Luxury furniture retailer RH (NYSE:RH) fell short of analysts' expectations in Q4 CY2023, with revenue down 4.4% year on year to $738.3 million. It made a non-GAAP profit of $0.72 per share, down from its profit of $2.88 per share in the same quarter last year.

RH (RH) Q4 CY2023 Highlights:

- Revenue: $738.3 million vs analyst estimates of $777.8 million (5.1% miss)

- EPS (non-GAAP): $0.72 vs analyst estimates of $1.71 (57.9% miss)

- Revenue guidance for the full year calls for growth of 9.0% year on year, above expectations of 7.7%

- Management added that "we expect our demand trends to accelerate throughout fiscal 2024"

- Gross Margin (GAAP): 43.5%, down from 47.8% in the same quarter last year

- Free Cash Flow was -$251.5 million, down from $3.7 million in the same quarter last year

- Market Capitalization: $5.22 billion

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

The core customer is typically affluent and discerning, with a taste for high-end home decor. RH’s aesthetic is simple and clean-lined, with a focus on neutral colors and natural materials such as wood, stone, and leather. Antique and vintage elements are also featured in many products. RH’s furniture tends to be larger in size, which means that it is better suited for spacious homes rather than apartments and urban living.

RH stores, referred to as galleries, are typically located in high-end shopping areas. They are known for their expansive size and elegant layouts. Some of the larger galleries feature multiple levels with patios and decks to feature outdoor furniture. Rather than selling all sofas in one area of the store and all rugs in another, RH galleries are designed to showcase the company's furniture and home decor products in complete room formats.

RH has a strong e-commerce offering, which was launched in 2007. The platform not only allows customers to browse and purchase its products but to also read customer reviews and use digital augmented reality products to help customers visual RH products in their own spaces.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Competitors offering higher-end furniture include public companies Arhaus (NASDAQ:ARHS), MillerKnoll (NASDAQ:MLKN), and Design Capital Ltd. (SEHK:1545). Private company West Elm is also a competitor.Sales Growth

RH is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

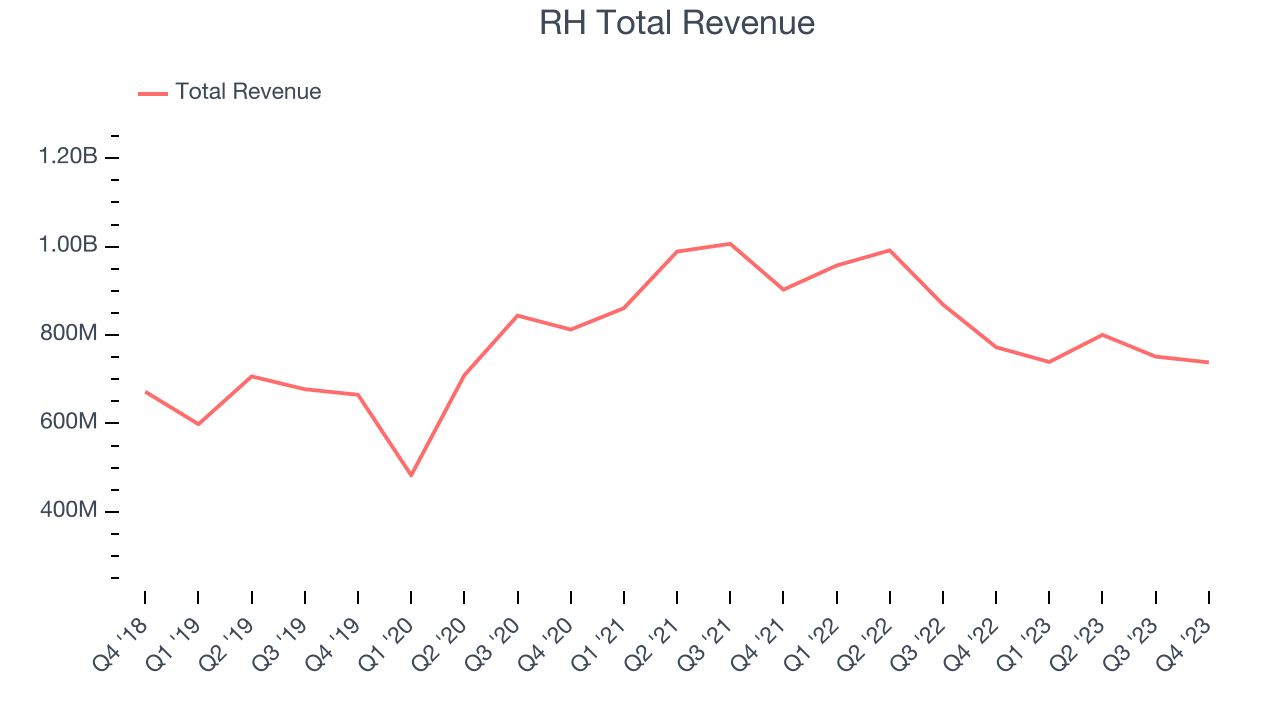

As you can see below, the company's annualized revenue growth rate of 3.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store footprint remained relatively unchanged.

