Cyber security company SentinelOne (NYSE:S) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue up 38.1% year on year to $174.2 million. The company expects next quarter's revenue to be around $181 million, in line with analysts' estimates. It made a non-GAAP loss of $0.02 per share, improving from its loss of $0.13 per share in the same quarter last year.

Is now the time to buy SentinelOne? Find out by accessing our full research report, it's free.

SentinelOne (S) Q4 FY2023 Highlights:

- Revenue: $174.2 million vs analyst estimates of $169.4 million (2.8% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.04

- Revenue Guidance for Q1 2024 is $181 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $815 million at the midpoint, in line with analyst expectations and implying 31.2% growth (vs 49.2% in FY2023)

- Gross Margin (GAAP): 72.3%, up from 68.5% in the same quarter last year

- Free Cash Flow was -$10.64 million compared to -$26.38 million in the previous quarter

- Annual Recurring Revenue: $724.4 million at quarter end, up 38.8% year on year

- Net Revenue Retention Rate: 115%, in line with the previous quarter

- Market Capitalization: $8.35 billion

“We closed the year on a very strong note and surpassed our fourth quarter top and bottom line expectations. In fiscal year 202[3], we delivered industry-leading revenue growth of 47% and operating margin improvement of more than 30 percentage points compared to the prior year,” said Tomer Weingarten, CEO of SentinelOne.

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Sales Growth

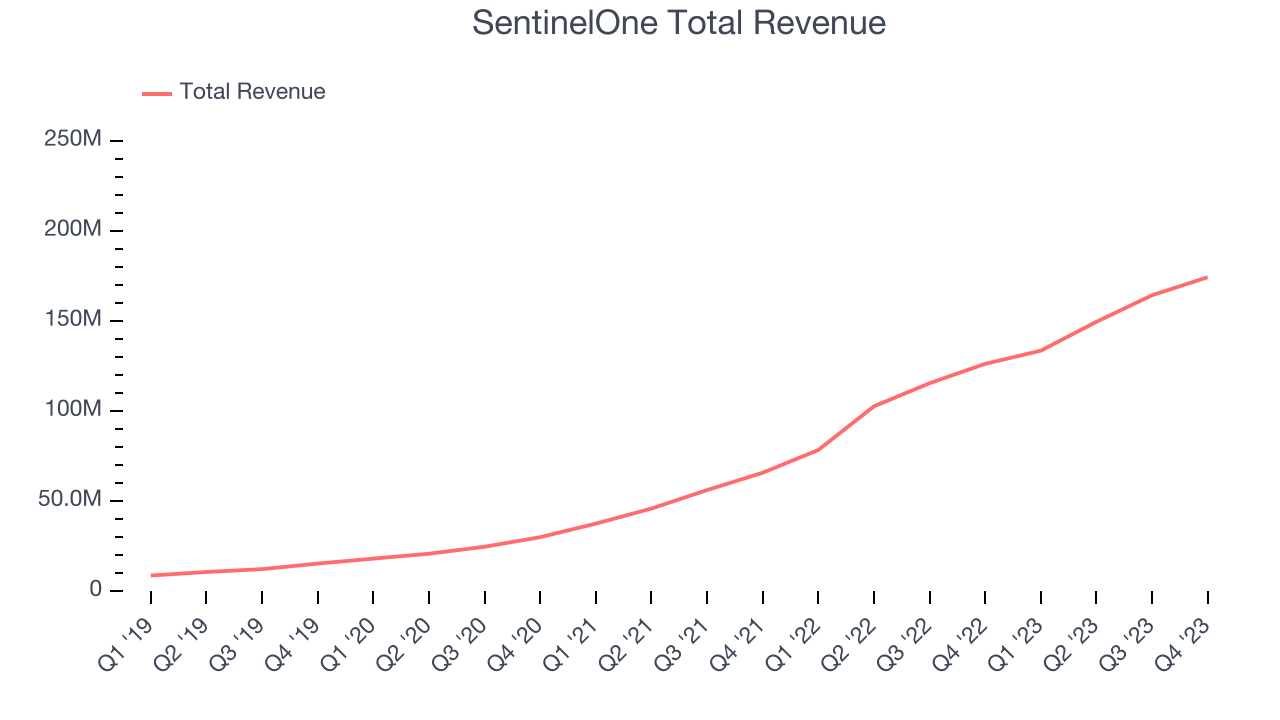

As you can see below, SentinelOne's revenue growth has been incredible over the last three years, growing from $29.87 million in Q4 2021 to $174.2 million this quarter.

