Beauty supply retailer Sally Beauty (NYSE:SBH) reported results in line with analysts' expectations in Q1 FY2024, with revenue down 2.7% year on year to $931.3 million. It made a GAAP profit of $0.35 per share, down from its profit of $0.52 per share in the same quarter last year.

Sally Beauty (SBH) Q1 FY2024 Highlights:

- Market Capitalization: $1.32 billion

- Revenue: $931.3 million vs analyst estimates of $928.6 million (small beat)

- EPS: $0.35 vs analyst expectations of $0.37 (4.5% miss)

- Free Cash Flow of $20.47 million, down 31.6% from the same quarter last year

- Gross Margin (GAAP): 50.2%, down from 50.8% in the same quarter last year

- Same-Store Sales were down 0.8% year on year

- Store Locations: 4,475 at quarter end, decreasing by 23 over the last 12 months

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

With regards to the merchandise selection, the company has a strong focus on hair color, hair care, skin care, and nail products. Brands such as Wella, Clairol Professional, and Conair can be found in stores. A Sally Beauty store tends to be small, roughly 2,500 square feet, and located in urban and suburban shopping centers. The company also has an e-commerce platform, launched in 1999, that supplements its brick and mortar operations.

The company operates two banners: Sally Beauty Supply and Beauty Systems Group. Sally Beauty Supply serves the everyday consumer while Beauty Systems serves the salon professional and requires certain credentials and identification to enter. Beauty Systems burnishes the company’s reputation, showing the everyday consumer that Sally Beauty products are used in salons, while Sally Beauty Supply addresses the much larger market of consumer beauty aficionados.

The core customer of Sally Beauty Supply is typically a woman between 18 and 35 years old who considers herself a beauty enthusiast. She has specific preferences with regards to her beauty products and desires more professional-grade offerings which may not be available in the average department store or general merchandise retailer.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Retailers specializing in beauty products include Ulta Beauty (NASDAQ:ULTA) and Bath & Body Works while department stores such as Kohl’s (NYSE:KSS) and Macy’s (NYSE:M) typically feature large cosmetics and fragrance sections.Sales Growth

