Freight Delivery Company RXO (NYSE:RXO) reported results in line with analysts' expectations in Q2 CY2024, with revenue down 3.4% year on year to $930 million. It made a non-GAAP profit of $0.03 per share, down from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy RXO? Find out by accessing our full research report, it's free.

RXO (RXO) Q2 CY2024 Highlights:

- Revenue: $930 million vs analyst estimates of $933.2 million (small miss)

- EPS (non-GAAP): $0.03 vs analyst expectations of $0.03 (in line)

- Gross Margin (GAAP): 24.7%, up from 18.8% in the same quarter last year

- Adjusted EBITDA Margin: 3%, in line with the same quarter last year

- Free Cash Flow was -$16 million compared to -$4 million in the previous quarter

- Sales Volumes rose 4% year on year (-37.5% in the same quarter last year)

- Market Capitalization: $3.51 billion

Drew Wilkerson, chief executive officer of RXO, said, “In the second quarter, RXO continued to execute well, including achieving 4% Brokerage volume growth despite the prolonged soft freight market. We focused on effectively managing our cost of purchased transportation and achieved Brokerage gross margin of 14.7%. Our complementary services were also a significant contributor to our performance. Last Mile stops grew at the fastest rate in nearly two years, and our Managed Transportation business was awarded more than $200 million in freight under management and continued to grow year-over-year synergy loads it provides to our Brokerage business.

With access to millions of trucks, RXO (NYSE:RXO) offers full-truckload, less-than-truckload, and last-mile deliveries.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

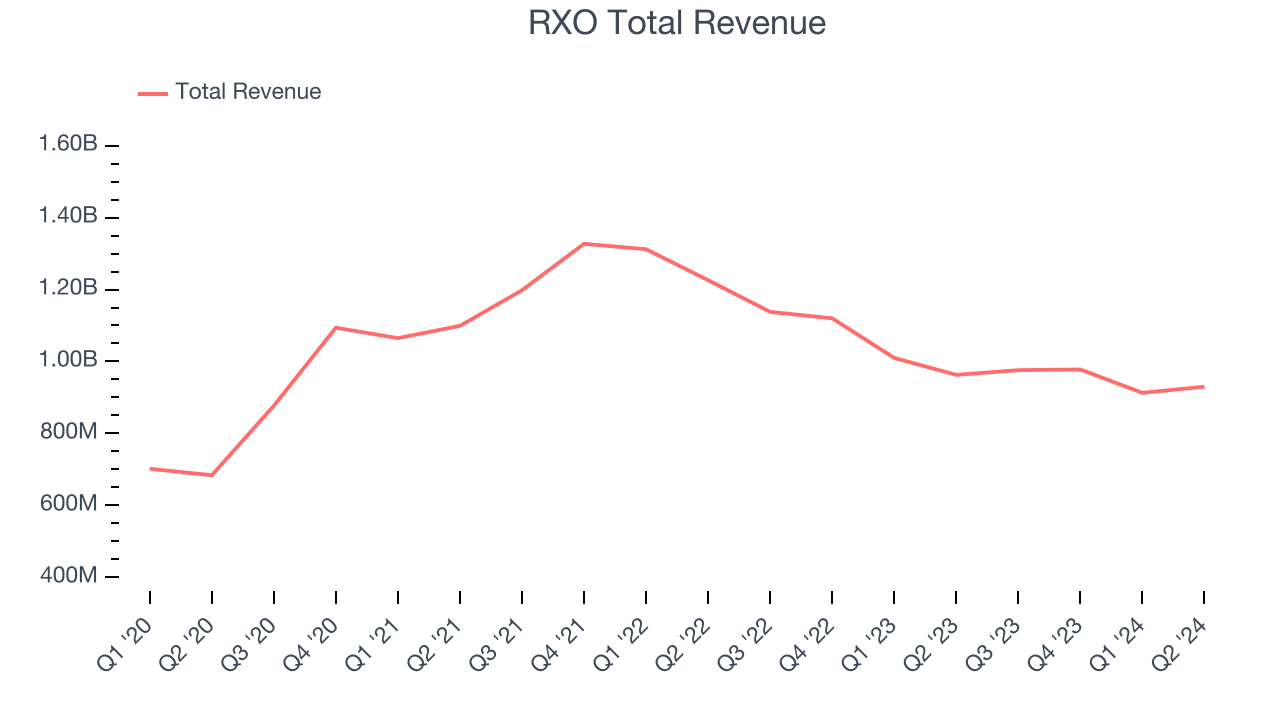

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Unfortunately, RXO's 7.4% annualized revenue growth over the last four years was mediocre. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. RXO's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 13.4% annually.

We can dig further into the company's revenue dynamics by analyzing its sales volumes, which show how much product it was pushing. Over the last two years, RXO's sales volumes averaged 15.3% year-on-year growth. Because this number is better than its revenue growth, we can see the company's average selling price decreased.

