As Q1 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the cybersecurity stocks, including SentinelOne (NYSE:S) and its peers.

Cybersecurity continues to be one of the fastest growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 10 cybersecurity stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.71%, while on average next quarter revenue guidance was 2.04% above consensus. Tech stocks have been under pressure since the end of last year, but cybersecurity stocks held their ground better than others, with share price down 3.71% since earnings, on average.

Best Q1: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

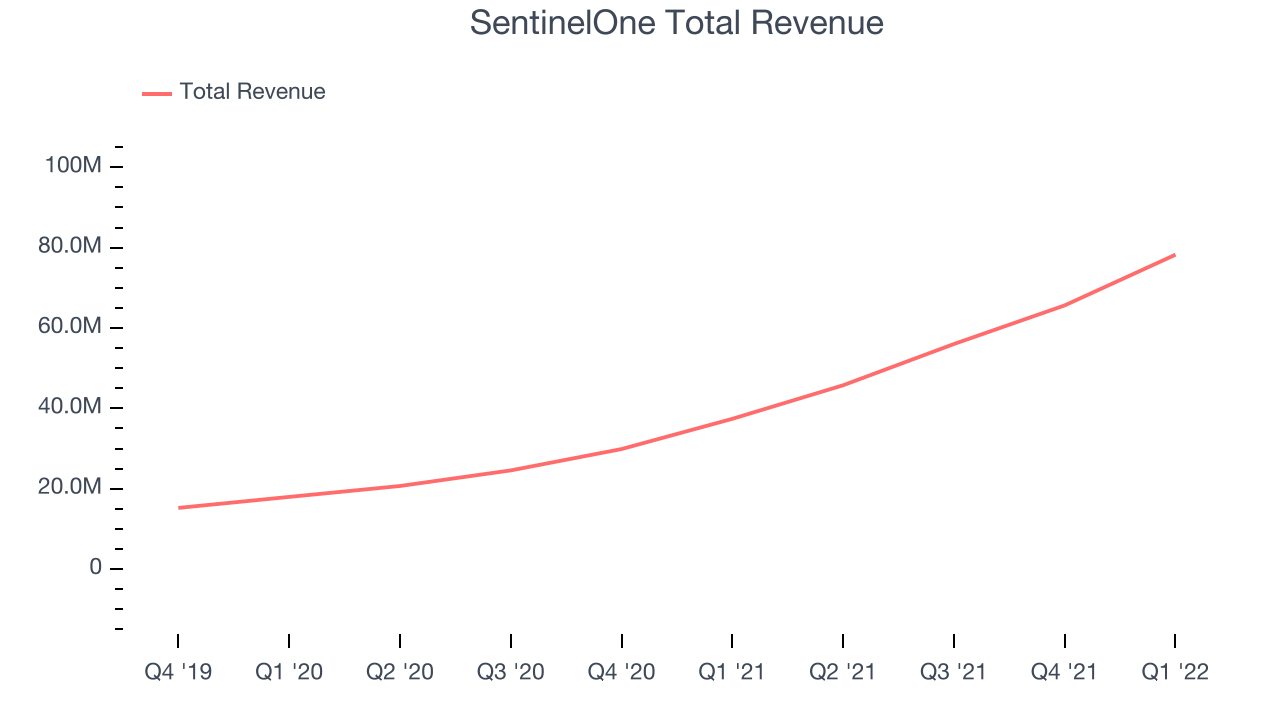

SentinelOne reported revenues of $78.2 million, up 109% year on year, beating analyst expectations by 4.83%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

“Our Q1 results demonstrate the combination of a robust demand environment for our leading cybersecurity platform and impressive execution across the board. We once again sustained triple-digit growth with significant margin expansion, added a record number of new customers, and exited the quarter with an extremely strong pipeline,” said Tomer Weingarten, CEO of SentinelOne.

SentinelOne achieved the fastest revenue growth and highest full year guidance raise of the whole group. The company added 71 enterprise customers paying more than $100,000 annually to a total of 591. The stock is down 4.54% since the results and currently trades at $23.51.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it's free.

Zscaler (NASDAQ:ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software as a service that helps companies securely connect to applications and networks in the cloud.

