Fast-food chain Shake Shack (NYSE:SHAK) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 14.7% year on year to $290.5 million. It made a non-GAAP profit of $0.13 per share, improving from its loss of $0.01 per share in the same quarter last year.

Shake Shack (SHAK) Q1 CY2024 Highlights:

- Revenue: $290.5 million vs analyst estimates of $290.9 million (small miss)

- Adjusted EBITDA: $35.9 million vs analyst estimates of $35.7 million (small beat)

- EPS (non-GAAP): $0.13 vs analyst estimates of $0.10 (31.3% beat)

- Gross Margin (GAAP): 36.7%, up from 35% in the same quarter last year

- Free Cash Flow was -$2.39 million, down from $8.41 million in the previous quarter

- Same-Store Sales were up 1.6% year on year (slight miss vs expectations of up 1.9% year on year)

- Store Locations: 520 at quarter end, increasing by 71 over the last 12 months

- Market Capitalization: $4.10 billion

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

The company was founded in 2004 by Danny Meyer, an acclaimed restaurateur, who envisioned a concept of serving high-quality food made from premium ingredients. Although burgers are its most popular menu items, Shake Shack also offers french fries, hot dogs, chicken sandwiches, and milkshakes made with sustainably-sourced ingredients.

Shake Shack’s diehard fans will argue that the company’s burgers are the best in the business. Preparation is unique, using a "smash and sear" technique that involves quickly pressing a beef patty onto a hot griddle. This leads to caramelized edges while sealing in the juices.

Shake Shack primarily targets consumers who seek the convenience of fast food but with better ingredients and the halo of a famous restaurateur behind the brand. This target customer is therefore willing to pay more for their burgers, hot dogs, and fries compared to mainstream fast-food restaurants.

The average Shake Shack location has a sleek but inviting aesthetic, often incorporating elements of its humble hot dog cart beginnings. To respond to evolving customer demands, the company offers online ordering and delivery through third-party platforms such as DoorDash and Seamless (Grubhub).

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Top competitors that also specialize in burgers include The Habit Burger Grill (owned by YUM! Brands, NYSE:YUM), Fatburger (owned by FAT Brands, NASDAQ:FAT), Burger King (owned by Restaurant Brands, NYSE:QSR), McDonald’s (NYSE:MCD), Wendy’s (NASDAQ:WEN), and Jack in the Box (NASDAQ:JACK).Sales Growth

Shake Shack is larger than most restaurant chains and benefits from economies of scale, giving it an edge over its smaller competitors.

