As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at industrial packaging stocks, starting with Sealed Air (NYSE:SEE).

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 9 industrial packaging stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 2.3% below.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Thankfully, industrial packaging stocks have been resilient with share prices up 7.5% on average since the latest earnings results.

Sealed Air (NYSE:SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

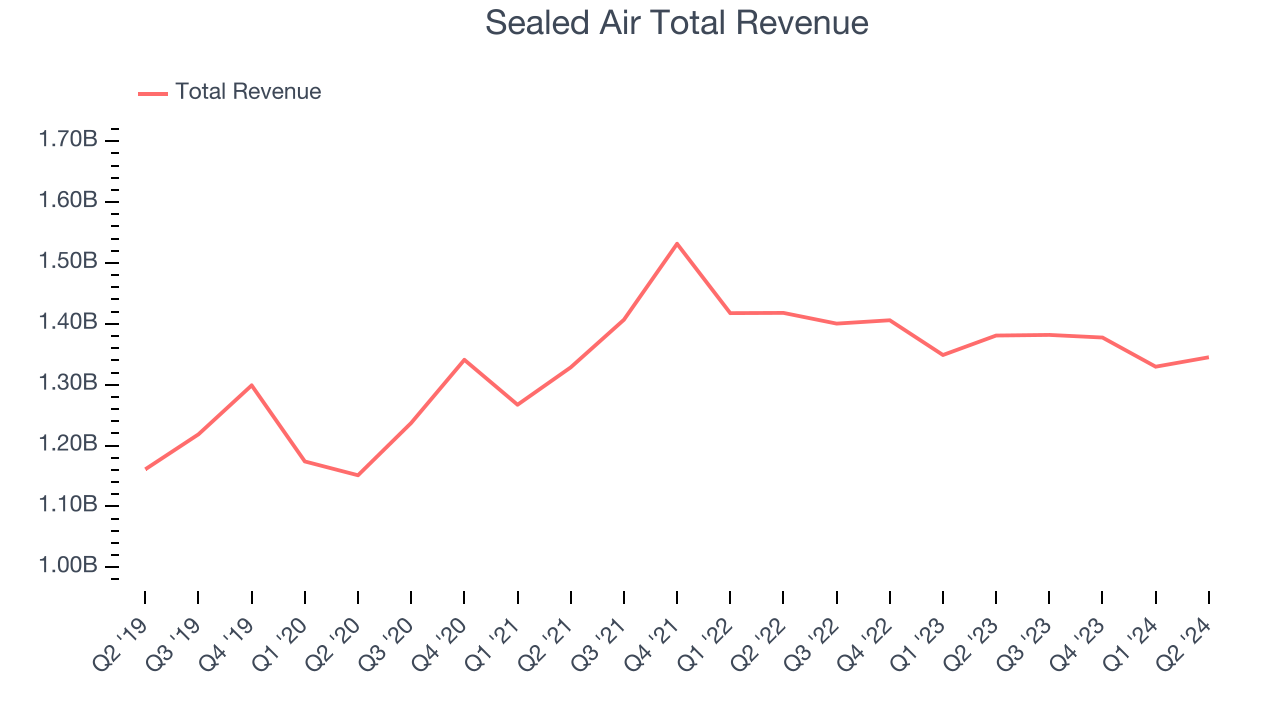

Sealed Air reported revenues of $1.35 billion, down 2.6% year on year. This print exceeded analysts’ expectations by 2.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ operating margin and volume estimates.

"Our second quarter results were ahead of our expectations, reflecting strong sequential demand within our Food business, accelerated benefits from our CTO2Grow program that more than offset the continued pressure within our Protective business," said Patrick Kivits, Sealed Air's CEO.

Sealed Air pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 3.5% since reporting and currently trades at $35.60.

Is now the time to buy Sealed Air? Access our full analysis of the earnings results here, it’s free.

Best Q2: Avery Dennison (NYSE:AVY)

Founded as Kum Kleen Products, Avery Dennison (NYSE:AVY) is a manufacturer of adhesive materials, display graphics, and packaging products, serving various industries.

