Sweetgreen has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.3%. The stock now trades at $32.06, marking a 14.6% gain. This performance may have investors wondering how to approach the situation.

Following the strength, is SG a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does SG Stock Spark Debate?

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Two Positive Attributes:

1. Surging Same-Store Sales Show Increasing Demand

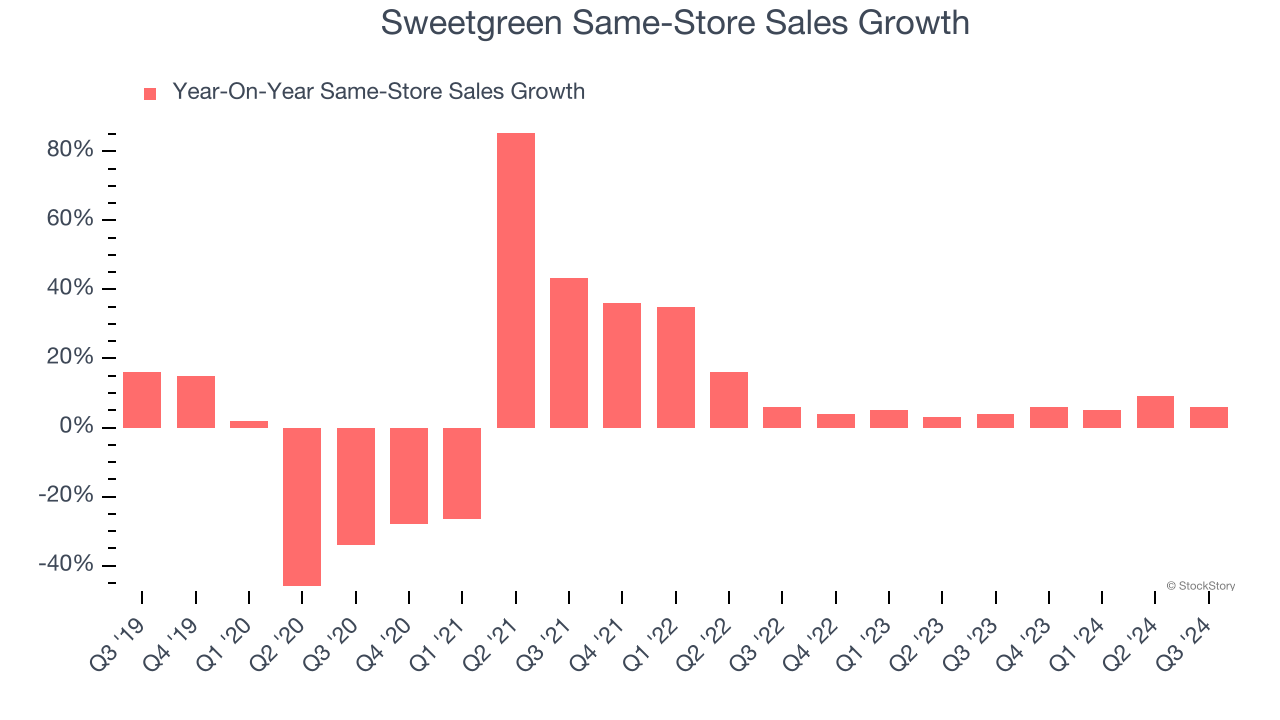

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Sweetgreen has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.2%.

