Cyber security company SentinelOne (NYSE:S) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 39.7% year on year to $186.4 million. The company expects next quarter's revenue to be around $197 million, in line with analysts' estimates. It made a non-GAAP loss of $0 per share, improving from its loss of $0.15 per share in the same quarter last year.

Is now the time to buy SentinelOne? Find out by accessing our full research report, it's free.

SentinelOne (S) Q1 CY2024 Highlights:

- Revenue: $186.4 million vs analyst estimates of $181.1 million (2.9% beat)

- EPS (non-GAAP): $0 vs analyst estimates of -$0.05 ($0.05 beat)

- Revenue Guidance for Q2 CY2024 is $197 million at the midpoint, roughly in line with what analysts were expecting

- The company reconfirmed its revenue guidance for the full year of $811.5 million at the midpoint

- Gross Margin (GAAP): 73.1%, up from 68.1% in the same quarter last year

- Free Cash Flow of $33.76 million is up from -$10.64 million in the previous quarter

- Annual Recurring Revenue: $762 million at quarter end, up 35.2% year on year

- Market Capitalization: $6.46 billion

“We delivered an extraordinary 40% revenue growth and our first ever quarter of positive free cash flow, a significant milestone in our growth journey,” said Tomer Weingarten, CEO of SentinelOne.

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

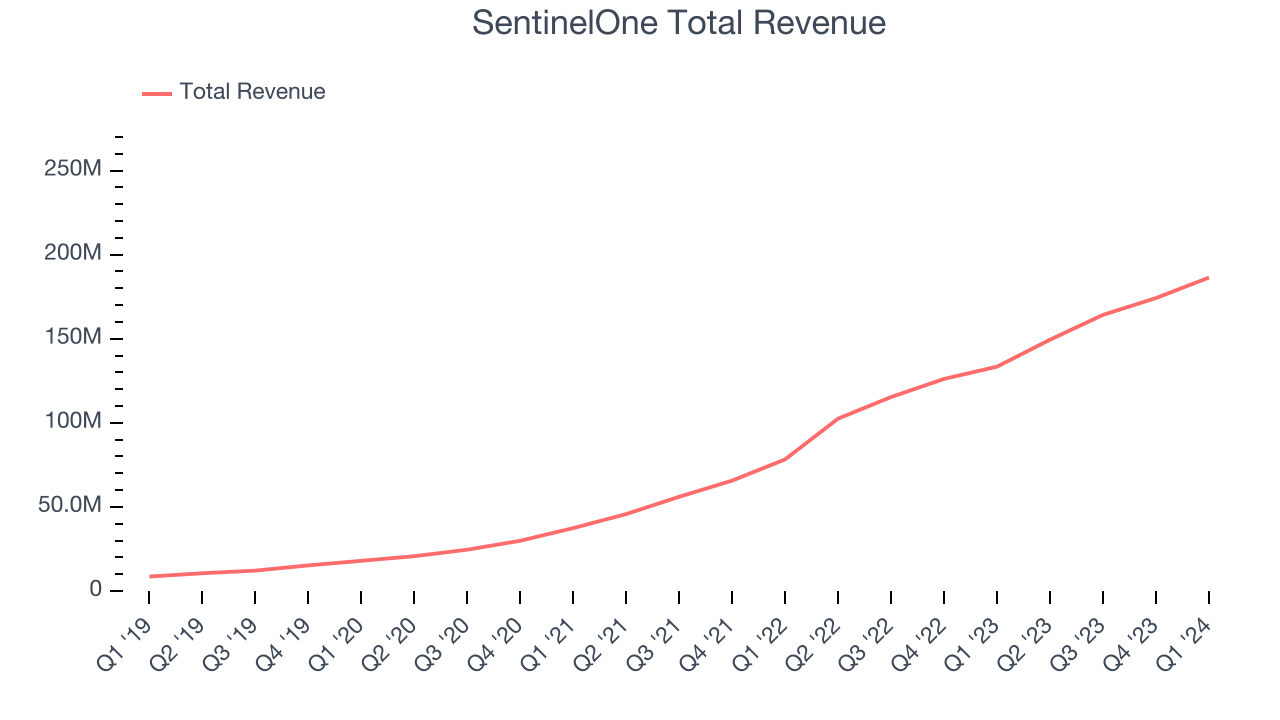

Sales Growth

As you can see below, SentinelOne's revenue growth has been incredible over the last three years, growing from $37.4 million in Q1 2022 to $186.4 million this quarter.

