Office and call centre communications software provider RingCentral (NYSE:RNG) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 8.9% year on year to $571.3 million. On the other hand, the company expects next quarter's revenue to be around $577.5 million, slightly below analysts' estimates. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.60 per share in the same quarter last year.

RingCentral (RNG) Q4 FY2023 Highlights:

- Revenue: $571.3 million vs analyst estimates of $570.4 million (small beat)

- EPS (non-GAAP): $0.86 vs analyst estimates of $0.82 (4.6% beat)

- Revenue Guidance for Q1 2024 is $577.5 million at the midpoint, below analyst estimates of $581.8 million

- Management's revenue guidance for the upcoming financial year 2024 is $2.38 billion at the midpoint, missing analyst estimates by 0.8% and implying 8.2% growth (vs 10.9% in FY2023)

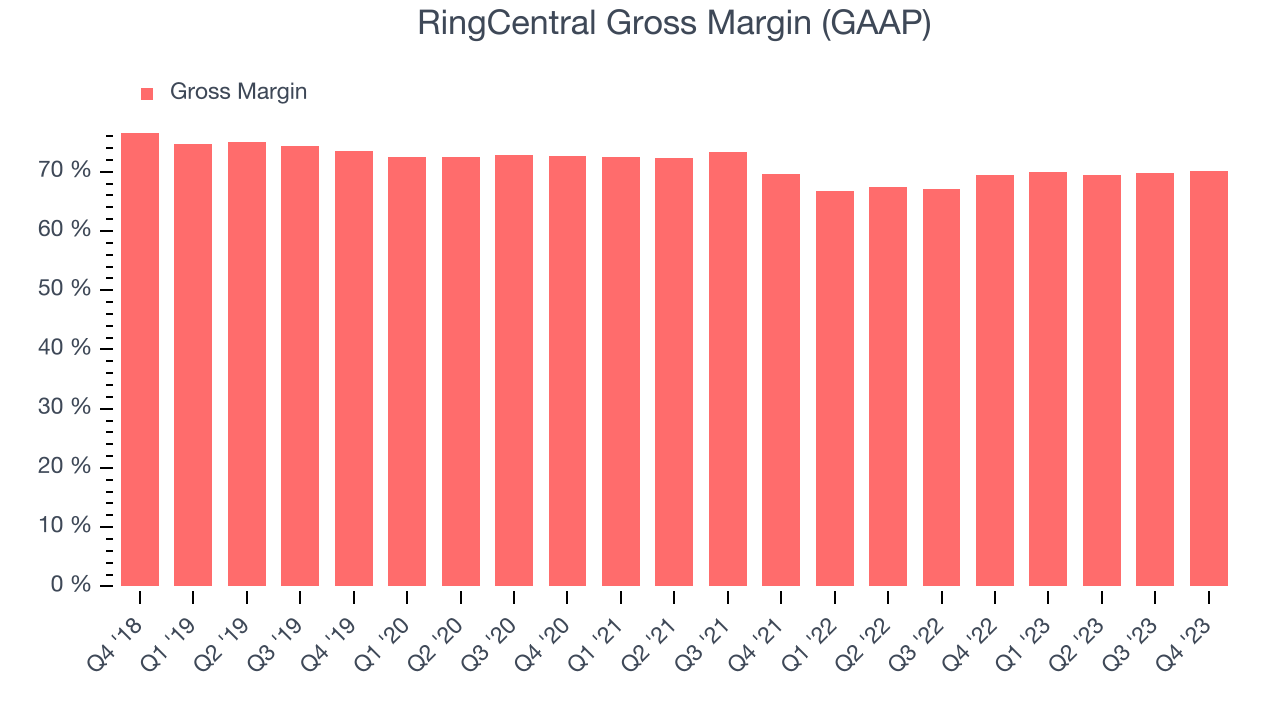

- Gross Margin (GAAP): 70.2%, up from 69.4% in the same quarter last year

- Market Capitalization: $2.87 billion

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

Traditionally, the technology used by enterprises to set up their own private telephone networks to communicate both internally and externally involved a lot of on-premise technology and even getting locked into proprietary phones.

RingCentral offers the same functionality through internet telephony (VoIP) integrated in its cloud based phone app. Its advantages include running on any mobile or desktop device, lower cost than legacy competitors, additional functionality like auto-receptionist and rule-based call routing. The company has integrated video calls and chat into their app, with the aim of making their software the only one a company needs to power all their communications. Building on the same technology, RingCentral also develops software to power contact centres.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

RingCentral competes with other providers of unified communications as a service platforms such as 8x8 (NYSE:EGHT) or Vonage (NASDAQ:VG), but lately also with Zoom (Nasdaq:ZM) which has started expanding into the space with their Zoom Phone platform.

