Social club operator Soho House (NYSE:SHCO) fell short of analysts' expectations in Q4 FY2023, with revenue up 7.5% year on year to $290.8 million. The company's full-year revenue guidance of $1.23 billion at the midpoint also came in 5.5% below analysts' estimates. It made a GAAP loss of $0.29 per share, down from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy Soho House? Find out by accessing our full research report, it's free.

Soho House (SHCO) Q4 FY2023 Highlights:

- Revenue: $290.8 million vs analyst estimates of $301.9 million (3.7% miss)

- EPS: -$0.29 vs analyst estimates of -$0.07 (-$0.22 miss)

- Management's revenue guidance for the upcoming financial year 2024 is $1.23 billion at the midpoint, missing analyst estimates by 5.5% and implying 7.8% growth (vs 18% in FY2023) (adjusted EBITDA guidance for the period also missed)

- Gross Margin (GAAP): 49.6%, up from 46.7% in the same quarter last year

- Free Cash Flow of $2.01 million, down 60.3% from the previous quarter

- Members: 259,884

- Market Capitalization: $1.12 billion

Boasting fancy locations in hubs such as NYC and Miami, Soho House (NYSE:SHCO) is a global hospitality brand offering exclusive private member clubs, hotels, and restaurants.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

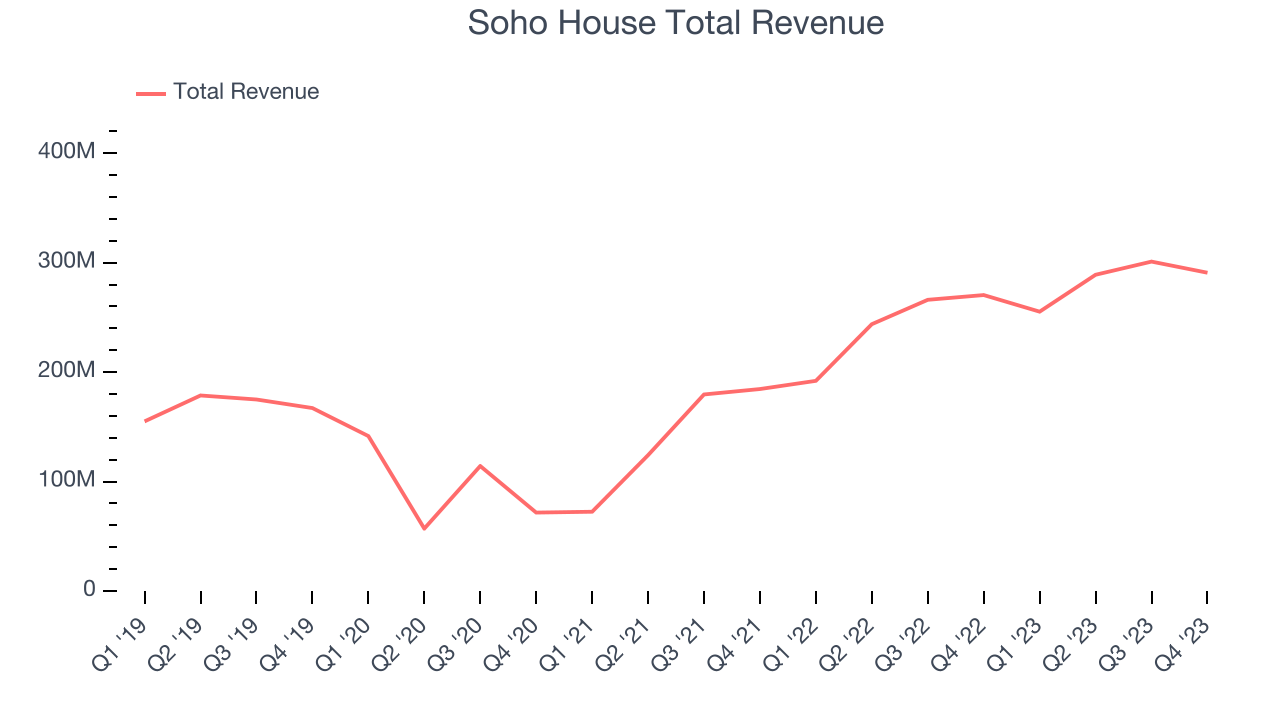

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Soho House's annualized revenue growth rate of 13.9% over the last four years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Soho House's annualized revenue growth of 42.3% over the last two years is above its four-year trend, suggesting some bright spots. We can better understand the company's revenue dynamics by analyzing its number of members, which reached 259,884 in the latest quarter. Over the last two years, Soho House's members averaged 21.9% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company's monetization has risen.

This quarter, Soho House's revenue grew 7.5% year on year to $290.8 million, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 12.4% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While Soho House posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Soho House's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 3.7%.

Soho House broke even from a free cash flow perspective in Q4. This quarter's result was great for the business as its margin was 13.3 percentage points higher than in the same period last year. Over the next year, analysts predict Soho House will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 1.6% will increase to positive 4.2%.

Key Takeaways from Soho House's Q4 Results

We were impressed by how significantly Soho House blew past analysts' operating margin expectations this quarter. On the other hand, its full-year revenue and adjusted EBITDA guidance missed and its number of members fell short of Wall Street's estimates. Overall, this was a mixed quarter for Soho House. The stock is flat after reporting and currently trades at $5.75 per share.

So should you invest in Soho House right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.