Casual salad chain Sweetgreen (NYSE:SG) announced better-than-expected results in Q1 CY2024, with revenue up 26.2% year on year to $157.9 million. The company expects the full year's revenue to be around $667.5 million, in line with analysts' estimates. It made a GAAP loss of $0.23 per share, improving from its loss of $0.30 per share in the same quarter last year.

Is now the time to buy Sweetgreen? Find out by accessing our full research report, it's free.

Sweetgreen (SG) Q1 CY2024 Highlights:

- Revenue: $157.9 million vs analyst estimates of $152 million (3.9% beat)

- EPS: -$0.23 vs analyst expectations of -$0.22 (6.3% miss)

- The company reconfirmed its revenue guidance for the full year of $667.5 million at the midpoint

- Gross Margin (GAAP): 18.1%, up from 13.5% in the same quarter last year

- Same-Store Sales were up 5% year on year

- Market Capitalization: $2.63 billion

“Sweetgreen delivered strong first quarter results across the board. Year-over-year, revenue grew 26% and Restaurant-Level Profit Margin expanded by 400 basis points to 18%. We delivered positive Adjusted EBITDA during a traditionally slower first quarter. We remain confident that our strategy positions Sweetgreen for success today as well as for long-term, capital efficient, profitable growth,” said Jonathan Neman, Co-Founder and Chief Executive Officer.

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Sweetgreen is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

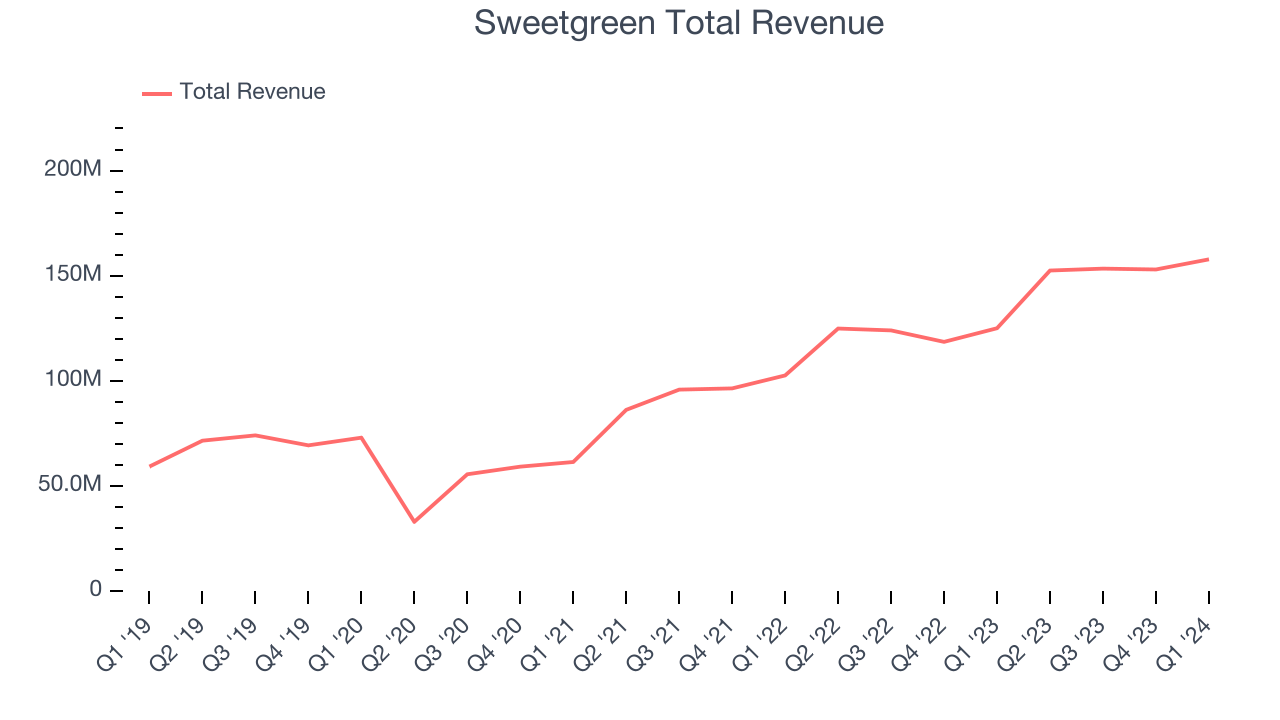

As you can see below, the company's annualized revenue growth rate of 21% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Sweetgreen reported remarkable year-on-year revenue growth of 26.2%, and its $157.9 million in revenue topped Wall Street's estimates by 3.9%. Looking ahead, Wall Street expects sales to grow 11.4% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