Sally Beauty is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

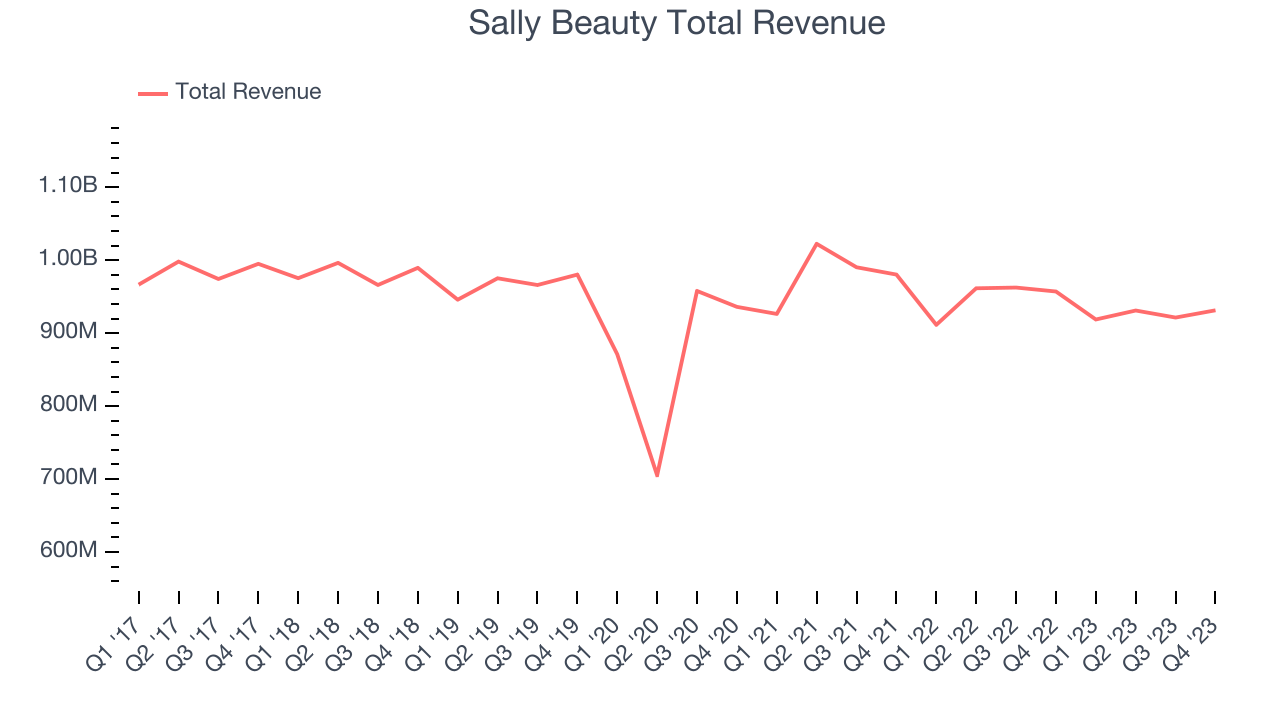

As you can see below, the company's revenue has declined over the last four years, dropping 1.1% annually as its store count shrunk.

This quarter, Sally Beauty reported a rather uninspiring 2.7% year-on-year revenue decline to $931.3 million in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Number of Stores

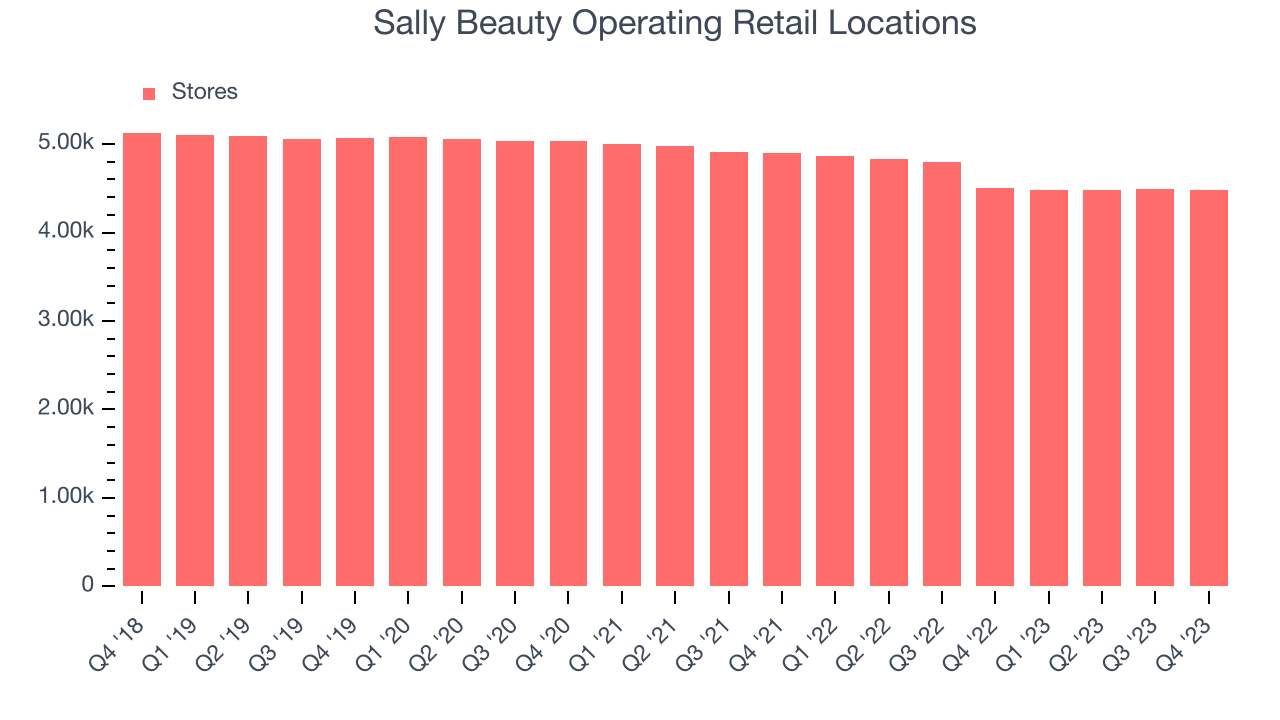

When a retailer like Sally Beauty is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. As of the most recently reported quarter, Sally Beauty operated 4,475 total retail locations, in line with its store count a year ago.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 4.8% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

