American firearm manufacturing company Ruger (NYSE:RGR) fell short of analysts' expectations in Q1 CY2024, with revenue down 8.5% year on year to $136.8 million. It made a GAAP profit of $0.40 per share, down from its profit of $0.81 per share in the same quarter last year.

Ruger (RGR) Q1 CY2024 Highlights:

- Revenue: $136.8 million vs analyst estimates of $153.4 million (10.8% miss)

- Diluted EPS: $0.40 vs analyst estimates of $0.84 (52.4% miss)

- Gross Margin (GAAP): 21.5%, down from 25.8% in the same quarter last year

- Free Cash Flow of $5.56 million, down 55.3% from the previous quarter

- Market Capitalization: $805.3 million

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger was founded by William B. Ruger and Alexander McCormick Sturm in a small rented machine shop, with their first product, the Ruger Standard .22 caliber pistol, setting a high standard for reliable, well-made guns. The founders' vision was to offer shooters quality firearms that were both functional and affordable, filling a gap in the market for well-crafted weapons that could be enjoyed by shooting enthusiasts of all levels.

Today, Ruger provides an array of firearms, including rifles, pistols, and revolvers, catering to the needs of hunters, competitive shooters, and those seeking personal defense options. Specifically, the company's customers include law enforcement and military organizations as well as recreational shooters.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the firearm sector include Smith & Wesson Brands (NASDAQ:SWBI), Vista Outdoor (NYSE:VSTO), and American Outdoor Brands (NASDAQ:AOUT).Sales Growth

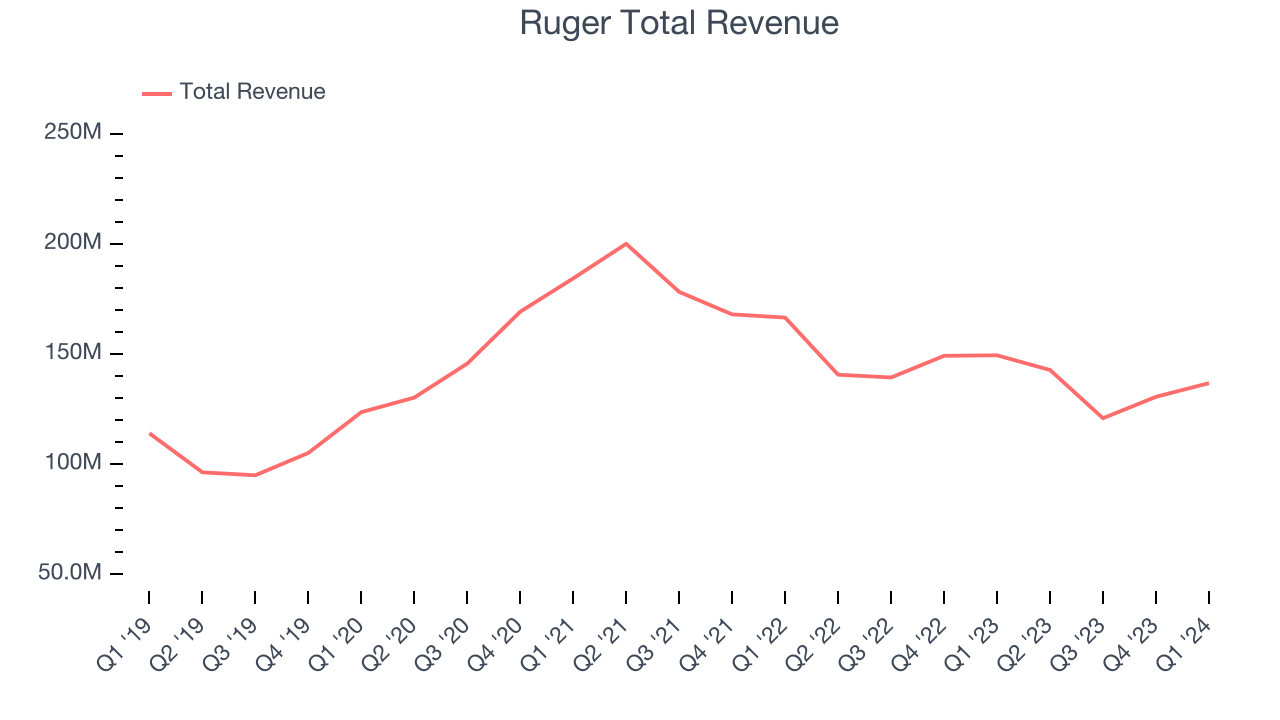

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Ruger's annualized revenue growth rate of 2.1% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Ruger's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 13.7% over the last two years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Ruger's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 13.7% over the last two years.