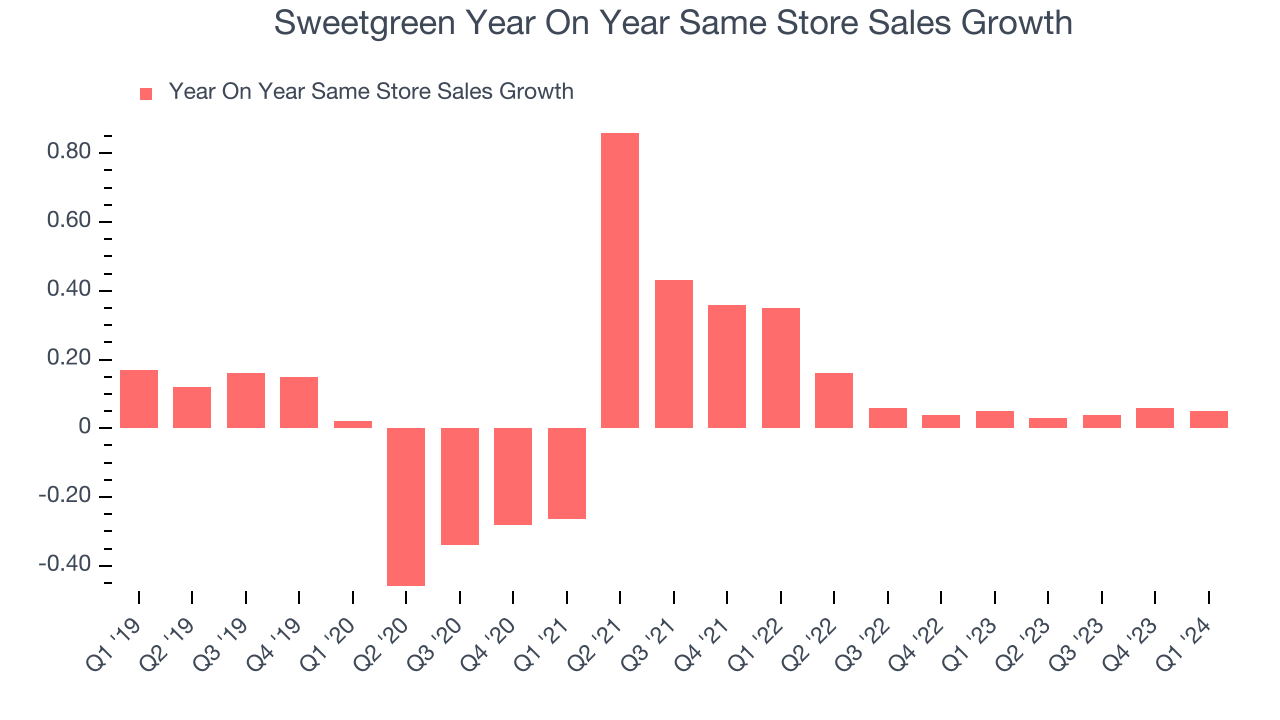

Sweetgreen's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 6.1% year on year. With positive same-store sales growth amid an increasing number of restaurants, Sweetgreen is reaching more diners and growing sales.

In the latest quarter, Sweetgreen's same-store sales rose 5% year on year. This growth was in line with the 5% year-on-year increase it posted 12 months ago.

Key Takeaways from Sweetgreen's Q1 Results

We were impressed by how significantly Sweetgreen blew past analysts' revenue expectations this quarter as its same-store sales grew 5%, enabling it to raise its full-year revenue guidance. We were also excited its gross margin outperformed Wall Street's estimates. On the other hand, its EPS missed analysts' expectations, but the market cares more about its upbeat outlook. Overall, we think this was a good quarter that should please shareholders. The stock is up 4% after reporting and currently trades at $24.5 per share.

Sweetgreen may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.