Marketing analytics software Semrush (NYSE:SEMR) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 21.1% year on year to $85.81 million. The company expects next quarter's revenue to be around $89.6 million, in line with analysts' estimates. It made a GAAP profit of $0.01 per share, improving from its loss of $0.07 per share in the same quarter last year.

SEMrush (SEMR) Q1 CY2024 Highlights:

- Revenue: $85.81 million vs analyst estimates of $85.05 million (small beat)

- EPS: $0.01 vs analyst estimates of $0.02 (-$0.01 miss)

- Revenue Guidance for Q2 CY2024 is $89.6 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly raised its revenue guidance for the full year of $367.5 million at the midpoint (also slightly raised operating margin guidance for the same period)

- Gross Margin (GAAP): 82.9%, in line with the same quarter last year

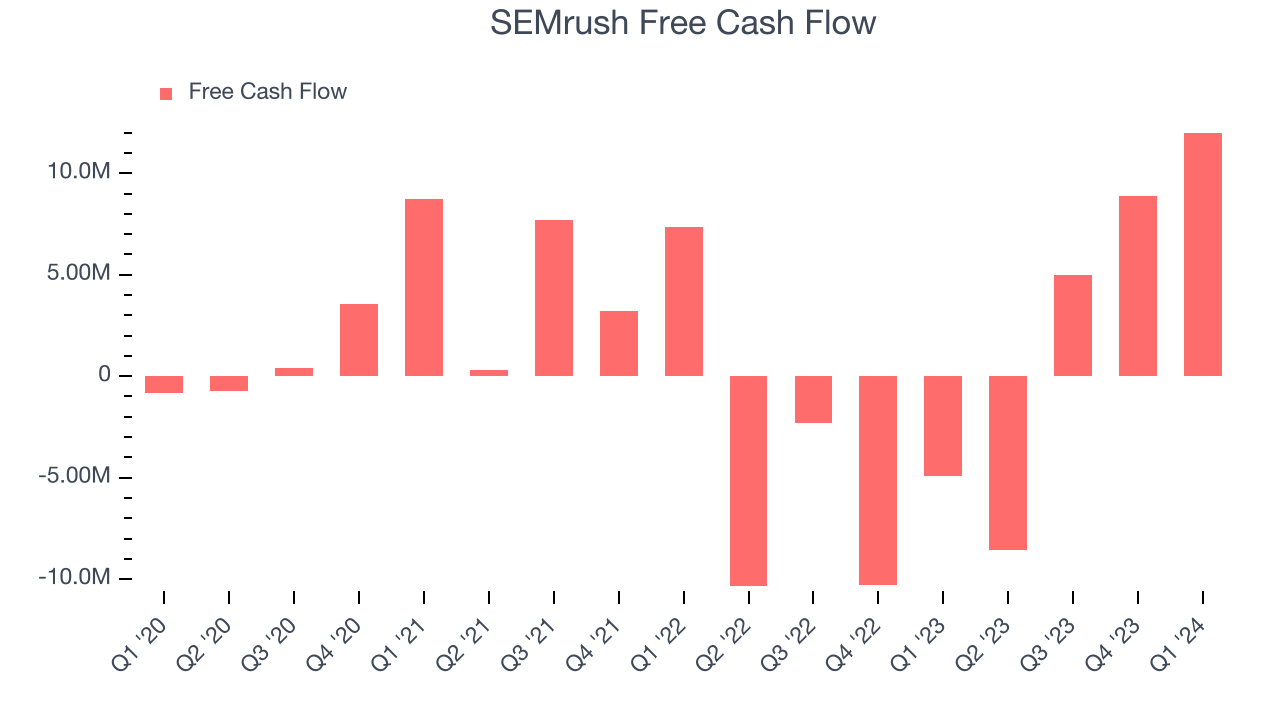

- Free Cash Flow of $12.01 million, up 35.2% from the previous quarter

- Net Revenue Retention Rate: 107%, in line with the previous quarter

- Customers: 112,000, up from 108,000 in the previous quarter

- Market Capitalization: $1.82 billion

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

With all the social media, blogs posts, and audio and video content non stop screaming for our attention, it is becoming increasingly difficult for small and medium sized businesses to compete for the attention of their customers online. p

Semrush offers a suite of tools that help companies to be found online. Users can simply insert their own or their competitor’s web domain name into the platform and immediately start seeing insights around what keywords they rank for in Google, who are the visitors and where is the traffic coming from. The tool automatically provides suggestions on how to optimize the website both from content and technical SEO perspective.

Semrush is constantly monitoring a large part of the internet and its large data set enables it to algorithmically suggest new content strategies based on popular topics and headlines or provides insights on how to optimize your online ads for better performance. The company has expanded from a pure search engine optimization product to a wide range of over 50 tools, covering everything from market research, social media, content marketing to paid online marketing. And even more impressively, Semrush is the leading tool in most of the categories it competes in.

