Marketing analytics software Semrush (NYSE:SEMR) reported results in line with analysts' expectations in Q2 FY2023, with revenue up 19.3% year on year to $74.7 million. The company also expects next quarter's revenue to be around $78.5 million, roughly in line with analysts' estimates. SEMrush made a GAAP loss of $279 thousand, improving from its loss of $8.28 million in the same quarter last year.

Is now the time to buy SEMrush? Find out by accessing our full research report free of charge.

SEMrush (SEMR) Q2 FY2023 Highlights:

- Revenue: $74.7 million vs analyst estimates of $74.4 million (small beat)

- EPS: $0 vs analyst estimates of -$0.03 ($0.03 beat)

- Revenue Guidance for Q3 2023 is $78.5 million at the midpoint, below analyst estimates of $79.1 million

- The company reconfirmed revenue guidance for the full year of $307.5 million at the midpoint

- Free Cash Flow was -$8.58 million compared to -$4.93 million in the previous quarter

- Net Revenue Retention Rate: 112%, down from 116% in the previous quarter

- Customers: 104,000, up from 100,000 in the previous quarter

- Gross Margin (GAAP): 82.6%, up from 79.9% in the same quarter last year

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

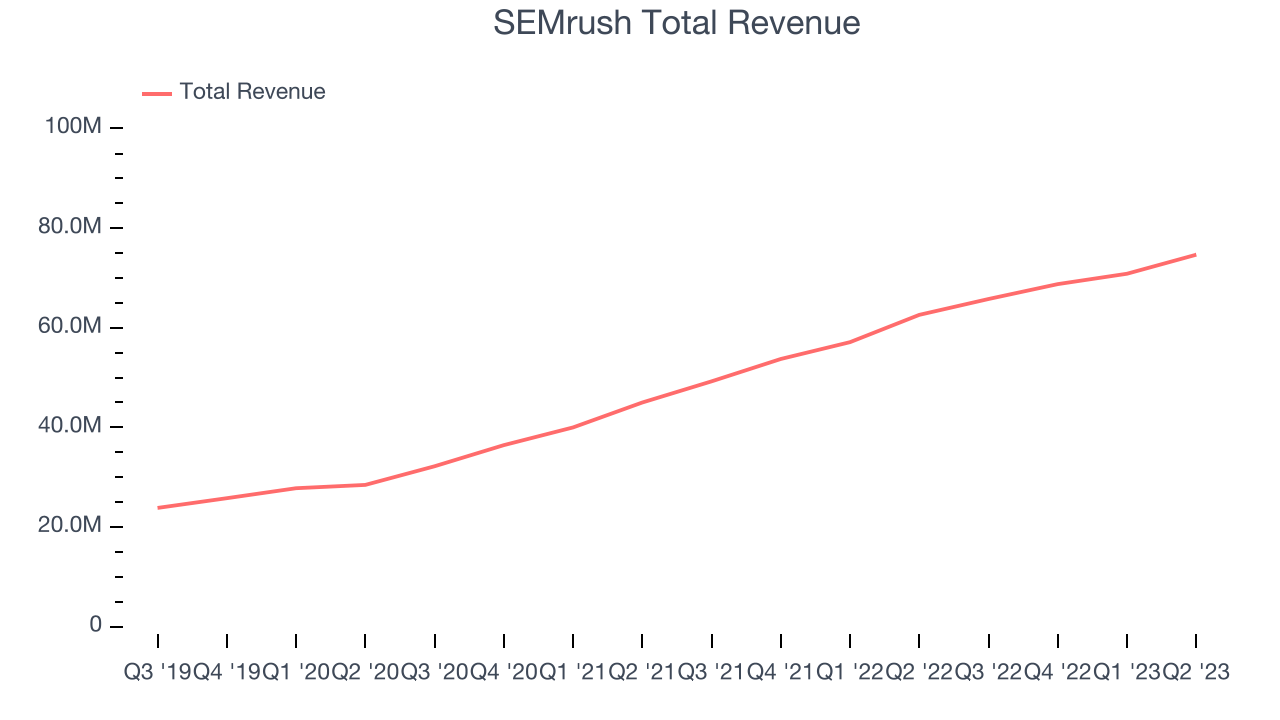

Sales Growth

As you can see below, SEMrush's revenue growth has been very strong over the last two years, growing from $45 million in Q2 FY2021 to $74.7 million this quarter.