This quarter, RH missed Wall Street's estimates and reported a rather uninspiring 4.4% year-on-year revenue decline, generating $738.3 million in revenue. Looking ahead, Wall Street expects sales to grow 8.3% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

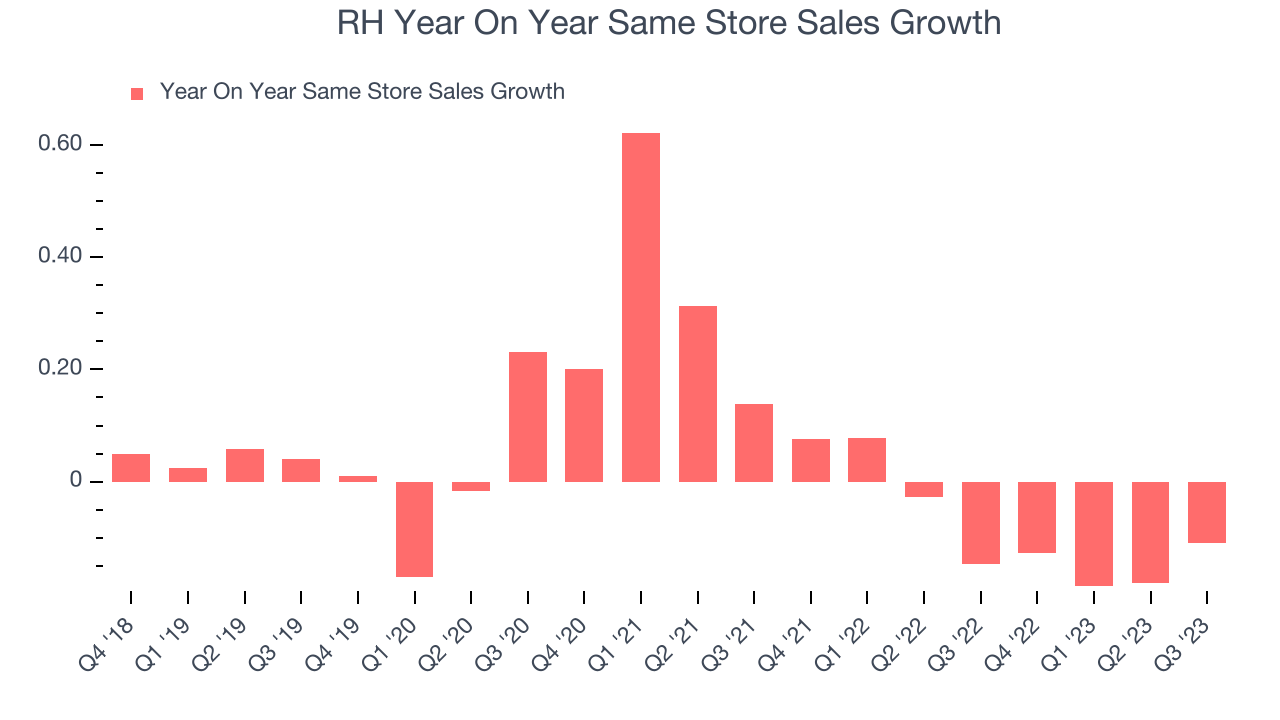

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

RH's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 10% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

