Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at SentinelOne (NYSE:S) and its peers.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

In light of this news, cybersecurity stocks have held steady with share prices up 4.3% on average since the latest earnings results.

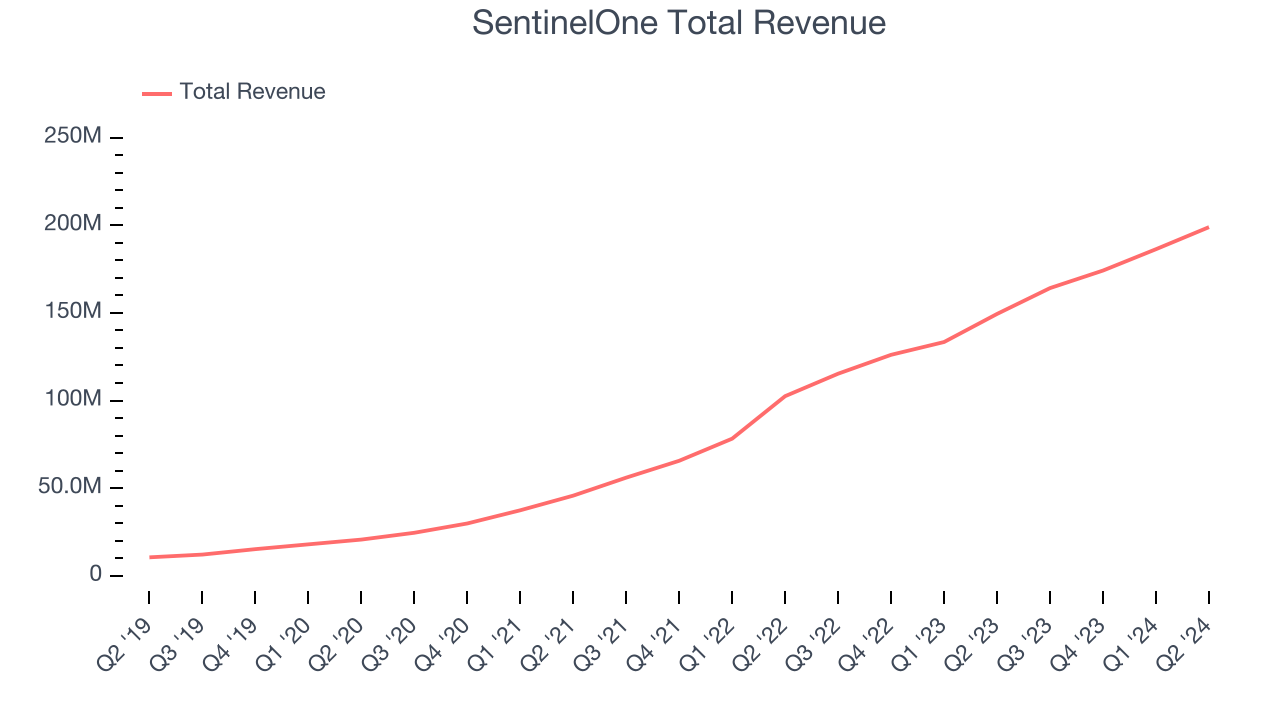

SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $198.9 million, up 33.1% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with full-year revenue guidance exceeding analysts’ expectations but a miss of analysts’ billings estimates.

“Based on strong execution and broad based demand, SentinelOne delivered exceptional results with industry-leading growth and our first ever quarter of positive net income and earnings per share,” said Tomer Weingarten, CEO of SentinelOne.

SentinelOne pulled off the fastest revenue growth of the whole group. The company added 40 enterprise customers paying more than $100,000 annually to reach a total of 1,233. Unsurprisingly, the stock is up 5.5% since reporting and currently trades at $26.10.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it’s free.

