Casual salad chain Sweetgreen (NYSE:SG) announced better-than-expected results in Q1 CY2024, with revenue up 26.2% year on year to $157.9 million. The company expects the full year's revenue to be around $667.5 million, in line with analysts' estimates. It made a GAAP loss of $0.23 per share, improving from its loss of $0.30 per share in the same quarter last year.

Sweetgreen (SG) Q1 CY2024 Highlights:

- Revenue: $157.9 million vs analyst estimates of $152 million (3.9% beat)

- EPS: -$0.23 vs analyst expectations of -$0.22 (6.3% miss)

- The company reconfirmed its revenue guidance for the full year of $667.5 million at the midpoint

- Gross Margin (GAAP): 18.1%, up from 13.5% in the same quarter last year

- Same-Store Sales were up 5% year on year

- Market Capitalization: $2.63 billion

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

The three thought that the market was missing a so-called fast casual option that offered healthy, fresh, and locally-sourced food. If it was fast, it leaned unhealthy and if it was healthy and fresh, it leaned upscale and full service.

Sweetgreen specifically offers salads and bowls that use fresh, organic ingredients. The ‘Guacamole Greens’, for example, is a cold salad that includes roasted chicken, avocado, and a slew of traditional salad ingredients. The ‘Shroomami’ is a warm bowl that features roasted tofu, warm portobello mushrooms, beets, warm wild rice, and a few other ingredients. You can alter existing menu items with substitutions, and if you’re really not inspired by what’s offered, you can feel free to create a completely custom salad or bowl.

The typical Sweetgreen customer is a health-conscious individual, often a busy millennial who wants a quick and convenient lunch or dinner without breaking the bank. These individuals care about the origin of their food, and Sweetgreen often has a board in their locations showing where each ingredient is sourced, down to the names of the farms themselves.

Sweetgreen’s locations feature a modern and minimalist vibe. Unlike traditional fast-food joints, these stores favor neutral colors, wood and exposed concrete, and plants. To cater to their often tech-forward customers, the company’s app features the full menu along with nutritional information about items. It also allows users to order ahead of time for pickup to maximize convenience and efficiency.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Competitors in the casual quick service industry include Chipotle (NYSE:CMG), CAVA (NYSE:CAVA), Noodles & Company (NASDAQ:NDLS), and private companies such as Chopt Creative Salad and Just Salad.Sales Growth

