Office and call centre communications software provider RingCentral (NYSE:RNG) reported Q1 FY2021 results that beat analyst expectations, with revenue up 31.7% year on year to $352 million. RingCentral made a GAAP loss of $186 thousand, improving on its loss of $60.7 million, in the same quarter last year.

RingCentral (NYSE:RNG) Q1 FY2021 Highlights:

- Revenue: $352 million vs analyst estimates of $339 million (3.67% beat)

- EPS (non-GAAP): $0.27 vs analyst estimates of $0.25 (8.65% beat)

- Revenue guidance for Q2 2021 is $358 million at the midpoint, above analyst estimates of $354 million (edit: previous version of the article included incorrect guidance numbers)

- The company lifted revenue guidance for the full year, from $1.48 billion to $1.5 billion at the midpoint, a 1.51% increase (edit: previous version of the article included incorrect guidance numbers)

- Free cash flow of $23.1 million, down 61.1% from previous quarter

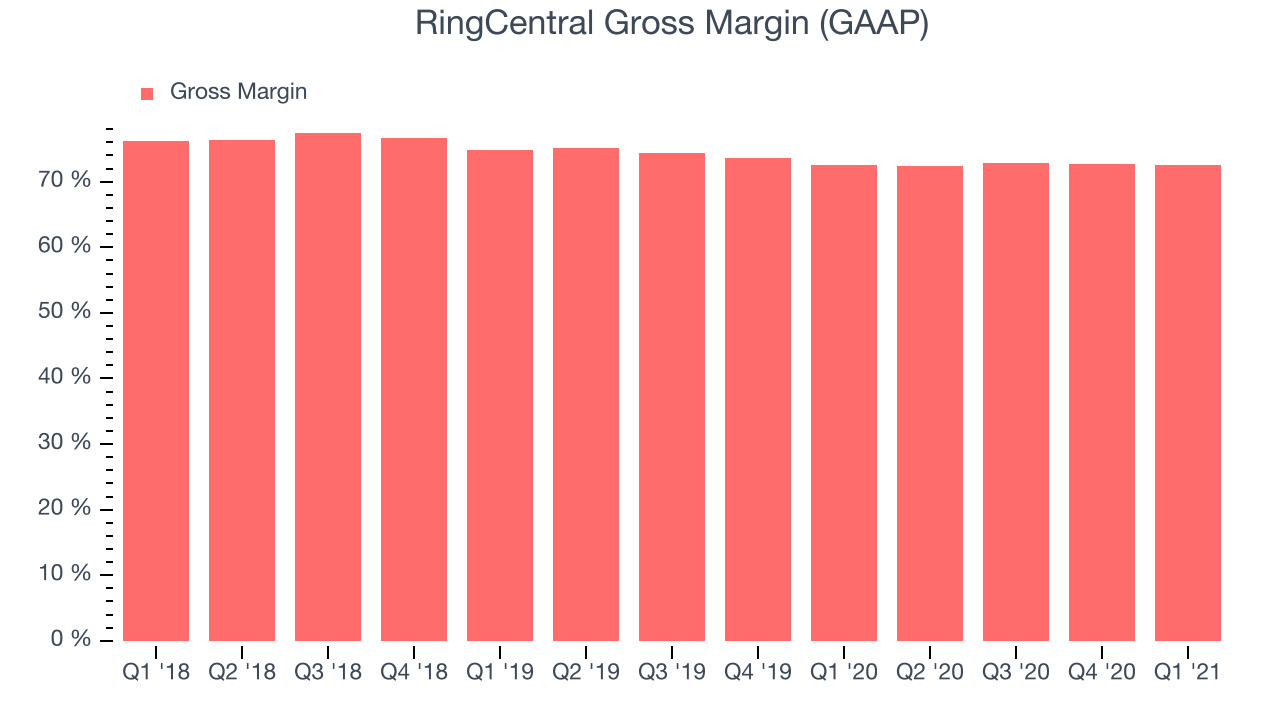

- Gross Margin (GAAP): 72.4%, in line with previous quarter

“First quarter results were exceptional, with meaningful contributions from key partners including Avaya, Atos, AT&T, BT, and Telus,” said Vlad Shmunis, RingCentral’s founder, chairman and CEO. “We believe we are witnessing the intersection of two megatrends of digital transformation and hybrid workforce adoption, which is creating a structural shift in awareness and demand for cloud communications solutions. RingCentral has always been about work from anywhere. With our proven UCaaS platform and a comprehensive CCaaS portfolio, RingCentral continues to win as a trusted communications partner of choice for businesses of all sizes in their digital transformation journeys.”

