Industrials automation company Rockwell (NYSE:ROK) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 8.4% year on year to $2.05 billion. It made a non-GAAP profit of $2.71 per share, down from its profit of $3.46 per share in the same quarter last year.

Is now the time to buy Rockwell Automation? Find out by accessing our full research report, it's free.

Rockwell Automation (ROK) Q2 CY2024 Highlights:

- Revenue: $2.05 billion vs analyst estimates of $2.03 billion (small beat)

- EPS (non-GAAP): $2.71 vs analyst estimates of $2.08 (30.2% beat)

- EPS (non-GAAP) guidance for the full year is $9.60 at the midpoint, missing analyst estimates by 5.2%

- Gross Margin (GAAP): 38.8%, down from 40.9% in the same quarter last year

- EBITDA Margin: 24.6%, up from 22.3% in the same quarter last year

- Free Cash Flow of $238.4 million, up from $68.6 million in the previous quarter

- Organic Revenue fell 8.4% year on year (13.2% in the same quarter last year)

- Market Capitalization: $28.59 billion

"Rockwell delivered another quarter of good execution with sales, margin, and EPS all above our expectations. I’m particularly pleased with the progress we are making on driving productivity to support our long-term margin expansion targets. We are already seeing the benefit from these actions this fiscal year and expect to drive margin growth and productivity through FY25 and beyond. On the demand side, we did see additional project delays this quarter, with customers citing weaker consumer demand, high interest rates, and policy uncertainty around tax, tariffs, and stimulus incentives as the main drivers for deferring their investment plans. Therefore, while we saw progress on inventory de-stocking at our distributors and machine builders in Q3, our low-single-digit sequential growth in orders was lower than we expected," said Blake Moret, Chairman and CEO.

One of the first companies to address industrial automation, Rockwell Automation (NYSE:ROK) sells products that help customers extract more efficiency from their machinery.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