This quarter, RXO reported a rather uninspiring 3.4% year-on-year revenue decline to $930 million of revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 8% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

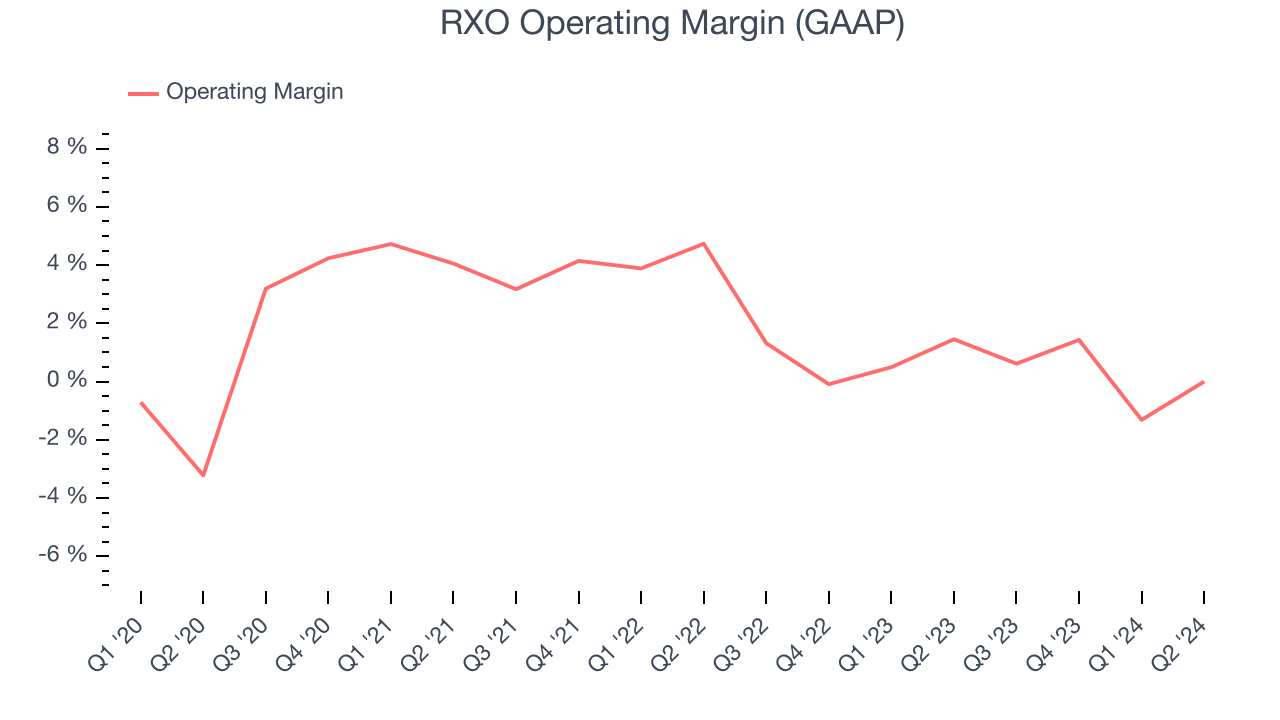

RXO was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 2.1%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, RXO's annual operating margin rose by 1.3 percentage points over the last five years

In Q2, RXO's breakeven margin was down 1.5 percentage points year on year. Conversely, the company's gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like sales, marketing, R&D, and administrative overhead.

