Beer company Boston Beer (NYSE:SAM) reported Q1 CY2024 results topping analysts' expectations, with revenue up 10.3% year on year to $452.2 million. It made a GAAP profit of $1.04 per share, improving from its loss of $0.73 per share in the same quarter last year.

Boston Beer (SAM) Q1 CY2024 Highlights:

- Revenue: $452.2 million vs analyst estimates of $412.3 million (9.7% beat)

- Operating profit: $15.3 million vs analyst estimates of roughly breakeven (large beat)

- EPS: $1.04 vs analyst estimates of $0 (large beat)

- EPS guidance for full year 2024 maintained from previous ($9.00 at the midpoint, below current expectations)

- Gross Margin (GAAP): 47%, up from 38% in the same quarter last year

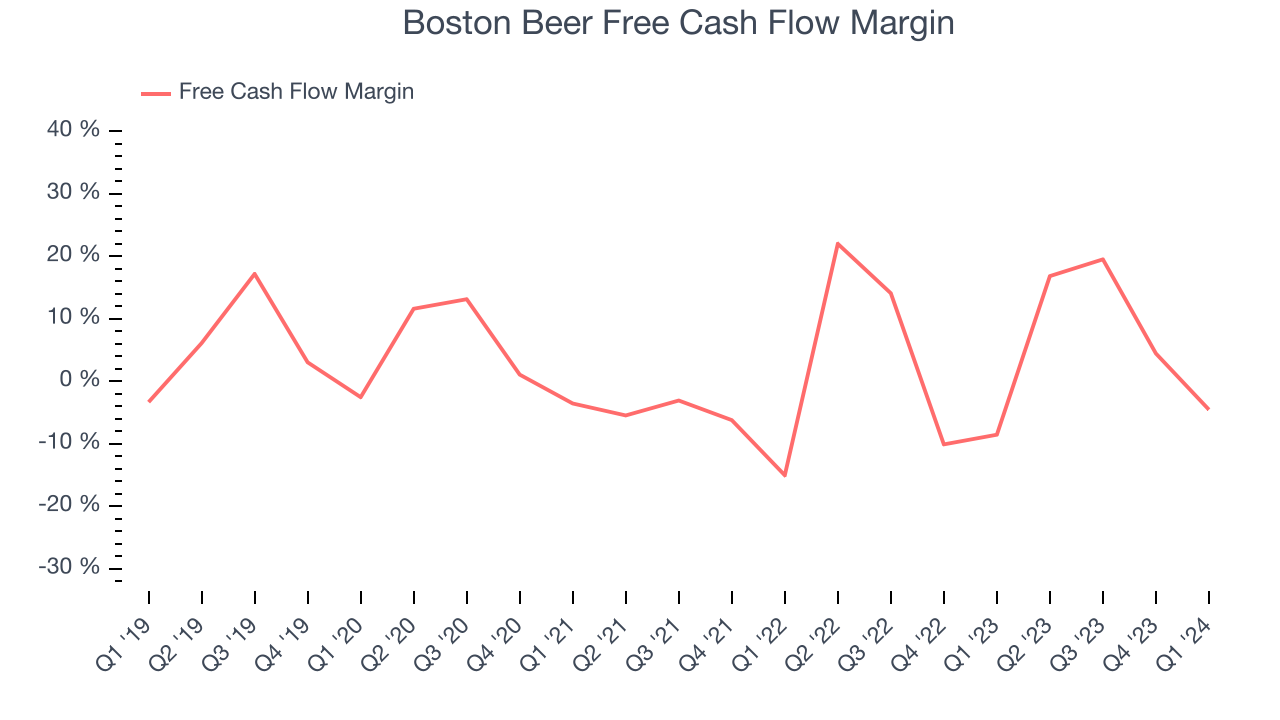

- Free Cash Flow was -$20.62 million, down from $17.44 million in the previous quarter

- Market Capitalization: $3.49 billion

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

The company was founded in 1984 by Jim Koch in Boston, Massachusetts. Koch had a vision to reintroduce traditional brewing techniques and artisanal flavors to American consumers, catalyzing a craft beer revolution.

In this context, it’s quite fitting that Boston Beer’s first brand was named after Samuel Adams, an American Founding Father and revolutionary patriot. Samuel Adams Boston Lager is the flagship brand in Boston Beer’s portfolio, which also includes other household names like Truly Hard Seltzer and Angry Orchard hard cider.

Boston Beer’s diversity of beverage types helps it adapt to changing market dynamics and consumer demands. It also positions itself well to capitalize on trends in the beverage industry.