2. EPS Improving Significantly

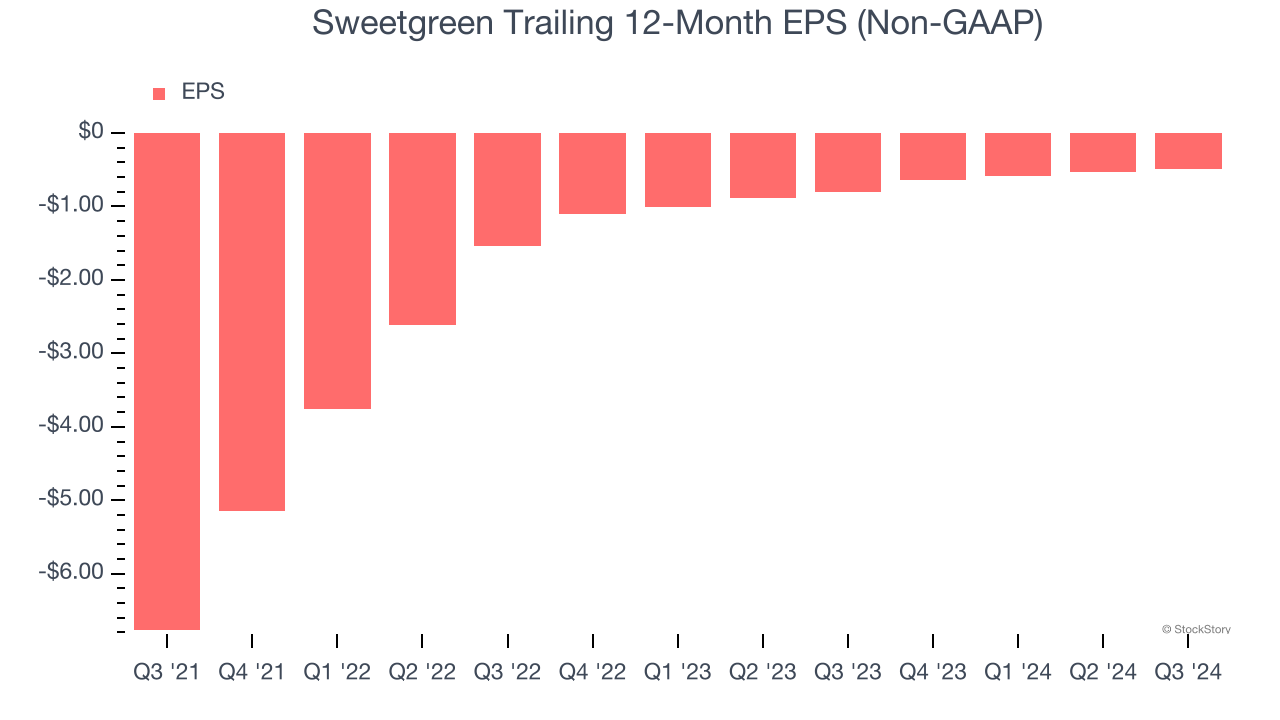

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Although Sweetgreen’s full-year earnings are still negative, it reduced its losses and improved its EPS by 58.4% annually over the last three years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

One Reason to be Careful:

Cash Burn Ignites Concerns

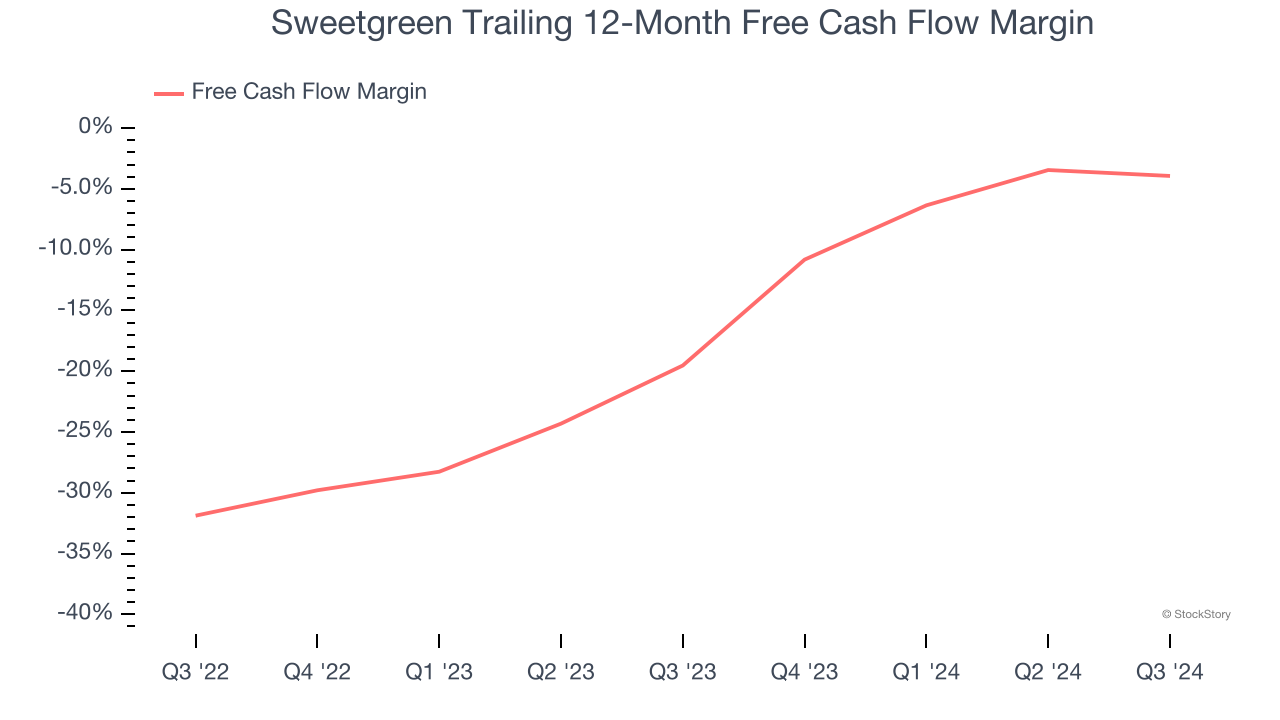

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Sweetgreen’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 11%, meaning it lit $10.97 of cash on fire for every $100 in revenue.

Final Judgment

Sweetgreen’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 116.1× forward EV-to-EBITDA (or $32.06 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Sweetgreen

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.