Sweetgreen is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

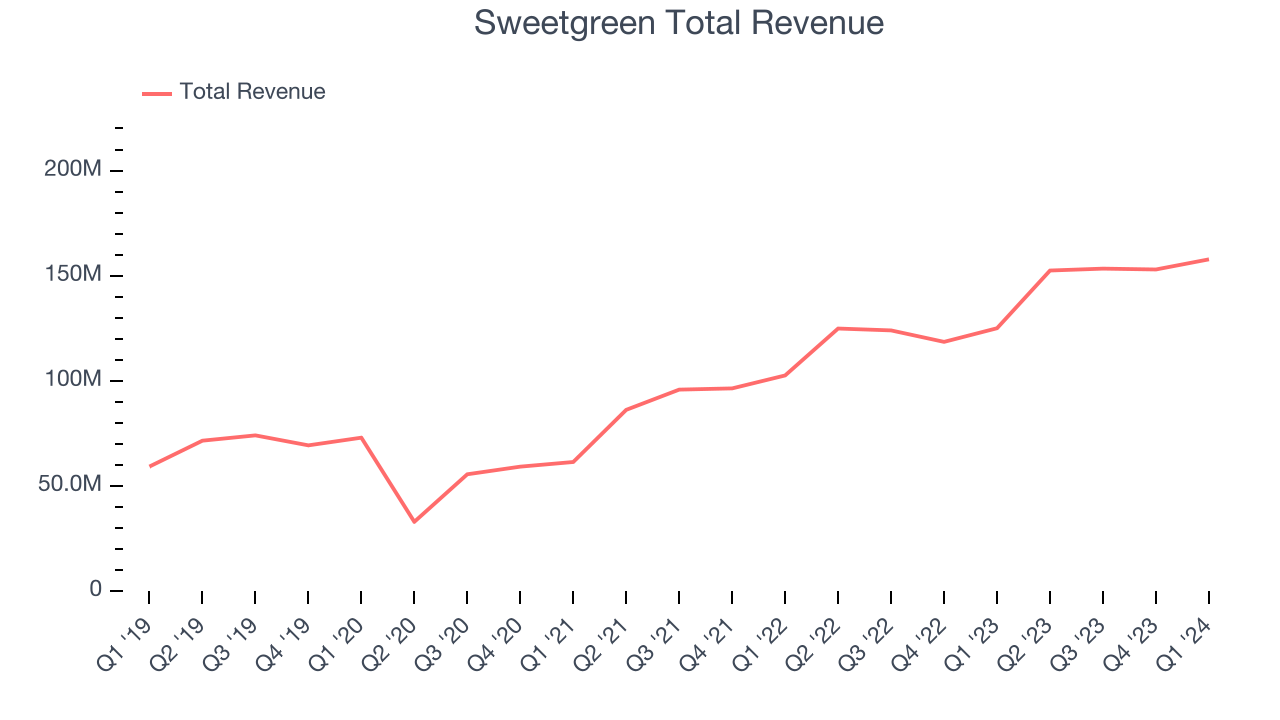

As you can see below, the company's annualized revenue growth rate of 21% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Sweetgreen reported remarkable year-on-year revenue growth of 26.2%, and its $157.9 million in revenue topped Wall Street's estimates by 3.9%. Looking ahead, Wall Street expects sales to grow 11.4% over the next 12 months, a deceleration from this quarter.

Same-Store Sales

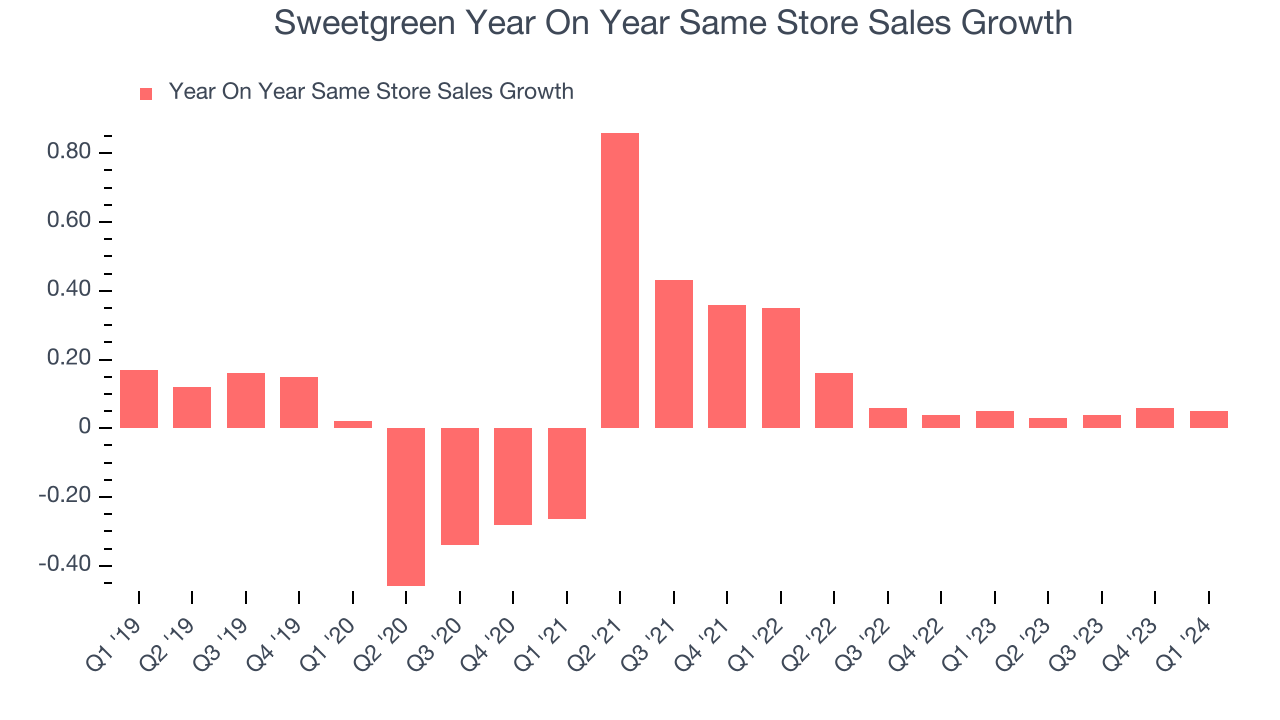

Sweetgreen's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 6.1% year on year. With positive same-store sales growth amid an increasing number of restaurants, Sweetgreen is reaching more diners and growing sales.