The company’s influence extends across the United States and select international markets. To get its products into the hands of consumers, it leverages a network of distributors and retailers. This includes partnerships with bars, restaurants, supermarkets, and liquor stores.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors include Anheuser-Busch Inbev (NYSE:BUD), Constellation Brands (NYSE:STZ), and Molson Coors (NYSE:TAP) along with international companies such as Asahi, Carlsberg, and Heineken.Sales Growth

Boston Beer carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Boston Beer can still achieve high growth rates because its revenue base is not yet monstrous.

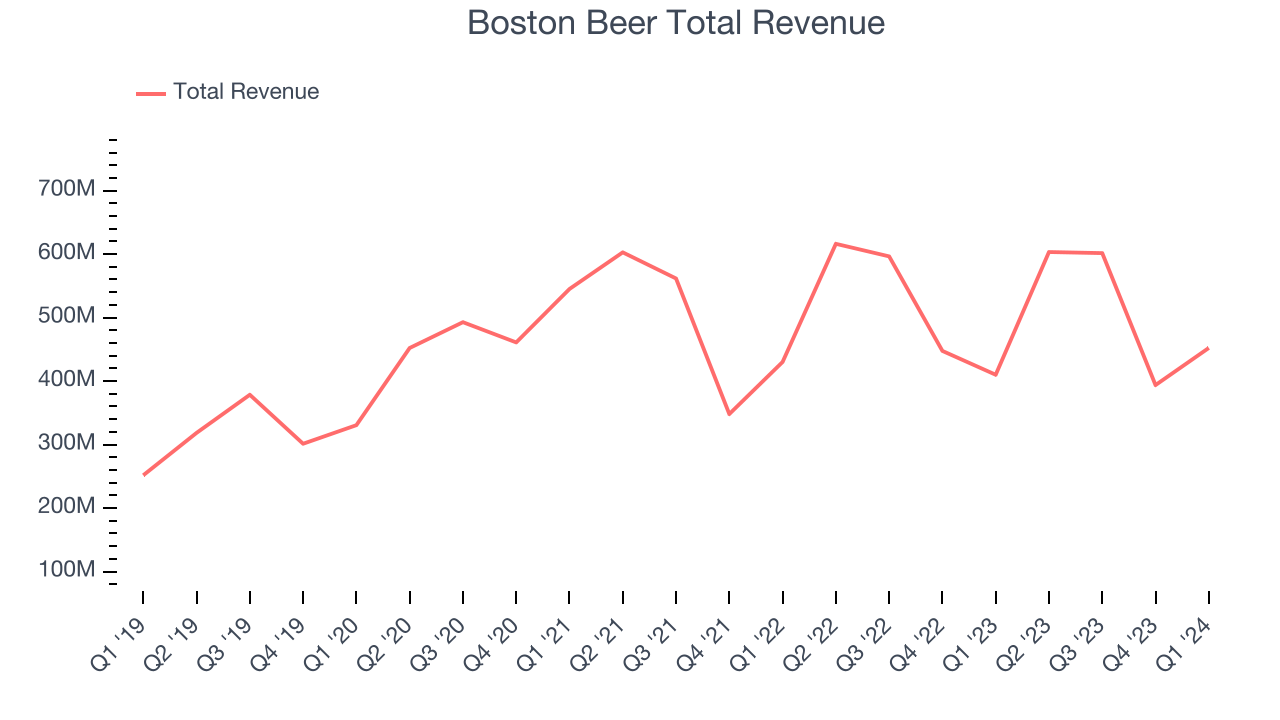

As you can see below, the company's annualized revenue growth rate of 1.7% over the last three years was weak for a consumer staples business.

This quarter, Boston Beer reported robust year-on-year revenue growth of 10.3%, and its $452.2 million in revenue exceeded Wall Street's estimates by 9.7%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