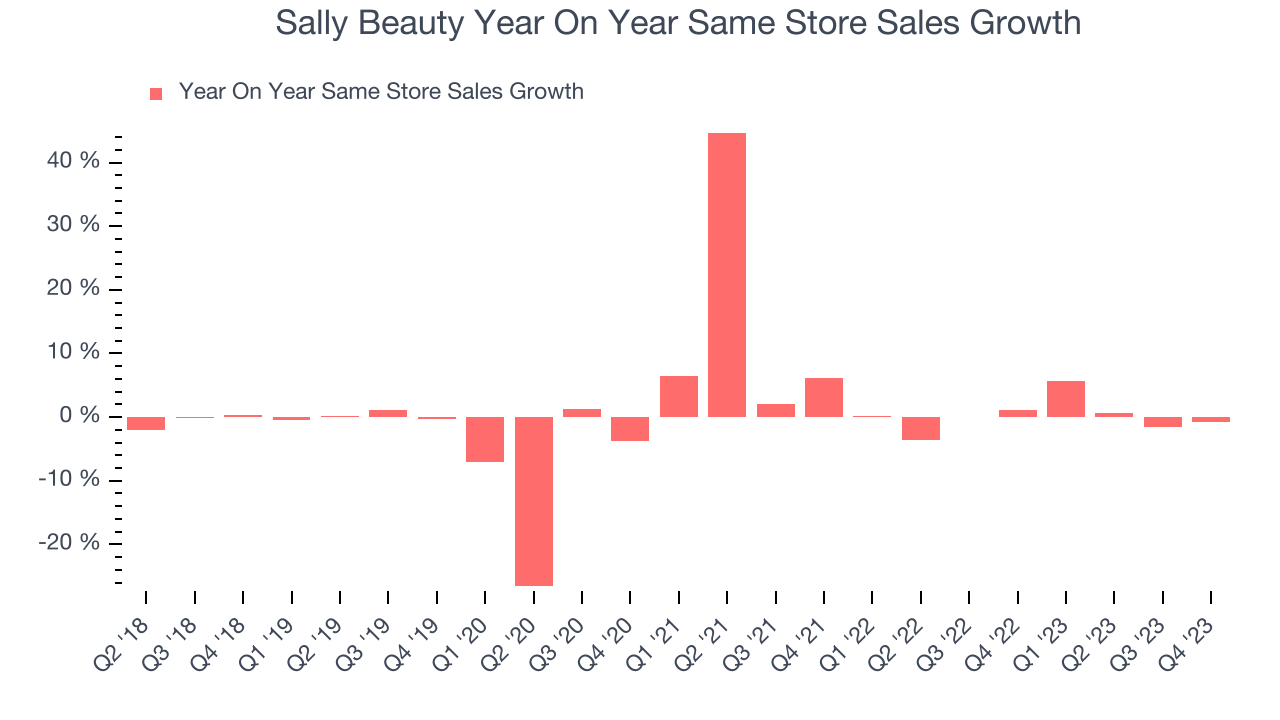

Sally Beauty's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Sally Beauty's year on year same-store sales were flat. By the company's standards, this growth was a meaningful deceleration from the 1.1% year-on-year increase it posted 12 months ago. We'll be watching Sally Beauty closely to see if it can reaccelerate growth.