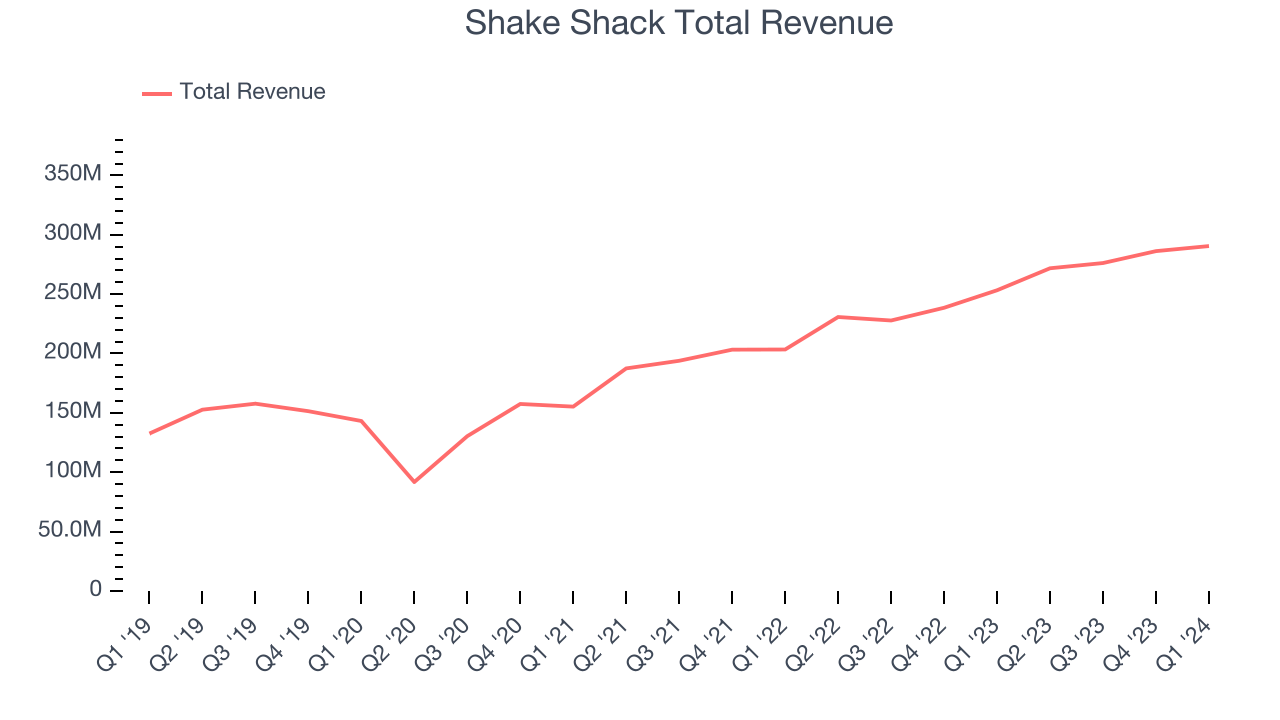

As you can see below, the company's annualized revenue growth rate of 17.9% over the last five years was excellent as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Shake Shack's revenue grew 14.7% year on year to $290.5 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 14.3% over the next 12 months, a deceleration from this quarter.

Same-Store Sales

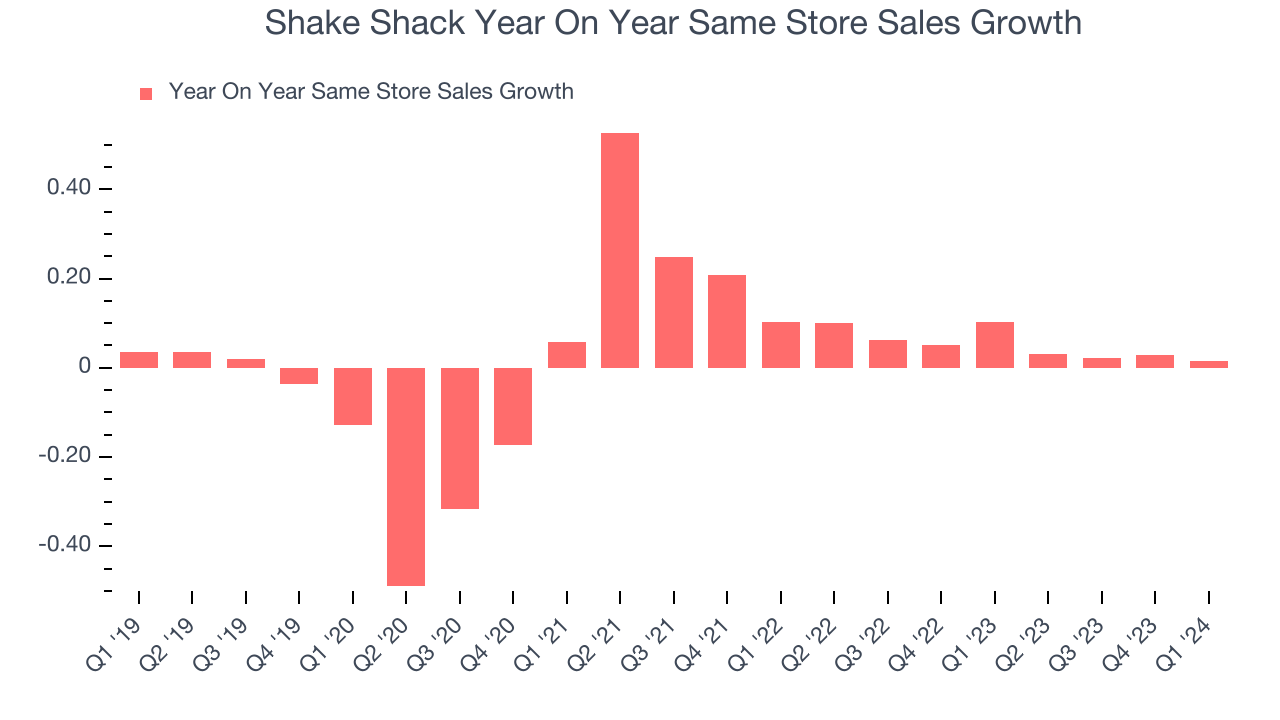

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

Shake Shack's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 5.2% year on year. With positive same-store sales growth amid an increasing number of restaurants, Shake Shack is reaching more diners and growing sales.