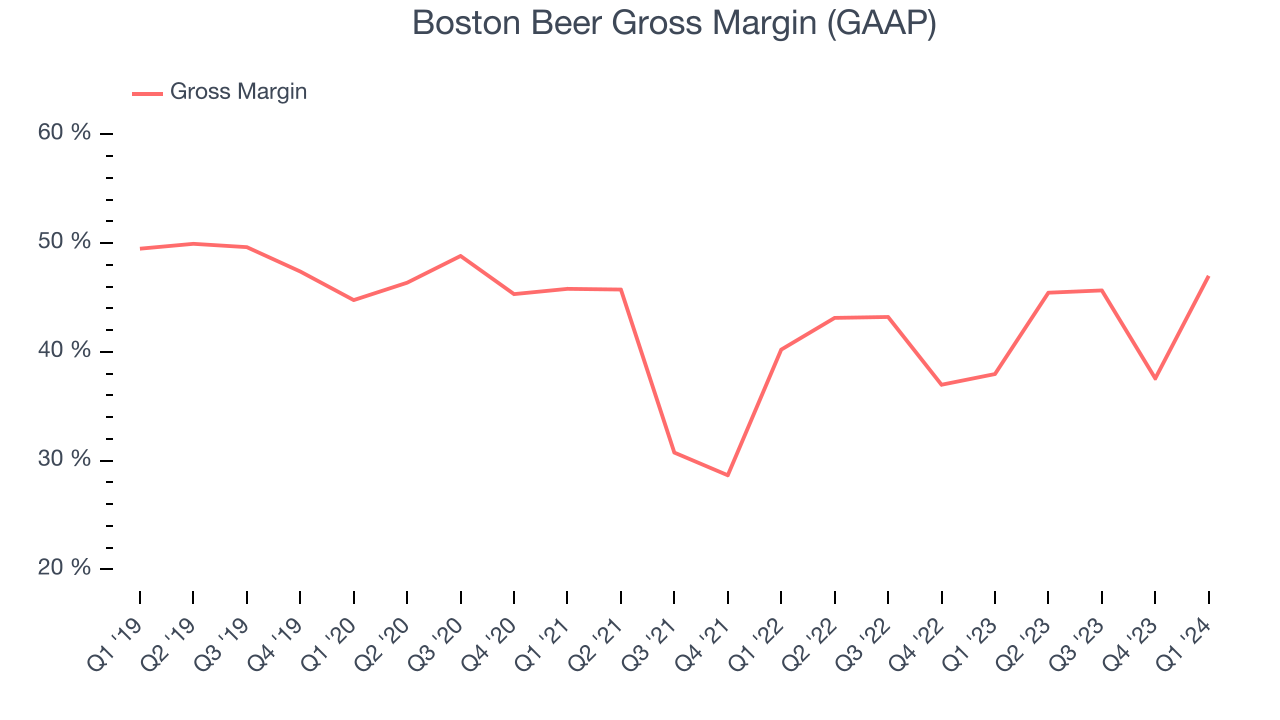

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

Boston Beer's gross profit margin came in at 47% this quarter, up 9 percentage points year on year. That means for every $1 in revenue, $0.53 went towards paying for raw materials, production of goods, and distribution expenses.

Boston Beer has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 42.6% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 9.1% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

