Fashion brand Ralph Lauren (NYSE:RL) beat analysts' expectations in Q3 FY2024, with revenue up 5.6% year on year to $1.93 billion. It made a non-GAAP profit of $4.17 per share, improving from its profit of $3.35 per share in the same quarter last year.

Ralph Lauren (RL) Q3 FY2024 Highlights:

- Revenue: $1.93 billion vs analyst estimates of $1.87 billion (3.4% beat)

- EPS (non-GAAP): $4.17 vs analyst estimates of $3.55 (17.5% beat)

- Free Cash Flow of $562.6 million, up from $30.1 million in the previous quarter

- Gross Margin (GAAP): 66.5%, up from 65.2% in the same quarter last year

- Market Capitalization: $9.51 billion

Originally founded as a necktie company, Ralph Lauren (NYSE:RL) is an iconic American fashion brand known for its classic and sophisticated style.

Ralph Lauren is a global leader in the fashion industry with a quintessentially American style, recognizable for its classic, preppy, and sporty fashion. Featuring the iconic polo player logo, Ralph Lauren encompasses a wide range of clothing, from tailored suits to casual sportswear and accessories. Its flagship Polo Ralph Lauren brand caters to a high-end customer base, reflected in its products' premium prices.

Beyond clothing, Ralph Lauren offers an extensive portfolio of products that embody its distinct lifestyle vision. Ralph Lauren Home is known for luxurious home furnishings, bedding, and décor that mirror the same sophistication found in its fashion collections. The brand's fragrances and accessories have also been successful extensions to bring customers into the Ralph Lauren ecosystem.

Ralph Lauren products can be found in its retail stores, department stores, and online through popular e-commerce websites.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Ralph Lauren’s main domestic competitors are PVH Corp (NYSE:PVH), Tapestry (NYSE:TPR), and private company Stuart Weitzman. International competitors include Kering (OTCMKTS:PPRUY) which owns Gucci, Yves Saint Laurent, and Bottega Veneta, and LVMH (OTCMKTS:LVMUY) which owns Louis Vuitton, Dior, and Givenchy.Sales Growth

