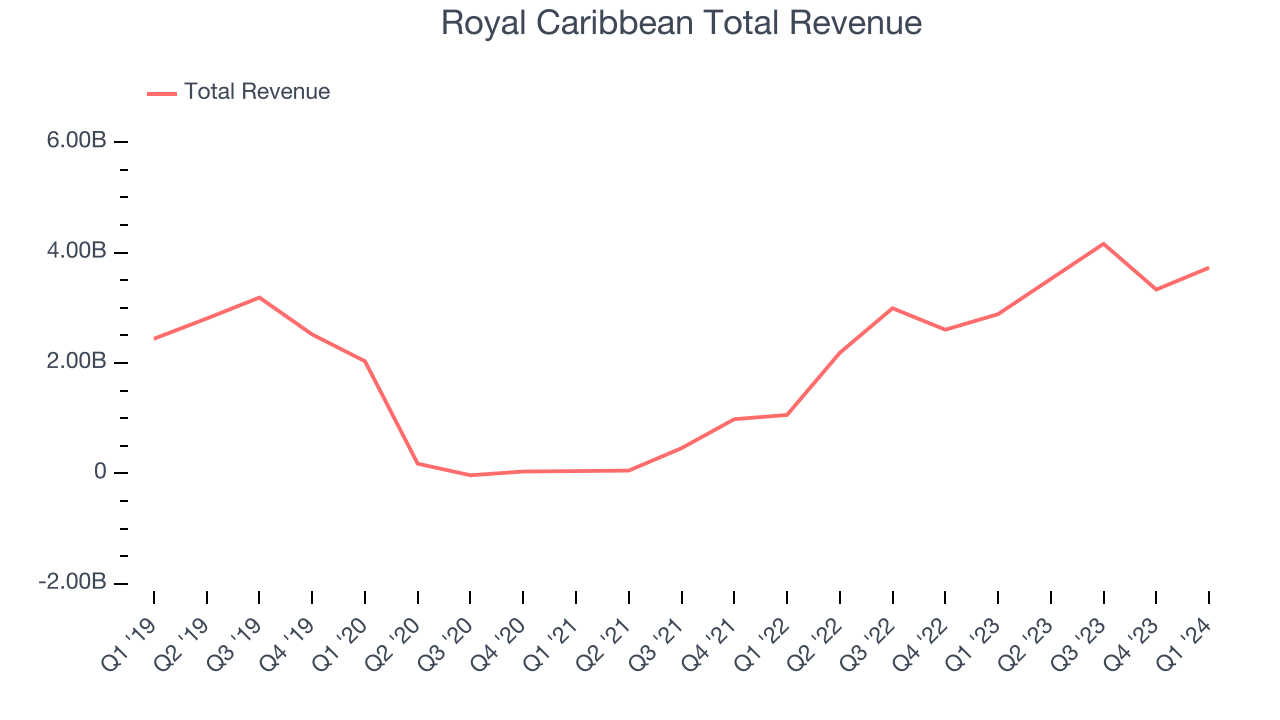

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Royal Caribbean's annualized revenue growth rate of 8.3% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Royal Caribbean's annualized revenue growth of 140% over the last two years is above its five-year trend, suggesting some bright spots.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Royal Caribbean's annualized revenue growth of 140% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its number of passenger cruise days, which reached 13.15 million in the latest quarter. Over the last two years, Royal Caribbean's passenger cruise days grew massively as COVID impacted its base year numbers.

This quarter, Royal Caribbean reported remarkable year-on-year revenue growth of 29.2%, and its $3.73 billion of revenue topped Wall Street estimates by 1%. Looking ahead, Wall Street expects sales to grow 12.1% over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Royal Caribbean has managed its expenses well over the last two years. It's demonstrated solid profitability for a consumer discretionary business, producing an average operating margin of 14.7%.

This quarter, Royal Caribbean generated an operating profit margin of 20.1%, up 10.7 percentage points year on year.

Over the next 12 months, Wall Street expects Royal Caribbean to maintain its LTM operating margin of 22.8%.

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Royal Caribbean's EPS was roughly flat, which isn't ideal. Thankfully, Royal Caribbean has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q1, Royal Caribbean reported EPS at $1.77, up from negative $0.23 in the same quarter last year. This print beat analysts' estimates by 35.2%. Over the next 12 months, Wall Street expects Royal Caribbean to grow its earnings. Analysts are projecting its LTM EPS of $8.69 to climb by 19.6% to $10.40.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Royal Caribbean has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.2%, subpar for a consumer discretionary business.

Royal Caribbean's free cash flow came in at $1.09 billion in Q1, equivalent to a 29.1% margin and in line with the same quarter last year.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Royal Caribbean reported $437 million of cash and $21.19 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $4.88 billion of EBITDA over the last 12 months, we view Royal Caribbean's 4.3x net-debt-to-EBITDA ratio as safe. We also see its $602.4 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Royal Caribbean's Q1 Results

We were impressed by how significantly Royal Caribbean blew past analysts' EPS expectations this quarter. We were also glad next quarter's earnings guidance exceeded Wall Street's estimates and full yea earnings guidance was raised to well above expectations. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 3.4% after reporting and currently trades at $141.39 per share.

Is Now The Time?

Royal Caribbean may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Royal Caribbean isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last five years, but at least growth is expected to increase in the short term. And while its number of passenger cruise days have surged over the last two years, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its low free cash flow margins give it little breathing room.

Royal Caribbean's price-to-earnings ratio based on the next 12 months is 13.2x. In the end, beauty is in the eye of the beholder. While Royal Caribbean wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $148.89 per share right before these results (compared to the current share price of $141.39).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.