Luxury furniture retailer RH (NYSE:RH) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 1.7% year on year to $727 million. It made a non-GAAP loss of $0.40 per share, down from its profit of $2.21 per share in the same quarter last year.

Is now the time to buy RH? Find out by accessing our full research report, it's free.

RH (RH) Q1 CY2024 Highlights:

- Revenue: $727 million vs analyst estimates of $725.2 million (small beat)

- Adjusted EBITDA: $89.1 million vs analyst estimates of $89.8 million (0.7% miss)

- EPS (non-GAAP): -$0.40 vs analyst estimates of -$0.09 (-$0.31 miss)

- Q2'24 guidance below for revenue growth (3-4% guide vs analyst estimates of 7%) and adjusted EBITDA margin (17-18% vs analyst estimates of 21%)

- Gross Margin (GAAP): 43.5%, down from 47% in the same quarter last year

- Free Cash Flow was -$10.13 million, down from $52.55 million in the same quarter last year

- Market Capitalization: $5.24 billion

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

RH is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

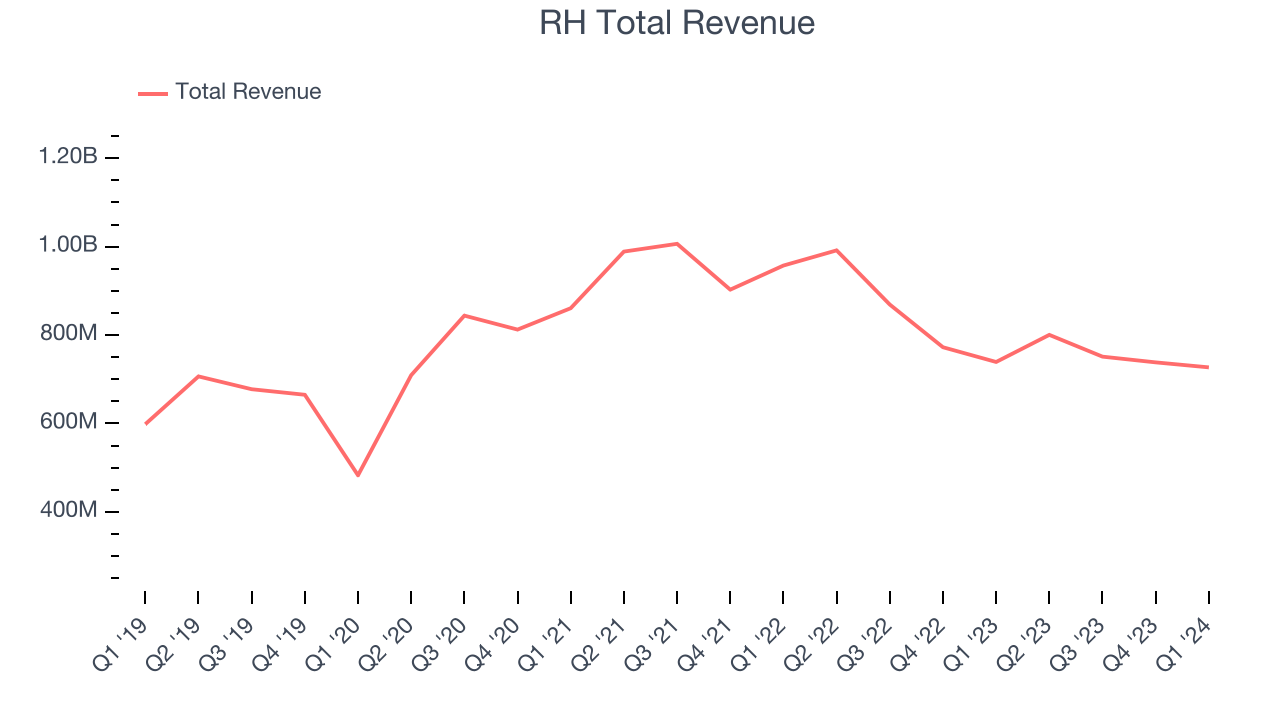

As you can see below, the company's annualized revenue growth rate of 3.4% over the last five years was sluggish , but to its credit, it opened new stores and expanded its reach.