Gross Margin & Pricing Power

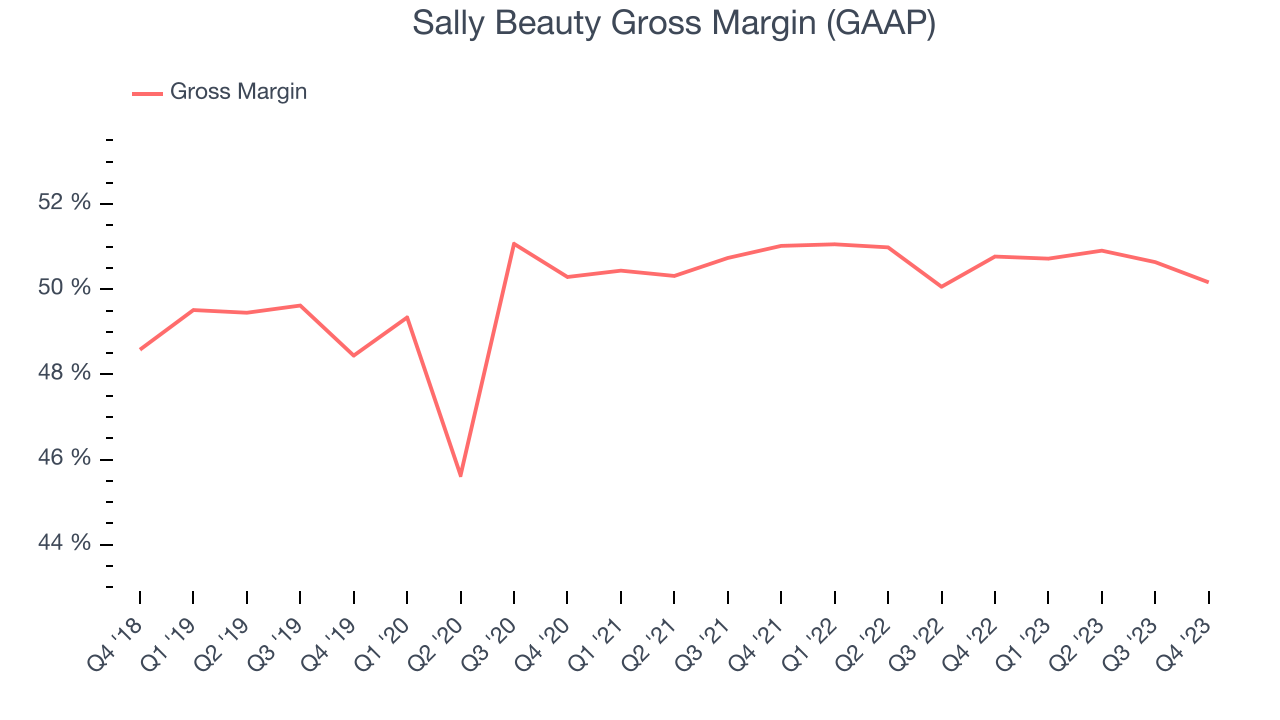

Sally Beauty has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 50.7% gross margin over the last two years. This means the company makes $0.51 for every $1 in revenue before accounting for its operating expenses.

Sally Beauty's gross profit margin came in at 50.2% this quarter, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