All-In-One Communications Platform

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

Traditionally, the technology used by enterprises to set up their own private telephone networks to communicate both internally and externally involved a lot of on-premise technology and even getting locked into proprietary phones. RingCentral offers the same functionality through internet telephony (VoIP) integrated in its cloud based phone app. Its advantages include running on any mobile or desktop device, lower cost than legacy competitors, additional functionality like auto-receptionist and rule-based call routing. The company has integrated video calls and chat into their app, with the aim of making their software the only one a company needs to power all their communications. Building on the same technology, RingCentral also develops software to power contact centres.

RingCentral competes with other providers of unified communications as a service platforms such as 8x8 (NYSE:EGHT) or Vonage (NASDAQ:VG), but lately also with Zoom (Nasdaq:ZM) which has started expanding into the space with their Zoom Phone platform.

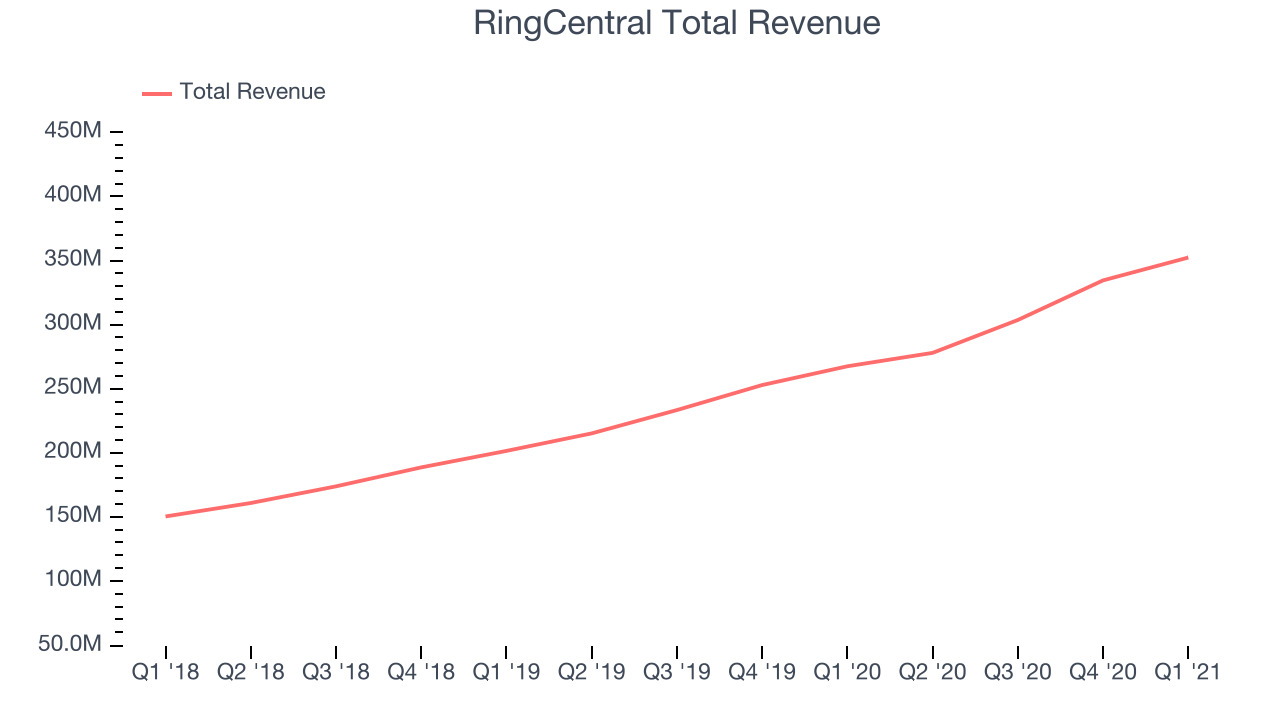

As you can see below, RingCentral's revenue growth has been very strong over the last twelve months, growing from $267 million to $352 million.

And unsurprisingly, this was another great quarter for RingCentral with revenue up an absolutely stunning 31.7% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $17.8 million in Q1, compared to $30.9 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers.

RingCentral's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 72.4% in Q1. That means that for every $1 in revenue the company had $0.72 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the lower average of what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market so it is important to track.

Key Takeaways from RingCentral's Q1 Results

With market capitalisation of $28.6 billion, more than $463 million in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

It was good to see RingCentral outperform Wall St’s revenue expectations this quarter. And we were also glad to see good revenue growth. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think RingCentral will look more attractive to growth investors after these results.

edit: Previous version of the article included incorrect revenue guidance numbers, this has now been fixed

The author has no position in any of the stocks mentioned.