Beer company Boston Beer (NYSE:SAM) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue up 1.8% year on year to $614.2 million. It made a GAAP profit of $4.39 per share, down from its profit of $4.73 per share in the same quarter last year.

Is now the time to buy Boston Beer? Find out by accessing our full research report, it's free.

Boston Beer (SAM) Q2 CY2024 Highlights:

- Revenue: $614.2 million vs analyst estimates of $597.3 million (2.8% beat)

- EPS: $4.39 vs analyst expectations of $5.02 (12.5% miss)

- Gross Margin (GAAP): 49.1%, up from 45.4% in the same quarter last year

- Free Cash Flow of $75.65 million is up from -$20.62 million in the previous quarter

- Market Capitalization: $3.21 billion

“I’m pleased to have completed my first quarter as Boston Beer’s CEO and believe there are many areas of opportunity ahead for the company,” said President and CEO Michael Spillane.

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Boston Beer carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Boston Beer can still achieve high growth rates because its revenue base is not yet monstrous.

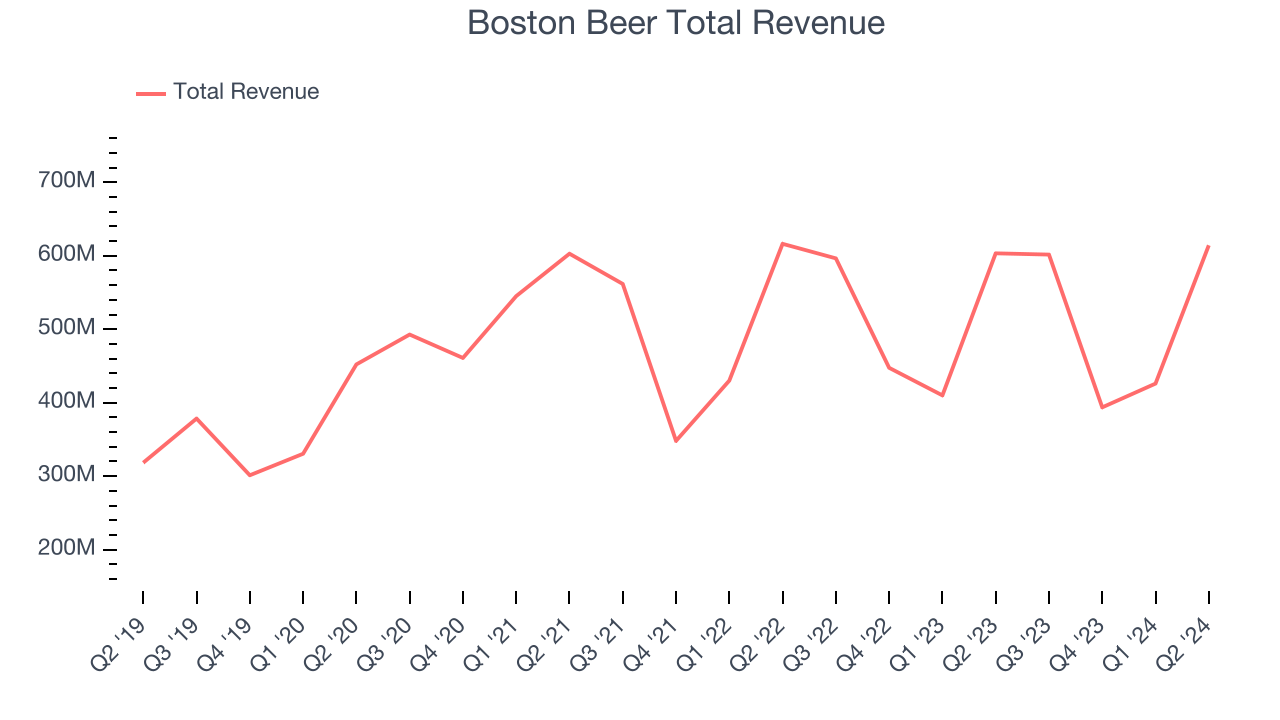

As you can see below, the company's revenue has declined over the last three years, dropping 1.1% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Boston Beer reported decent year-on-year revenue growth of 1.8%, and its $614.2 million in revenue topped Wall Street's estimates by 2.8%. Looking ahead, Wall Street expects sales to grow 1.9% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

