Cyber security company SentinelOne (NYSE:S) reported Q2 FY2024 results exceeding Wall Street analysts' expectations, with revenue up 45.8% year on year to $149.4 million. The company also expects next quarter's revenue to be around $156 million, in line with analysts' estimates. Turning to EPS, SentinelOne made a GAAP loss of $0.31 per share, improving from its loss of $0.35 per share in the same quarter last year.

Is now the time to buy SentinelOne? Find out by accessing our full research report, it's free.

SentinelOne (S) Q2 FY2024 Highlights:

- Revenue: $149.4 million vs analyst estimates of $141 million (5.98% beat)

- EPS (non-GAAP): -$0.08 vs analyst estimates of -$0.14 (beat)

- Revenue Guidance for Q3 2024 is $156 million at the midpoint, above analyst estimates of $154.5 million

- The company lifted its revenue guidance for the full year from $595 million to $605 million at the midpoint, a 1.68% increase

- Free Cash Flow was -$15.2 million compared to -$31.4 million in the previous quarter

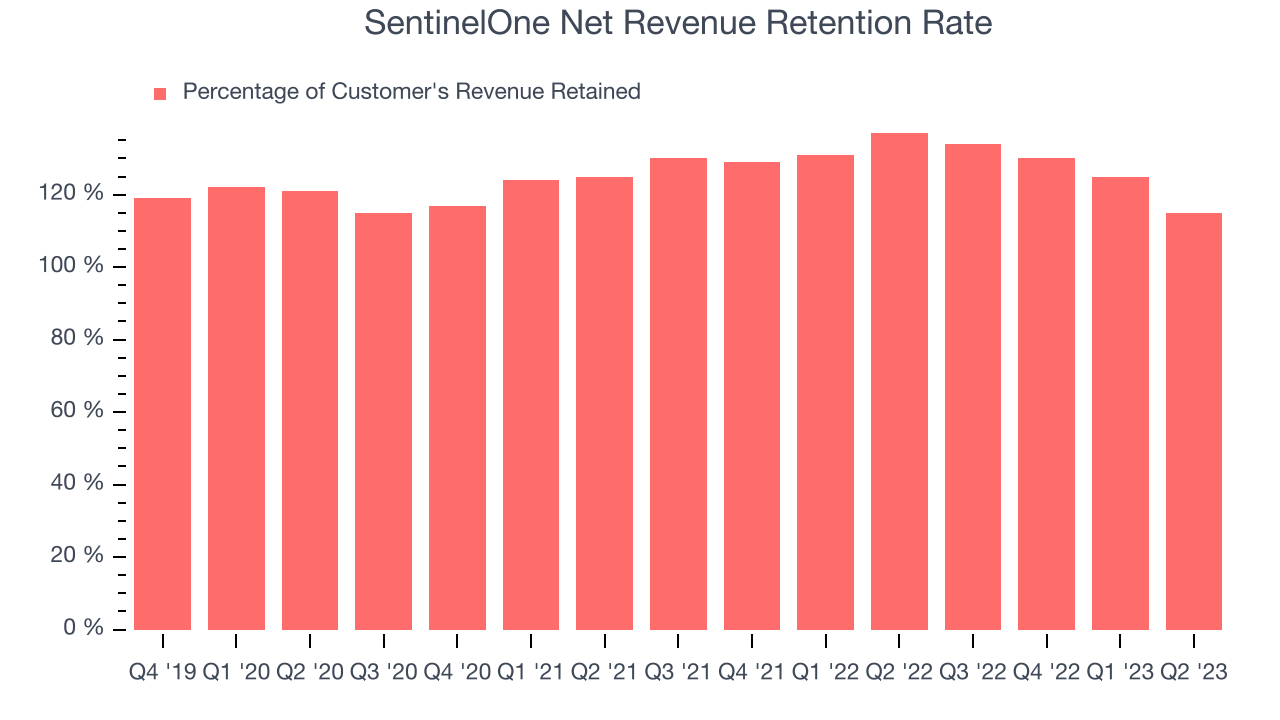

- Net Revenue Retention Rate: 115%, down from 125% in the previous quarter

- Customers: 11,000, up from 10,680 in the previous quarter

- Gross Margin (GAAP): 70.1%, up from 64.6% in the same quarter last year

“Our second quarter performance exceeded our expectations across the board. I’m proud of the resilience, dedication, and execution of our teams. We’re delivering industry-leading margin improvement while maintaining strong growth, and steadily approaching positive free cash flow generation,” said Tomer Weingarten, CEO of SentinelOne.