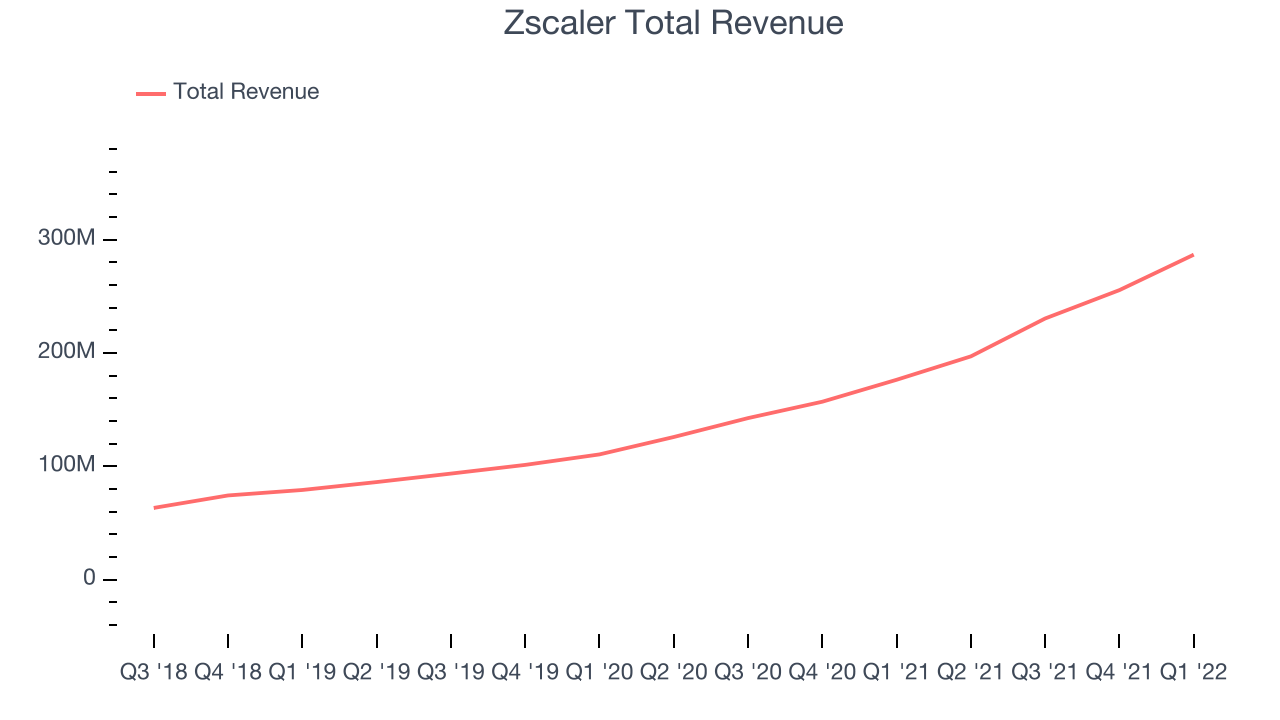

Zscaler reported revenues of $286.8 million, up 62.5% year on year, beating analyst expectations by 5.64%. It was a very strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

The stock is up 3.67% since the results and currently trades at $147.36.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it's free.

Slowest Q1: ForgeRock (NYSE:FORG)

Founded in Norway by former Sun Microsystems engineers, ForgeRock (NYSE:FORG) offers software as a service that helps companies secure and manage the identity of their customers and employees.

ForgeRock reported revenues of $48 million, up 13.4% year on year, beating analyst expectations by 3.35%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

ForgeRock had the slowest revenue growth and weakest full year guidance update in the group. The stock is up 34.6% since the results and currently trades at $19.27.

Read our full analysis of ForgeRock's results here.

Rapid7 (NASDAQ:RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $157.3 million, up 33.9% year on year, beating analyst expectations by 2.1%. It was a mixed quarter for the company, with decelerating customer growth.

The company added 124 customers to a total of 10,407. The stock is down 33.7% since the results and currently trades at $62.76.

Read our full, actionable report on Rapid7 here, it's free.

Tenable (NASDAQ:TENB)

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ:TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Tenable reported revenues of $159.3 million, up 29.3% year on year, beating analyst expectations by 3.82%. It was a mixed quarter for the company, with a decent beat of analyst estimates but a decline in gross margin.

The stock is down 17.8% since the results and currently trades at $45.62.

Read our full, actionable report on Tenable here, it's free.

The author has no position in any of the stocks mentioned