Identity governance software company SailPoint (NYSE:SAIL) beat analyst expectations in Q2 FY2021 quarter, with revenue up 10.8% year on year to $102.4 million. Sailpoint made a GAAP loss of $16.7 million, down on its profit of $3.04 million, in the same quarter last year.

Is now the time to buy Sailpoint? Access our full analysis of the earnings results here, it's free.

Sailpoint (SAIL) Q2 FY2021 Highlights:

- Revenue: $102.4 million vs analyst estimates of $99.2 million (3.22% beat)

- EPS (non-GAAP): $0 vs analyst estimates of -$0.06 ($0.06 beat)

- Revenue guidance for Q3 2021 is $103 million at the midpoint, below analyst estimates of $103.9 million

- The company reconfirmed revenue guidance for the full year, at $410 million at the midpoint

- Free cash flow was negative -$13.62 million, compared to negative free cash flow of -$12.99 million in previous quarter

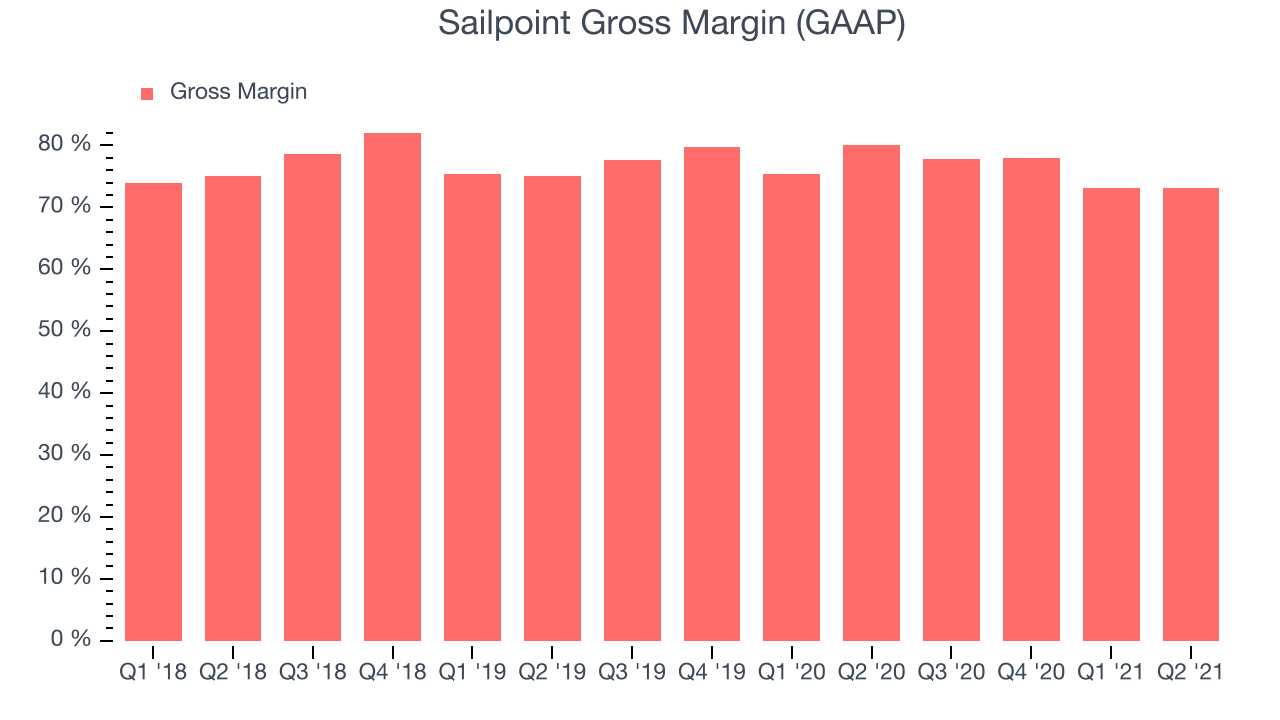

- Gross Margin (GAAP): 73%, in line with previous quarter

- Company’s Chief Financial Officer tendered his resignation

“SailPoint finished another strong quarter, exceeding prior revenue and ARR guidance with Total ARR up 43% year-over-year. The outperformance this quarter was driven by our team’s relentless focus on customer satisfaction and the demonstrated value our identity security platform has on addressing the sophisticated needs of the modern enterprise,” said Mark McClain, SailPoint CEO and Founder.

Founded in 2005 by Kevin Cunningham and Mark McClain, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

As companies move more data and applications into the cloud and more users are granted access to these resources, it brings more business efficiencies but also opens them to more vulnerabilities. Managing user access through a centralized cloud-based solution is a way to reduce the risks and the demand for identity security platforms has been growing.