Unsurprisingly, this was another great quarter for SentinelOne with revenue up 39.7% year on year. On top of that, its revenue increased $12.18 million quarter on quarter, a very strong improvement from the $10.01 million increase in Q4 CY2023. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that SentinelOne is expecting revenue to grow 31.8% year on year to $197 million, slowing down from the 45.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 28.7% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

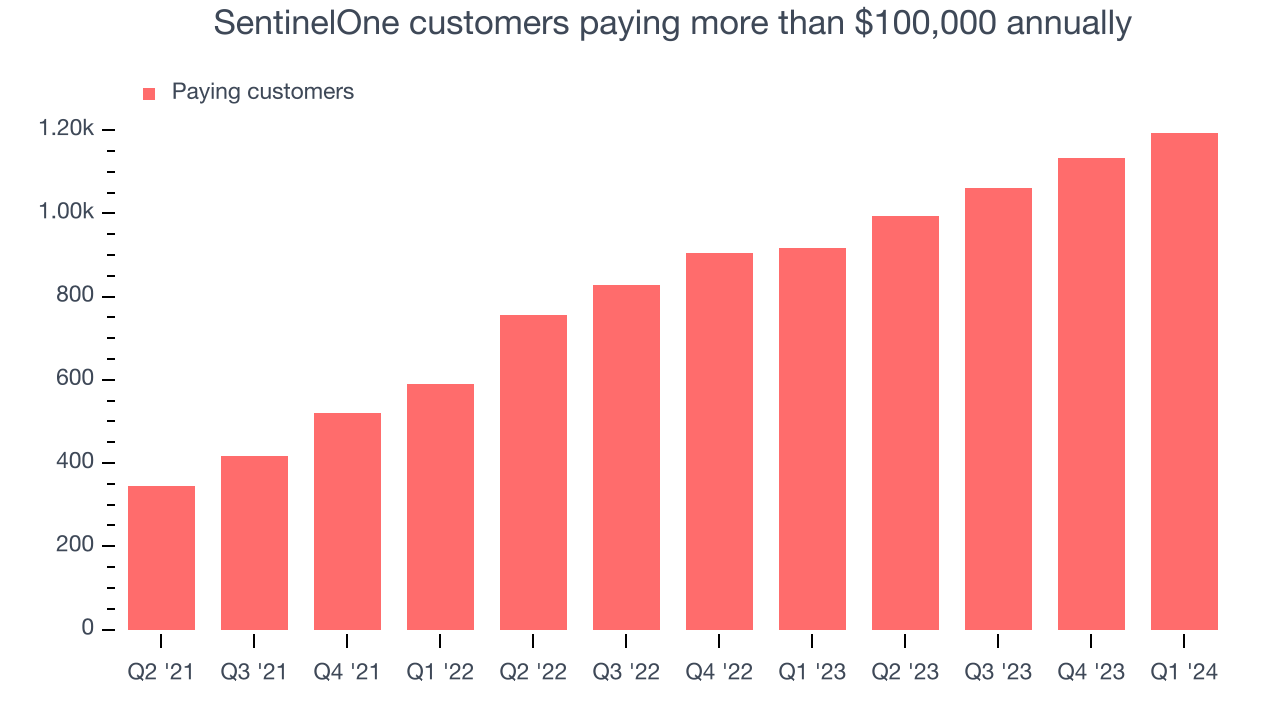

Large Customers Growth

This quarter, SentinelOne reported 1,193 enterprise customers paying more than $100,000 annually, an increase of 60 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from SentinelOne's Q1 Results

It was good to see SentinelOne beat analysts' revenue and EPS expectations this quarter. We were also glad its gross margin improved. On the other hand, its full-year revenue guidance was below expectations, sending the stock down 8% after hours. Overall, this was a mediocre quarter for SentinelOne. The company currently trades at $17.87 per share.

SentinelOne may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.