Freight Delivery Company RXO (NYSE:RXO) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 6.6% year on year to $1.04 billion. Its non-GAAP profit of $0.05 per share was 6.2% below analysts’ consensus estimates.

Is now the time to buy RXO? Find out by accessing our full research report, it’s free.

RXO (RXO) Q3 CY2024 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.05 billion (in line)

- Adjusted EPS: $0.05 vs analyst expectations of $0.05 (6.2% miss)

- EBITDA: $33 million vs analyst estimates of $30.91 million (6.8% beat)

- EBITDA guidance for Q4 CY2024 is $42.5 million at the midpoint, below analyst estimates of $48.49 million

- Gross Margin (GAAP): 17.5%, in line with the same quarter last year

- Operating Margin: -1.9%, down from 0.6% in the same quarter last year

- EBITDA Margin: 3.2%, in line with the same quarter last year

- Free Cash Flow was -$18 million compared to -$16.33 million in the same quarter last year

- Sales Volumes fell 5% year on year (100% in the same quarter last year)

- Market Capitalization: $5.13 billion

Drew Wilkerson, chief executive officer of RXO, said, “In the third quarter, our focus on execution enabled us to achieve a solid 13.7% gross margin in our Brokerage business, despite the prolonged soft freight market. Momentum continued within our complementary services. In Managed Transportation, we secured more than $300 million in new business and continue to have a strong sales pipeline of more than $1.3 billion in freight under management. In Last Mile, we grew stops by 11% year-over-year, an acceleration from our second-quarter growth rate.”

Company Overview

With access to millions of trucks, RXO (NYSE:RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