In the latest quarter, Shake Shack's same-store sales rose 1.6% year on year. By the company's standards, this growth was a meaningful deceleration from the 10.3% year-on-year increase it posted 12 months ago. We'll be watching Shake Shack closely to see if it can reaccelerate growth.

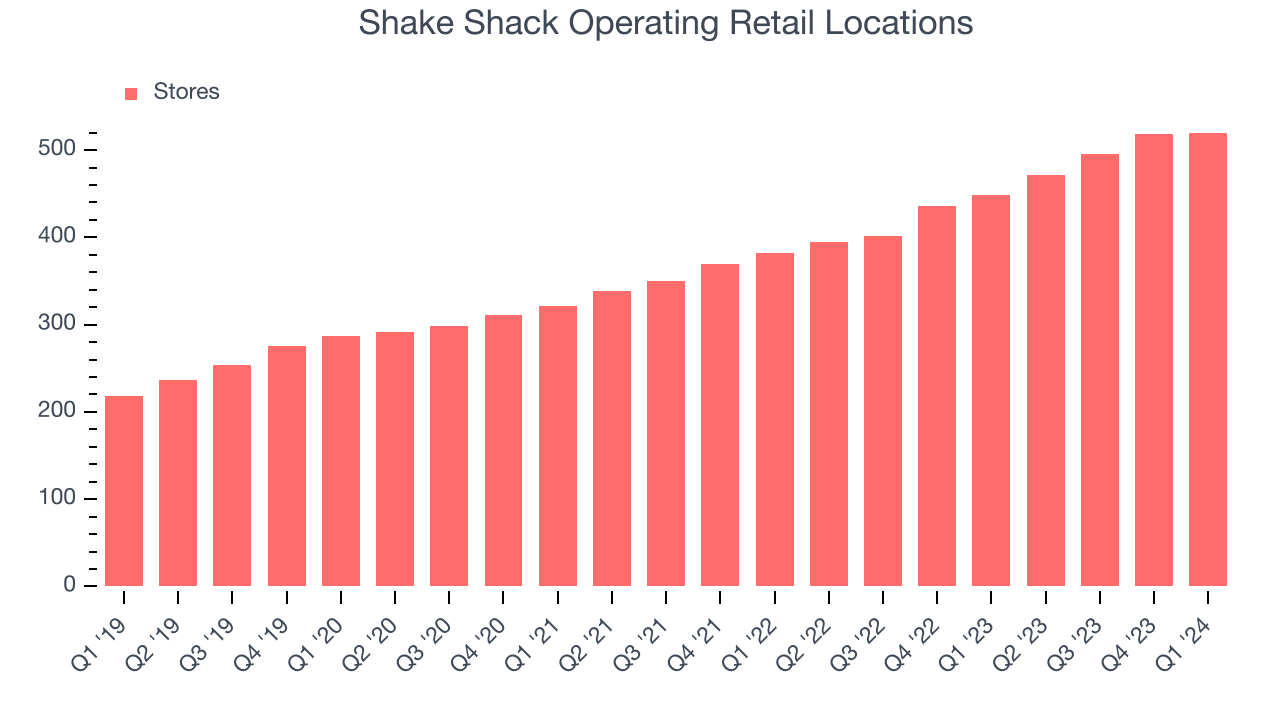

Number of Stores

When a chain like Shake Shack is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Shake Shack's restaurant count increased by 71, or 15.8%, over the last 12 months to 520 locations in the most recently reported quarter.

Over the last two years, Shake Shack has rapidly opened new restaurants, averaging 18% annual increases in new locations. This growth is among the fastest in the restaurant sector. Analyzing a restaurant's location growth is important because expansion means Shake Shack has more opportunities to feed customers and generate sales.