Listing Management Software

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

Semrush competes with companies like Hubspot (NYSE:HUBS) and Yext (NYSE:YEXT), although they only offer some of the features.

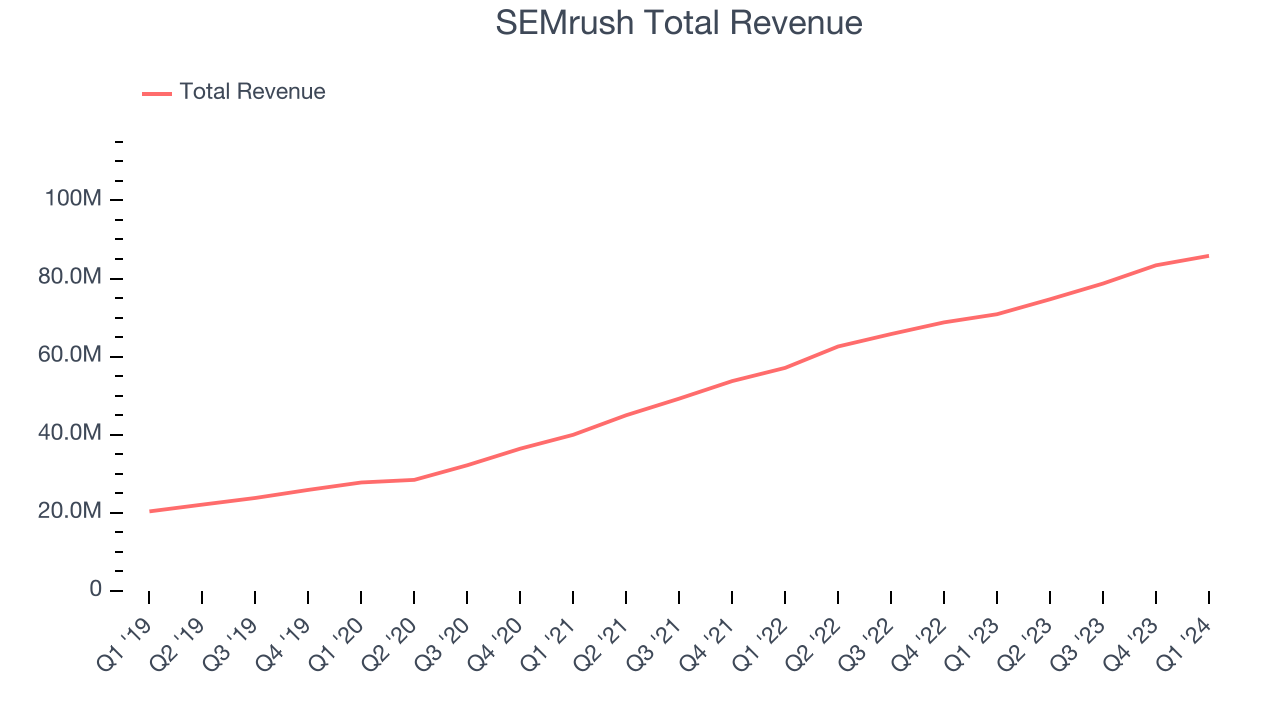

Sales Growth

As you can see below, SEMrush's revenue growth has been very strong over the last three years, growing from $40 million in Q1 2021 to $85.81 million this quarter.

This quarter, SEMrush's quarterly revenue was once again up a very solid 21.1% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $2.42 million in Q1 compared to $4.68 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that SEMrush is expecting revenue to grow 20% year on year to $89.6 million, in line with the 19.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 18.9% over the next 12 months before the earnings results announcement.