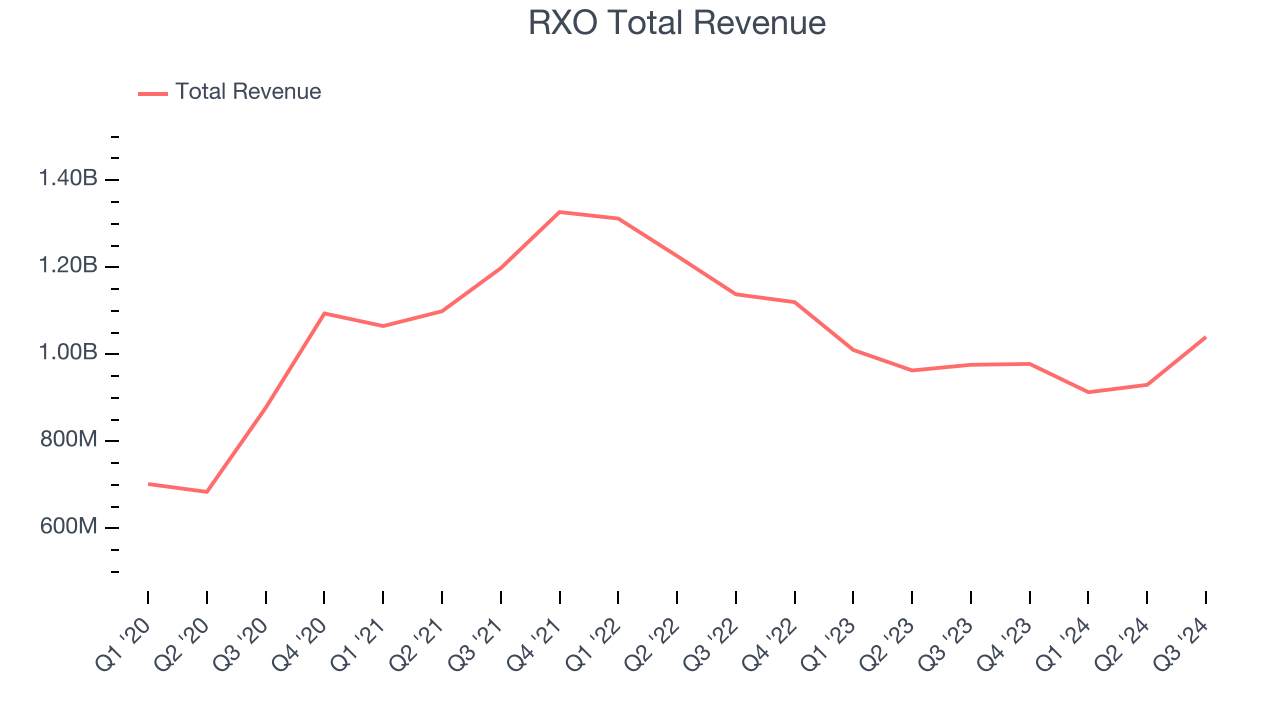

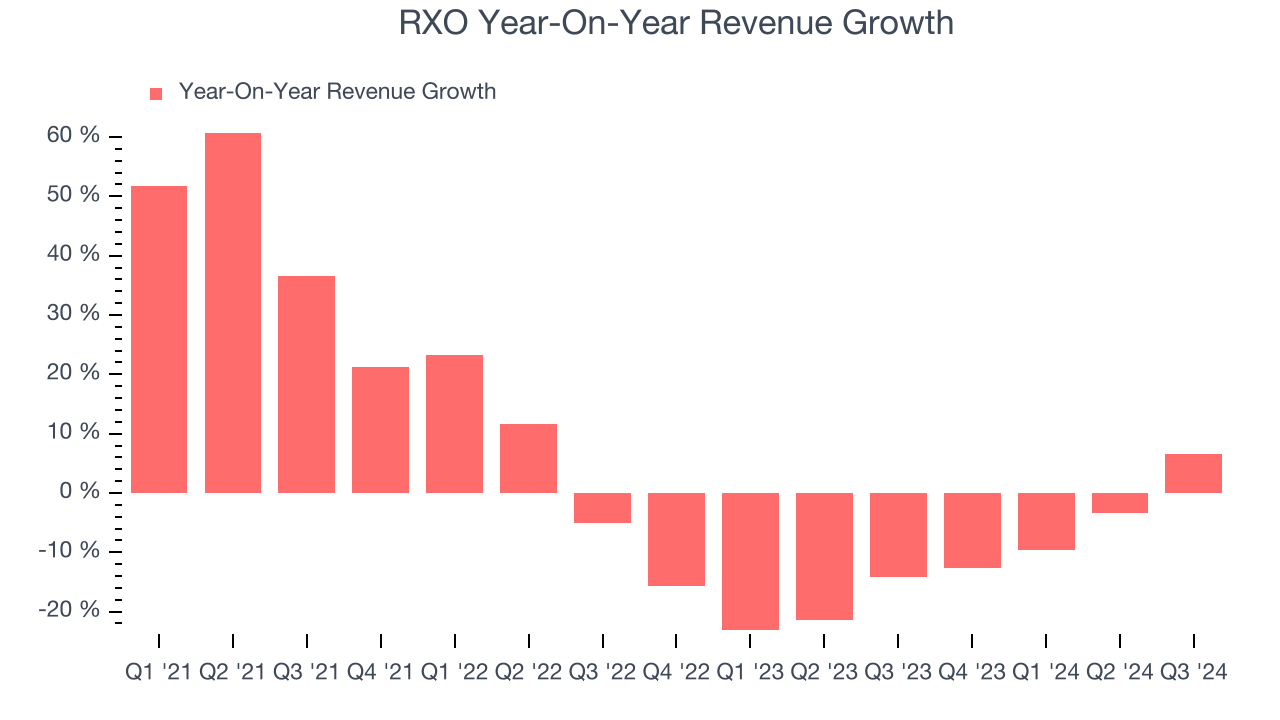

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, RXO’s 6.2% annualized revenue growth over the last four years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. RXO’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 12.2% annually. RXO isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

