Industrials automation company Rockwell (NYSE:ROK) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 20.6% year on year to $2.04 billion. Its non-GAAP profit of $2.47 per share was in line with analysts’ consensus estimates.

Is now the time to buy Rockwell Automation? Find out by accessing our full research report, it’s free.

Rockwell Automation (ROK) Q3 CY2024 Highlights:

- Revenue: $2.04 billion vs analyst estimates of $2.08 billion (2.2% miss)

- Adjusted EPS: $2.47 vs analyst expectations of $2.47 (in line)

- EBITDA: $373.5 million vs analyst estimates of $428.9 million (12.9% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $9.20 at the midpoint, missing analyst estimates by 14.5%

- Operating Margin: 20.1%, in line with the same quarter last year

- EBITDA Margin: 18.3%, down from 20.4% in the same quarter last year

- Free Cash Flow Margin: 18%, down from 30.3% in the same quarter last year

- Organic Revenue fell 21% year on year (17.7% in the same quarter last year)

- Market Capitalization: $33.36 billion

"Orders for the quarter came in lower than expected, reflecting continued softness in many of our end markets. Operating performance was solid, with good sales conversion, margin, and EPS. The performance of our Lifecycle Services segment stands out, with its higher exposure to process end markets, growth in digital services, and continued margin expansion. Reflecting on the full year, our people around the world have demonstrated remarkable dedication to serve our customers and bring new innovation to market, and to make the changes necessary to position us for market-beating growth and profit,” said Blake Moret, Chairman and CEO.

Company Overview

One of the first companies to address industrial automation, Rockwell Automation (NYSE:ROK) sells products that help customers extract more efficiency from their machinery.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

