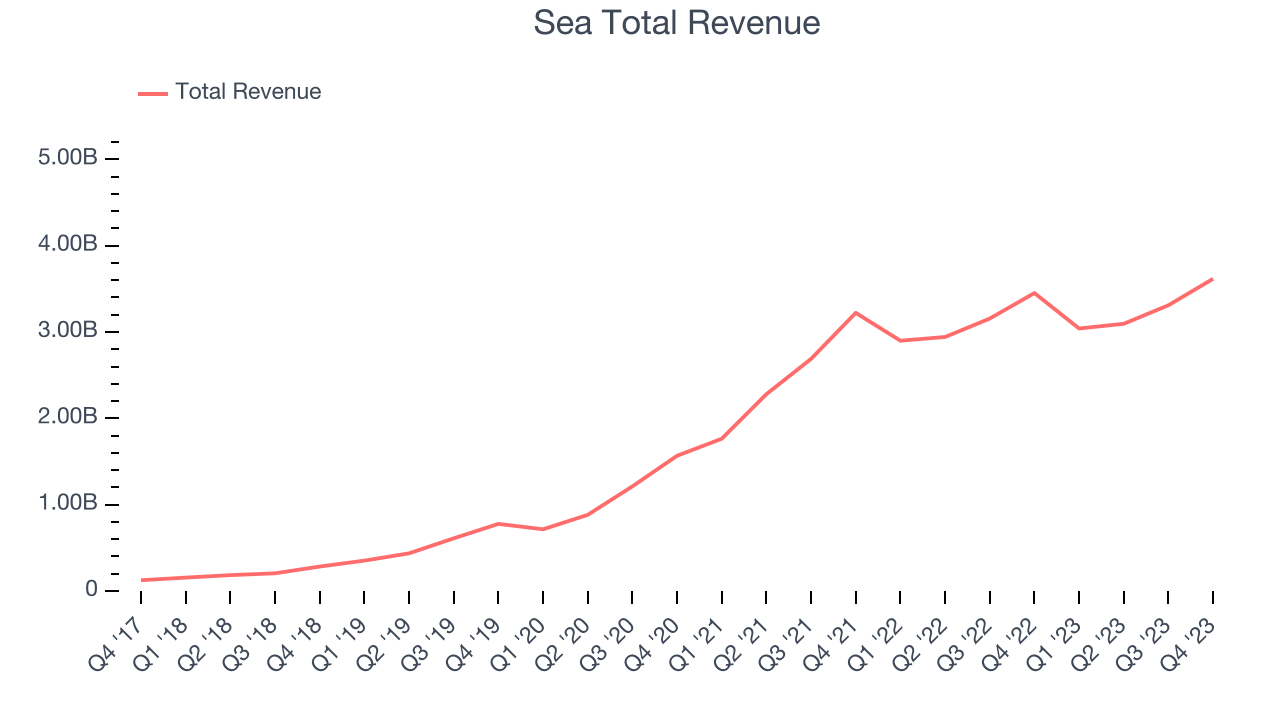

E-commerce and gaming company Sea (NYSE:SE) reported Q4 FY2023 results topping analysts' expectations, with revenue up 4.8% year on year to $3.62 billion. It made a GAAP loss of $0.19 per share, down from its profit of $0.70 per share in the same quarter last year.

Sea (SE) Q4 FY2023 Highlights:

- Revenue: $3.62 billion vs analyst estimates of $3.55 billion (1.8% beat)

- Adjusted EBITDA: $126.7 million vs analyst estimates of $40 million (big beat)

- EPS: -$0.19 vs analyst estimates of -$0.26 (28.1% beat)

