Online fashion retailer Revolve Group (NASDAQ: RVLV) reported Q2 CY2024 results topping analysts' expectations, with revenue up 3.2% year on year to $282.5 million. It made a GAAP profit of $0.21 per share, improving from its profit of $0.10 per share in the same quarter last year.

Is now the time to buy Revolve? Find out by accessing our full research report, it's free.

Revolve (RVLV) Q2 CY2024 Highlights:

- Revenue: $282.5 million vs analyst estimates of $277.1 million (1.9% beat)

- EPS: $0.21 vs analyst estimates of $0.12 ($0.09 beat)

- Gross Margin (GAAP): 54%, in line with the same quarter last year

- Adjusted EBITDA Margin: 7.2%, up from 3.8% in the same quarter last year

- Free Cash Flow was -$26.65 million, down from $36.66 million in the previous quarter

- Active Customers : 2.58 million, up 119,000 year on year

- Market Capitalization: $1.26 billion

"I'm thrilled with our team's performance that fueled a strong second quarter, highlighted by a return to top-line growth and a more than doubling of our net income year-over-year," said co-founder and co-CEO Mike Karanikolas.

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

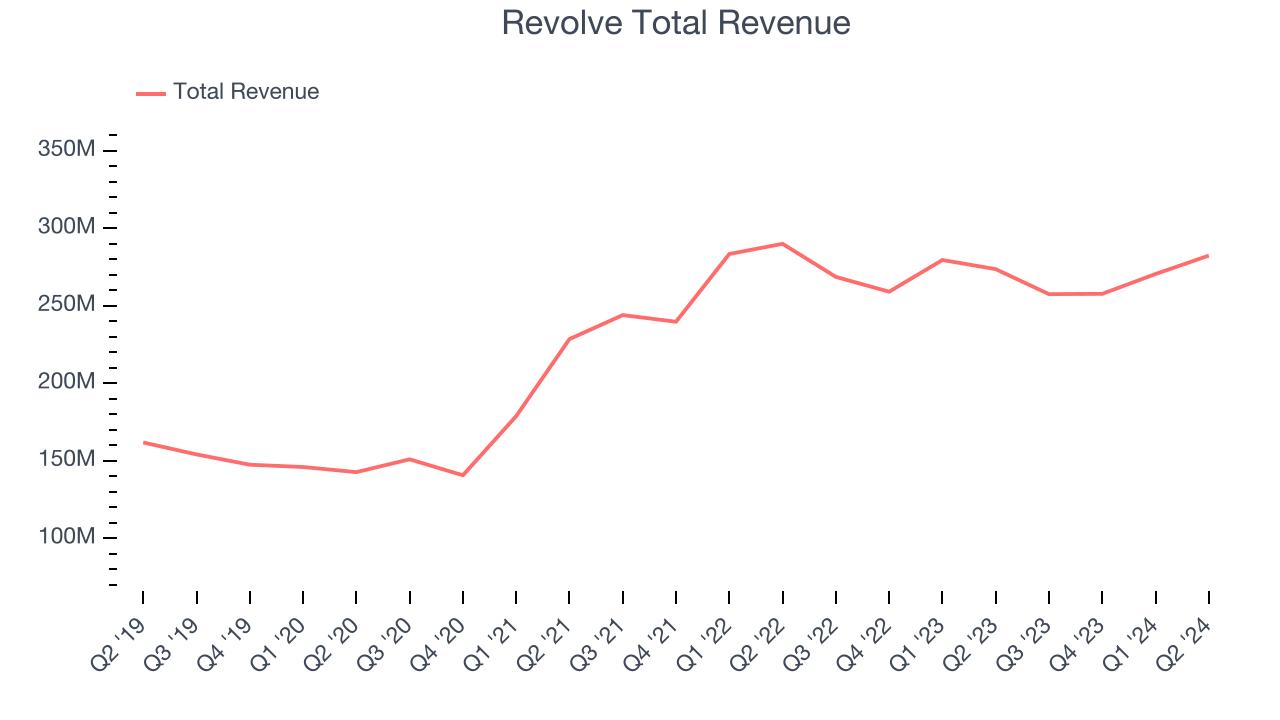

Sales Growth

Revolve's revenue growth over the last three years has been solid, averaging 18.6% annually. This quarter, Revolve beat analysts' estimates but reported lacklustre 3.2% year-on-year revenue growth.

Ahead of the earnings results, analysts were projecting sales to grow 5.7% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Usage Growth