Sales Growth

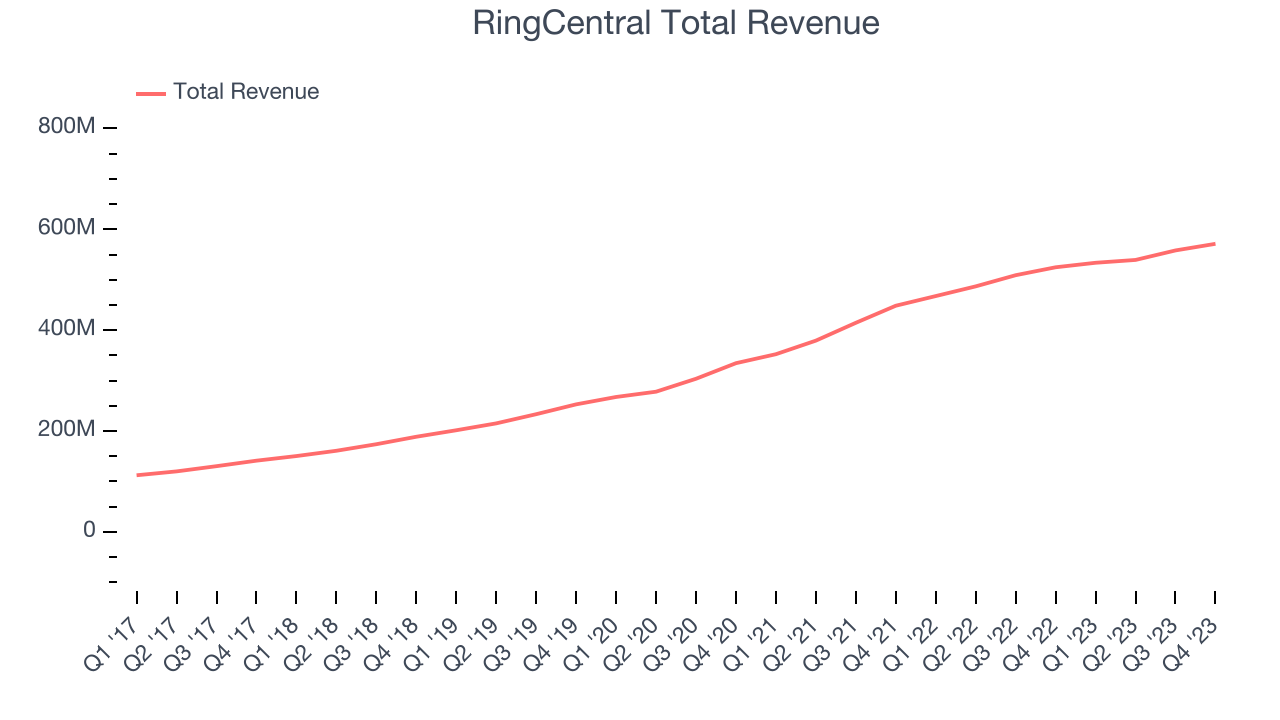

As you can see below, RingCentral's revenue growth has been mediocre over the last two years, growing from $448.5 million in Q4 FY2021 to $571.3 million this quarter.

RingCentral's quarterly revenue was only up 8.9% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $13.11 million in Q4 compared to $18.86 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that RingCentral is expecting revenue to grow 8.2% year on year to $577.5 million, slowing down from the 14.1% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.38 billion at the midpoint, growing 8.2% year on year compared to the 10.8% increase in FY2023.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. RingCentral's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 70.2% in Q4.

That means that for every $1 in revenue the company had $0.70 left to spend on developing new products, sales and marketing, and general administrative overhead. RingCentral's gross margin is lower than that of a typical SaaS businesses. Gross margin has a major impact on a company’s ability to develop new products and invest in marketing, which may ultimately determine the winner in a competitive market. This makes it a critical metric to track for the long-term investor.

Key Takeaways from RingCentral's Q4 Results

Growth is slow these days and RingCentral's full-year revenue guidance was below expectations. Overall, the results could have been better. The company is down 1.9% on the results and currently trades at $30.25 per share.

Is Now The Time?

When considering an investment in RingCentral, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of RingCentral, we'll be cheering from the sidelines. Although its , Wall Street expects growth to deteriorate from here. And while its strong free cash flow generation gives it re-investment options, the downside is its existing customers have been reducing their spend, which is a bit of a concern. On top of that, its customer acquisition is less efficient than many comparable companies.

RingCentral's price-to-sales ratio based on the next 12 months is 1.2x, suggesting that the market does have lower expectations of the business, relative to the high growth tech stocks. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $41.17 per share right before these results (compared to the current share price of $30.25).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.