Social club operator Soho House (NYSE:SHCO) fell short of analysts' expectations in Q4 FY2023, with revenue up 7.5% year on year to $290.8 million. The company's full-year revenue guidance of $1.23 billion at the midpoint also came in 5.5% below analysts' estimates. It made a GAAP loss of $0.29 per share, down from its profit of $0.07 per share in the same quarter last year.

Soho House (SHCO) Q4 FY2023 Highlights:

- Revenue: $290.8 million vs analyst estimates of $301.9 million (3.7% miss)

- EPS: -$0.29 vs analyst estimates of -$0.07 (-$0.22 miss)

- Management's revenue guidance for the upcoming financial year 2024 is $1.23 billion at the midpoint, missing analyst estimates by 5.5% and implying 7.8% growth (vs 18% in FY2023) (adjusted EBITDA guidance for the period also missed)

- Gross Margin (GAAP): 49.6%, up from 46.7% in the same quarter last year

- Free Cash Flow of $2.01 million, down 60.3% from the previous quarter

- Members: 259,884

- Market Capitalization: $1.12 billion

Boasting fancy locations in hubs such as NYC and Miami, Soho House (NYSE:SHCO) is a global hospitality brand offering exclusive private member clubs, hotels, and restaurants.

Soho House began as a small, single-location private members' club for those in the film, media, and creative industries. Since then, the company has expanded its presence internationally, providing stylish, comfortable spaces for its creative community to socialize, work, and relax.

Today, Soho House operates nearly 30 clubs along with hotels, cinemas, spas, and workspaces. The "Houses", as they are known, are set in a variety of locations from bustling city centers to more rural, picturesque settings.

Each House is distinct, with interiors and experiences tailored to their local context. However, each shares a common thread of sophisticated and eclectic design, high-quality food and drink, and an atmosphere of exclusivity and comfort.

Membership to Soho House is selective, aiming to foster a diverse and dynamic community. Its members are granted access to its global network of Houses, along with benefits such as exclusive events, screenings, and workshops.

In recent years, Soho House has diversified its offerings even further to include public restaurants, branded home furnishings, and a line of skincare and grooming products, expanding its brand footprint in the consumer lifestyle sector.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Soho House's primary competitors include private companies The Groucho Club, The Hospital Club, Shoreditch House, The Arts Club, and The Ivy Club. Publicly traded competitors with slightly different business models include Marriott (NASDAQ:MAR), Hilton (NYSE:HLT), Hyatt (NYSE:H), and InterContinental Hotels (NYSE:IHG).Sales Growth

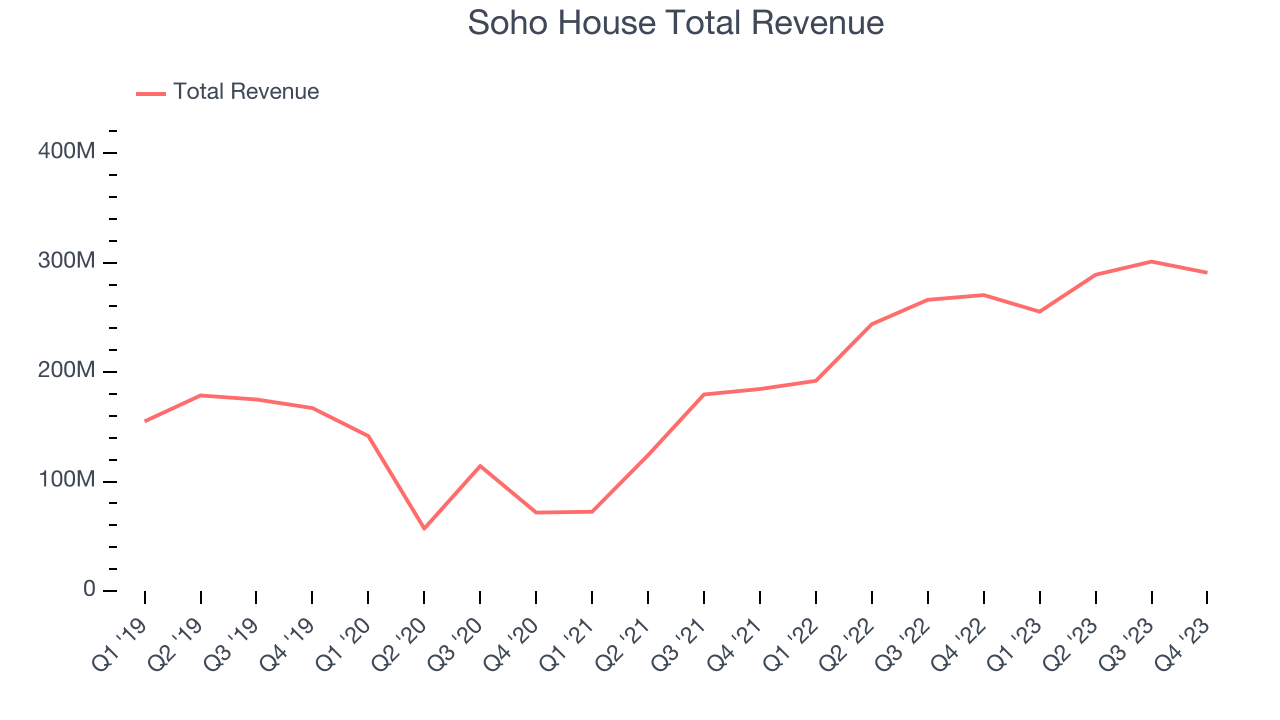

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Soho House's annualized revenue growth rate of 13.9% over the last four years was decent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Soho House's annualized revenue growth of 42.3% over the last two years is above its four-year trend, suggesting some bright spots. We can better understand the company's revenue dynamics by analyzing its number of members, which reached 259,884 in the latest quarter. Over the last two years, Soho House's members averaged 21.9% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company's monetization has risen.

This quarter, Soho House's revenue grew 7.5% year on year to $290.8 million, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 12.4% over the next 12 months, an acceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although Soho House was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 5.2% over the last two years. This performance isn't ideal as demand in the consumer discretionary sector is volatile. We prefer to invest in companies that can weather industry downturns through consistent profitability.This quarter, Soho House generated an operating profit margin of 13%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Over the next 12 months, Wall Street expects Soho House to break even on its operating profits. Analysts are expecting the company’s LTM operating margin of 3.3% to decline by 2.5 percentage points.EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last three years, Soho House cut its earnings losses and improved its EPS by 30.8% each year.

In Q4, Soho House reported EPS at negative $0.29, down from $0.07 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Soho House to improve its earnings losses. Analysts are projecting its LTM EPS of negative $0.60 to advance to negative $0.34.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While Soho House posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Soho House's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 3.7%.

Soho House broke even from a free cash flow perspective in Q4. This quarter's result was great for the business as its margin was 13.3 percentage points higher than in the same period last year. Over the next year, analysts predict Soho House will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 1.6% will increase to positive 4.2%.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Soho House's five-year average return on invested capital was negative 20.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Key Takeaways from Soho House's Q4 Results

We were impressed by how significantly Soho House blew past analysts' operating margin expectations this quarter. On the other hand, its full-year revenue and adjusted EBITDA guidance missed and its number of members fell short of Wall Street's estimates. Overall, this was a mixed quarter for Soho House. The stock is flat after reporting and currently trades at $5.75 per share.

Is Now The Time?

Soho House may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Soho House, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last four years, its relatively low ROIC suggests it has historically struggled to find compelling business opportunities. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

While we've no doubt one can find things to like about Soho House, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $9.10 per share right before these results (compared to the current share price of $5.75).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.