This quarter, Ruger missed Wall Street's estimates and reported a rather uninspiring 8.5% year-on-year revenue decline, generating $136.8 million of revenue.

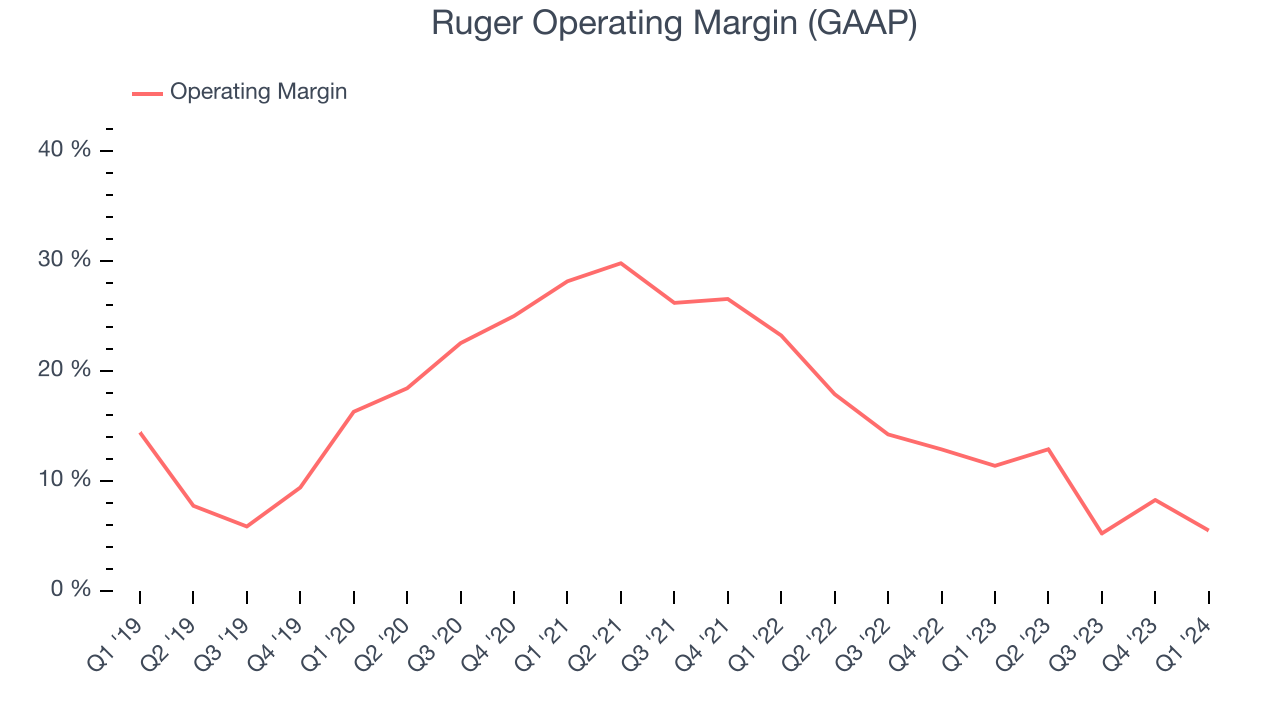

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Ruger has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 11.2%, higher than the broader consumer discretionary sector.

This quarter, Ruger generated an operating profit margin of 5.5%, down 5.9 percentage points year on year.