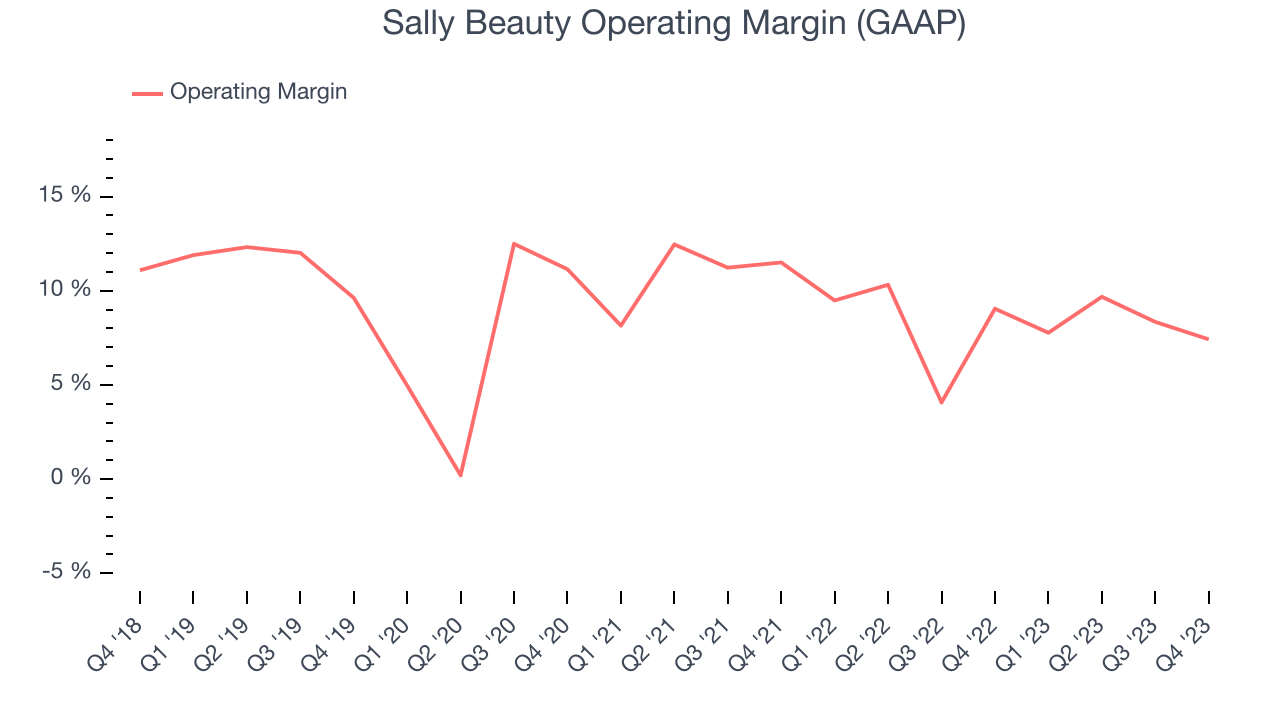

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Sally Beauty generated an operating profit margin of 7.4%, down 1.6 percentage points year on year. We can infer Sally Beauty was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Sally Beauty has done a decent job managing its expenses over the last eight quarters. It's produced an average operating margin of 8.3%, higher than the broader consumer retail sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Sally Beauty has done a decent job managing its expenses over the last eight quarters. It's produced an average operating margin of 8.3%, higher than the broader consumer retail sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

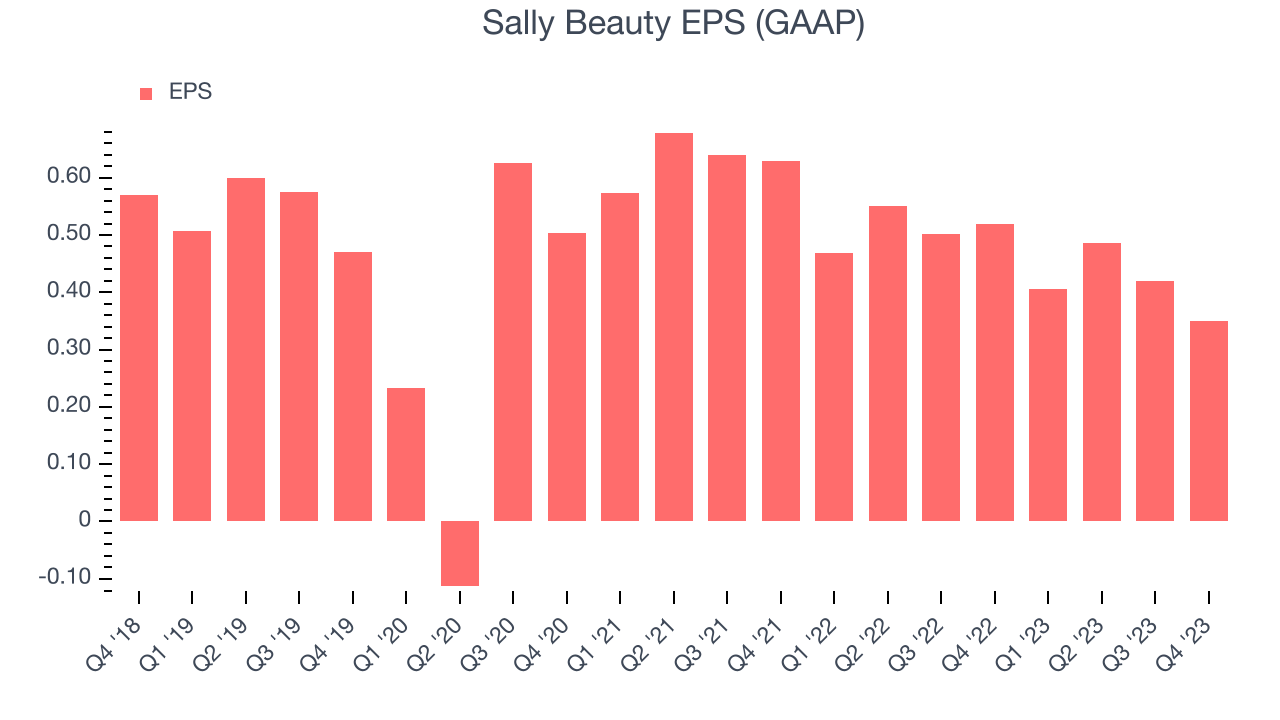

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Sally Beauty reported EPS at $0.35, down from $0.52 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2020 and FY2024, Sally Beauty's adjusted diluted EPS dropped 27.3%, translating into 7.7% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 20.2% year-on-year increase in EPS.

