E-Commerce software platform Shopify (NYSE:SHOP) reported Q4 FY2023 results beating Wall Street analysts' expectations, with revenue up 23.6% year on year to $2.14 billion. It made a non-GAAP profit of $0.34 per share, improving from its profit of $0.07 per share in the same quarter last year.

Is now the time to buy Shopify? Find out by accessing our full research report, it's free.

Shopify (SHOP) Q4 FY2023 Highlights:

- Revenue: $2.14 billion vs analyst estimates of $2.07 billion (3.3% beat)

- EPS (non-GAAP): $0.34 vs analyst estimates of $0.30 (13.1% beat)

- Free Cash Flow of $446 million, up 61.6% from the previous quarter

- Gross Margin (GAAP): 49.5%, up from 46% in the same quarter last year

- Market Capitalization: $114.7 billion

"2023 was an incredible year for both Shopify and our merchants. Our strong Q4 and annual results are a powerful testament to the progress we have made building fast, reliable, and unified software for merchants of all sizes," said Harley Finkelstein, President of Shopify.

Originally created as an internal tool for a snowboarding company, Shopify (NYSE:SHOP) provides a software platform for building and operating e-commerce businesses.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

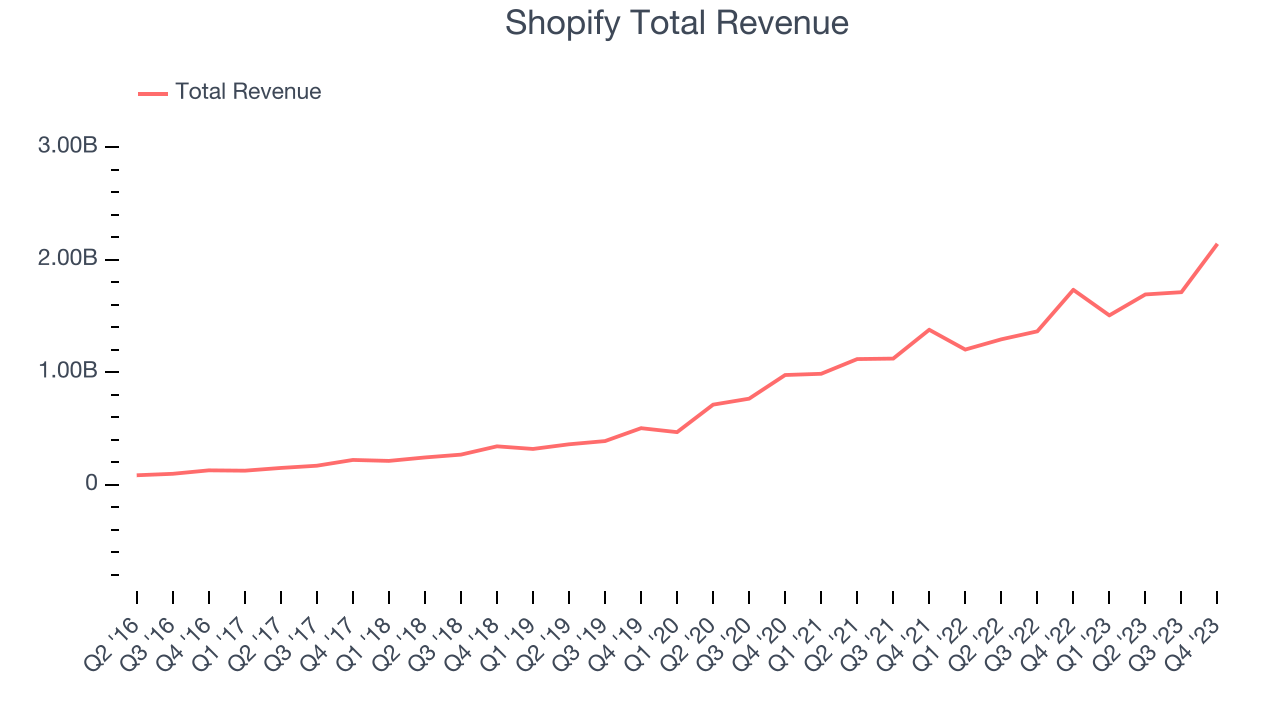

As you can see below, Shopify's revenue growth has been strong over the last two years, growing from $1.38 billion in Q4 FY2021 to $2.14 billion this quarter.