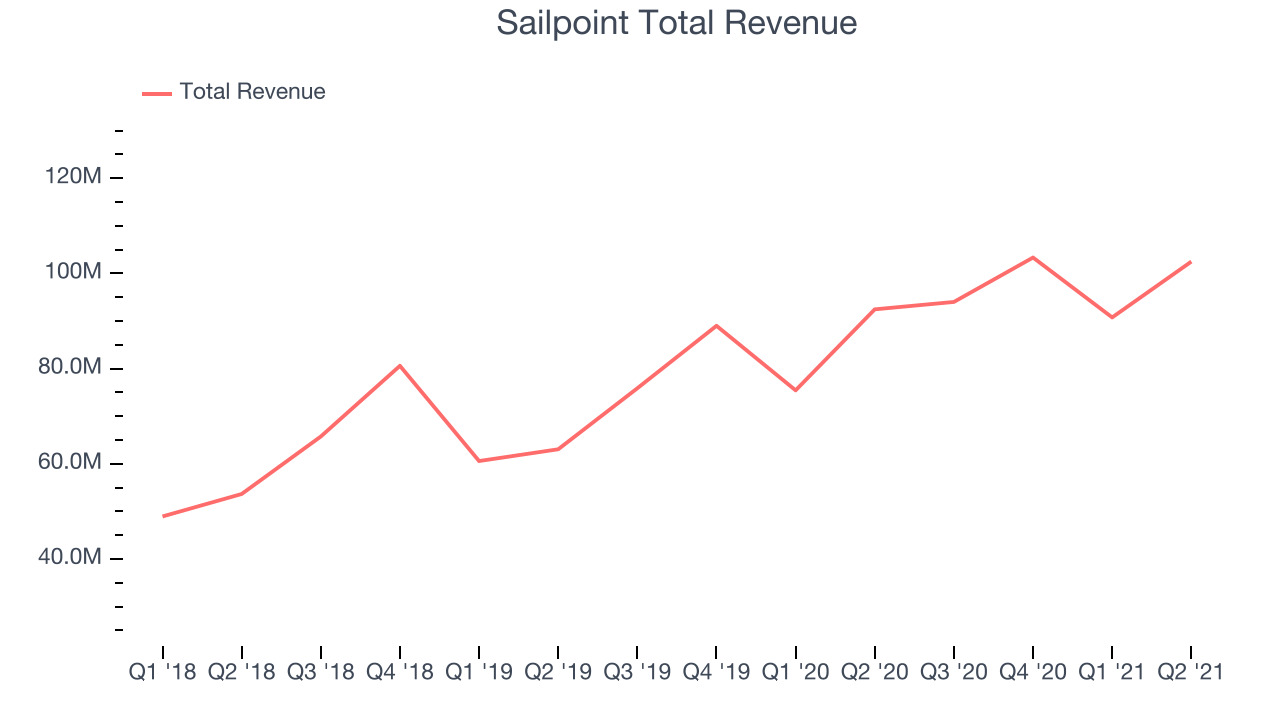

Sales Growth

As you can see below, Sailpoint's revenue growth has been decent over the last year, growing from quarterly revenue of $92.4 million, to $102.4 million.

This quarter, Sailpoint's quarterly revenue was once again up 10.8% year on year. We can see that the company increased revenue by $11.7 million quarter on quarter. That's a solid improvement on the $12.58 million decrease in Q1 2021, so shareholders should appreciate the acceleration of growth.

Analysts covering the company are expecting the revenues to grow 12.3% over the next twelve months, although we would expect them to review their estimates once they get to read these results.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Sailpoint's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 73% in Q2.

That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. Despite it going down over the last year, this is still around the average of what we typically see in SaaS businesses. Gross margin has a major impact on a company’s ability to invest in developing new products and sales & marketing, which may ultimately determine the winner in a competitive market, so it is important to track.

Key Takeaways from Sailpoint's Q2 Results

With market capitalisation of $4.56 billion Sailpoint is among smaller companies, but its more than $407.6 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

It was good to see Sailpoint outperform Wall St’s revenue expectations this quarter. That feature of these results stood out as a positive. On the other hand, revenue growth is overall a bit slower these days and the revenue guidance for the next quarter missed analysts' expectations. Zooming out, we think this was a mixed quarter, but the company is still staying more or less on target. The company is down 6.12% on the results and currently trades at $46.5 per share.

Should you invest in Sailpoint right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our full report which you can read here, it's free.

One way how to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.