Unsurprisingly, this was another great quarter for SentinelOne with revenue up 38.1% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $10.01 million in Q4 compared to $14.74 million in Q3 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that SentinelOne is expecting revenue to grow 35.7% year on year to $181 million, slowing down from the 70.5% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $815 million at the midpoint, growing 31.2% year on year compared to the 47.1% increase in FY2024.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

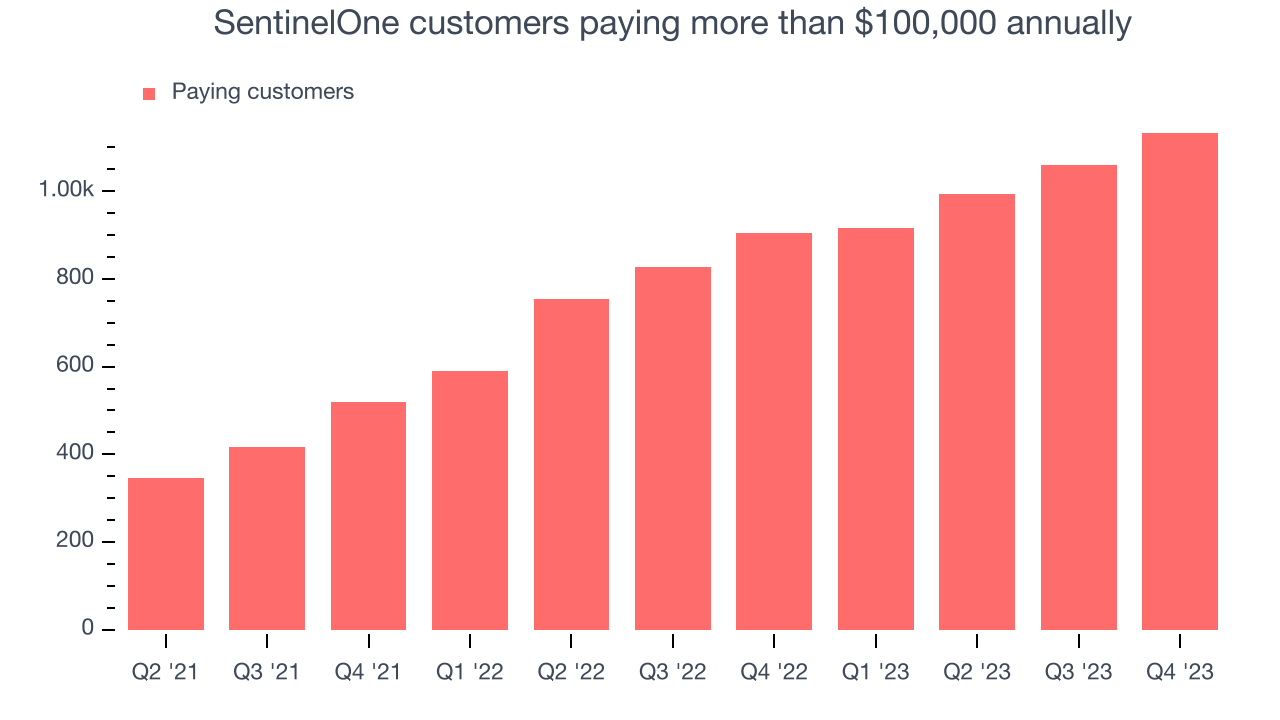

Large Customers Growth

This quarter, SentinelOne reported 1,133 enterprise customers paying more than $100,000 annually, an increase of 73 from the previous quarter. That's quite a bit more contract wins than last quarter and about the same as what we've seen in past quarters, demonstrating that the business has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is running smoothly.

Key Takeaways from SentinelOne's Q4 Results

Although SentinelOne beat analysts' revenue expectations this quarter, its net revenue retention rate of 115% missed estimates of 118%. That means its existing customers bought fewer products, and the company is more dependent on new customers (expensive to acquire) to generate growth. Its revenue guidance for the upcoming year also came in below expectations, suggesting a slowdown in demand amidst an intense competitive landscape with cybersecurity peers like CrowdStrike. Overall, this was a tough quarter for SentinelOne. The company is down 10% on the results and currently trades at $25.15 per share.

So should you invest in SentinelOne right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.