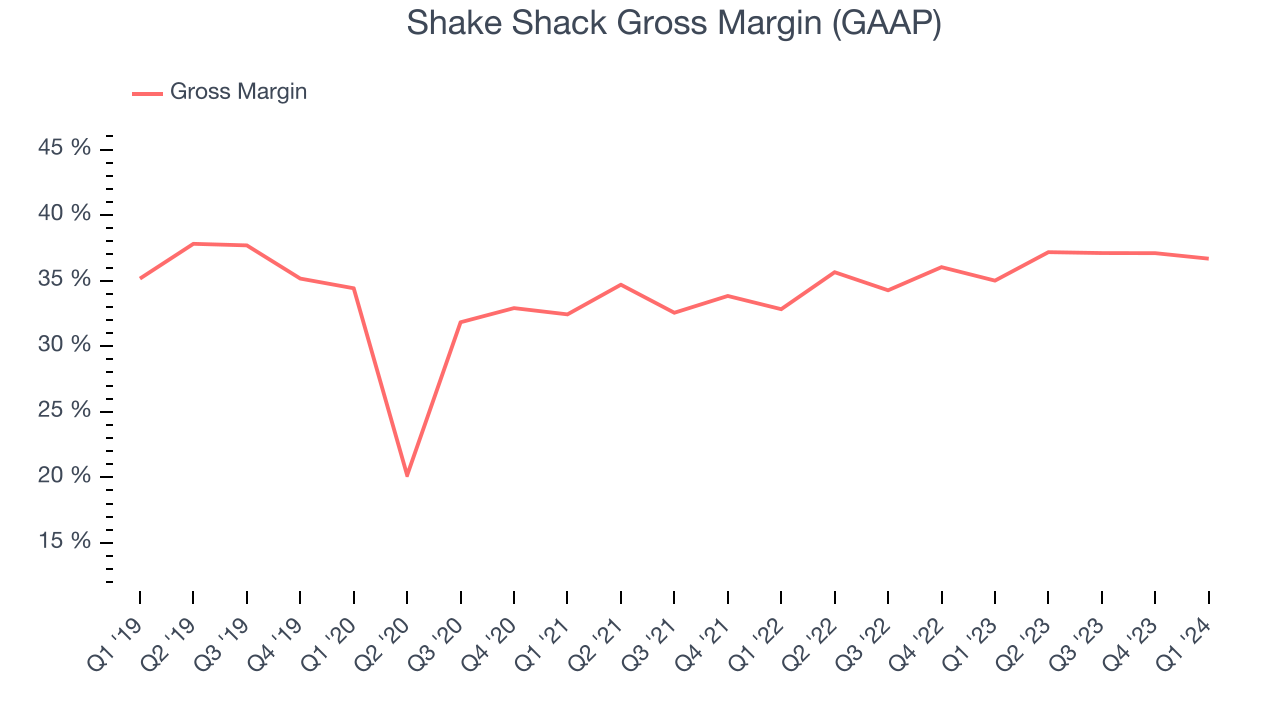

Gross Margin & Pricing Power

In Q1, Shake Shack's gross profit margin was 36.7%. up 1.7 percentage points year on year. This means the company makes $0.36 for every $1 in revenue before accounting for its operating expenses.

Shake Shack has good unit economics for a restaurant company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 36.2% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 5.1% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more stable input costs (such as ingredients and transportation expenses).