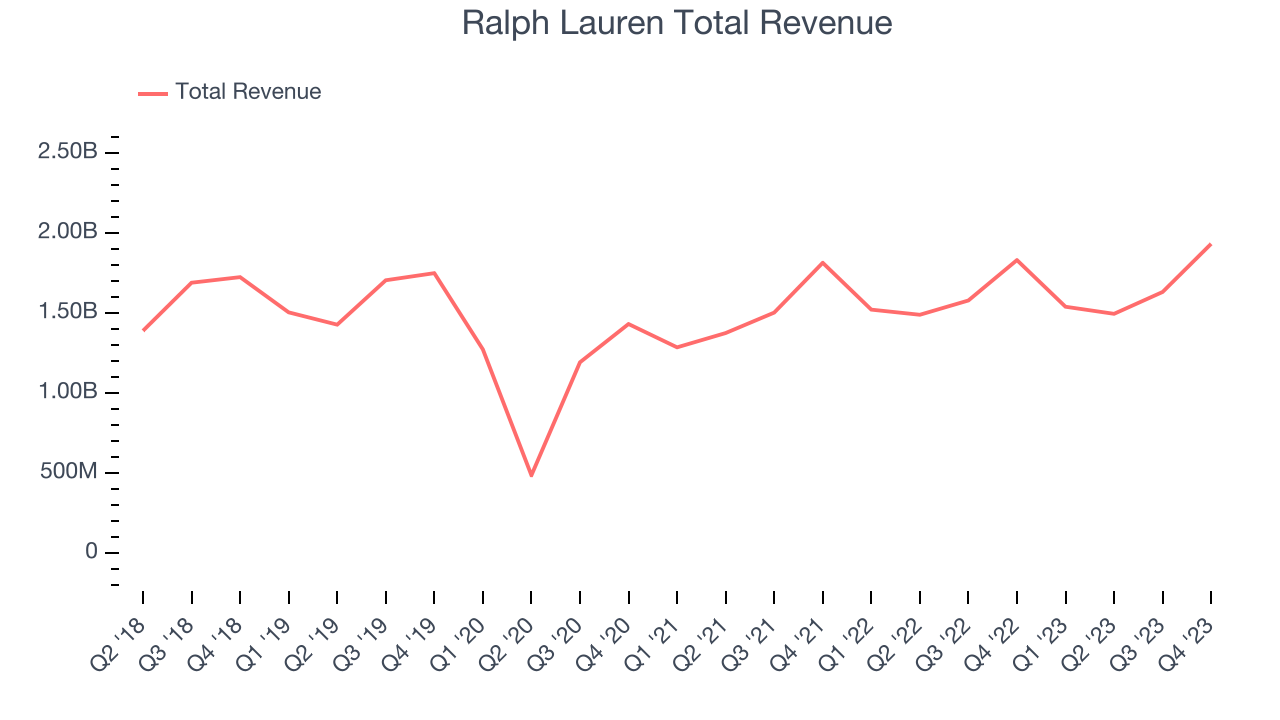

Exploring a company's long-term performance can offer valuable insights into its business quality. Any business can experience brief periods of success, but distinguished ones maintain steady growth over time. Ralph Lauren's revenue was flat over the last 5 years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Ralph Lauren's annualized revenue growth of 5.1% over the last 2 years is above its 5-year trend, suggesting there are some bright spots.

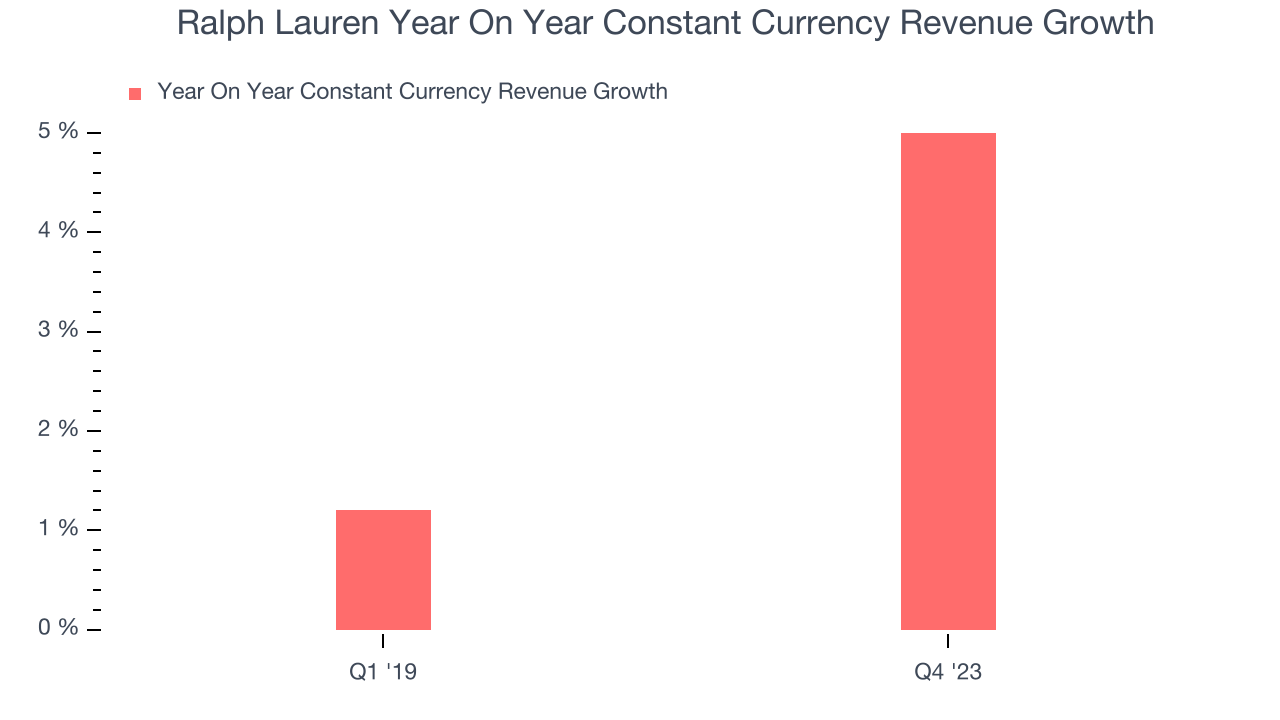

Ralph Lauren also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales averaged 8.5% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered Ralph Lauren's top-line performance.