In the latest quarter, Sweetgreen's same-store sales rose 5% year on year. This growth was in line with the 5% year-on-year increase it posted 12 months ago.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

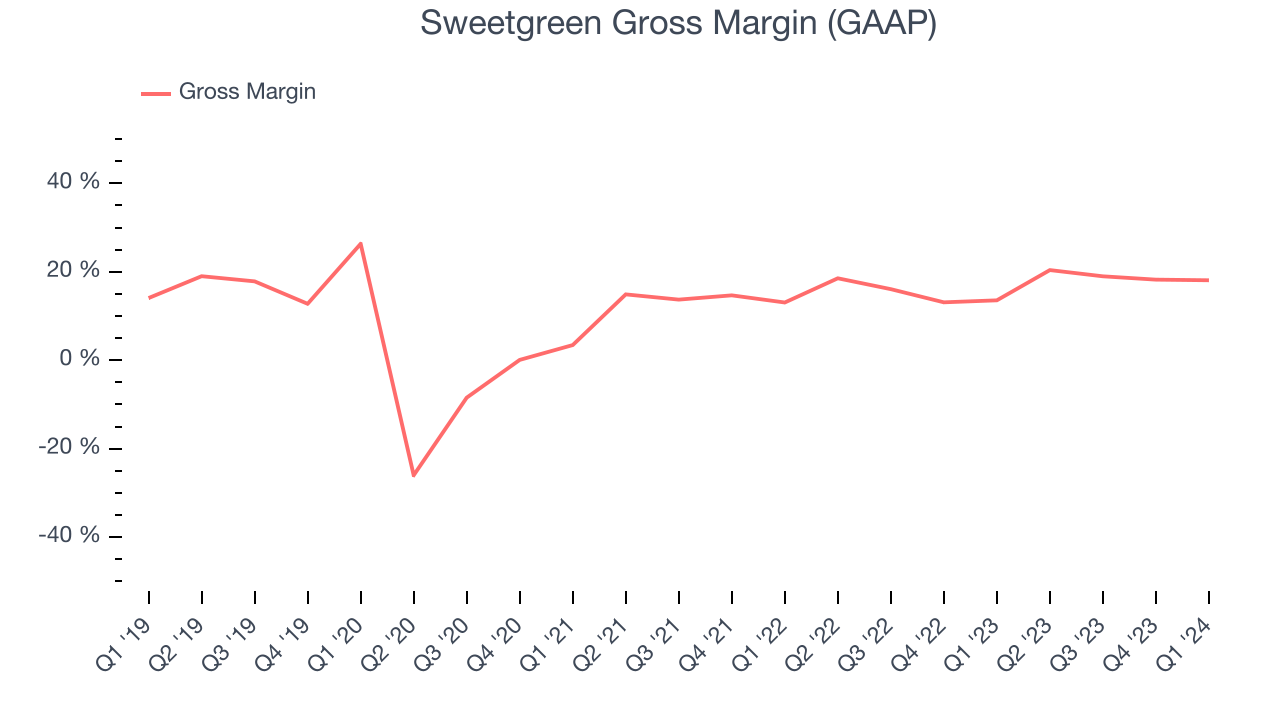

In Q1, Sweetgreen's gross profit margin was 18.1%. up 4.5 percentage points year on year. This means the company makes $0.17 for every $1 in revenue before accounting for its operating expenses.