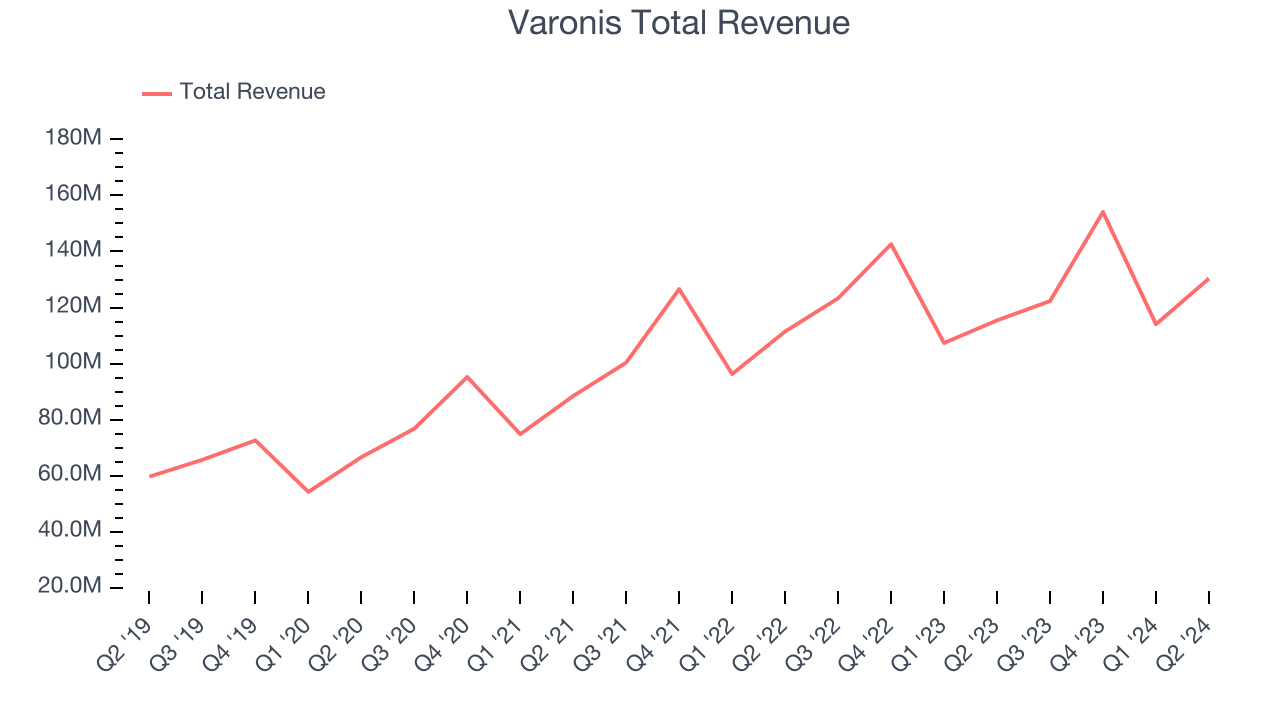

Best Q2: Varonis (NASDAQ:VRNS)

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ:VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Varonis reported revenues of $130.3 million, up 12.9% year on year, outperforming analysts’ expectations by 4.4%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 21.7% since reporting. It currently trades at $58.97.

Is now the time to buy Varonis? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Qualys (NASDAQ:QLYS)

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Qualys reported revenues of $148.7 million, up 8.4% year on year, in line with analysts’ expectations. It was a softer quarter as it posted underwhelming revenue guidance for the next quarter and a miss of analysts’ billings estimates.

Qualys delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 8.5% since the results and currently trades at $125.60.

Read our full analysis of Qualys’s results here.

Tenable (NASDAQ:TENB)

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ:TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

Tenable reported revenues of $221.2 million, up 13.4% year on year. This number beat analysts’ expectations by 1.2%. Zooming out, it was a slower quarter as it produced a miss of analysts’ ARR (annual recurring revenue) and billings estimates.

The stock is down 7.2% since reporting and currently trades at $42.69.

Read our full, actionable report on Tenable here, it’s free.

Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $646 million, up 16.2% year on year. This result topped analysts’ expectations by 2.1%. More broadly, it was a satisfactory quarter as it also produced full-year revenue guidance exceeding analysts’ expectations but a miss of analysts’ billings estimates.

The stock is down 20.3% since reporting and currently trades at $76.99.

Read our full, actionable report on Okta here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.