Marketing analytics software Semrush (NYSE:SEMR) reported Q3 FY2021 results beating Wall St's expectations, with revenue up 52.9% year on year to $49.2 million. Guidance for next quarter's revenue was $52 million at the midpoint, 2.58% above the average of analyst estimates. Semrush made a GAAP loss of $615 thousand, improving on its loss of $1.52 million, in the same quarter last year.

Is now the time to buy Semrush? Access our full analysis of the earnings results here, it's free.

Semrush (SEMR) Q3 FY2021 Highlights:

- Revenue: $49.2 million vs analyst estimates of $47.4 million (3.73% beat)

- EPS (GAAP): $0.00 (fully diluted EPS)

- Revenue guidance for Q4 2021 is $52 million at the midpoint, above analyst estimates of $50.7 million

- Free cash flow of $7.72 million, up from $468 thousand in previous quarter

- Net Revenue Retention Rate: 124%, up from 121% previous quarter

- Customers: 79,000, up from 76,000 in previous quarter

- Gross Margin (GAAP): 76.9%, in line with same quarter last year

“We experienced strong growth in the number of user licenses per customer in the quarter and year to date. Growth in user licenses per customer combined with strength from product add-ons helped drive year over year average revenue per customer growth of more than 20%. I believe the continued growth in revenue per customer indicates that our platform strategy is working and our products continue to deliver outstanding value to our customers,” said Oleg Shchegolev, CEO and Founder of Semrush.

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

As the share of the global population with internet connectivity grows, companies are continuing to rapidly increase their online presence to engage with their customers. The Covid pandemic has further accelerated this trend and drives demand for integrated tools that help companies market their products online.

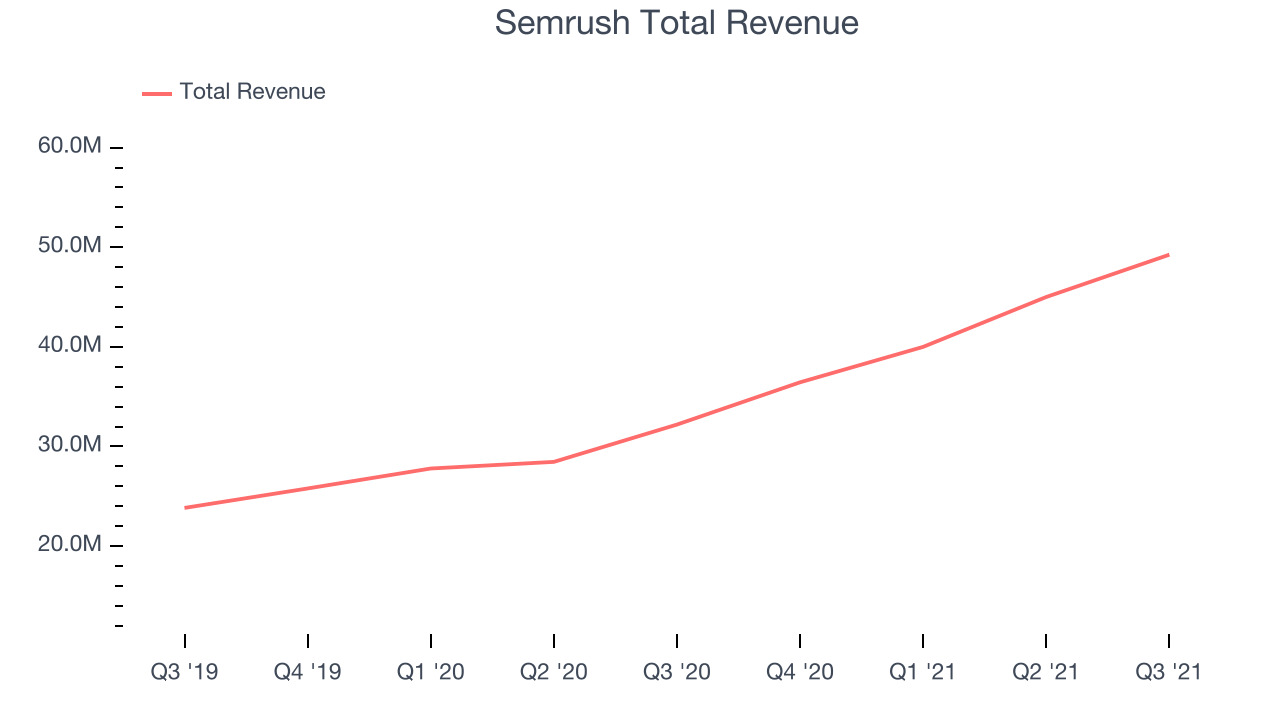

Sales Growth

As you can see below, Semrush's revenue growth has been impressive over the last year, growing from quarterly revenue of $32.1 million, to $49.2 million.

