Luxury furniture retailer RH (NYSE:RH) reported results in line with analysts’ expectations in Q2 CY2024, with revenue up 3.6% year on year to $829.7 million. It made a non-GAAP profit of $1.69 per share, down from its profit of $3.93 per share in the same quarter last year.

Is now the time to buy RH? Find out by accessing our full research report, it’s free.

RH (RH) Q2 CY2024 Highlights:

- Revenue: $829.7 million vs analyst estimates of $824.5 million (small beat)

- EPS (non-GAAP): $1.69 vs analyst estimates of $1.61 (5.2% beat)

- Gross Margin (GAAP): 45.2%, down from 47.5% in the same quarter last year

- EBITDA Margin: 17.2%, down from 24.7% in the same quarter last year

- Free Cash Flow was -$37.9 million, down from $114.2 million in the same quarter last year

- Market Capitalization: $4.56 billion

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

RH is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s growing off a smaller base than its larger counterparts.

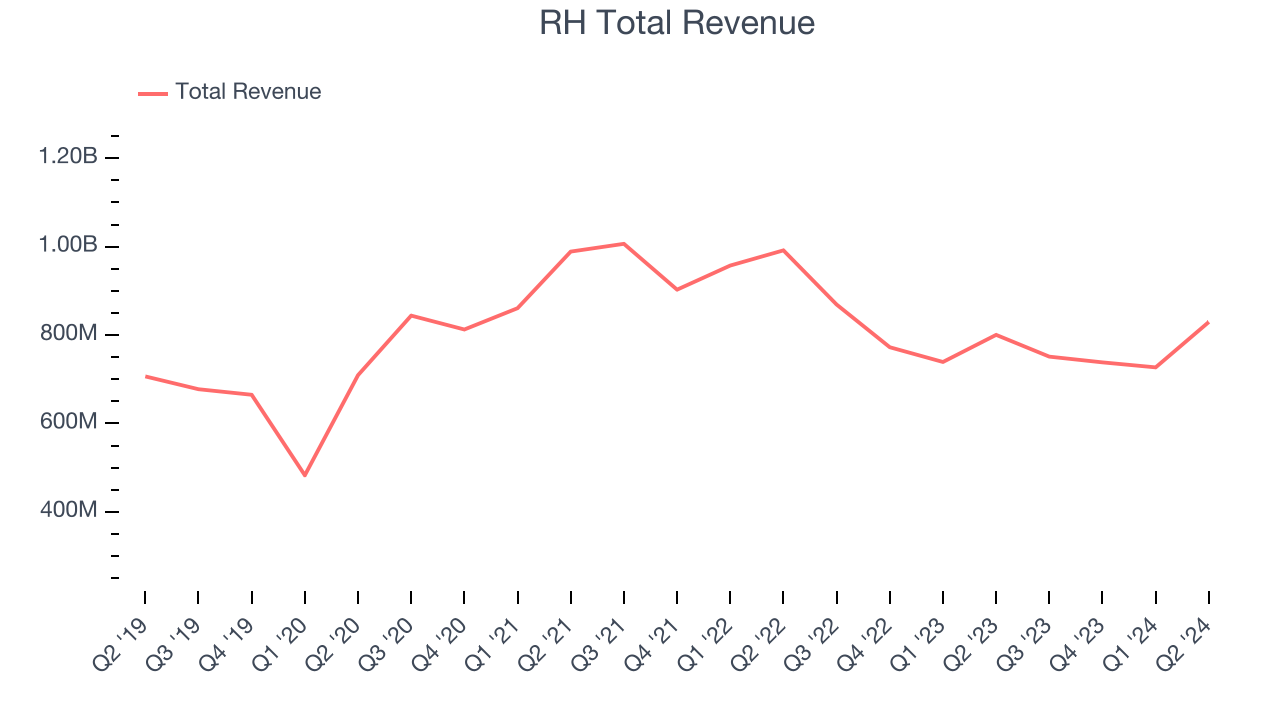

As you can see below, the company’s annualized revenue growth rate of 3.1% over the last five years was sluggish , but to its credit, it opened new stores and expanded its reach.

This quarter, RH grew its revenue by 3.6% year on year, and its $829.7 million in revenue was in line with Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 10.3% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

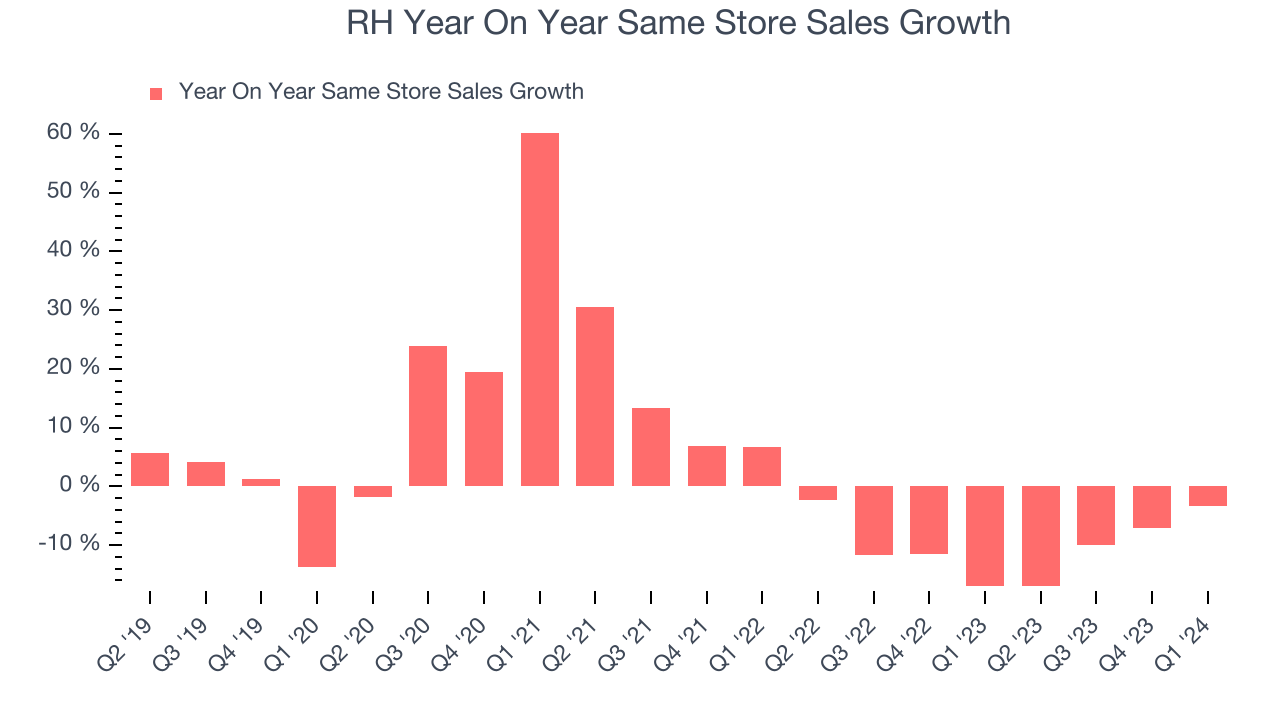

RH’s demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 11.1% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from RH’s Q2 Results

It was good to see RH beat analysts’ gross margin expectations this quarter. We were also happy its revenue and EPS narrowly outperformed Wall Street’s estimates, especially in a weaker consumer environment. Overall, this quarter had some key positives. The stock traded up 17.1% to $300.43 immediately after reporting.

RH may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.