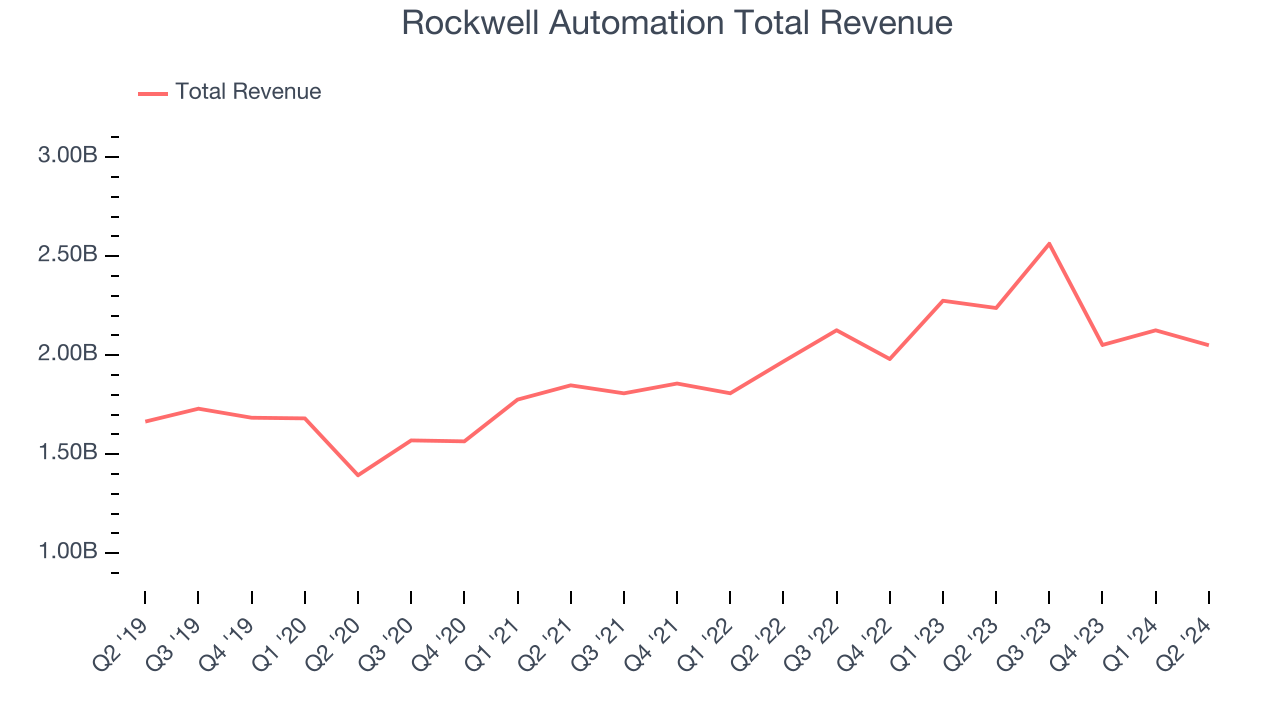

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Regrettably, Rockwell Automation's sales grew at a weak 5.6% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

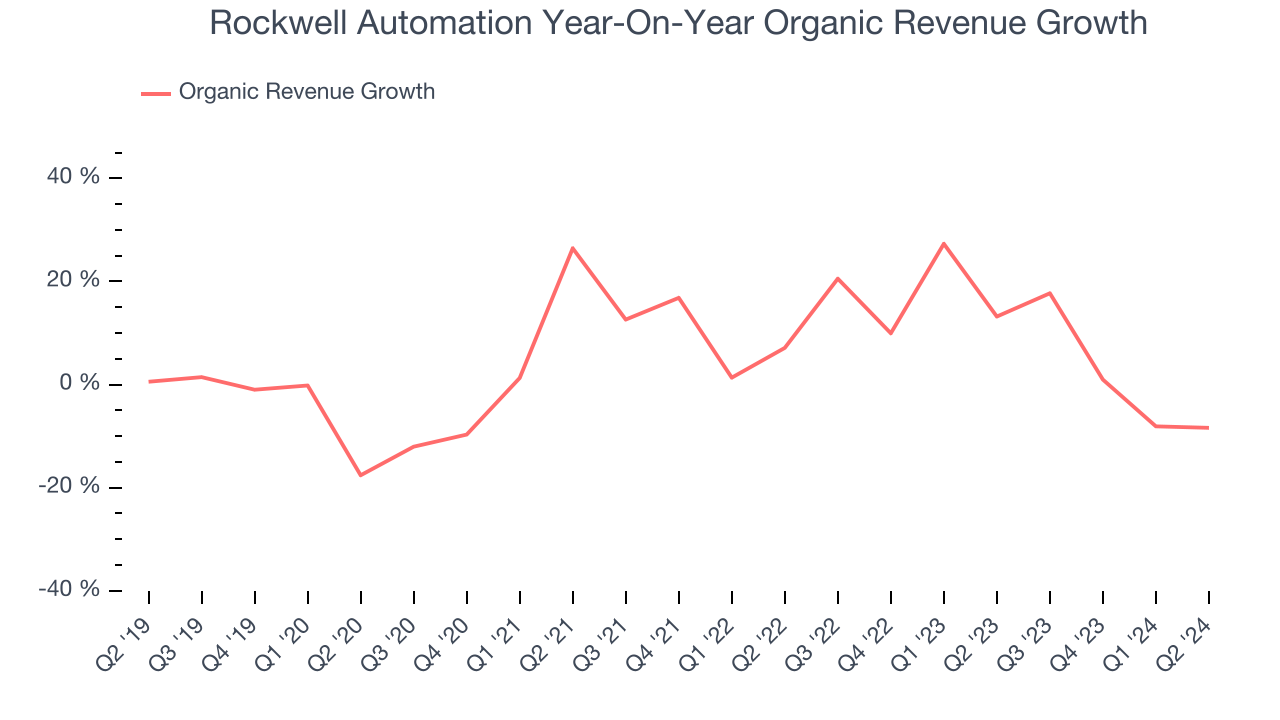

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Rockwell Automation's annualized revenue growth of 8.7% over the last two years is above its five-year trend, suggesting some bright spots.