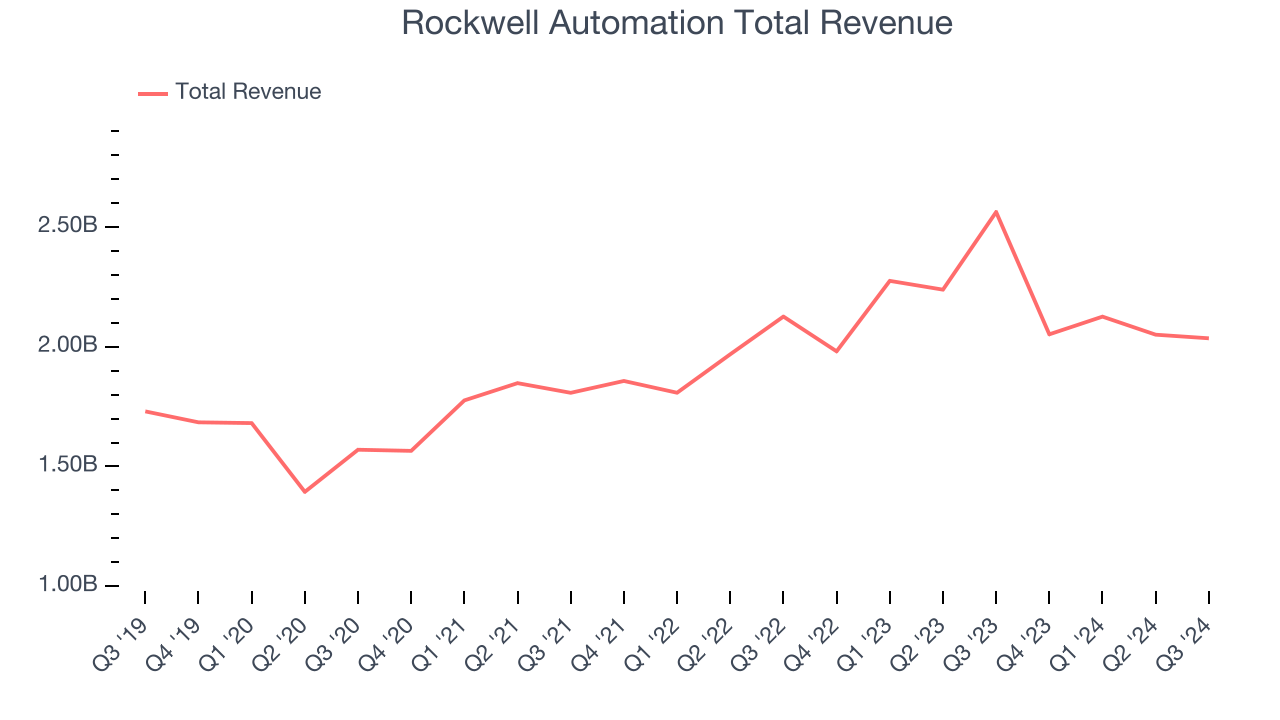

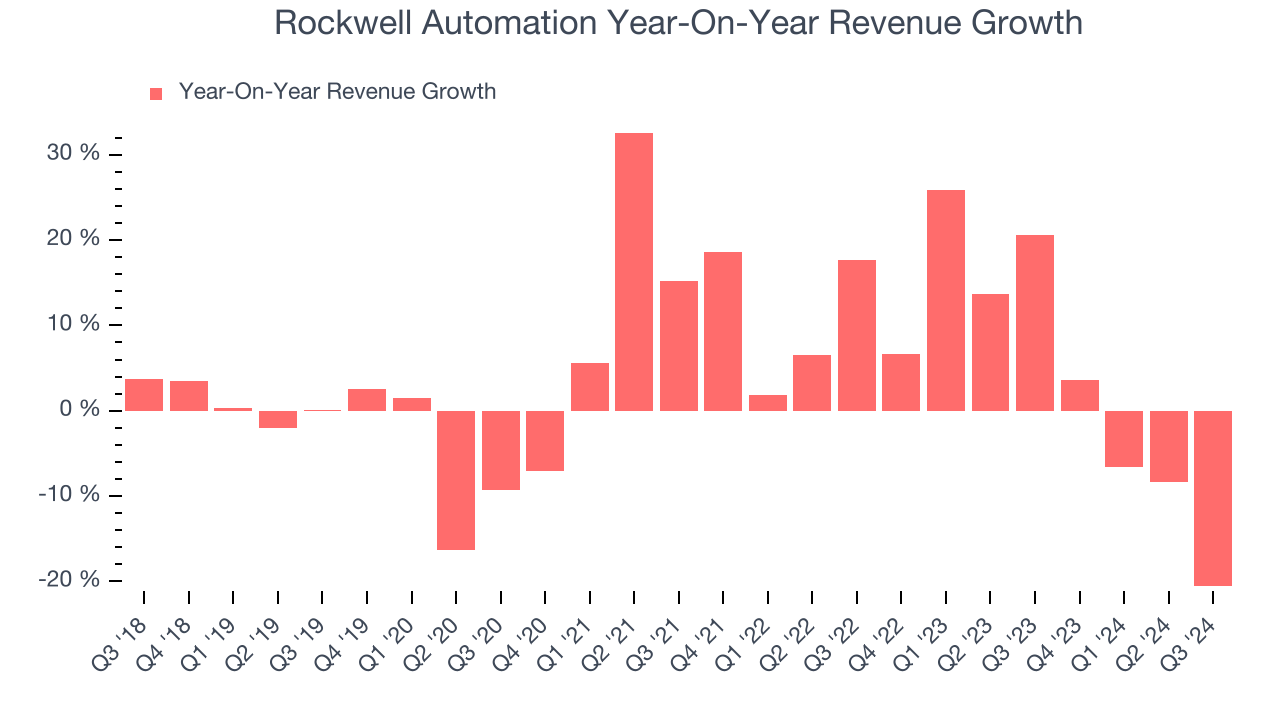

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Rockwell Automation grew its sales at a sluggish 4.3% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