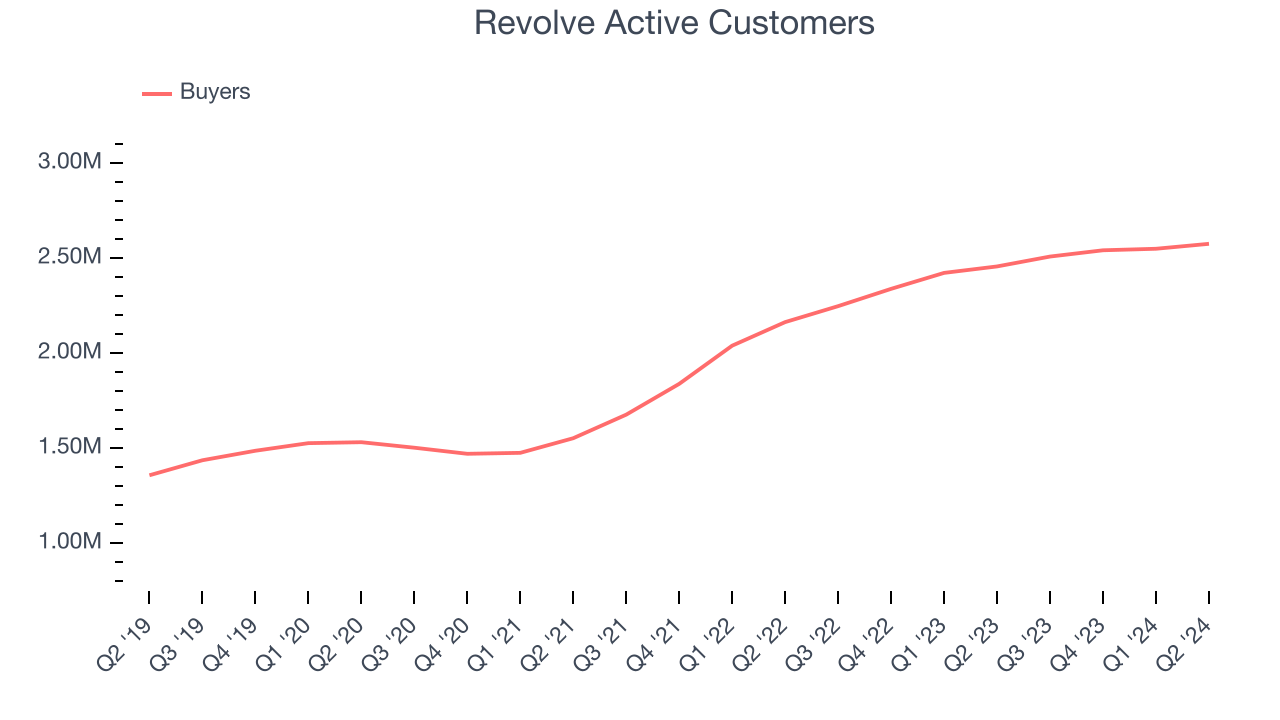

As an online retailer, Revolve generates revenue growth by expanding its number of buyers and the average order size in dollars.

Over the last two years, Revolve's active buyers, a key performance metric for the company, grew 15.5% annually to 2.58 million. This is solid growth for a consumer internet company.

In Q2, Revolve added 119,000 active buyers, translating into 4.8% year-on-year growth.

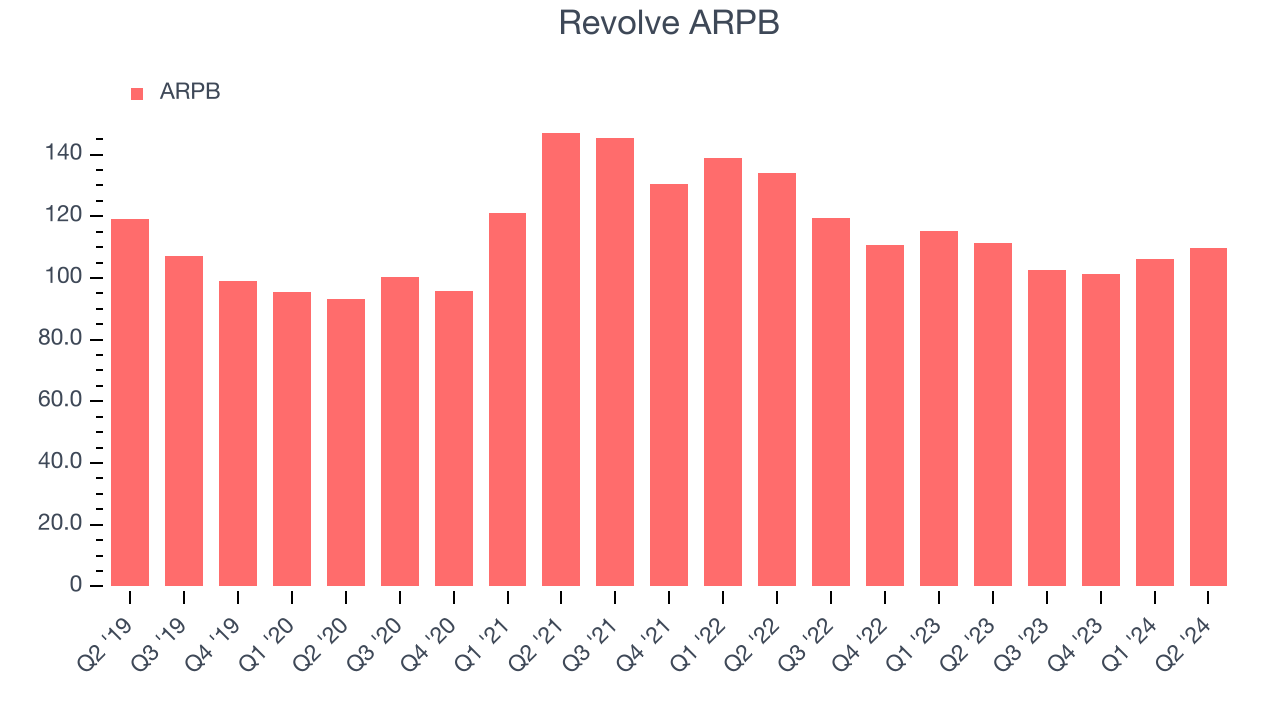

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Revolve because it measures how much customers spend per order.

Revolve's ARPB has declined over the last two years, averaging 12.4%. Although the company's buyers have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPB declined 1.6% year on year to $109.61 per buyer.

Key Takeaways from Revolve's Q2 Results

It was good to see Revolve narrowly top analysts' revenue expectations this quarter. We were also glad its buyers outperformed Wall Street's estimates. On the other hand, its revenue growth regrettably slowed. Overall, this was a solid quarter for Revolve. The stock traded up 5.9% to $18.60 immediately after reporting.

So should you invest in Revolve right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.