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

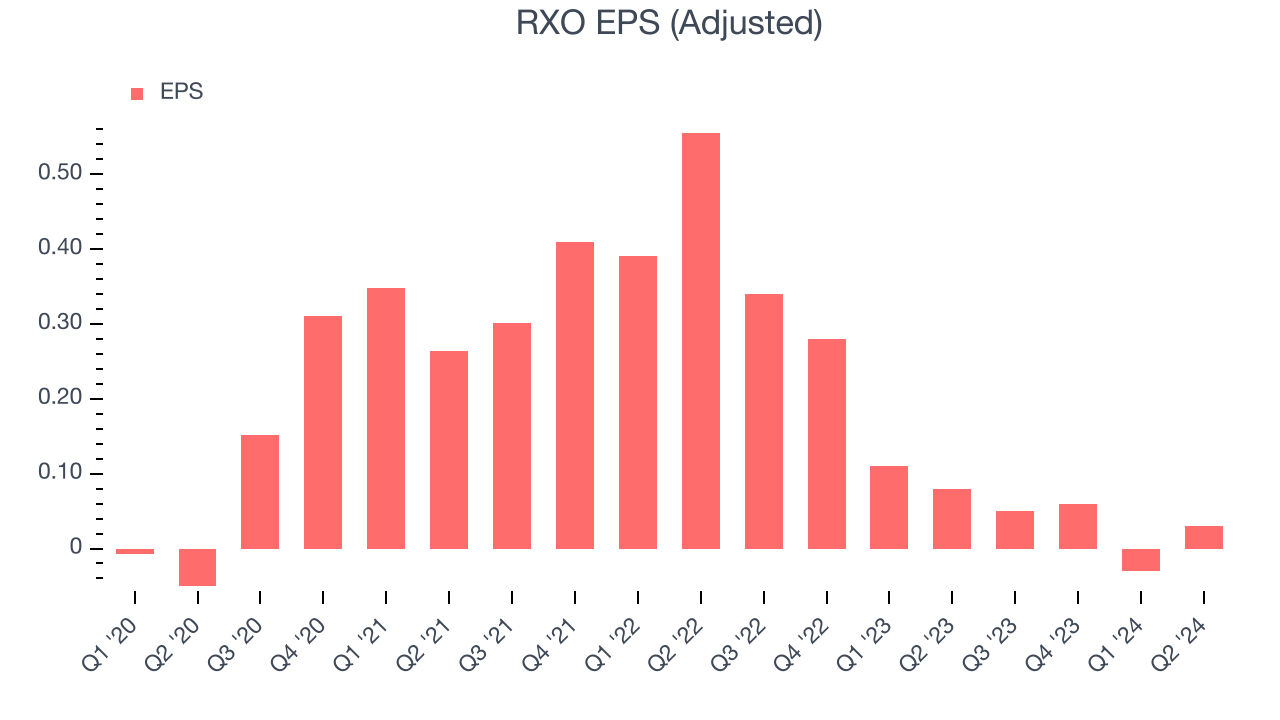

RXO's full-year EPS flipped from negative to positive over the last four years. This is encouraging and shows it's at a critical moment in its life.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. Sadly for RXO, its EPS declined more than its revenue over the last two years, dropping by 74.2%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

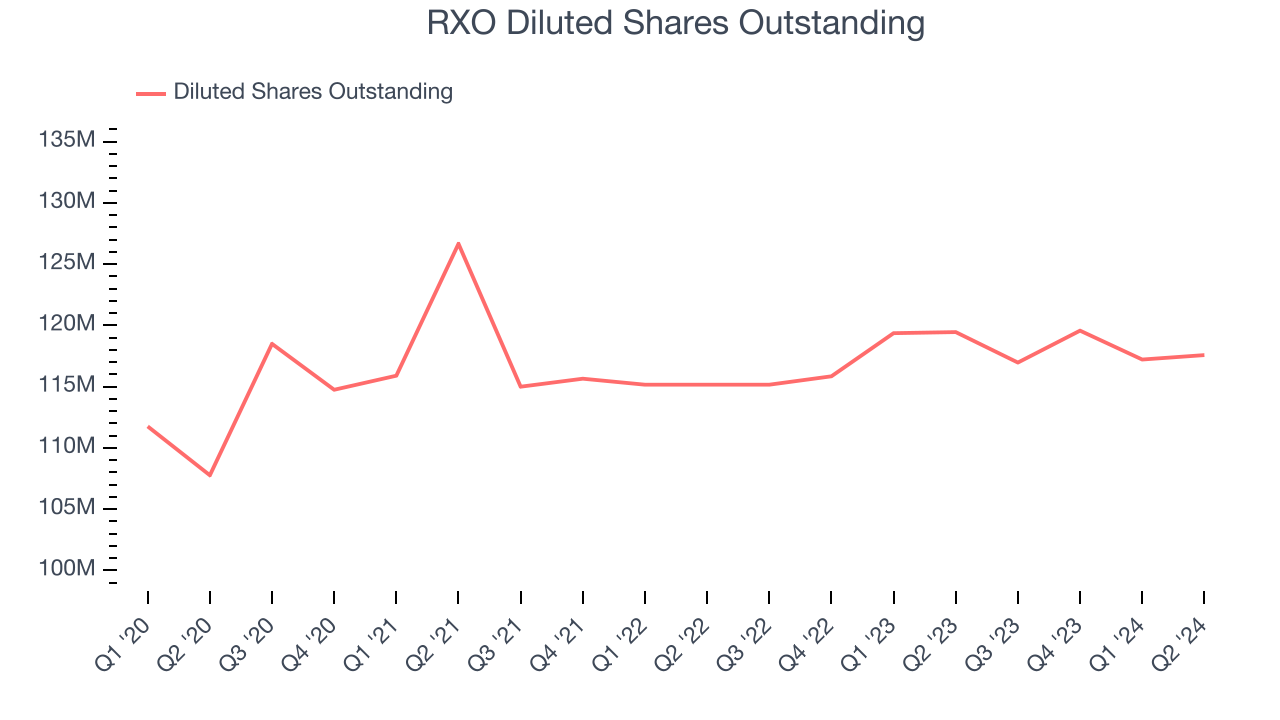

Diving into the nuances of RXO's earnings can give us a better understanding of its performance. RXO's operating margin has declined 4.7 percentage points over the last two years while its share count has grown 2.1%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q2, RXO reported EPS at $0.03, down from $0.08 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects RXO to perform poorly. Analysts are projecting its EPS of $0.11 in the last year to hit $0.36.

Key Takeaways from RXO's Q2 Results

It was good to see RXO beat analysts' EPS expectations this quarter. On the other hand, its revenue unfortunately missed. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The market was likely expecting more, and the stock traded down 4.2% to $28.63 immediately following the results.

So should you invest in RXO right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.