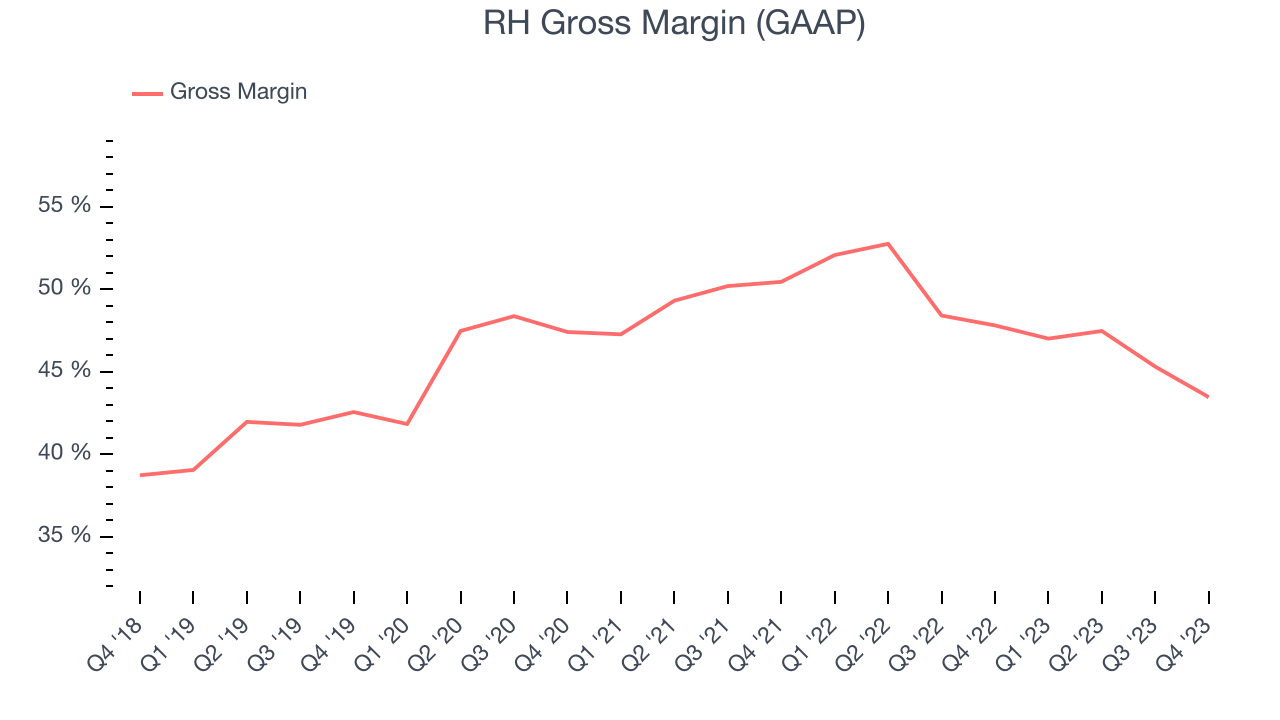

Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer's pricing power, product differentiation, and negotiating leverage.

RH has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 48.4% gross margin over the last two years. This means the company makes $0.48 for every $1 in revenue before accounting for its operating expenses.

RH produced a 43.5% gross profit margin in Q4, marking a 4.3 percentage point decrease from 47.8% in the same quarter last year. Although the company could've performed better, we care more about its long-term trends rather than just one quarter. Additionally, a retailer's gross margin can often change due to factors outside its control, such as product discounting and dynamic input costs (think distribution and freight expenses to move goods). We'll keep a close eye on this.