Sweetgreen has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 17.3% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 25.2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

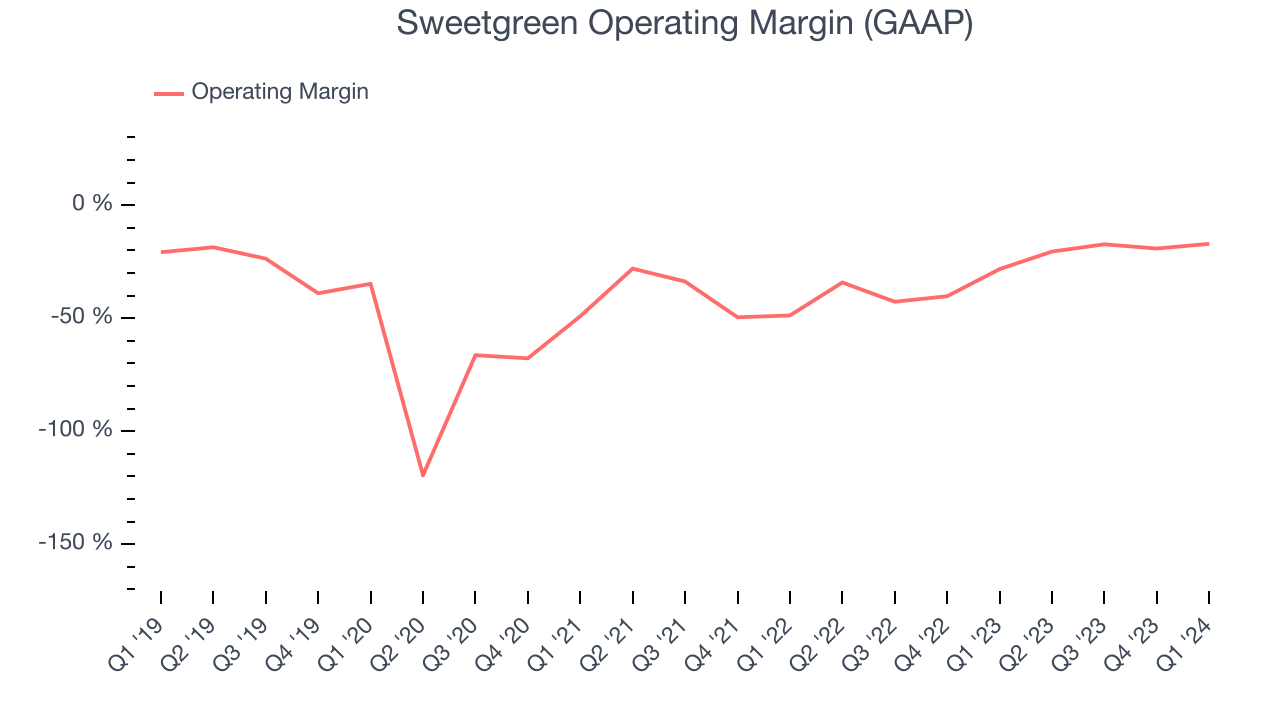

In Q1, Sweetgreen generated an operating profit margin of negative 17.1%, up 11.2 percentage points year on year. This increase was encouraging, and we can infer Sweetgreen was more disciplined with its expenses or gained leverage on its fixed costs because its operating margin expanded more than its gross margin.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Sweetgreen has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 26.4%. However, Sweetgreen's margin has improved, on average, by 17.8 percentage points each year, an encouraging sign for shareholders. The tide could be turning.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. Unfortunately, Sweetgreen has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 26.4%. However, Sweetgreen's margin has improved, on average, by 17.8 percentage points each year, an encouraging sign for shareholders. The tide could be turning.EPS