This quarter, Ralph Lauren reported solid year-on-year revenue growth of 5.6%, and its $1.93 billion of revenue outperformed Wall Street's estimates by 3.4%. Looking ahead, Wall Street expects sales to grow 3.2% over the next 12 months, a deceleration from this quarter.

Operating Margin

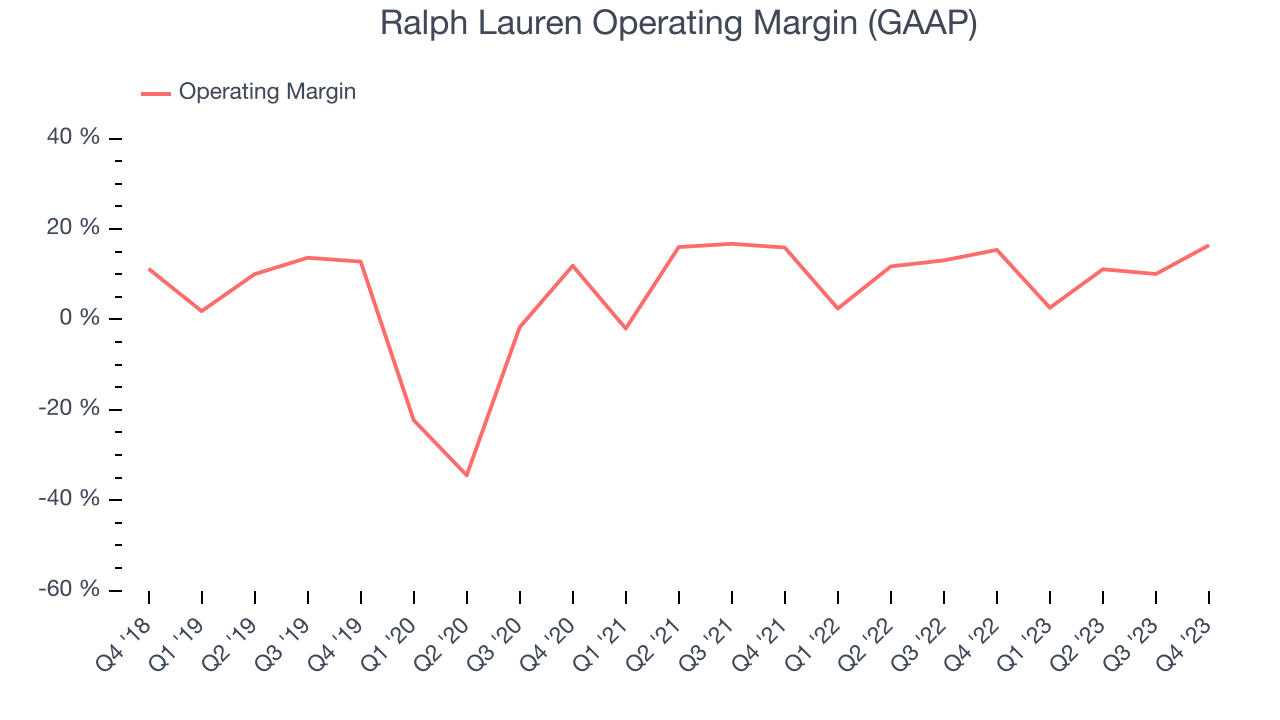

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Ralph Lauren has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.4%, higher than the broader consumer discretionary sector.

This quarter, Ralph Lauren generated an operating profit margin of 16.4%, up 1 percentage points year on year. This increase indicates the company was more efficient with its expenses over the last quarter, spending less money in areas like corporate overhead and advertising.