This quarter, RH reported a rather uninspiring 1.7% year-on-year revenue decline to $727 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 9.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

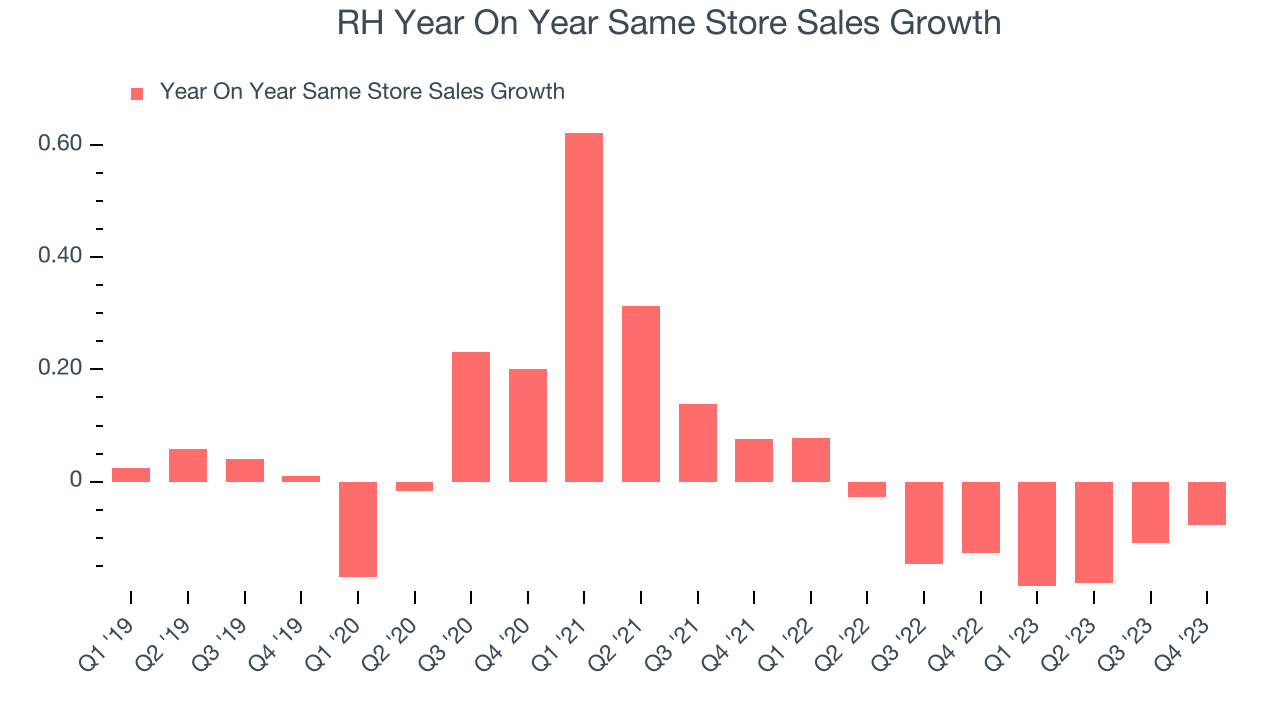

RH's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 12.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from RH's Q1 Results

We struggled to find many strong positives in these results. Its adjusted EBITDA and EPS missed analysts' expectations. Next quarter's guidance was below for both revenue growth and adjusted EBITDA margin, showing that the company is not only growing slower but that growth is less profitable. Finally, management struck a very cautious tone, calling out "the most challenging housing market in three decades" and the expectation that "the constantly changing outlook regarding monetary policy will continue to weigh on the housing market through the second half of 2024 and possibly into 2025." Overall, the results could have been better. The company is down 9.9% on the results and currently trades at $249.50 per share.

RH may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.