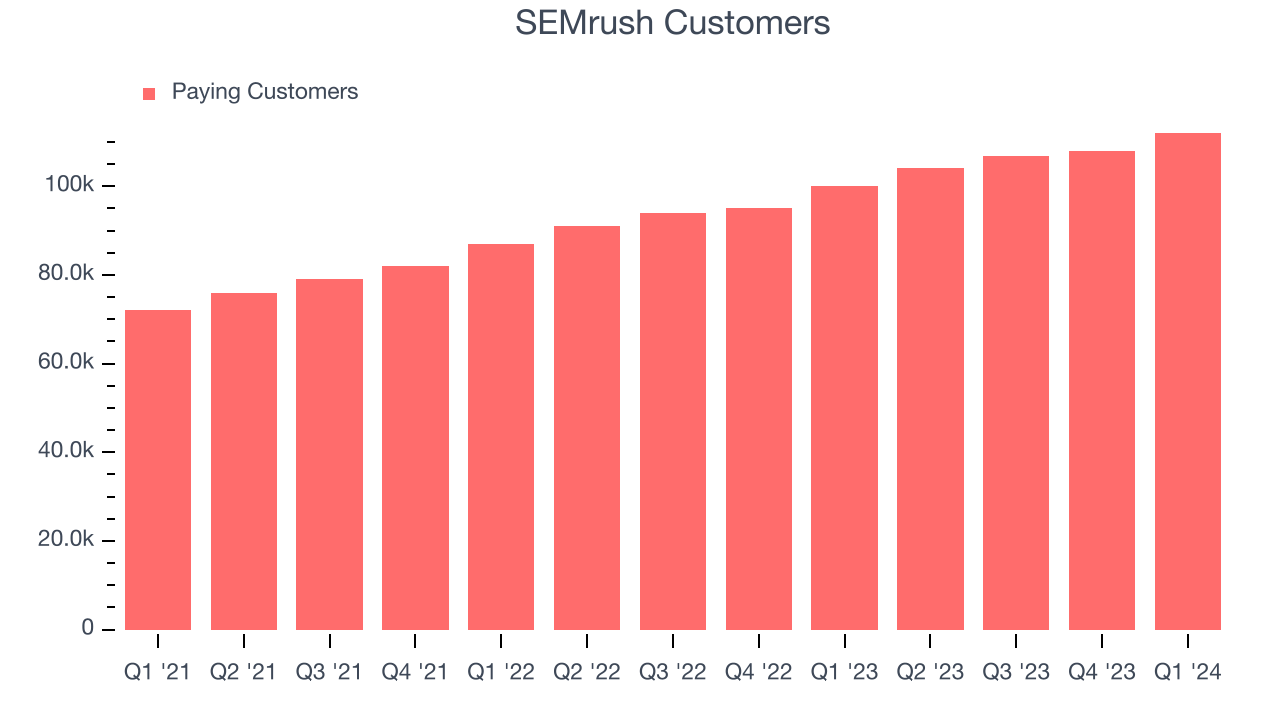

Customer Growth

SEMrush reported 112,000 customers at the end of the quarter, an increase of 4,000 from the previous quarter. That's a little better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that SEMrush's go-to-market strategy is working very well.

Product Success

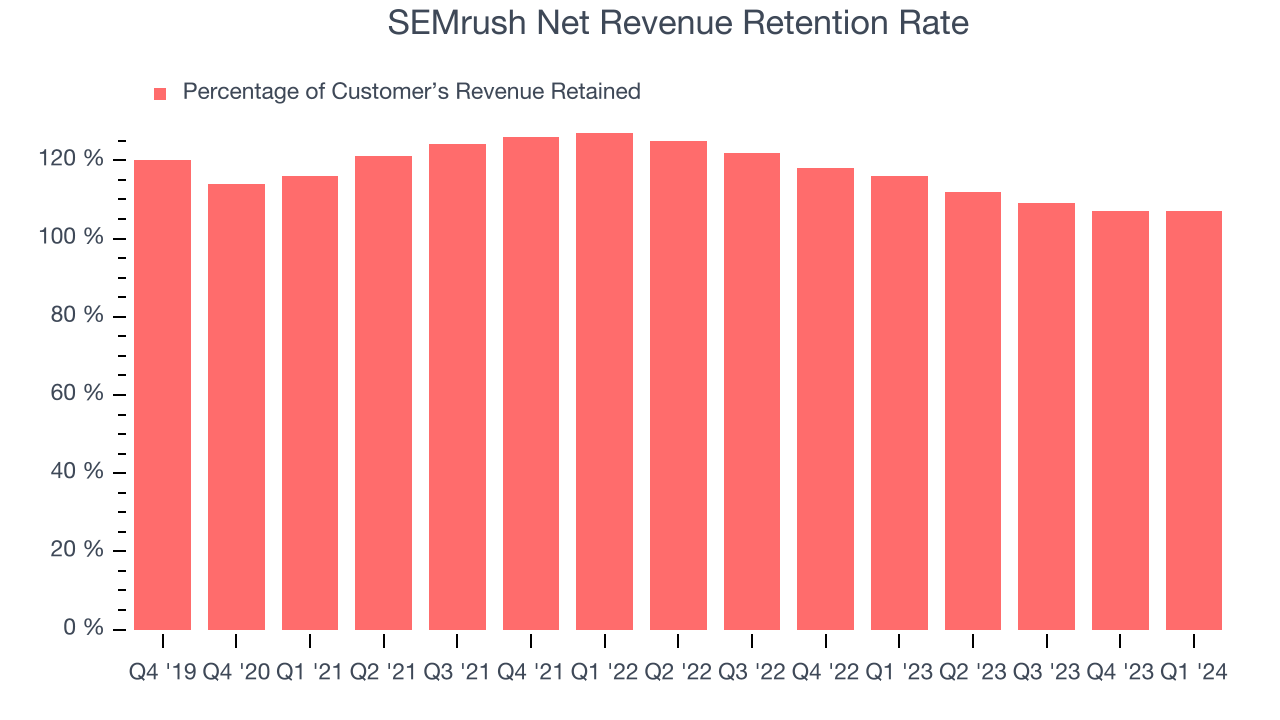

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

SEMrush's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 107% in Q1. This means that even if SEMrush didn't win any new customers over the last 12 months, it would've grown its revenue by 7%.