Over the next 12 months, Wall Street expects Ralph Lauren to become more profitable. Analysts are expecting the company’s LTM operating margin of 10.4% to rise to 13%.EPS

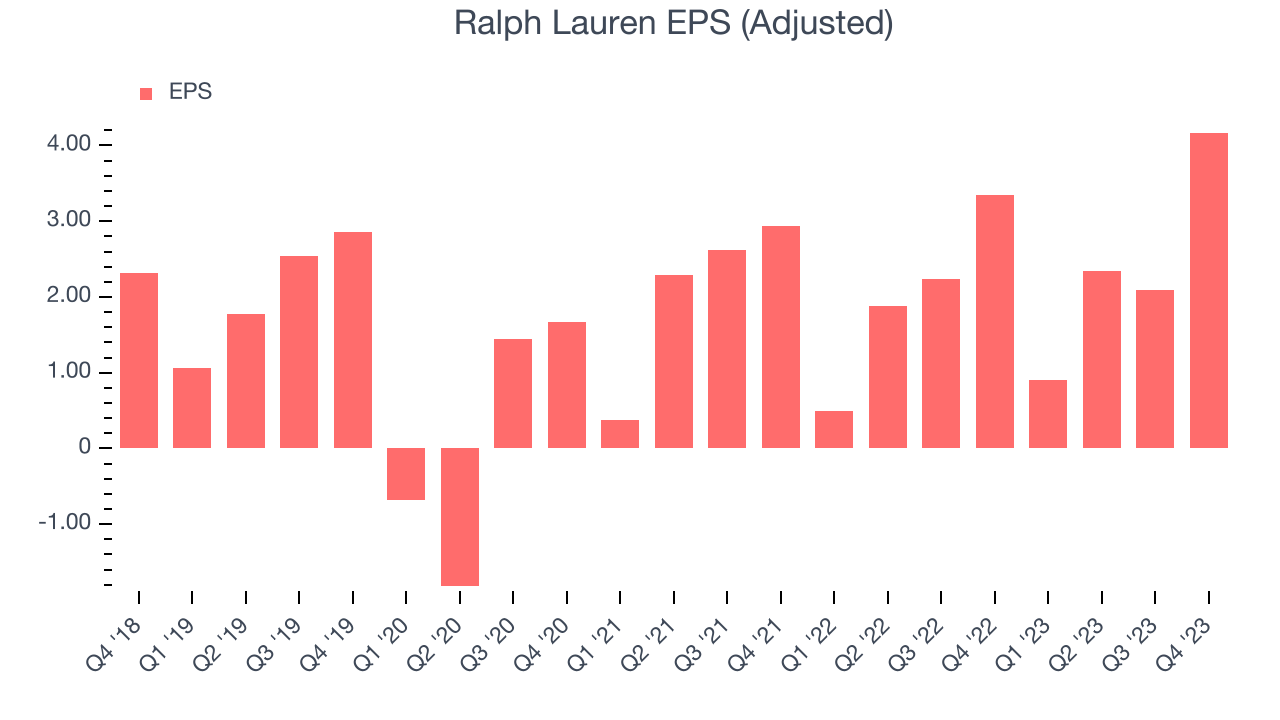

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last 5 years, Ralph Lauren's EPS grew 35.5%, translating into an unimpressive 6.3% compounded annual growth rate. This performance, however, is materially higher than its flat revenue over the same period. Let's dig into why.

Ralph Lauren's operating margin has expanded 5.2 percentage points over the last 5 years, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q3, Ralph Lauren reported EPS at $4.17, up from $3.35 in the same quarter a year ago. This print beat analysts' estimates by 17.5%. Over the next 12 months, Wall Street expects Ralph Lauren to grow its earnings. Analysts are projecting its LTM EPS of $9.51 to climb by 10.3% to $10.49.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