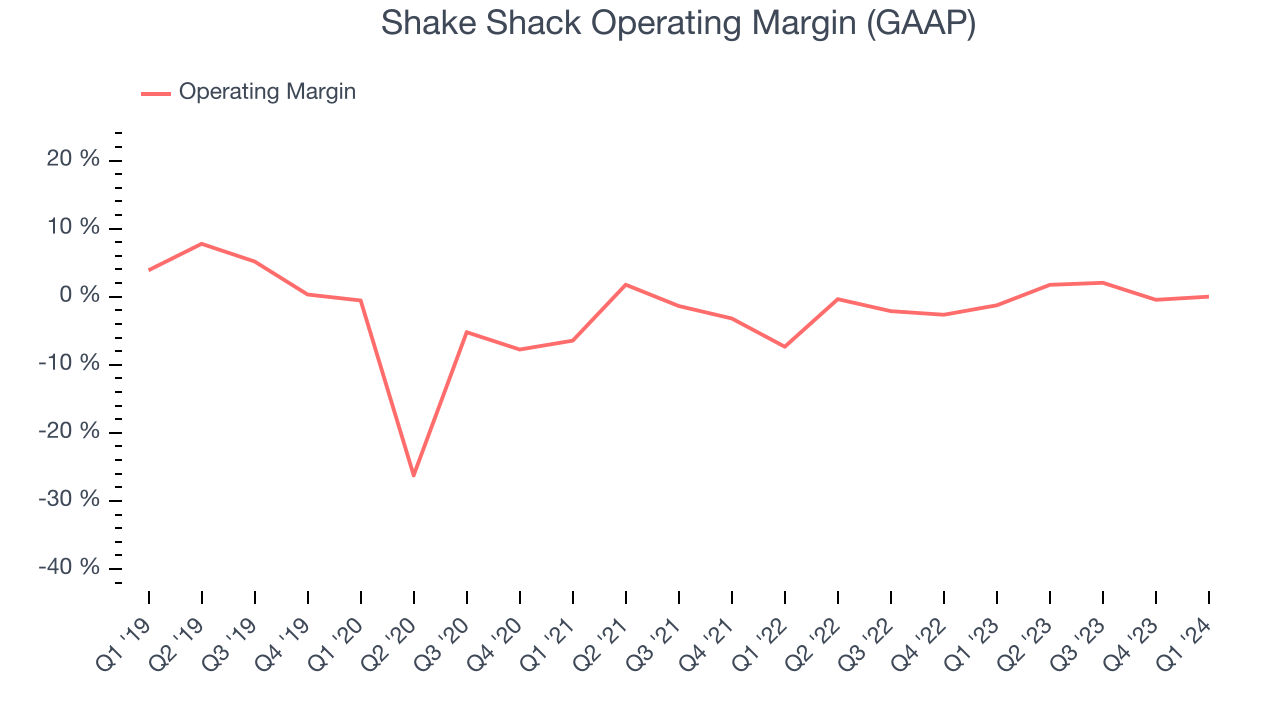

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Shake Shack generated an operating profit margin of 0%, up 1.3 percentage points year on year. This increase was encouraging and driven by stronger pricing power or lower ingredient/transportation costs, as indicated by the company's larger rise in gross margin.

Although Shake Shack was profitable this quarter from an operational perspective, it's generally struggled when zooming out. The company has been susceptible to the restaurant industry's unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. These challenges have manifested into high expenses over the last two years, contributing to an average operating margin of negative 0.3%. However, Shake Shack's margin has improved, on average, by 2.4 percentage points each year, an encouraging sign for shareholders. The tide could be turning.

Although Shake Shack was profitable this quarter from an operational perspective, it's generally struggled when zooming out. The company has been susceptible to the restaurant industry's unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients rising thanks to supply shortages. These challenges have manifested into high expenses over the last two years, contributing to an average operating margin of negative 0.3%. However, Shake Shack's margin has improved, on average, by 2.4 percentage points each year, an encouraging sign for shareholders. The tide could be turning.EPS