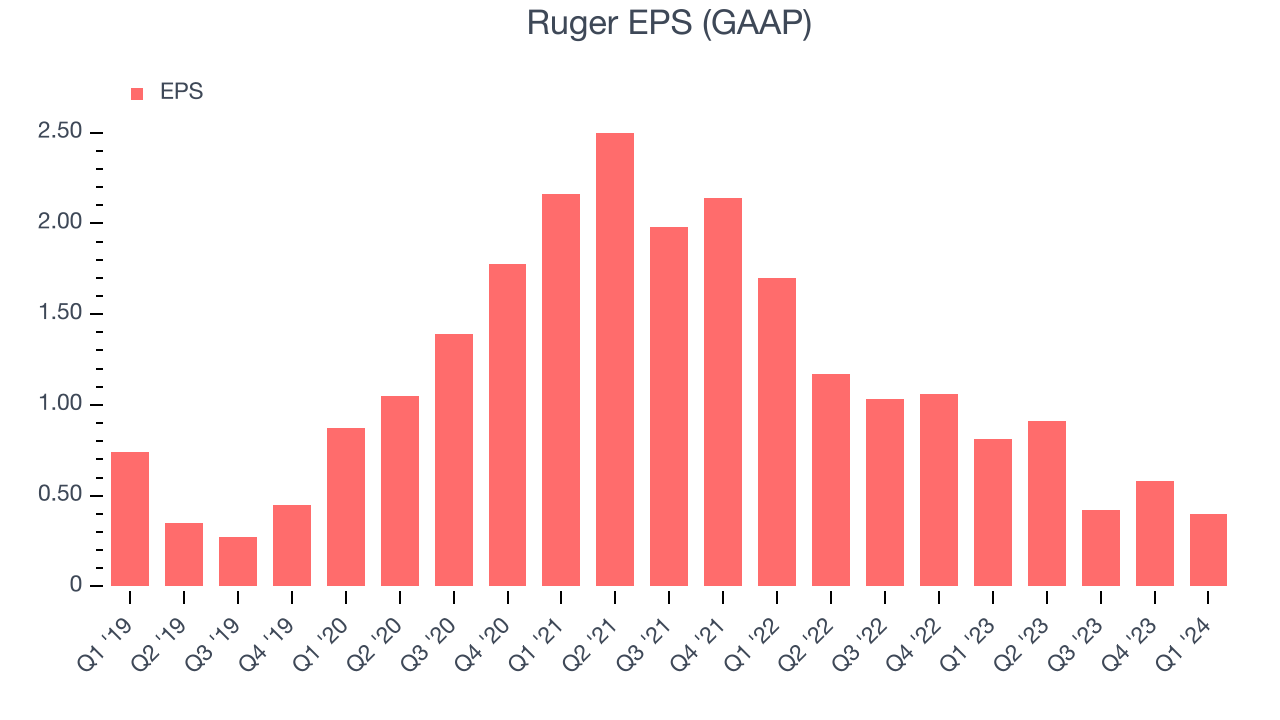

EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Ruger's EPS dropped 36.5%, translating into 6.4% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, Ruger reported EPS at $0.40, down from $0.81 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

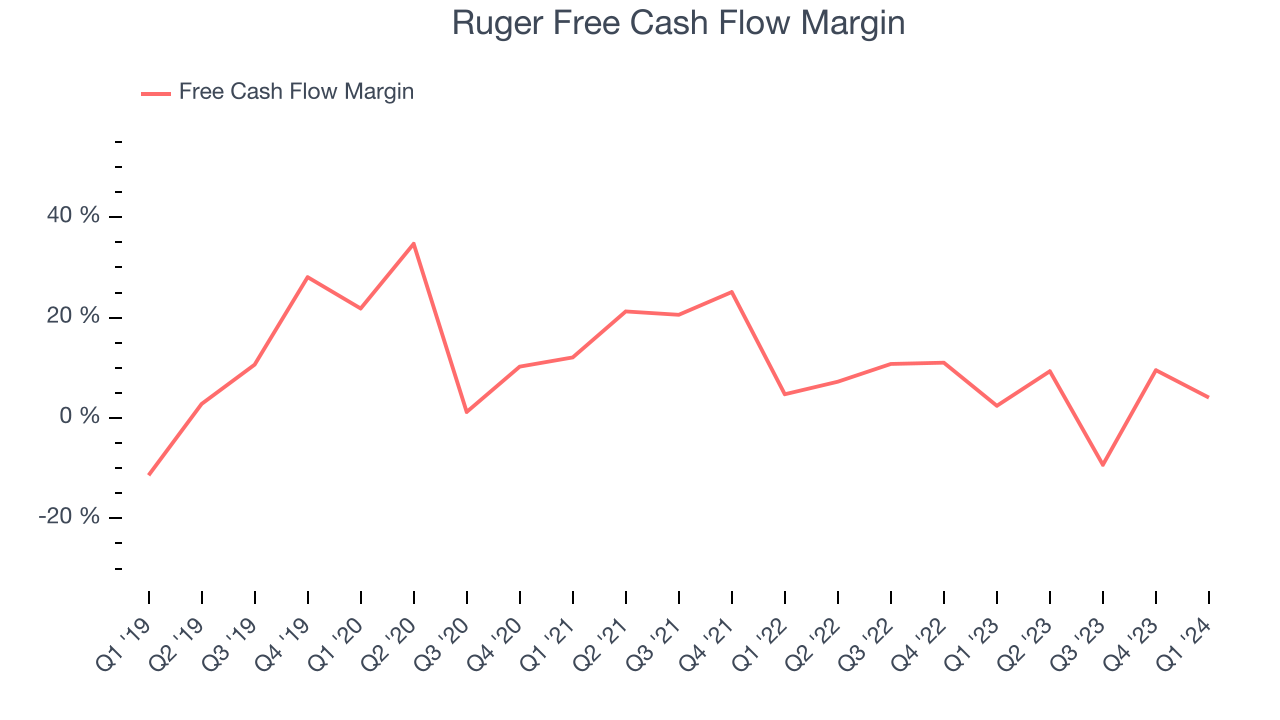

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Ruger has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.9%, subpar for a consumer discretionary business.