Despite falling over the last year, SEMrush still has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

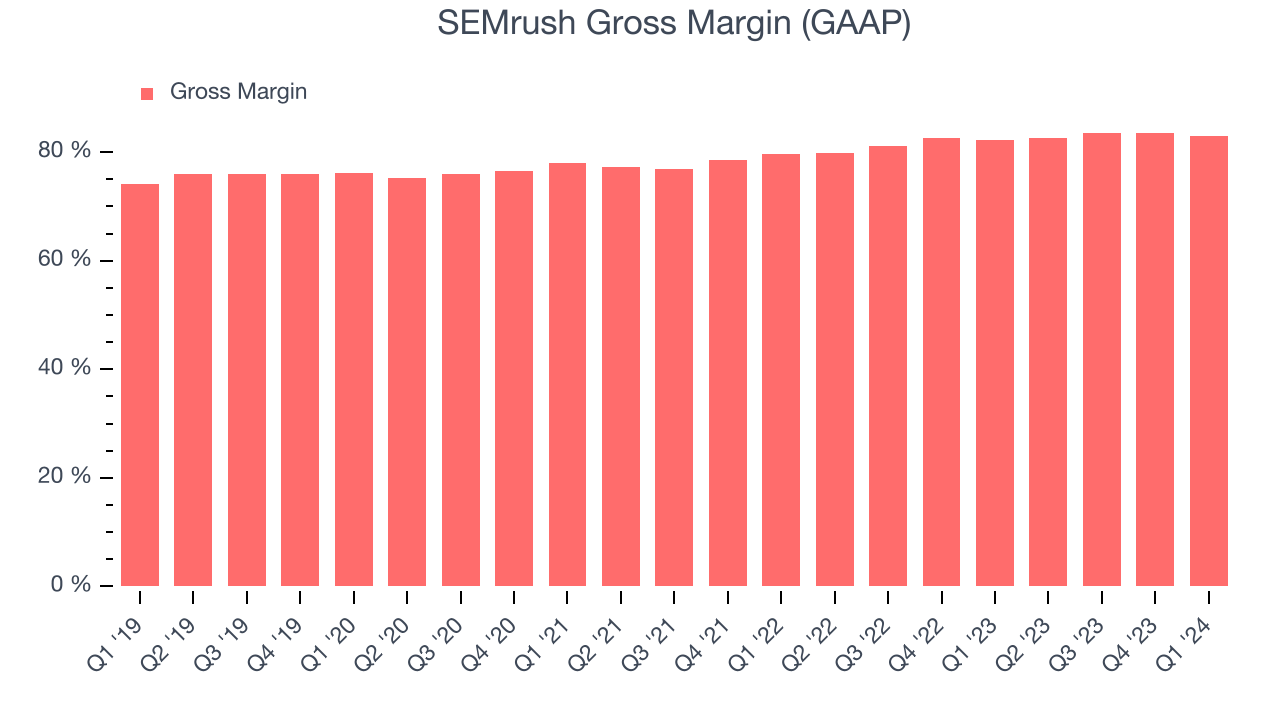

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. SEMrush's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 82.9% in Q1.

That means that for every $1 in revenue the company had $0.83 left to spend on developing new products, sales and marketing, and general administrative overhead. SEMrush's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that SEMrush is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. SEMrush's free cash flow came in at $12.01 million in Q1, turning positive over the last year.

SEMrush has generated $17.27 million in free cash flow over the last 12 months, or 5.4% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from SEMrush's Q1 Results

We were impressed by SEMrush's strong growth in customers this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is flat after reporting and currently trades at $13.14 per share.

Is Now The Time?

When considering an investment in SEMrush, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think SEMrush is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been impressive over the last three years. Additionally, its impressive gross margins indicate excellent business economics, and its efficient customer acquisition is better than many similar companies.

The market is certainly expecting long-term growth from SEMrush given its price-to-sales ratio based on the next 12 months is 5.1x. But looking at the tech landscape today, SEMrush's qualities stand out. We like the stock at this price, even more so when considering the company is trading at a discount to its similar-growth peers.

Wall Street analysts covering the company had a one-year price target of $14 right before these results (compared to the current share price of $13.14), implying they see short-term upside potential in SEMrush.

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.