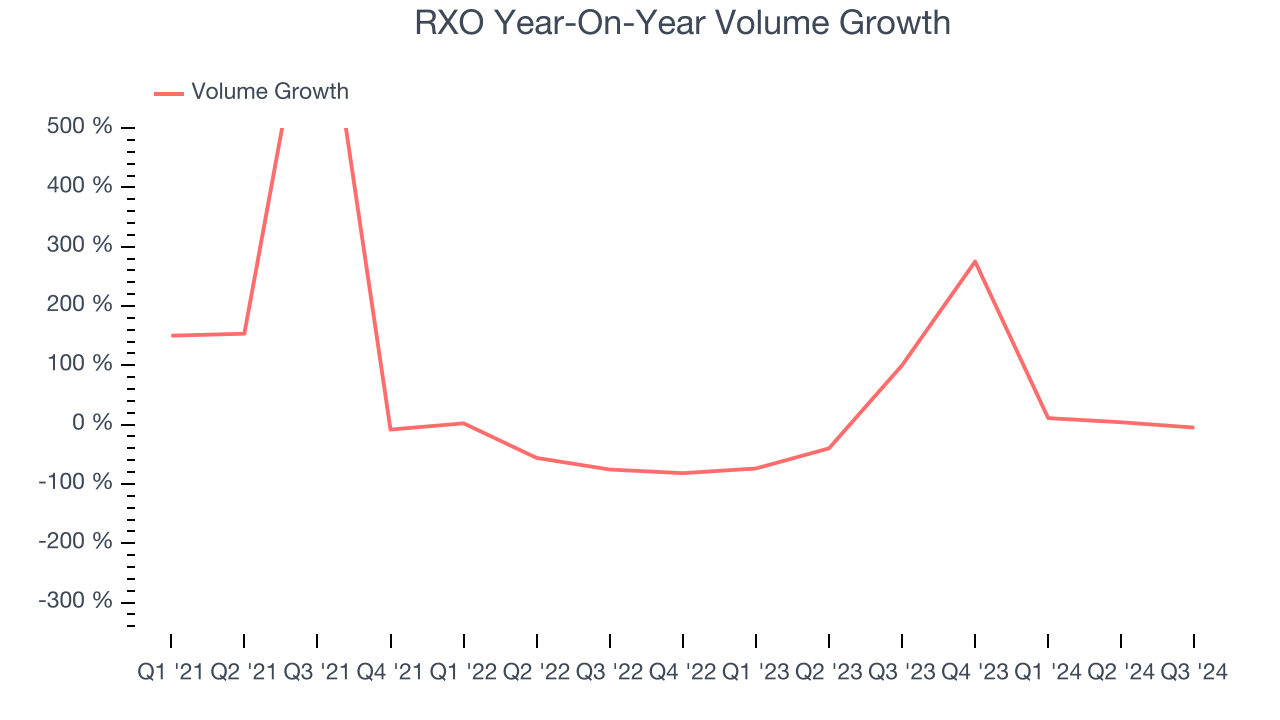

RXO also reports its sales volumes, which show how many products it was moving. Over the last two years, RXO’s sales volumes averaged 23.7% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, RXO grew its revenue by 6.6% year on year, and its $1.04 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 81.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates the market believes its newer products and services will catalyze higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