Ruger's free cash flow came in at $5.56 million in Q1, equivalent to a 4.1% margin and up 53% year on year.

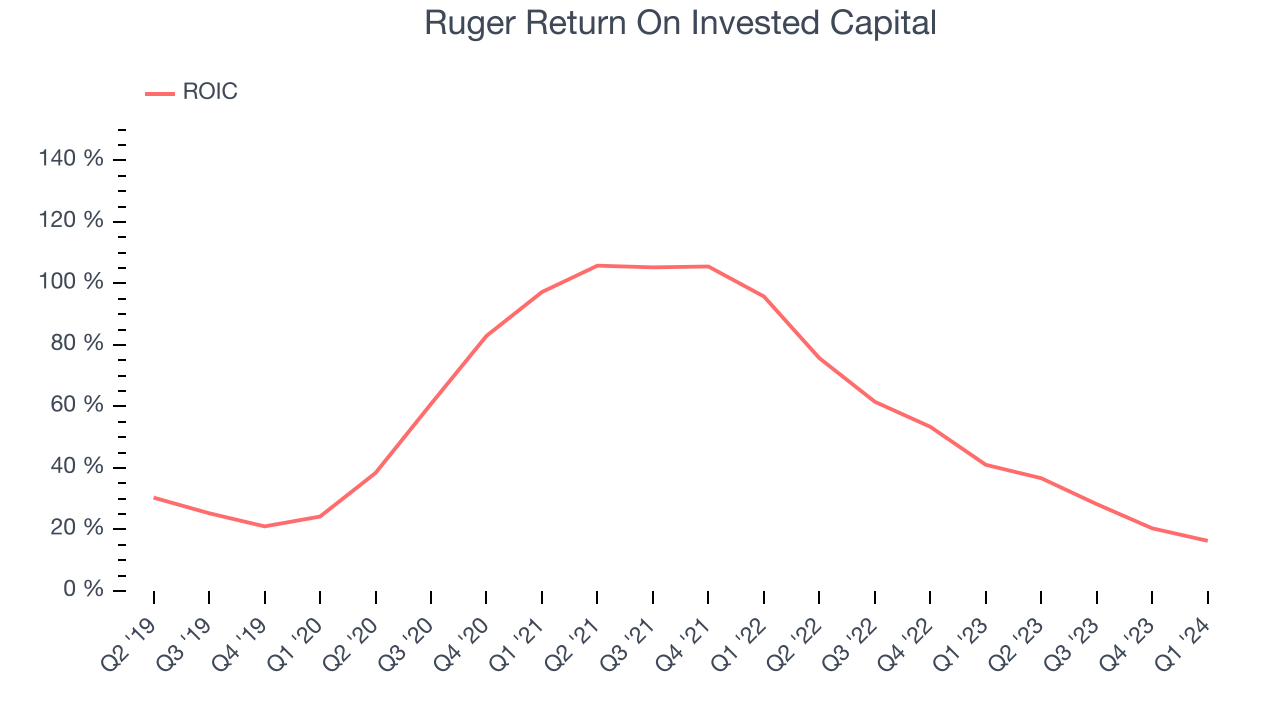

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Ruger hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 54.9%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Ruger's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Ruger is a profitable, well-capitalized company with $115.3 million of cash and $2.04 million of debt, meaning it could pay back all its debt tomorrow and still have $113.3 million of cash on its balance sheet. This net cash position gives Ruger the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Ruger's Q1 Results

We struggled to find many strong positives in these results. Its revenue, operating margin, and EPS fell short of Wall Street's estimates. Overall, this was a bad quarter for Ruger. The company is down 4.6% on the results and currently trades at $44.21 per share.

Is Now The Time?

Ruger may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Ruger, we'll be cheering from the sidelines. First off, its revenue growth has been weak over the last five years. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its declining EPS over the last five years makes it hard to trust. On top of that, its low free cash flow margins give it little breathing room.

While we've no doubt one can find things to like about Ruger, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $54 per share right before these results (compared to the current share price of $44.21).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.