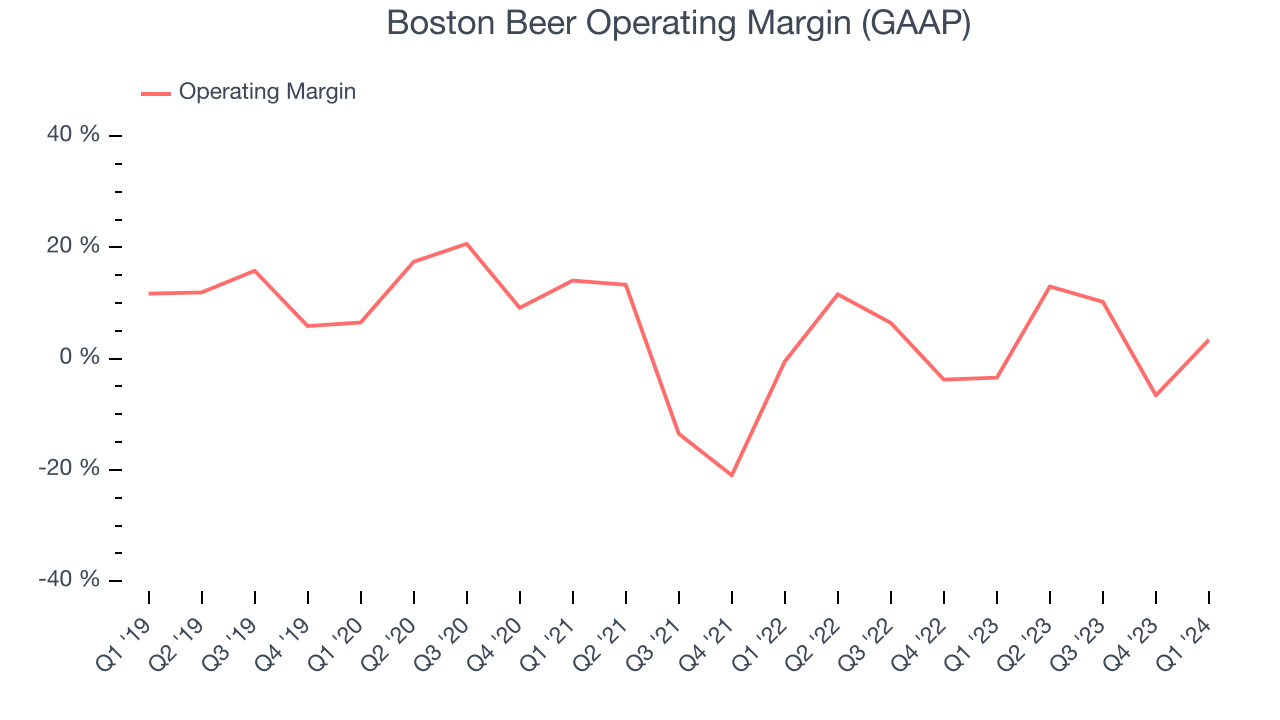

Operating Margin

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Boston Beer generated an operating profit margin of 3.4%, up 6.8 percentage points year on year. This increase was encouraging, and we can infer Boston Beer had stronger pricing power and lower raw materials/transportation costs because its gross margin expanded more than its operating margin.

Zooming out, Boston Beer was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.1%. However, Boston Beer's margin has improved by 2.5 percentage points on average over the last year, showing the company is heading in the right direction.

Zooming out, Boston Beer was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer staples business, producing an average operating margin of 5.1%. However, Boston Beer's margin has improved by 2.5 percentage points on average over the last year, showing the company is heading in the right direction.EPS

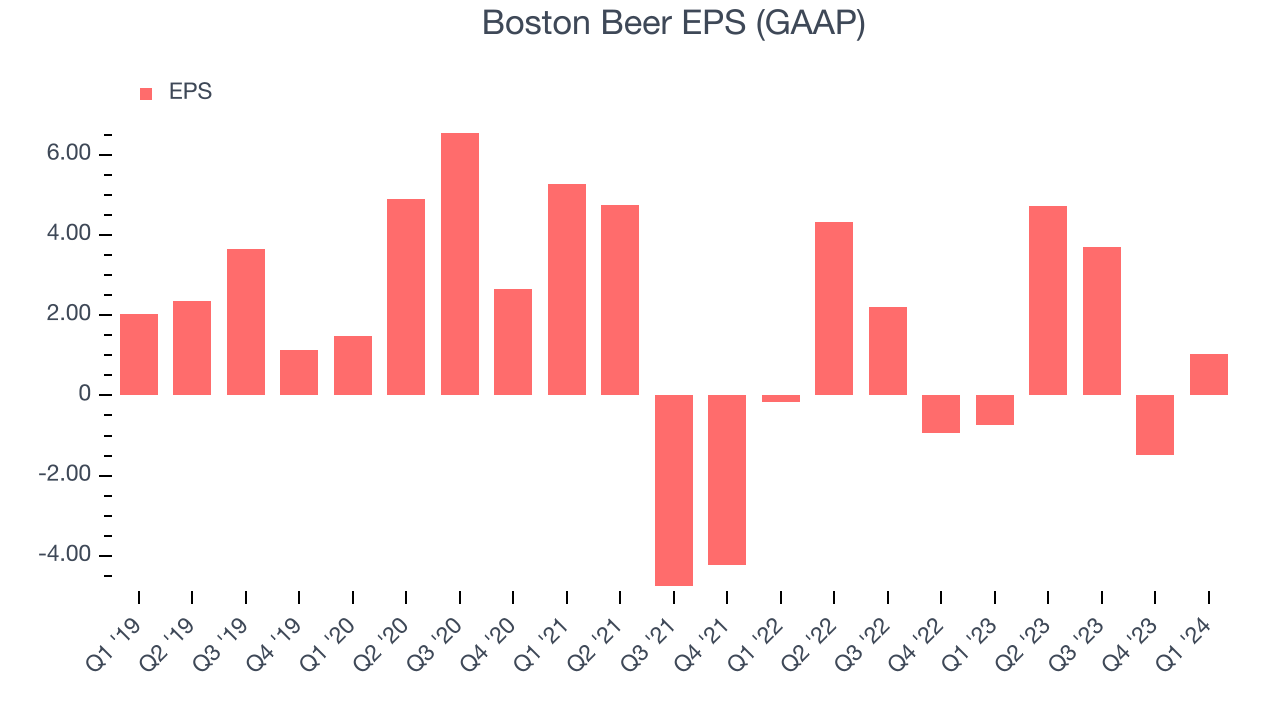

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Boston Beer reported EPS at $1.04, up from negative $0.73 in the same quarter a year ago. This print easily cleared Wall Street's estimates, and shareholders should be content with the results.