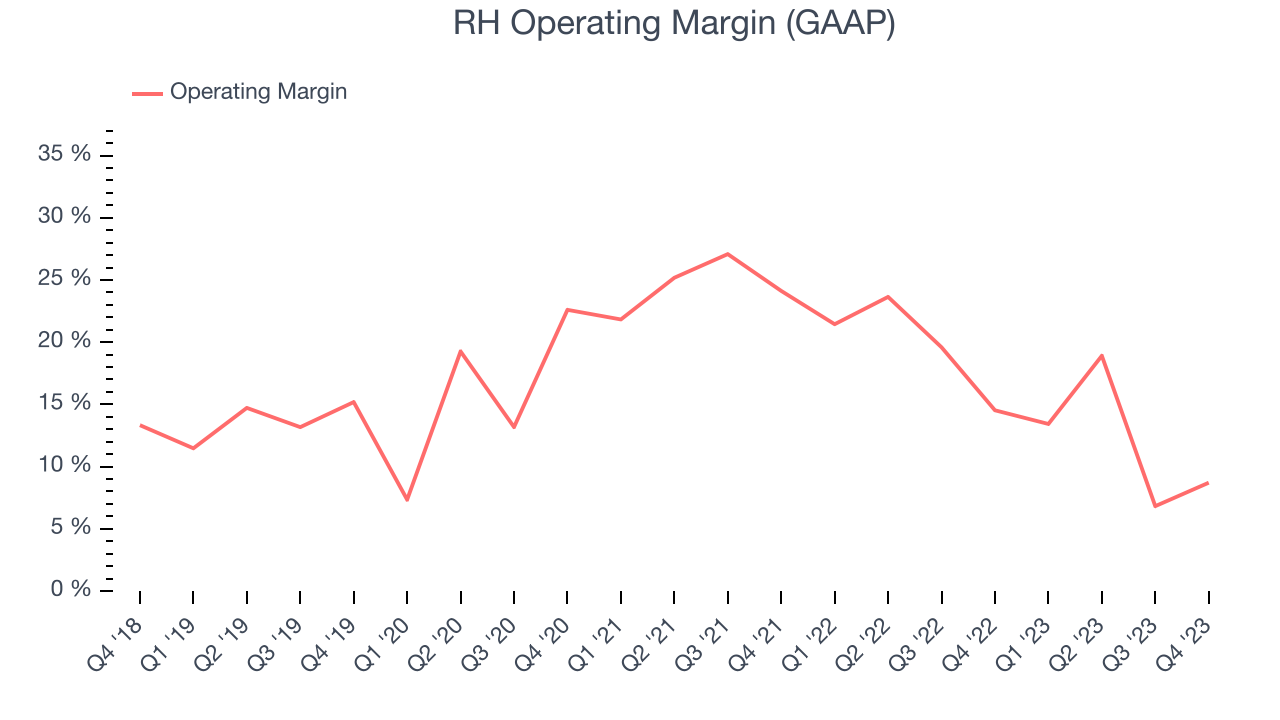

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q4, RH generated an operating profit margin of 8.7%, down 5.8 percentage points year on year. We can infer RH was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, RH has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 16.4%. However, RH's margin has declined by 8 percentage points year on year (on average). Although this isn't the end of the world, some investors were likely hoping for better results.

Zooming out, RH has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 16.4%. However, RH's margin has declined by 8 percentage points year on year (on average). Although this isn't the end of the world, some investors were likely hoping for better results. EPS

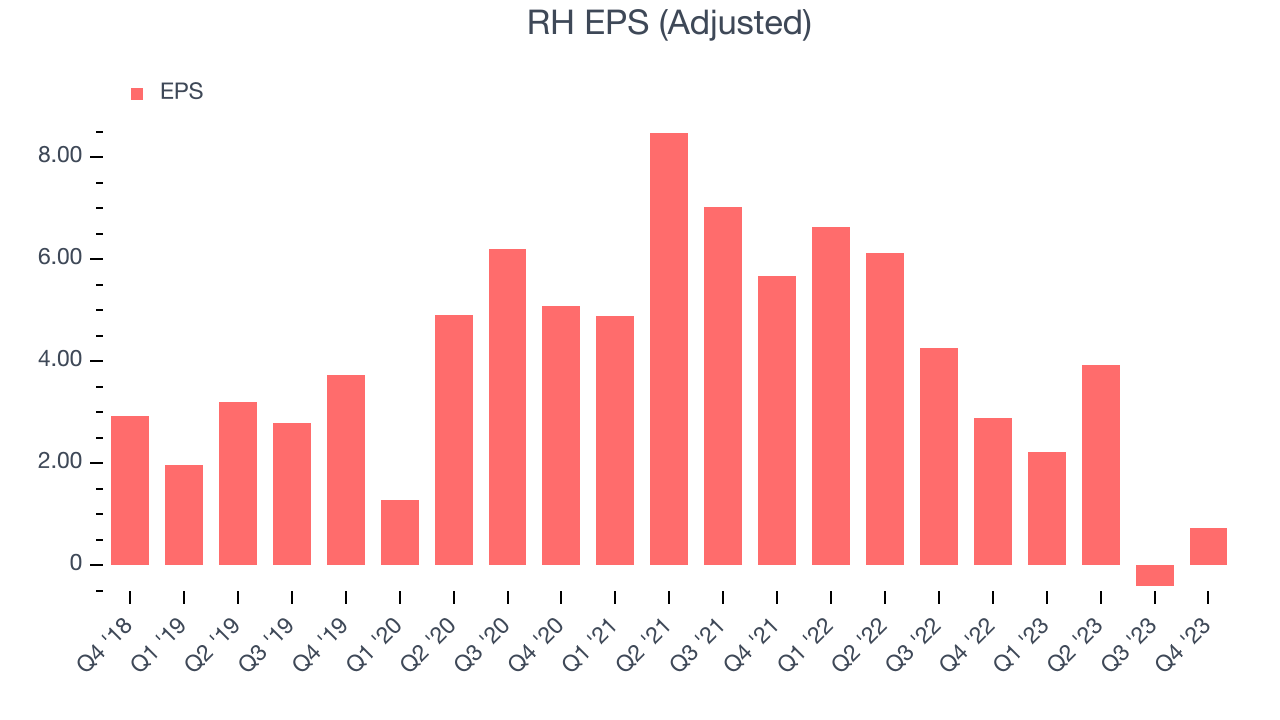

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, RH reported EPS at $0.72, down from $2.88 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, RH's adjusted diluted EPS dropped 44.9%, translating into 13.8% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 75.8% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

