Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at RH (NYSE:RH) and its peers.

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

The 4 home furniture retailer stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 7.2% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Luckily, home furniture retailer stocks have performed well with share prices up 18.6% on average since the latest earnings results.

RH (NYSE:RH)

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

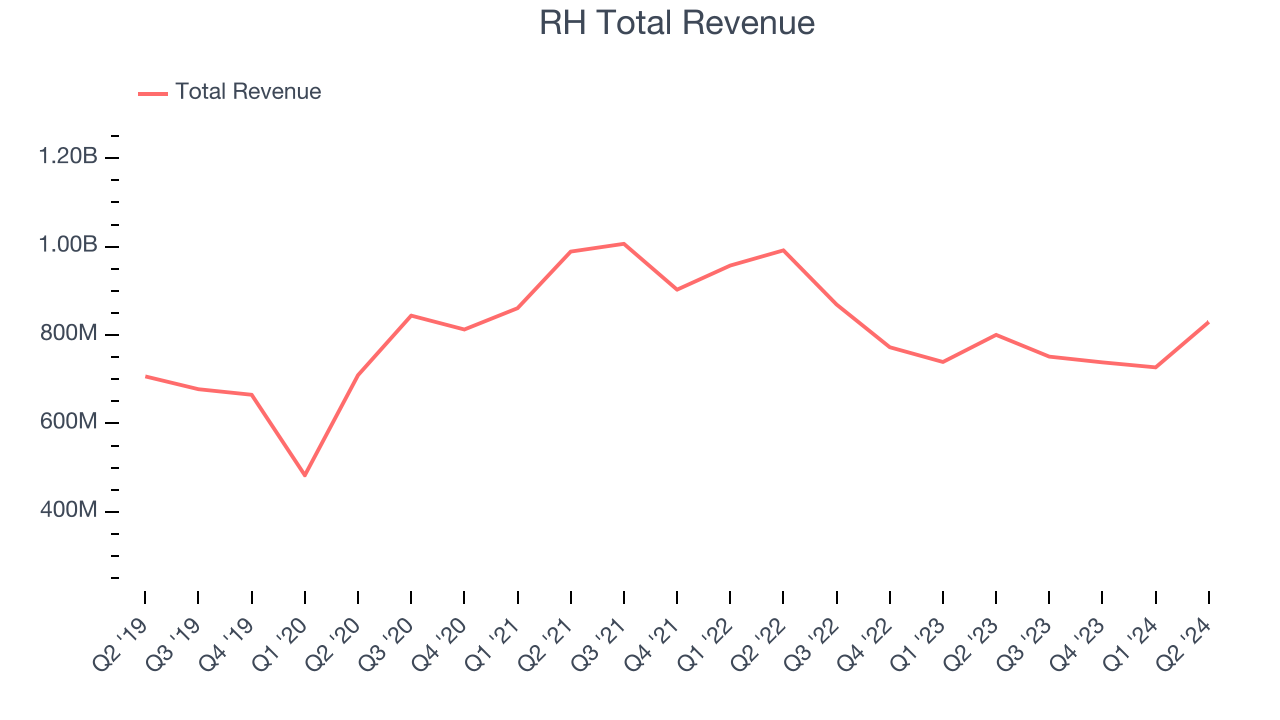

RH reported revenues of $829.7 million, up 3.6% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a decent beat of analysts’ gross margin and earnings estimates.

RH achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 33.1% since reporting and currently trades at $341.51.

Is now the time to buy RH? Access our full analysis of the earnings results here, it’s free.

Best Q2: Sleep Number (NASDAQ:SNBR)

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Sleep Number reported revenues of $408.4 million, down 11% year on year, falling short of analysts’ expectations by 1.9%. However, the business still had a strong quarter with an impressive beat of analysts’ earnings estimates and a solid beat of analysts’ gross margin estimates.

The market seems happy with the results as the stock is up 42.1% since reporting. It currently trades at $16.81.

Is now the time to buy Sleep Number? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Arhaus (NASDAQ:ARHS)

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ:ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Arhaus reported revenues of $309.8 million, flat year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 5.8% since the results and currently trades at $13.05.

Read our full analysis of Arhaus’s results here.

Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Williams-Sonoma reported revenues of $1.79 billion, down 4% year on year. This print missed analysts’ expectations by 1.2%. More broadly, it was actually a strong quarter as it logged an impressive beat of analysts’ gross margin estimates and a decent beat of analysts’ earnings estimates.

The stock is up 5.1% since reporting and currently trades at $151.25.

Read our full, actionable report on Williams-Sonoma here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.