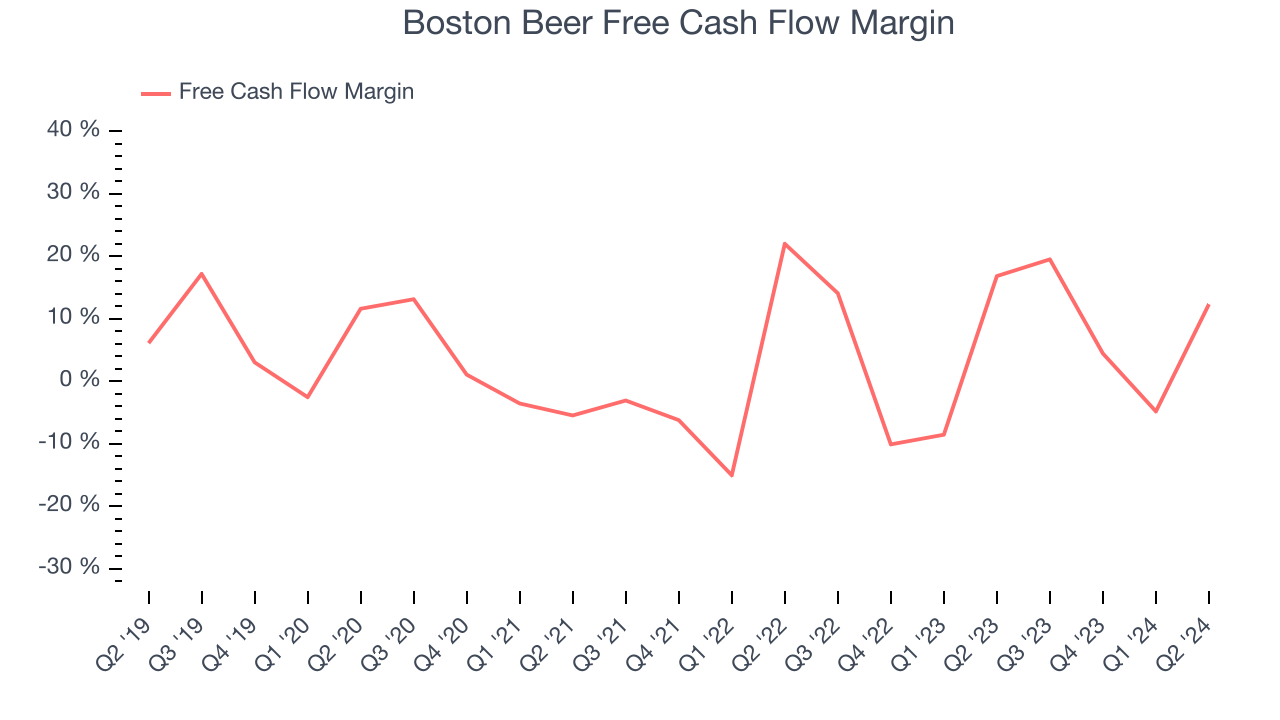

Boston Beer has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company's free cash flow margin averaged 7.2% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Boston Beer's margin expanded by 4.2 percentage points during that time. This shows the company is heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could suggest it's becoming a less capital-intensive business.

Boston Beer's free cash flow clocked in at $75.65 million in Q2, equivalent to a 12.3% margin. The company's cash profitability regressed as it was 4.5 percentage points lower than in the same quarter last year, but it's still above its two-year average. We wouldn't read too much into this quarter's decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Key Takeaways from Boston Beer's Q2 Results

We enjoyed seeing Boston Beer exceed analysts' revenue estimates this quarter. On the other hand, its EPS missed, and its lower profitability outweighed the top-line beat. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock traded down 5.1% to $257 immediately after reporting.

So should you invest in Boston Beer right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.