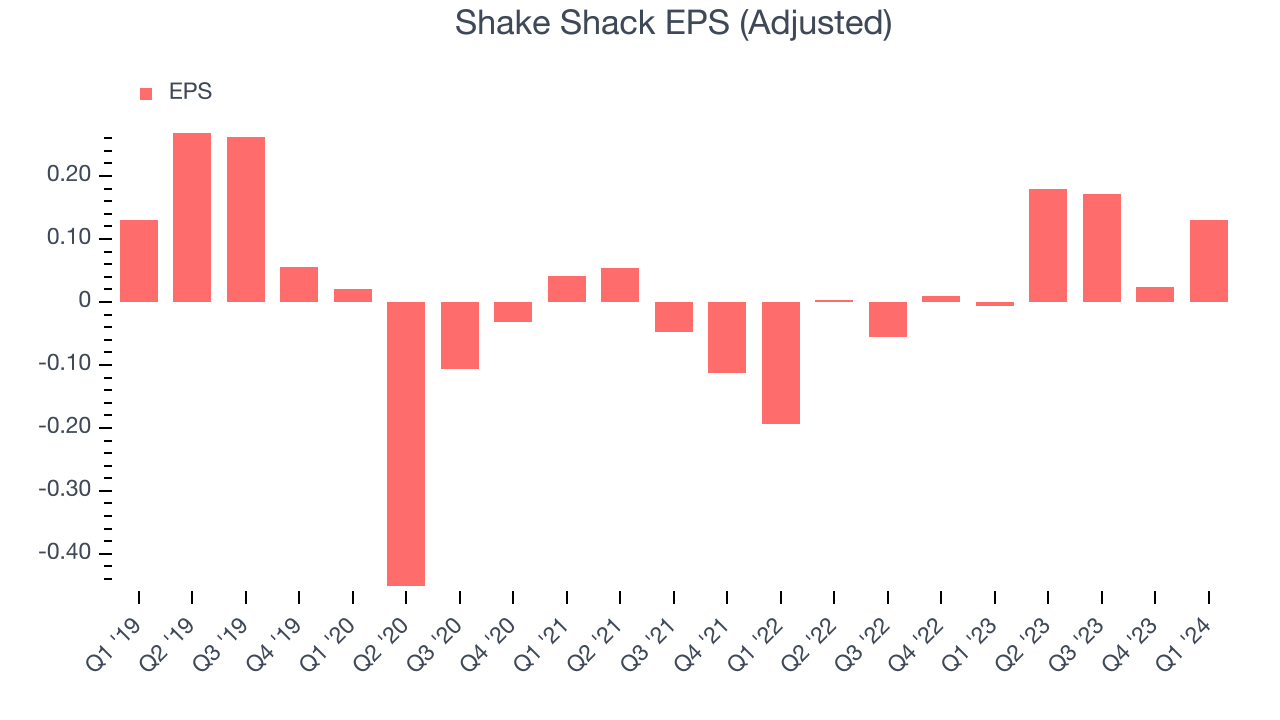

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Shake Shack reported EPS at $0.13, up from negative $0.01 in the same quarter a year ago. This print beat Wall Street's estimates by 31.3%.

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 45.2% year-on-year increase in EPS.

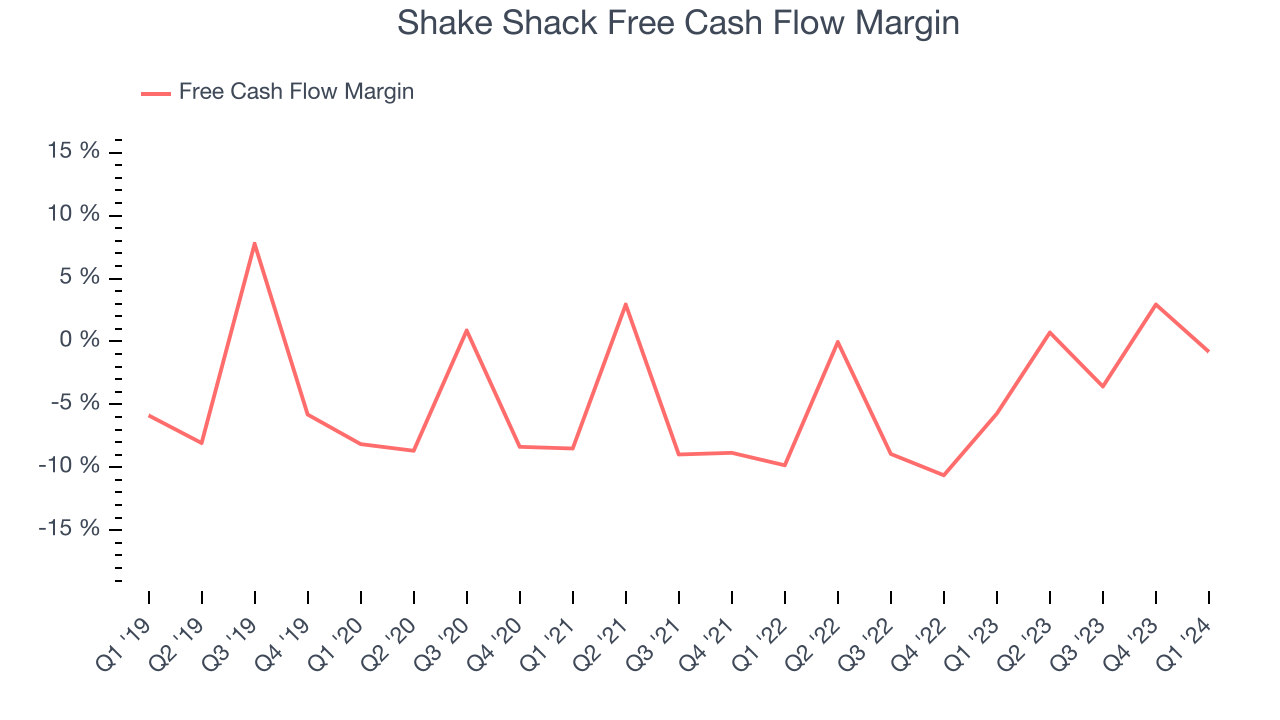

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Shake Shack broke even from a free cash flow perspective in Q1. This quarter's result was great for the business as its margin was 4.9 percentage points higher than in the same period last year.