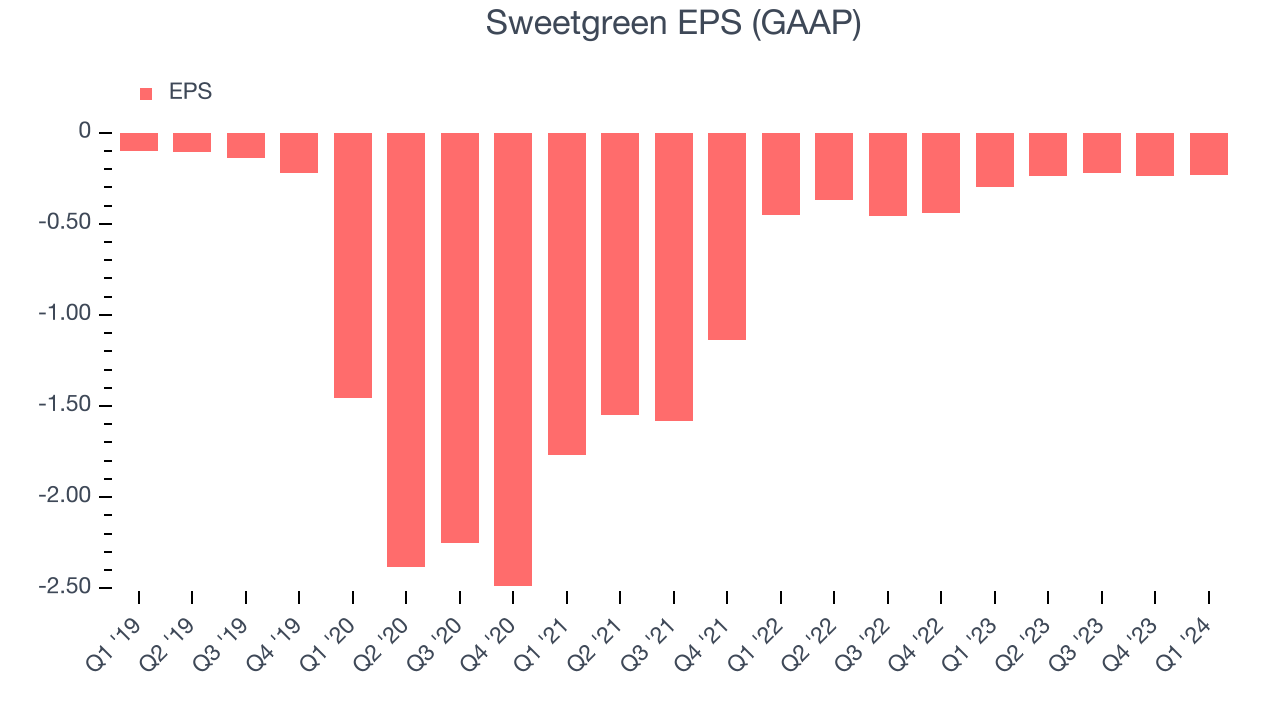

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Sweetgreen reported EPS at negative $0.23, up from negative $0.30 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2020 and FY2024, Sweetgreen's adjusted diluted EPS grew 85.4%, translating into a decent 16.7% compounded annual growth rate. If it can maintain this rate of growth, Sweetgreen will more than double its EPS in the next five years.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 26.3% year-on-year increase in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Sweetgreen's five-year average ROIC was negative 61.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Sweetgreen has $243.8 million of cash and $304.4 million of debt on its balance sheet. As investors in high-quality companies, we focus primarily on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $4.01 million of EBITDA over the last 12 months, Sweetgreen's net-debt-to-EBITDA ratio sits at 15.1x, showing it is overleveraged. We also view its annual interest payments of $6.78 million as high enough to hinder the performance of the business.

If the company's profitability falls or the market turns unexpectedly, credit agencies could downgrade the company’s rating, making incremental borrowing more expensive and restricting growth prospects. We believe this puts Sweetgreen in a risky situation, something we seek to avoid. We hope Sweetgreen can improve its balance sheet and remain cautious until it increases its profitability or reduces its debt.

Key Takeaways from Sweetgreen's Q1 Results

We were impressed by how significantly Sweetgreen blew past analysts' revenue expectations this quarter as its same-store sales grew 5%, enabling it to raise its full-year revenue guidance. We were also excited its gross margin outperformed Wall Street's estimates. On the other hand, its EPS missed analysts' expectations, but the market cares more about its upbeat outlook. Overall, we think this was a good quarter that should please shareholders. The stock is up 4% after reporting and currently trades at $24.5 per share.

Is Now The Time?

Sweetgreen may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Sweetgreen, we'll be cheering from the sidelines. Although its revenue growth has been exceptional over the last four years, its relatively low ROIC suggests it has struggled to grow profits historically. And while its new restaurant openings have increased its brand equity, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

While we've no doubt one can find things to like about Sweetgreen, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $24 per share right before these results (compared to the current share price of $24.50), implying they didn't see much short-term potential in Sweetgreen.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.