Between FY2021 and FY2024, Boston Beer's EPS dropped 58.8%, translating into 25.6% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 30.5% year-on-year increase in EPS.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Boston Beer burned through $20.62 million of cash in Q1, representing a negative 4.6% free cash flow margin. The company increased its cash burn by 41.3% year on year.

Over the last eight quarters, Boston Beer has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 8.6%, above the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 3.8 percentage points over the last 12 months. This likely pleases the company's investors.

Return on Invested Capital (ROIC)

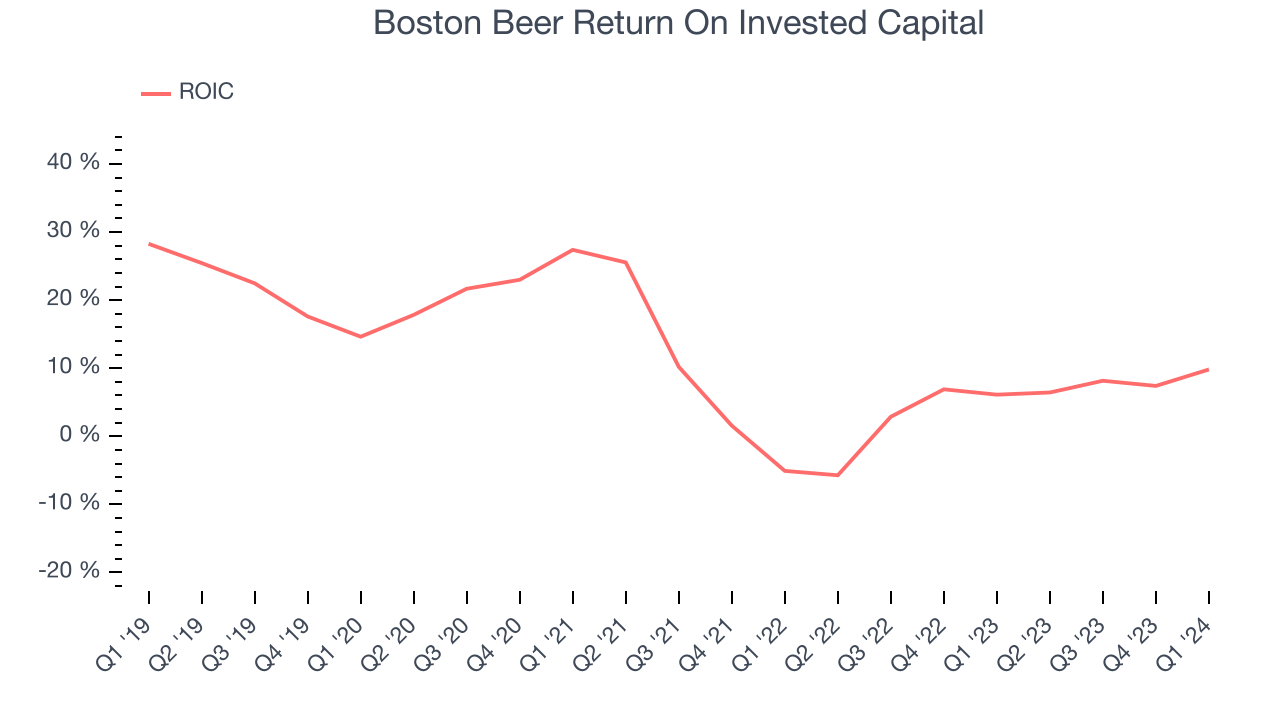

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Boston Beer's five-year average ROIC was 10.6%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Boston Beer's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Boston Beer's ROIC averaged 13 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Boston Beer is a profitable, well-capitalized company with $205.4 million of cash and $42.65 million of debt, meaning it could pay back all its debt tomorrow and still have $162.8 million of cash on its balance sheet. This net cash position gives Boston Beer the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Boston Beer's Q1 Results

We were impressed by how significantly Boston Beer blew past analysts' revenue, operating profit, and EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. EPS guidance for the full year was maintained, showing that the operating environment and demand trends the management saw three months ago have remained roughly the same. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 8.3% after reporting and currently trades at $311 per share.

Is Now The Time?

Boston Beer may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Boston Beer, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its declining EPS over the last three years makes it hard to trust. On top of that, its brand caters to a niche market.

Boston Beer's price-to-earnings ratio based on the next 12 months is 28.0x. While we've no doubt one can find things to like about Boston Beer, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $319.29 per share right before these results (compared to the current share price of $311).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.