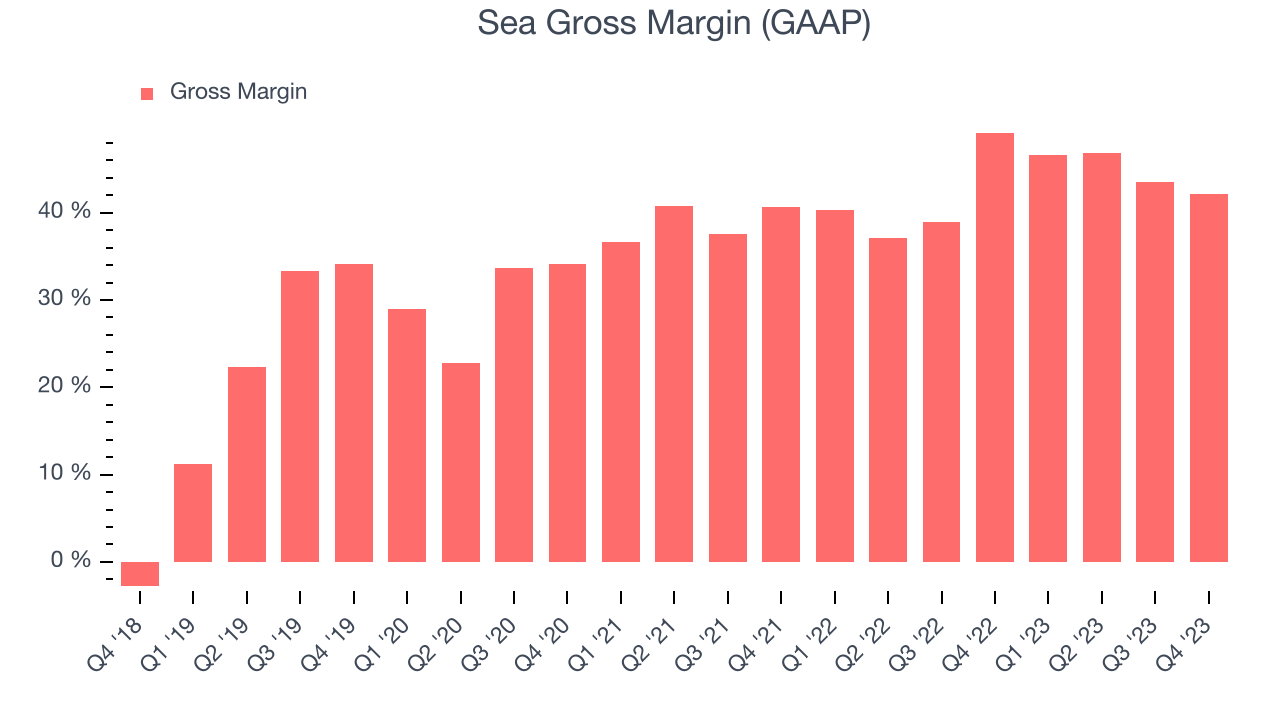

- Gross Margin (GAAP): 42.2%, down from 49.2% in the same quarter last year

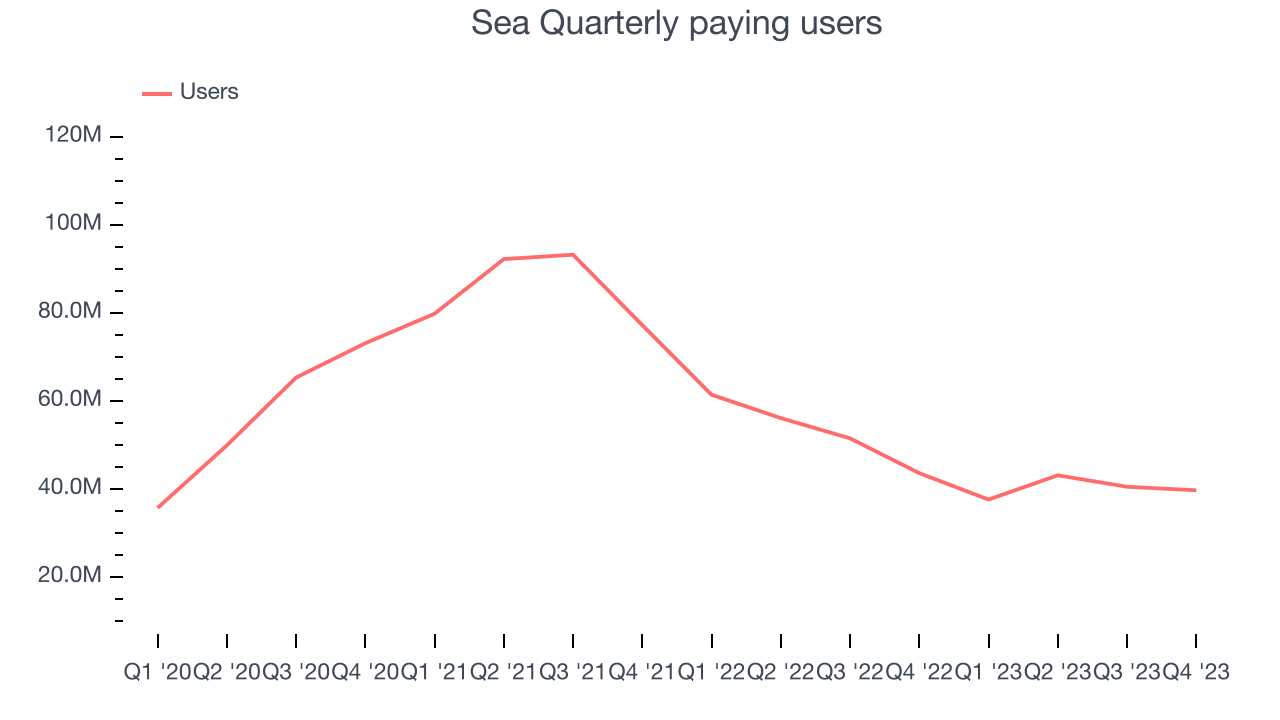

- Quarterly paying users: 39.7 million, down 3.9 million year on year

- Market Capitalization: $28.93 billion

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Garena, the initial product offering, is not just a single game but an ecosystem that allows users to play and socialize with other gamers from around the world. Whether players prefer action-packed shooters or strategy games, Garena seemingly has something for everyone, with additional features such as real-time chat to enhance engagement.

After gaming, Sea expanded into e-commerce with its Shopee platform, which is one of the largest digital marketplaces in Southeast Asia. Shopee allows users to buy and sell a wide variety of products, from electronics to groceries. Sea’s approach to e-commerce is a hybrid one–it acts as a marketplace but also holds inventory for some product categories. The company also offers financial services such as money transfers, bill payments, and pre-paid mobile phone top-ups through its SeaMoney platform.

In e-commerce, Sea generates revenue by taking a cut of the sale price when it acts as a marketplace and makes money on the actual sale price when it holds inventory. Gaming revenue primarily makes money through in-game purchases, where players can buy virtual goods such as skins, weapons, and other enhancements to improve the gaming experience.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering e-commerce platforms include Amazon.com (NASDAQ:AMZN) and Alibaba (NYSE:BABA), and competitors offering digital gaming include Sony (TSE:6758) and Nintendo (TSE:7974).Sales Growth

Sea's revenue growth over the last three years has been exceptional, averaging 55.9% annually. This quarter, Sea beat analysts' estimates but reported lacklustre 4.8% year-on-year revenue growth.

Usage Growth

As an online marketplace, Sea generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Sea has been struggling to grow its users, a key performance metric for the company. Over the last two years, its users have declined 30.3% annually to 39.7 million. This is one of the lowest rates of growth in the consumer internet sector.

In Q4, Sea's users decreased by 3.9 million, a 8.9% drop since last year.