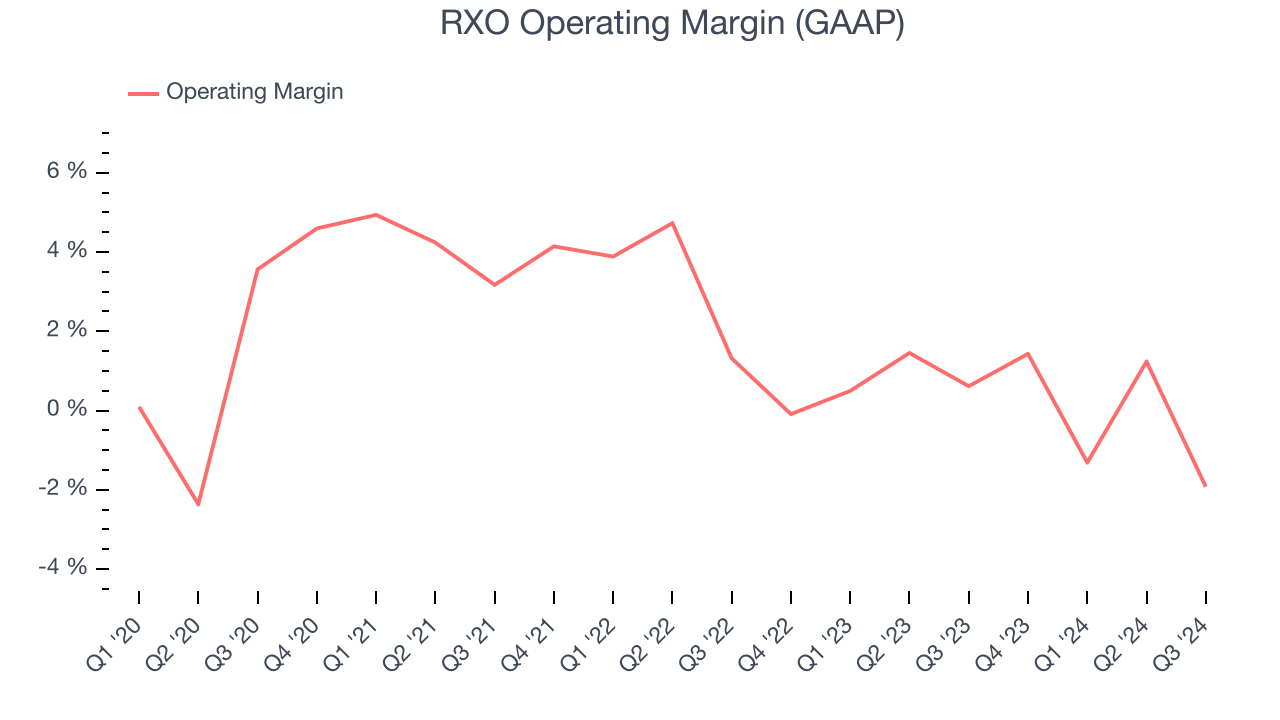

Operating Margin

RXO was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, RXO’s annual operating margin decreased by 1.4 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, RXO generated an operating profit margin of negative 1.9%, down 2.5 percentage points year on year. Since RXO’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

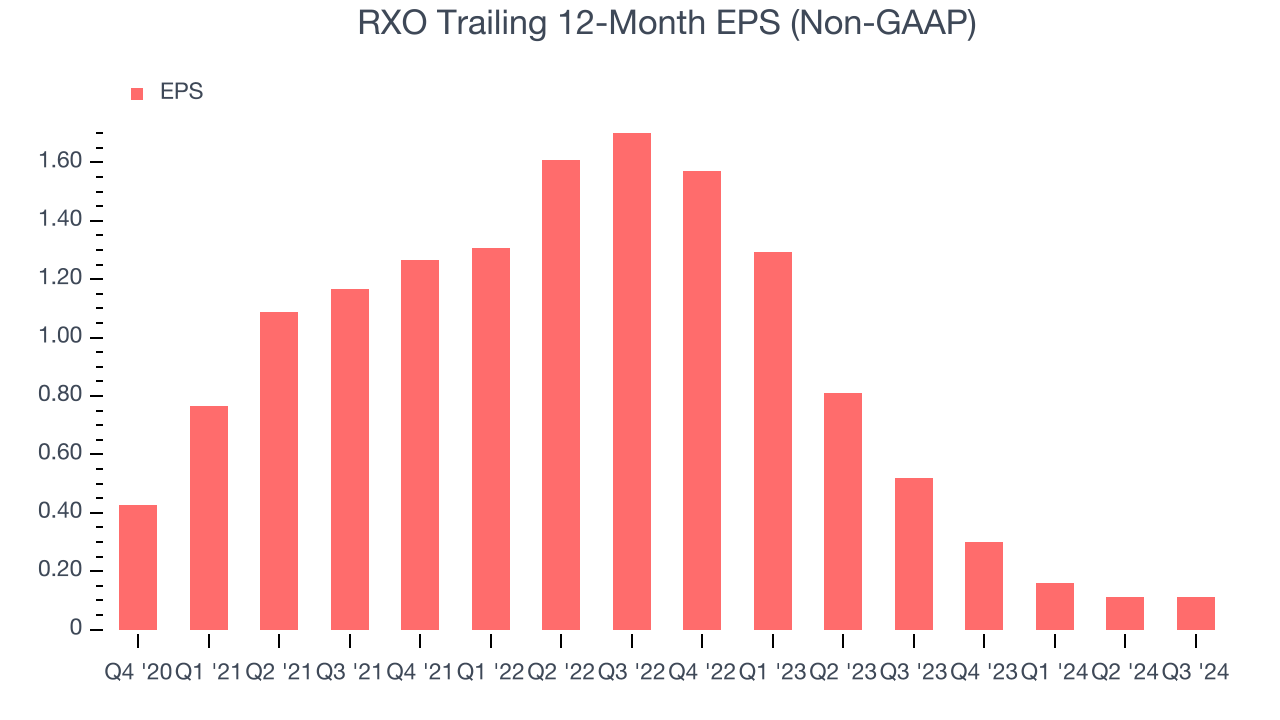

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for RXO, its EPS declined by 18.5% annually over the last four years while its revenue grew by 6.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For RXO, its two-year annual EPS declines of 74.6% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, RXO reported EPS at $0.05, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects RXO’s full-year EPS of $0.11 to grow by 399%.

Key Takeaways from RXO’s Q3 Results

We were impressed by how significantly RXO blew past analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.5% to $30.46 immediately following the results.

RXO underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.