This quarter, SEMrush's quarterly revenue was once again up 19.3% year on year. We can see that SEMrush's revenue increased by $3.82 million quarter on quarter, which is a solid improvement from the $2.09 million increase in Q1 2023. Shareholders should applaud the acceleration of growth.

Next quarter's guidance suggests that SEMrush is expecting revenue to grow 19.3% year on year to $78.5 million, slowing down from the 33.6% year-on-year increase it recorded in the same quarter last year. Ahead of the earnings results announcement, the analysts covering the company were expecting sales to grow 20.1% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

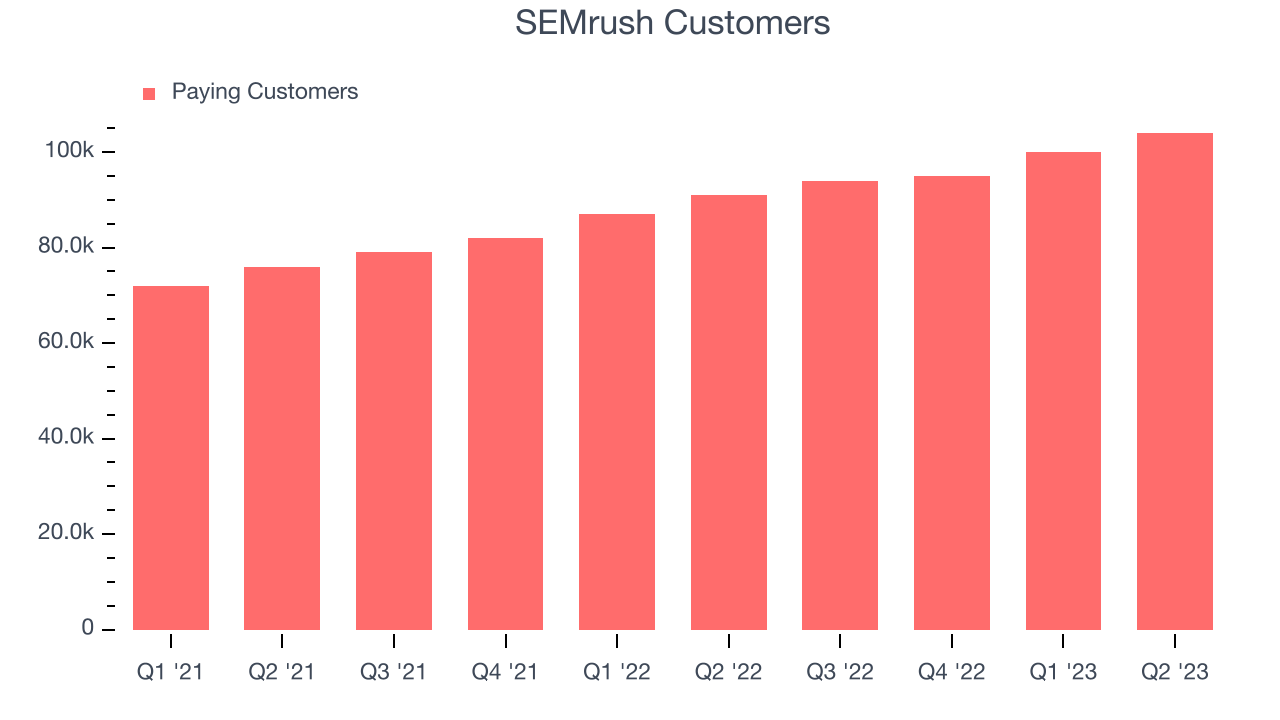

Customer Growth

SEMrush reported 104,000 customers at the end of the quarter, an increase of 4,000 from the previous quarter. That's a little slower customer growth than last quarter but quite a bit above what we've typically observed over the last 12 months, suggesting that its sales momentum is healthy but softening after a tough comp quarter from last year.

Key Takeaways from SEMrush's Q2 Results

With a market capitalization of $1.45 billion, SEMrush is among smaller companies, but its more than $24.1 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

While revenue beat by a small amount in the quarter, ARR missed and revenue guidance for next quarter was disappointing, coming in below Wall Street analysts' expectations. Additionally, there was a slowdown in customer growth. However, the CEO said “We expect revenue growth to reaccelerate with increasing adoption of our expanding product portfolio, tools, and add-ons." The company therefore raised full year guidance. Overall, this was a mixed quarter for SEMrush and the market will have to wait to see if the reacceleration materializes. The stock is flat after reporting and currently trades at $10.18 per share.

SEMrush may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.