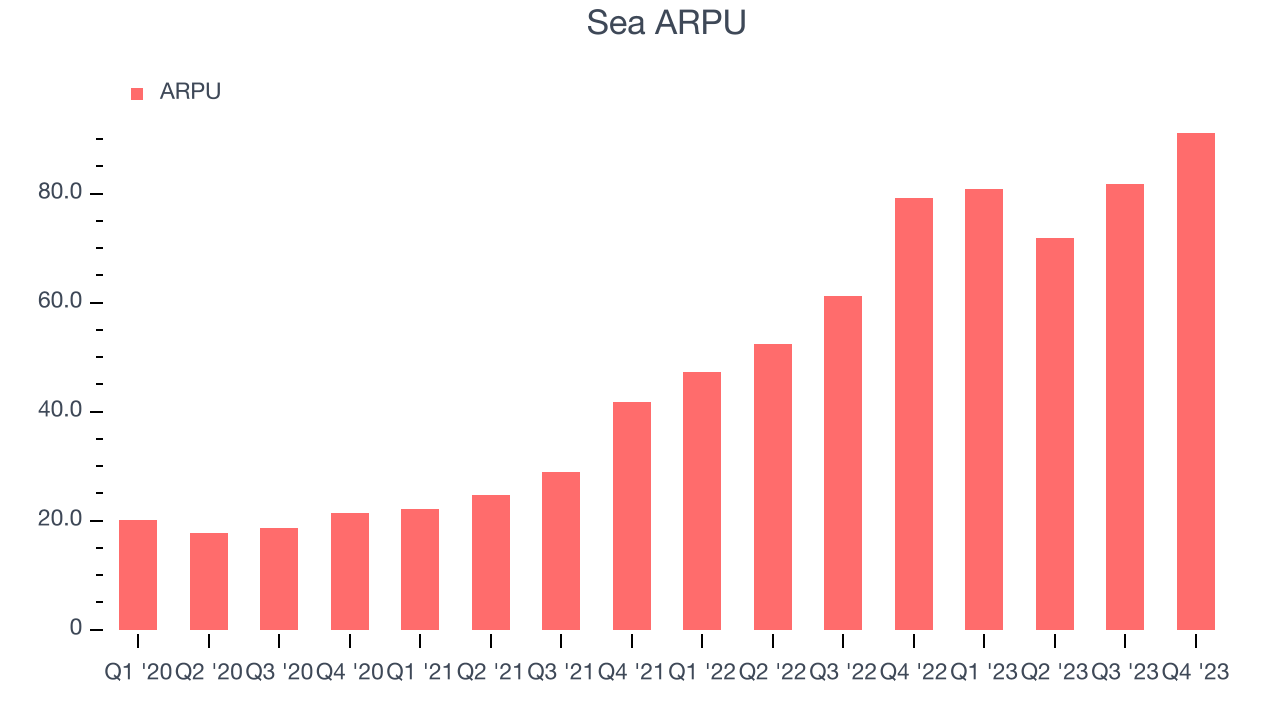

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Sea because it measures how much the company earns in transaction fees from each user. Furthermore, ARPU gives us unique insights as it's a function of a user's average order size and Sea's take rate, or "cut", on each order.

Sea's ARPU growth has been exceptional over the last two years, averaging 73.1%. Although its users have shrunk during this time, the company's ability to successfully increase prices demonstrates its platform's enduring value for existing users. This quarter, ARPU grew 15.1% year on year to $91.10 per user.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Sea's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 42.2% this quarter, down 7 percentage points year on year.

For online marketplaces like Sea, these aforementioned costs typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification. After paying for these expenses, Sea had $0.42 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Sea's gross margins have been trending up over the last 12 months, averaging 44.7%. This is a welcome development, as Sea's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Sea grow from a combination of product virality, paid advertisement, and incentives.

Sea is extremely efficient at acquiring new users, spending only 15.6% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and customer acquisition advantages from scale, giving Sea the freedom to invest its resources into new growth initiatives while maintaining optionality.

Key Takeaways from Sea's Q4 Results

It was good to see Sea narrowly top analysts' revenue and adjusted EBITDA expectations this quarter. Guidance was not given. Overall, this was a solid quarter for Sea, especially the big beat on adjusted EBITDA and profitability. The stock is up 12.6% after reporting and currently trades at $57.48 per share.

Is Now The Time?

Sea may have had a bad quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Sea is a good business. Its revenue growth has been exceptional over the last three years, and growth is expected to increase in the short term. And while its growth in users has been lackluster, the good news is its top-tier ARPU growth shows the increasing value of its platform to its users. On top of that, its user acquisition efficiency is best in class.

At the moment Sea trades at 29.1x next 12 months EV-to-EBITDA. There's definitely a lot of things to like about Sea and looking at the consumer internet landscape right now, it seems that the company trades at a pretty interesting price point.

Wall Street analysts covering the company had a one-year price target of $54.96 per share right before these results (compared to the current share price of $57.48).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.