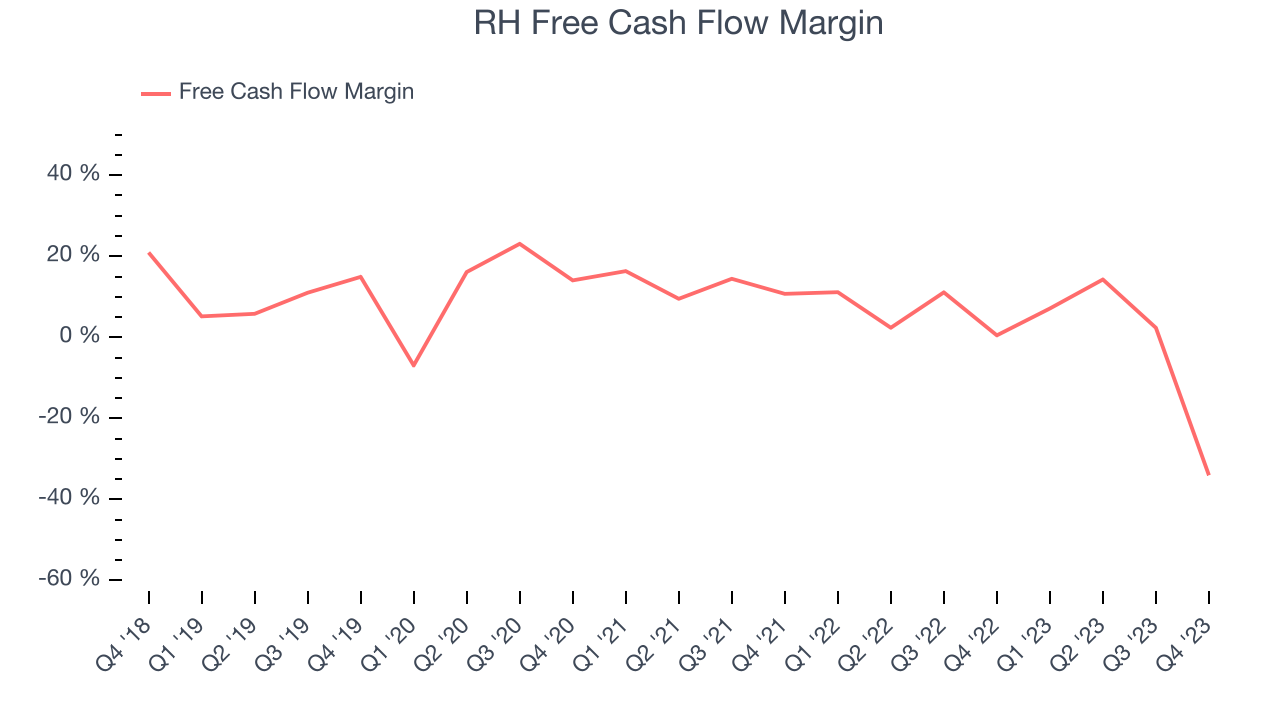

RH burned through $251.5 million of cash in Q4, representing a negative 34.1% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which happened for several reasons including (but not limited to) the stockpiling of inventory in anticipation of higher demand or unforeseen, one-time events.

Over the last two years, RH has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 2.5%, slightly better than the broader consumer retail sector. However, its margin has averaged year-on-year declines of 8.6 percentage points. Some investors are likely unhappy with this and would hope to see a reversal soon.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although RH hasn't been the highest-quality company lately because of its poor top-line performance, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 42.6%, splendid for a retail business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, RH's ROIC over the last two years averaged 6.3 percentage point decreases each year. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from RH's Q4 Results

While RH's revenue unfortunately missed analysts' expectations, revenue guidance for the full year was more encouraging. The company stated that they "expect demand trends to accelerate throughout fiscal 2024" despite a challenging backdrop due to a weak US housing market. Overall, the results could have been better, but the outlook is encouraging. The stock is up 4.1% after reporting and currently trades at $309.08 per share.

Is Now The Time?

RH may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of RH, we'll be cheering from the sidelines. Its revenue growth has been uninspiring over the last four years, but at least growth is expected to increase in the short term. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its shrinking same-store sales suggests it'll need to change its strategy to succeed. On top of that, its declining EPS over the last four years makes it hard to trust.

RH's price-to-earnings ratio based on the next 12 months is 26.2x. While we've no doubt one can find things to like about RH, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $307.47 per share right before these results (compared to the current share price of $316), implying they didn't see much short-term potential in RH.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.