Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at SEMrush (NYSE:SEMR), and the best and worst performers in the sales and marketing software group.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 22 sales and marketing software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 3.99%, while on average next quarter revenue guidance was 2.7% above consensus. The technology sell-off has been putting pressure on stocks since November and sales and marketing software stocks have not been spared, with share price down 26.8% since earnings, on average.

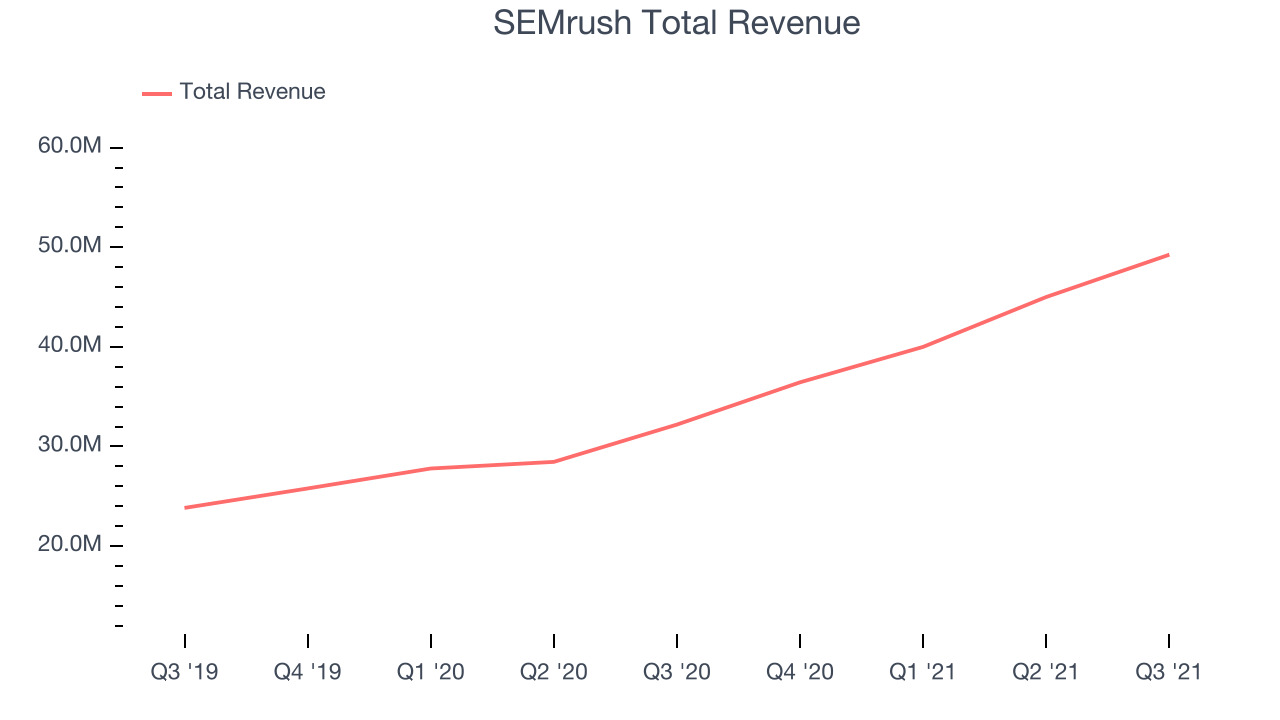

SEMrush (NYSE:SEMR)

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

SEMrush reported revenues of $49.2 million, up 52.9% year on year, beating analyst expectations by 3.73%. It was a good quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

“We experienced strong growth in the number of user licenses per customer in the quarter and year to date. Growth in user licenses per customer combined with strength from product add-ons helped drive year over year average revenue per customer growth of more than 20%. I believe the continued growth in revenue per customer indicates that our platform strategy is working and our products continue to deliver outstanding value to our customers,” said Oleg Shchegolev, CEO and Founder of Semrush.

The stock is down 34.1% since the results and currently trades at $17.07.

We think SEMrush is a good business, but is it a buy today? Read our full report here, it's free.