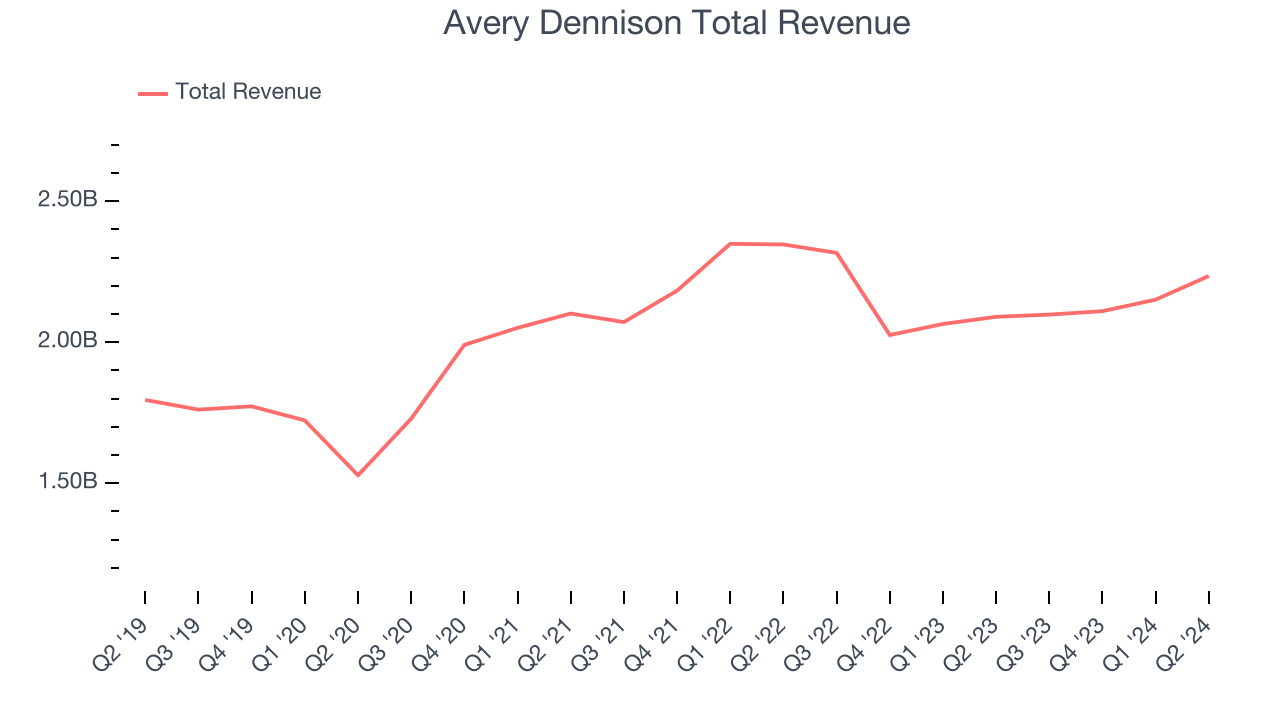

Avery Dennison reported revenues of $2.24 billion, up 6.9% year on year, outperforming analysts’ expectations by 1.9%. The business had a very strong quarter with an impressive beat of analysts’ organic revenue and operating margin estimates.

Avery Dennison achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.7% since reporting. It currently trades at $209.36.

Is now the time to buy Avery Dennison? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Silgan Holdings (NYSE:SLGN)

Established in 1987, Silgan Holdings (NYSE:SLGN) is a supplier of rigid packaging for consumer goods products, specializing in metal containers, closures, and plastic packaging.

Silgan Holdings reported revenues of $1.38 billion, down 3.2% year on year, falling short of analysts’ expectations by 3.4%. It was a softer quarter as it posted a miss of analysts’ organic revenue estimates.

Interestingly, the stock is up 5.6% since the results and currently trades at $51.45.

Read our full analysis of Silgan Holdings’s results here.

Graphic Packaging Holding (NYSE:GPK)

Founded in 1991, Graphic Packaging (NYSE:GPK) is a provider of paper-based packaging solutions for a wide range of products.

Graphic Packaging Holding reported revenues of $2.24 billion, down 6.5% year on year. This number lagged analysts' expectations by 1.3%. All in all, it was a mixed quarter for the company.

The stock is up 6.6% since reporting and currently trades at $29.86.

Read our full, actionable report on Graphic Packaging Holding here, it’s free.

Berry Global Group (NYSE:BERY)

Founded as Imperial Plastics, Berry Global (NYSE: BERY) is a manufacturer and marketer of plastic packaging products, including containers, bottles, and prescription packaging.

Berry Global Group reported revenues of $3.16 billion, down 2.1% year on year. This number came in 2.9% below analysts' expectations. It was a slower quarter as it also recorded a miss of analysts’ organic revenue estimates.

The stock is up 2.9% since reporting and currently trades at $67.54.

Read our full, actionable report on Berry Global Group here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.