Rockwell Automation also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don't accurately reflect its fundamentals. Over the last two years, Rockwell Automation's organic revenue averaged 9.1% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company's core operations (not M&A) drove most of its performance.

This quarter, Rockwell Automation reported a rather uninspiring 8.4% year-on-year revenue decline to $2.05 billion of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

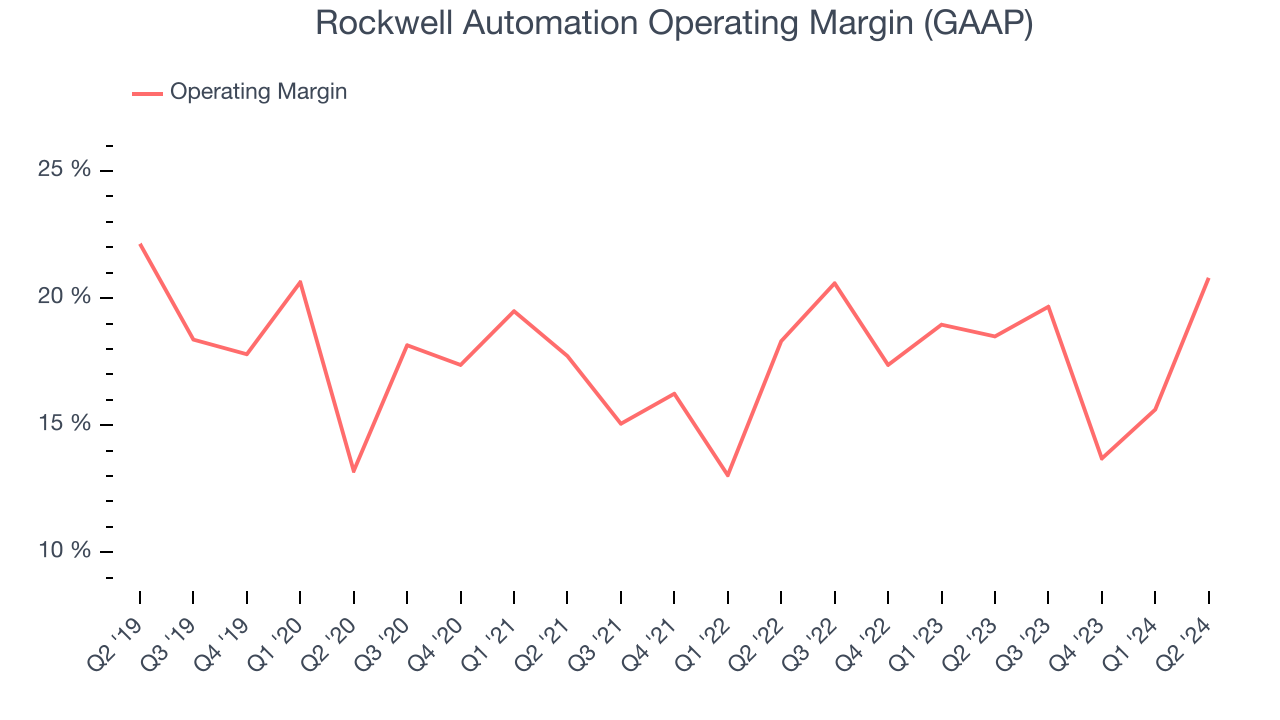

Operating Margin

Rockwell Automation has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.6%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Rockwell Automation's annual operating margin might have seen some fluctuations but has remained more or less the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Rockwell Automation generated an operating profit margin of 20.8%, up 2.3 percentage points year on year. This increase was encouraging, and since the company's revenue and gross margin actually decreased, we can assume it was recently more efficient because it trimmed its operating expenses like sales, marketing, R&D, and administrative overhead.