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Sales Growth

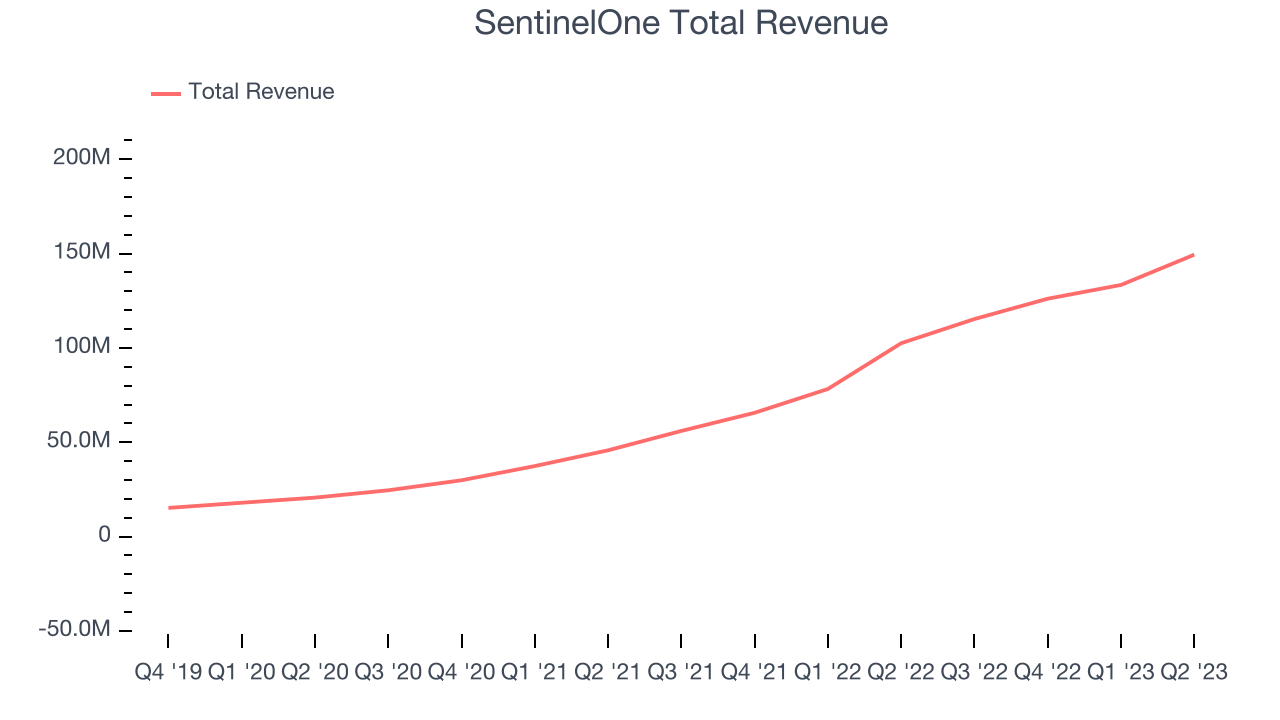

As you can see below, SentinelOne's revenue growth has been incredible over the last two years, growing from $45.8 million in Q2 FY2022 to $149.4 million this quarter.

Unsurprisingly, this was another great quarter for SentinelOne with revenue up 45.8% year on year. On top of that, its revenue increased $16 million quarter on quarter, a very strong improvement from the $7.3 million increase in Q1 2024. This is a sign of acceleration of growth and great to see.

Next quarter's guidance suggests that SentinelOne is expecting revenue to grow 35.3% year on year to $156 million, slowing down from the 106% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 30.8% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

SentinelOne's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 115% in Q2. This means that even if SentinelOne didn't win any new customers over the last 12 months, it would've grown its revenue by 15%.

Despite falling over the last year, SentinelOne still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from SentinelOne's Q2 Results

Although SentinelOne, which has a market capitalization of $4.75 billion, has been burning cash over the last 12 months, its more than $731.6 million in cash on hand gives it the flexibility to continue prioritizing growth over profitability.

We enjoyed seeing SentinelOne exceed analysts' revenue and non-GAAP operating profit expectations this quarter. We were also glad that its gross margin improved. Next quarter's guidance was ahead, and the company raised full year guidance for revenue, non-GAAP gross margin, and non-GAAP operating margin. However, the company continues its pattern of cash burn. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 9.87% after reporting and currently trades at $18.26 per share.

So should you invest in SentinelOne right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.