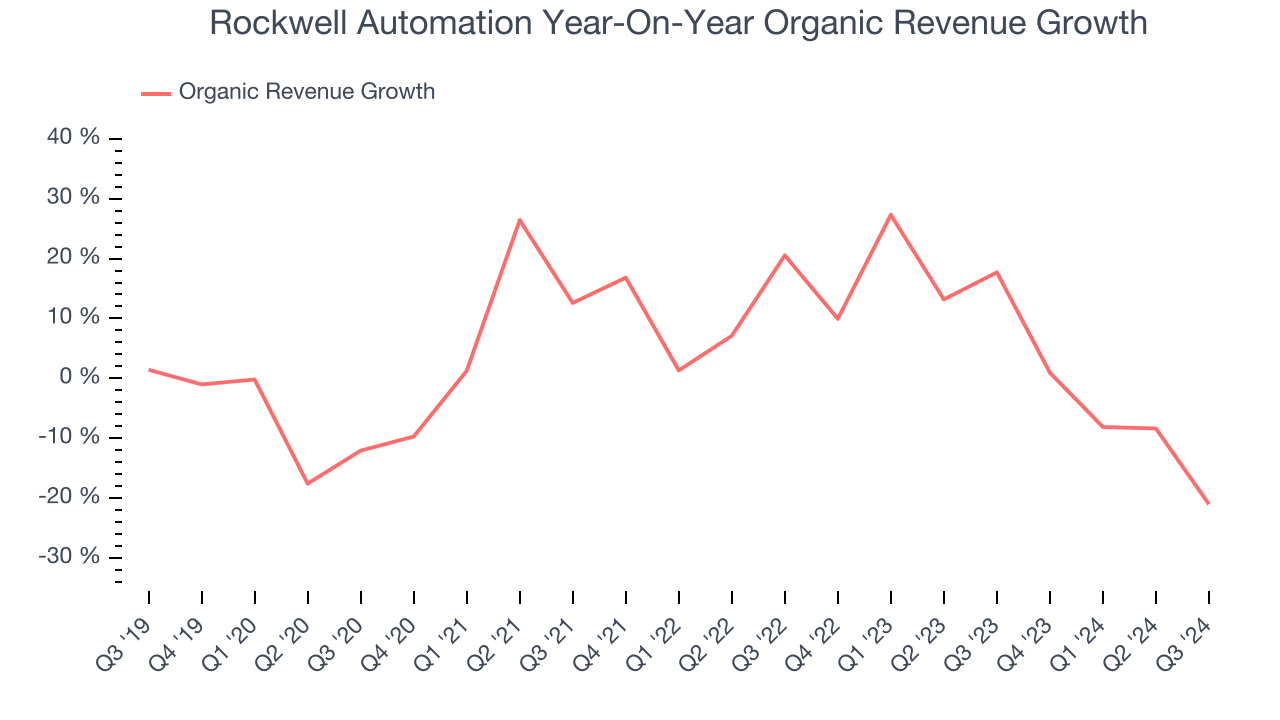

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Rockwell Automation’s recent history shows its demand slowed as its annualized revenue growth of 3.2% over the last two years is below its five-year trend.

Rockwell Automation also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Rockwell Automation’s organic revenue averaged 3.9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not M&A) drove most of its performance.

This quarter, Rockwell Automation missed Wall Street’s estimates and reported a rather uninspiring 20.6% year-on-year revenue decline, generating $2.04 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, similar to its two-year rate. This projection is underwhelming and shows the market believes its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

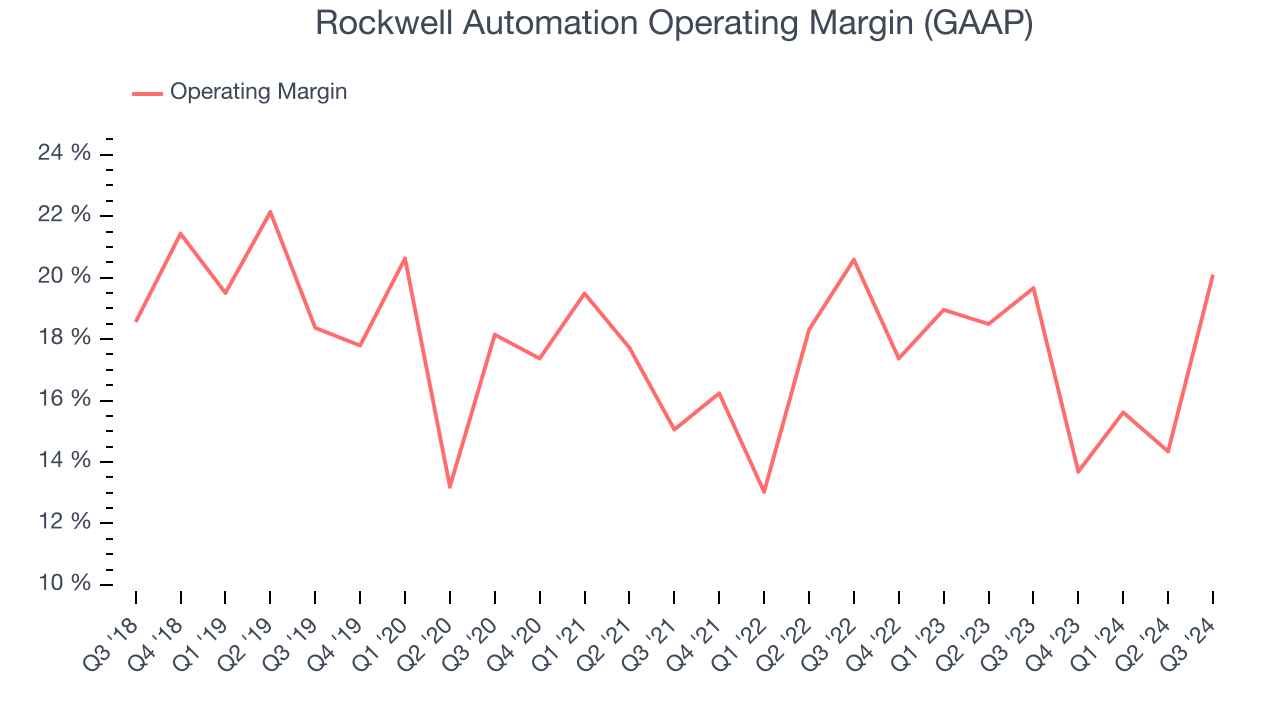

Operating Margin

Rockwell Automation has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Rockwell Automation’s annual operating margin decreased by 1.7 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Rockwell Automation become more profitable in the future.