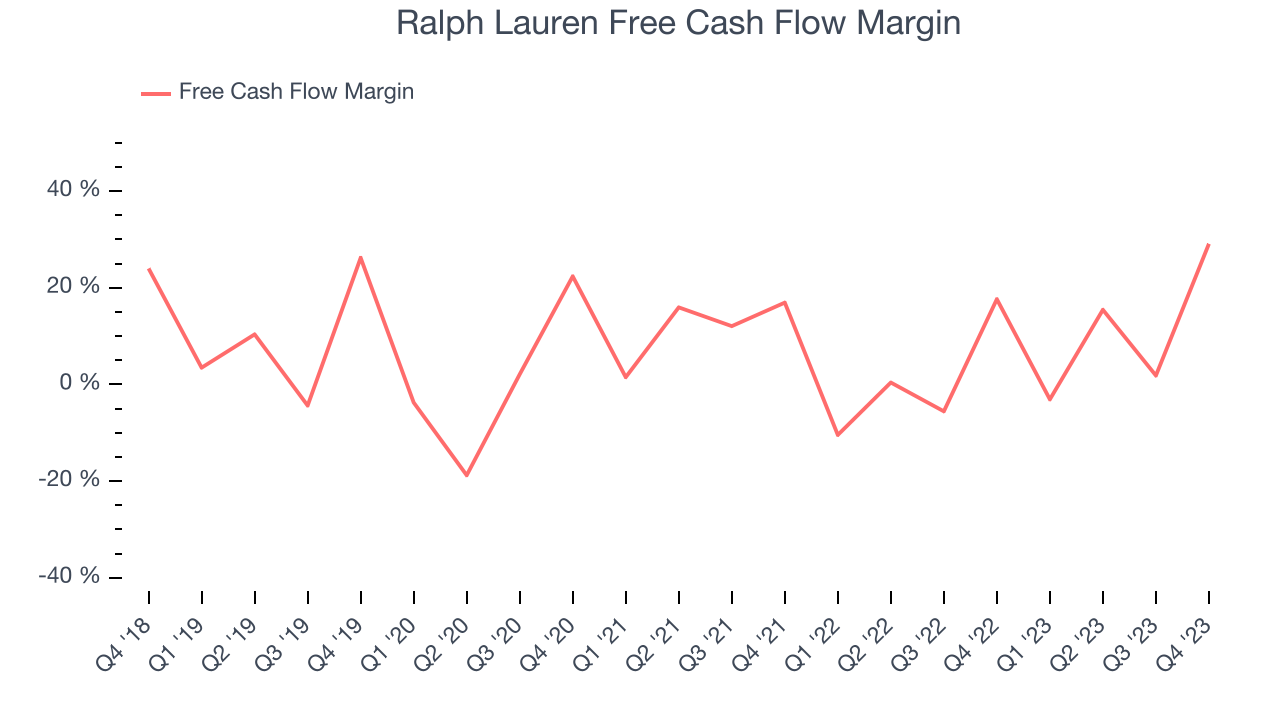

Over the last two years, Ralph Lauren has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.7%, subpar for a consumer discretionary business.

Ralph Lauren's free cash flow came in at $562.6 million in Q3, equivalent to a 29.1% margin, up 74.1% year on year. Over the next year, analysts predict Ralph Lauren's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 11.8% will decrease to 9%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Ralph Lauren hasn't been the highest-quality company lately because of its poor top-line performance, it historically did an excellent job investing in profitable business initiatives. Its five-year average return on invested capital was 21.5%, impressive for a consumer discretionary company.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Ralph Lauren's ROIC has averaged a 22.7 percentage point increase each year. This is a good sign, and if Ralph Lauren's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Ralph Lauren's Q3 Results

We were impressed by how significantly Ralph Lauren blew past analysts' revenue and EPS expectations this quarter, driven by strong outperformance in its Europe ($522 million of revenue vs estimates of $471 million) and Asia ($446 million of revenue vs estimates of $428 million) segments. The company also beat Wall Street's same-store sales estimates, posting 9% growth (vs the forecasted 4.3% growth).

Ralph Lauren repurchased approximately $103 million of its shares this quarter and guided to roughly 2% constant currency revenue growth for the full year 2024, and based on current exchange rates, expects to receive a modest benefit on overall revenue growth (a reversal from its 2-year trend). Overall, we think this was a really good quarter that should please shareholders. The stock is up 6.7% after reporting and currently trades at $157 per share.

Is Now The Time?

Ralph Lauren may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Ralph Lauren, we'll be cheering from the sidelines. Its revenue growth has been weak over the last five years, but at least growth is expected to increase in the short term. And while its rising ROIC shows management is finding profitable business opportunities, the downside is its low free cash flow margins give it little breathing room. On top of that, its constant currency sales performance has been subpar over the last two years.

Ralph Lauren's price-to-earnings ratio based on the next 12 months is 14.0x. While we've no doubt one can find things to like about Ralph Lauren, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $152.02 per share right before these results (compared to the current share price of $157), implying they didn't see much short-term potential in Ralph Lauren.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.