Over the last two years, Shake Shack's capital-intensive business model and large investments in new restaurant locations have drained company resources. Its free cash flow margin has been among the worst in the restaurant sector, averaging negative 3%. However, its margin has averaged year-on-year increases of 6.2 percentage points, showing the company is at least improving.

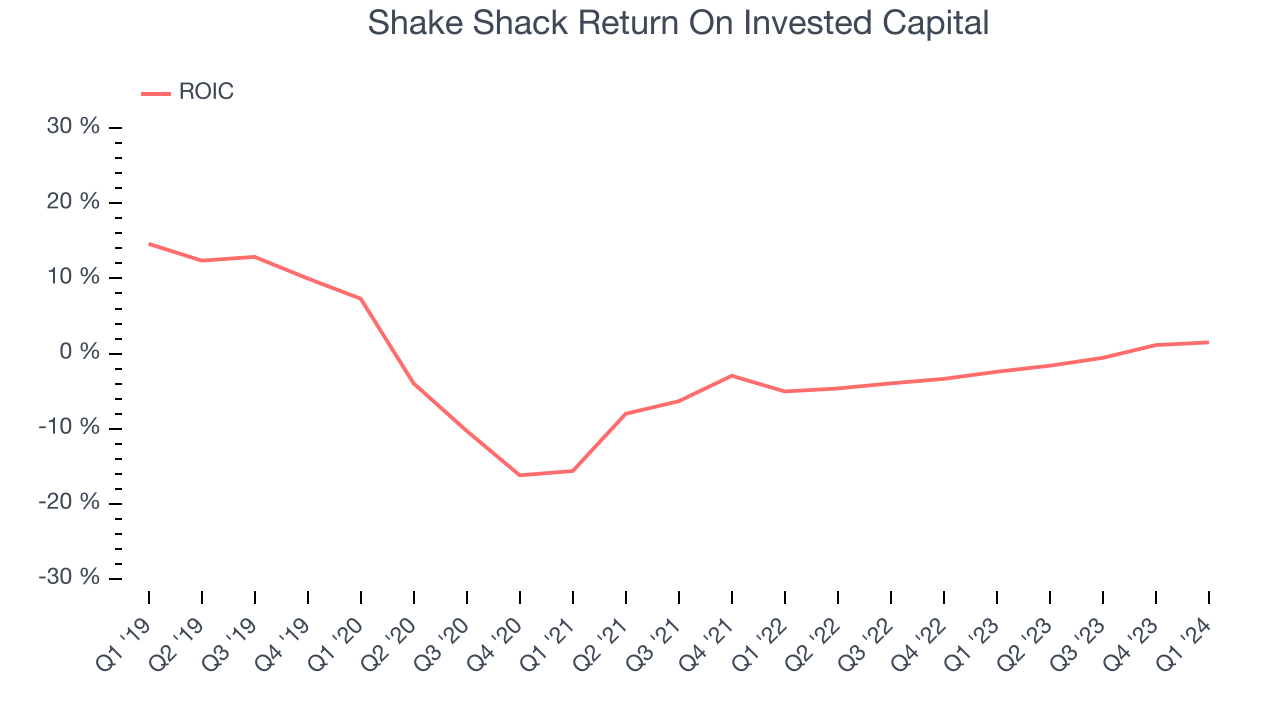

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Shake Shack's five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Shake Shack's ROIC averaged 3.7 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Shake Shack reported $284.8 million of cash and $773.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $140.1 million of EBITDA over the last 12 months, we view Shake Shack's 3.5x net-debt-to-EBITDA ratio as safe. We also see its $568,000 of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Shake Shack's Q1 Results

A slight same store sales miss led to a slight revenue miss. However, gross margin was better and adjusted EBITDA beat. Zooming out, this was a mixed quarter. The stock is flat after reporting and currently trades at $103.18 per share.

Is Now The Time?

Shake Shack may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Shake Shack isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been impressive over the last five years, its relatively low ROIC suggests it has struggled to grow profits historically. And while its new restaurant openings have increased its brand equity, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

Shake Shack's price-to-earnings ratio based on the next 12 months is 141.1x. We can find things to like about Shake Shack and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $106.48 per share right before these results (compared to the current share price of $103.18).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.