This quarter, Rockwell Automation generated an operating profit margin of 20.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

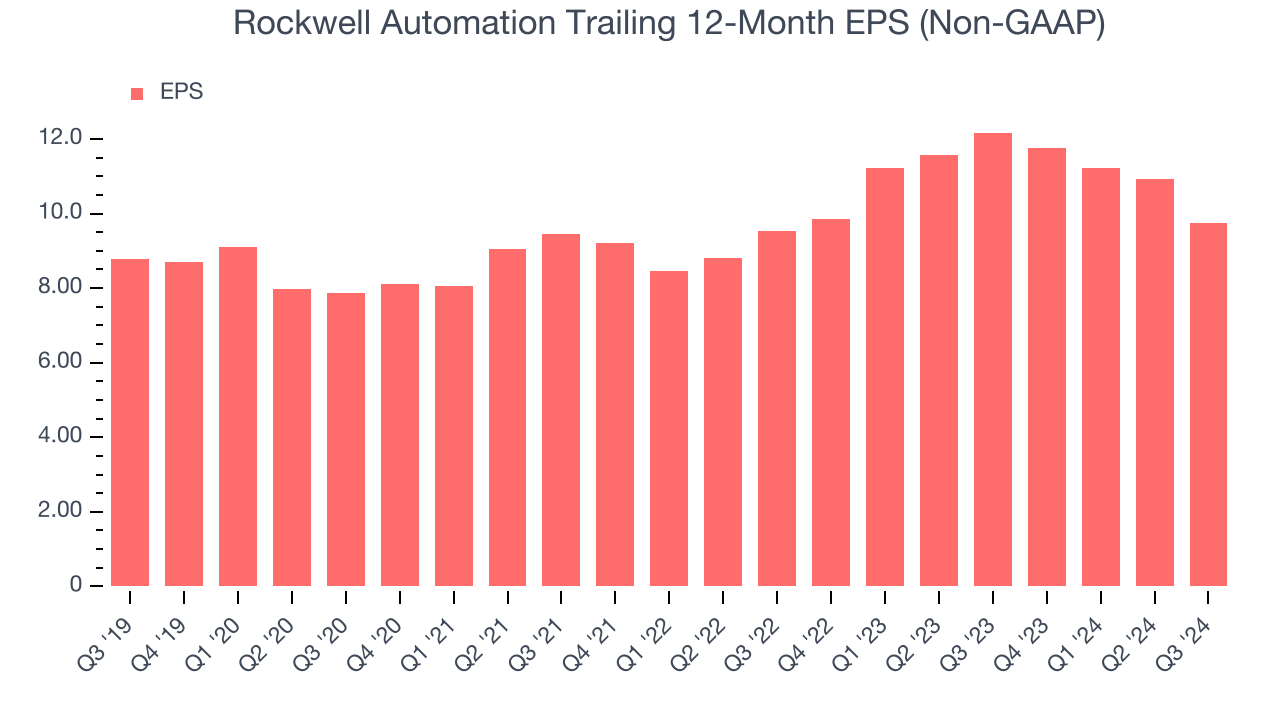

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Rockwell Automation’s EPS grew at a weak 2.1% compounded annual growth rate over the last five years, lower than its 4.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Rockwell Automation’s earnings can give us a better understanding of its performance. As we mentioned earlier, Rockwell Automation’s operating margin was flat this quarter but declined by 1.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rockwell Automation, its two-year annual EPS growth of 1.1% is similar to its five-year trend, implying stable earnings.In Q3, Rockwell Automation reported EPS at $2.47, down from $3.65 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Rockwell Automation’s full-year EPS of $9.74 to grow by 8.2%.

Key Takeaways from Rockwell Automation’s Q3 Results

We struggled to find many strong positives in these results. Its EPS forecast for the full year missed and its revenue fell short of Wall Street’s estimates on weak organic growth. Overall, this was a softer quarter. The stock traded down 2.7% to $285.79 immediately following the results.

Rockwell Automation didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.