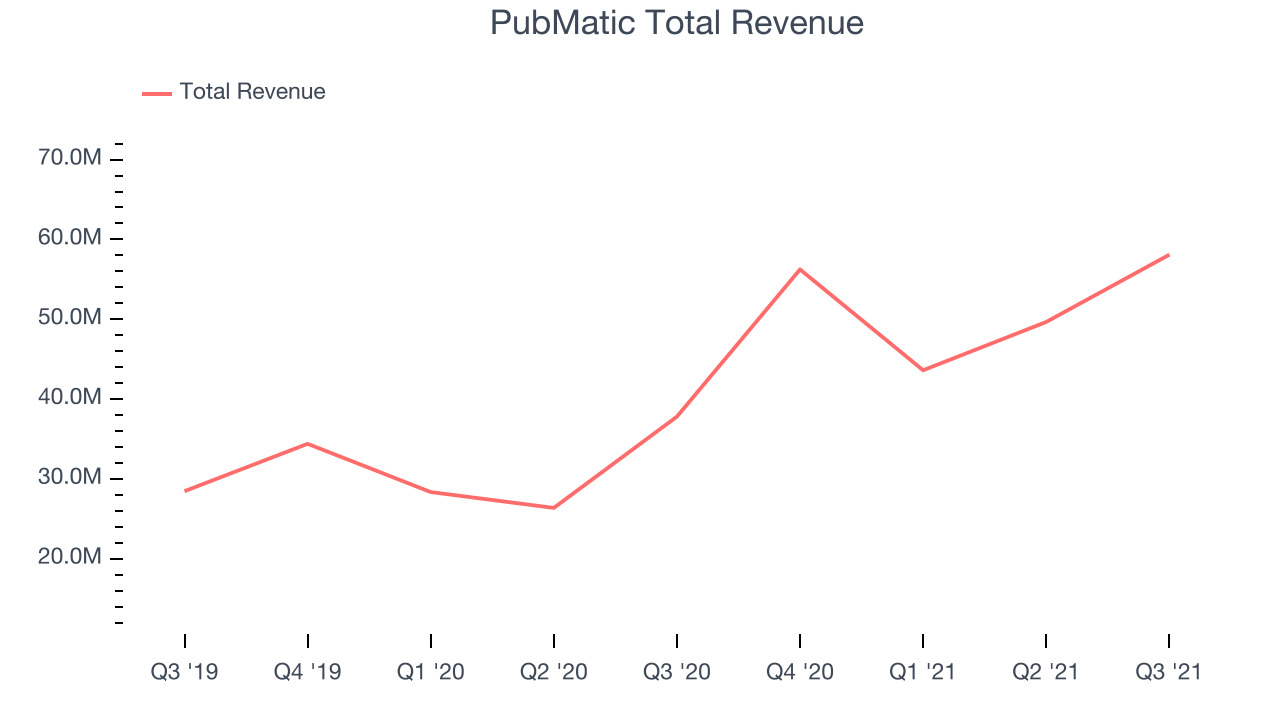

Best Q3: PubMatic (NASDAQ:PUBM)

Founded in 2006, as an online ad platform focused on ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $58 million, up 53.6% year on year, beating analyst expectations by 10.7%. It was a strong quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

PubMatic achieved the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 26.8% since the results and currently trades at $23.44.

Is now the time to buy PubMatic? Access our full analysis of the earnings results here, it's free.

Weakest Q3: ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $49.3 million, up 15.9% year on year, beating analyst expectations by 2.76%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a decline in gross margin.

The stock is down 9.97% since the results and currently trades at $16.25.

Read our full analysis of ON24's results here.

Qualtrics (NASDAQ:XM)

Founded in 2002 by Utah-based entrepreneur Ryan Smith, along with his father and brother, Qualtrics (NASDAQ:XM) provides organizations with software to collect and analyze feedback from customers and employees.

Qualtrics reported revenues of $271.6 million, up 40.8% year on year, beating analyst expectations by 5.21%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter.

The stock is down 40.7% since the results and currently trades at $26.20.

Read our full, actionable report on Qualtrics here, it's free.

DoubleVerify Holdings (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify Holdings reported revenues of $83 million, up 36.1% year on year, beating analyst expectations by 1.52%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter.

The stock is down 28.6% since the results and currently trades at $24.38.

Read our full, actionable report on DoubleVerify Holdings here, it's free.

The author has no position in any of the stocks mentioned