Beauty supply retailer Sally Beauty (NYSE:SBH) reported Q2 CY2024 results beating Wall Street analysts' expectations, with revenue up 1.2% year on year to $942.3 million. It made a non-GAAP profit of $0.45 per share, down from its profit of $0.49 per share in the same quarter last year.

Is now the time to buy Sally Beauty? Find out by accessing our full research report, it's free.

Sally Beauty (SBH) Q2 CY2024 Highlights:

- Revenue: $942.3 million vs analyst estimates of $931.7 million (1.1% beat)

- The company maintained its previous full year guidance, calling for "net sales and comparable sales to be approximately flat compared to the prior year"

- EPS (non-GAAP): $0.45 vs analyst estimates of $0.40 (11.6% beat)

- Gross Margin (GAAP): 51%, in line with the same quarter last year

- EBITDA Margin: 12.4%, in line with the same quarter last year

- Free Cash Flow of $28.75 million, similar to the same quarter last year

- Locations: 4,460 at quarter end, down from 4,477 in the same quarter last year

- Same-Store Sales rose 1.5% year on year, in line with the same quarter last year

- Market Capitalization: $972 million

“We are pleased to report solid third quarter results, including positive comparable sales in both our Sally Beauty and Beauty Systems Group segments,” said Denise Paulonis, president and chief executive officer.

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

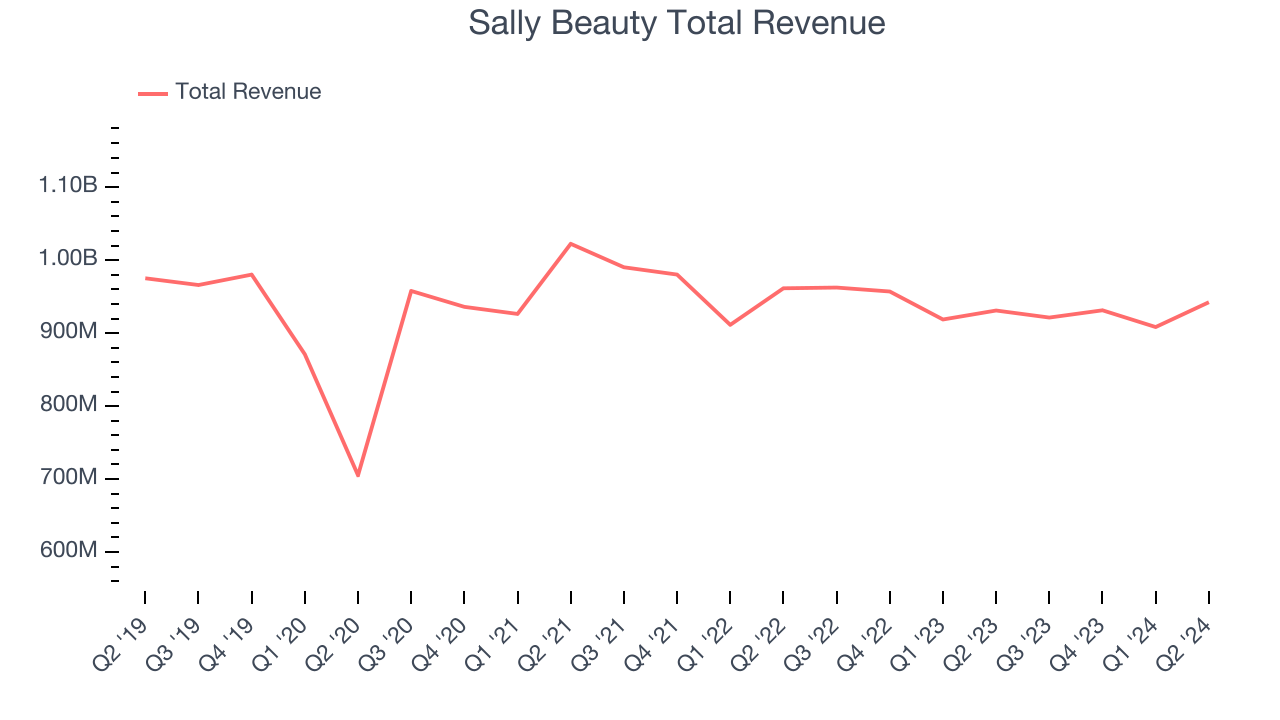

Sally Beauty is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

As you can see below, the company's revenue was flat over the last five years as its store count shrunk.