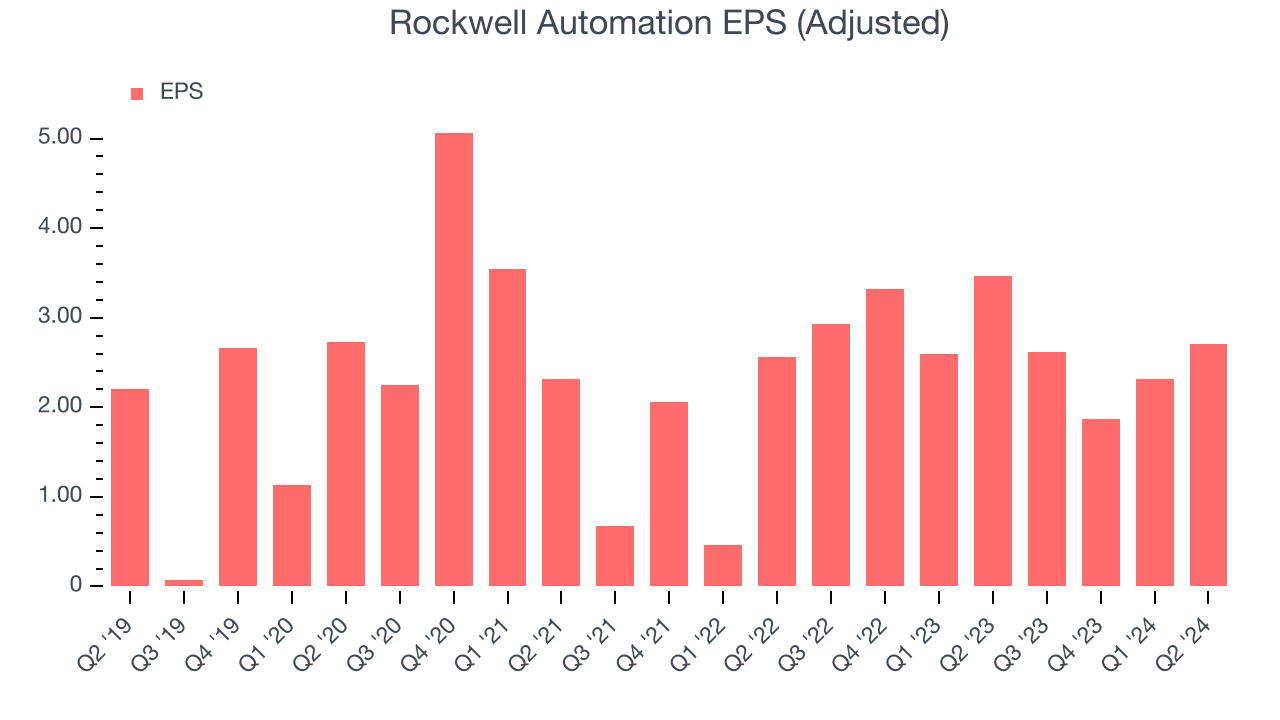

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Rockwell Automation's EPS grew at a weak 2.2% compounded annual growth rate over the last five years, lower than its 5.6% annualized revenue growth. However, its operating margin didn't change during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Rockwell Automation, its two-year annual EPS growth of 28.7% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q2, Rockwell Automation reported EPS at $2.71, down from $3.46 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Rockwell Automation to grow its earnings. Analysts are projecting its EPS of $9.52 in the last year to climb by 20.6% to $11.48.

Key Takeaways from Rockwell Automation's Q2 Results

We were impressed by how significantly Rockwell Automation blew past analysts' EPS expectations this quarter. We were also glad its organic revenue topped Wall Street's estimates. On the other hand, its EPS forecast for the full year missed, which is weighing on shares. The stock traded down 1.5% to $247 immediately following the results.

So should you invest in Rockwell Automation right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.