This was another standout quarter with the revenue up a splendid 52.9% year on year. But the growth did slow down a little compared to last quarter, as Semrush increased revenue by $4.24 million in Q3, compared to $5 million revenue add in Q2 2021. So while the growth is overall still impressive, we will be keeping an eye on the slowdown.

Analysts covering the company are expecting the revenues to grow 29.9% over the next twelve months, although estimates are likely to change post earnings.

There are others doing even better than Semrush. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

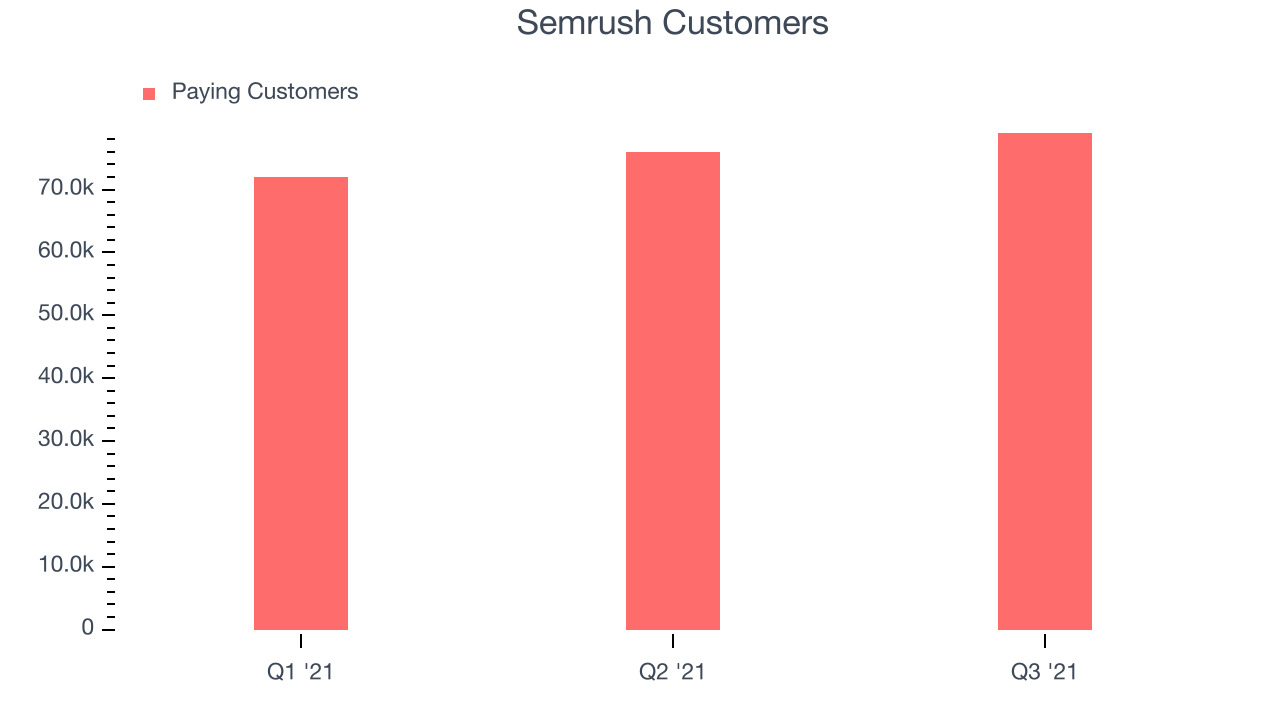

Customer Growth

You can see below that Semrush reported 79,000 customers at the end of the quarter, an increase of 3,000 on last quarter.

Key Takeaways from Semrush's Q3 Results

With a market capitalization of $3.39 billion Semrush is among smaller companies, but its more than $188.5 million in cash and positive free cash flow over the last twelve months put it in a very strong position to invest in growth.

We were impressed by the exceptional revenue growth Semrush delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was unfortunate to see the slowdown in customer growth. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. The company is up 8.02% on the results and currently trades at $28 per share.

Should you invest in Semrush right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.