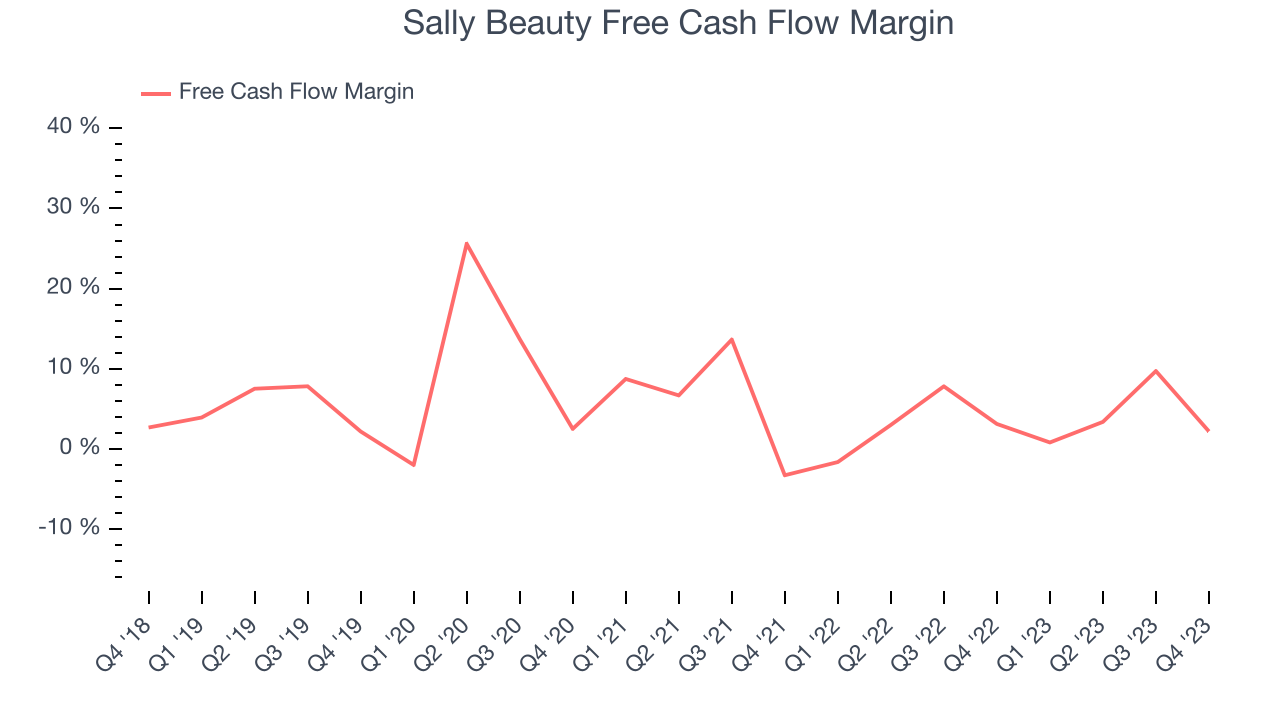

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Sally Beauty's free cash flow came in at $20.47 million in Q1, down 31.6% year on year. This result represents a 2.2% margin.

Over the last two years, Sally Beauty has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 3.6%, slightly better than the broader consumer retail sector. Furthermore, its margin has been flat, showing that the company's cash flows are relatively stable.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Understanding a company’s ROIC (return on invested capital) gives us insight into this because it factors the total debt and equity needed to generate operating profits. This metric is a proxy for not only the capital efficiency of a business but also a management team's ability to allocate limited resources.

Sally Beauty's five-year average ROIC was 14.6%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable growth initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, over the last two years, Sally Beauty's ROIC has averaged a 2.2 percentage point decrease each year. In conjunction with its already low returns, these declines are a red flag and suggest the company's profitable investment opportunities are fewer than in the past.

Key Takeaways from Sally Beauty's Q1 Results

We struggled to find many strong positives in these results. Although its revenue slightly beat estimates, driven by better-than-expected performance in its Beauty Systems Group which contributed to outperformance in its same-store sales, its operating margin and EPS missed Wall Street's expectations. Furthermore, its full-year free cash flow guidance fell short. Overall, the results could have been better. The stock is flat after reporting and currently trades at $12.4 per share.

Is Now The Time?

When considering an investment in Sally Beauty, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Sally Beauty, we'll be cheering from the sidelines. Its revenue has declined over the last four years, but at least growth is expected to increase in the short term. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining physical locations suggests its demand is falling. On top of that, its poor same-store sales performance has been a headwind.

Sally Beauty's price-to-earnings ratio based on the next 12 months is 6.4x. While the price is reasonable and there are some things to like about Sally Beauty, we think there are better opportunities elsewhere in the market right now.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.