This quarter, Sally Beauty reported decent year-on-year revenue growth of 1.2%, and its $942.3 million in revenue topped Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

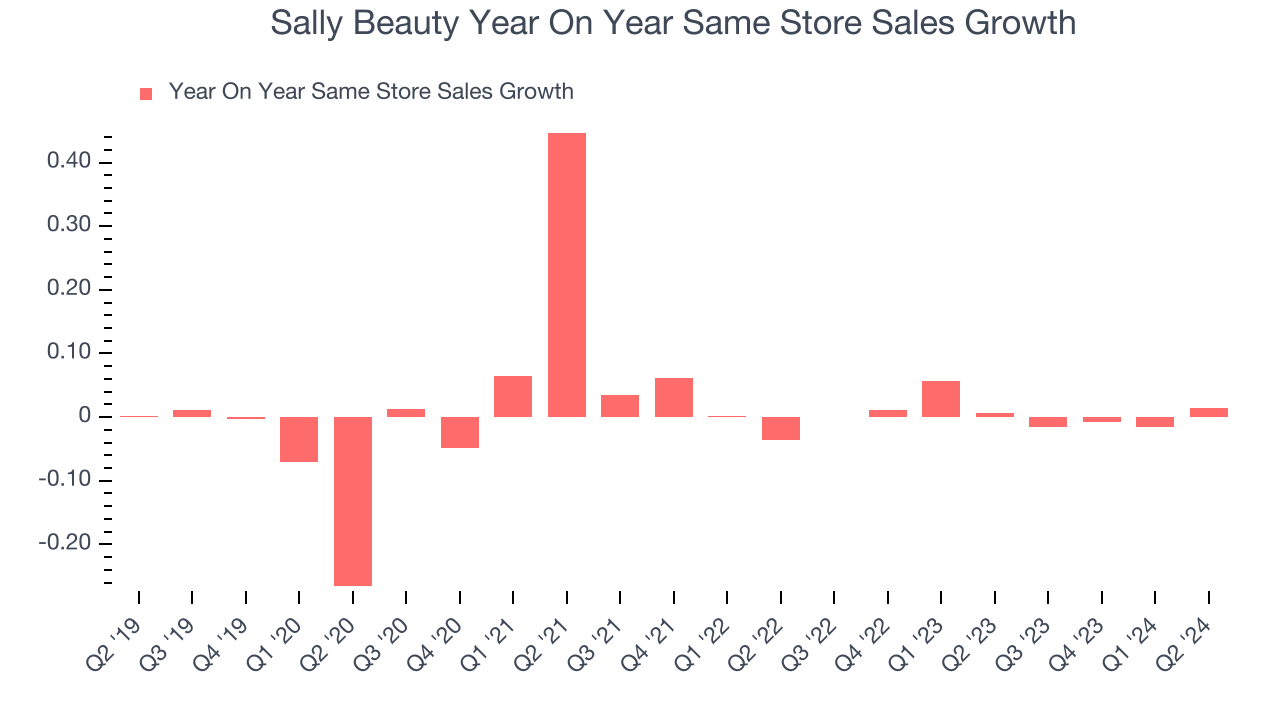

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

Sally Beauty's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Sally Beauty's same-store sales rose 1.5% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from Sally Beauty's Q2 Results

It was good to see Sally Beauty beat analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. The company maintained its previous full year guidance, calling for "net sales and comparable sales to be approximately flat compared to the prior year". Overall, this quarter was quite solid. The stock traded up 5.5% to $9.90 immediately after reporting.

Sally Beauty may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.