This quarter, Shopify's quarterly revenue was once again up a very solid 23.6% year on year. On top of that, its revenue increased $430 million quarter on quarter, a very strong improvement from the $20 million increase in Q3 2023. This is a sign of acceleration of growth and great to see.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

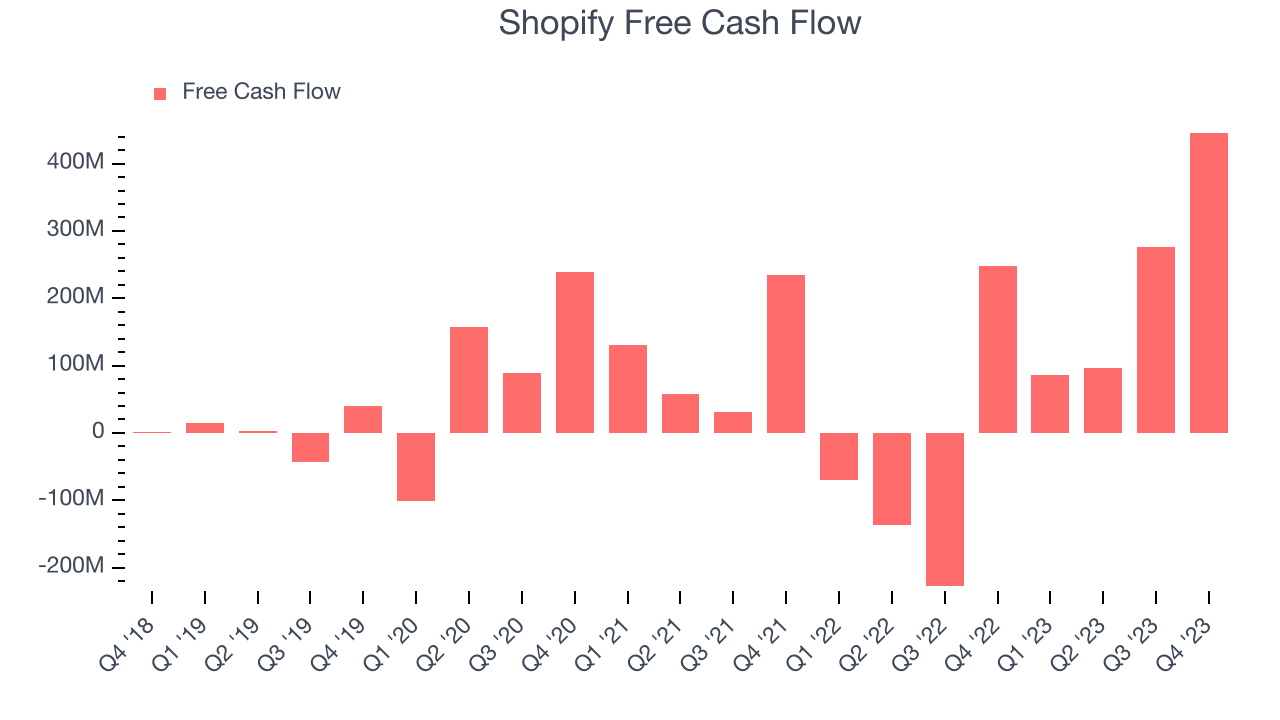

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Shopify's free cash flow came in at $446 million in Q4, up 80% year on year.

Shopify has generated $905 million in free cash flow over the last 12 months, a decent 12.1% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Shopify's Q4 Results

It was good to see Shopify beat analysts' revenue and free cash flow estimates this quarter. That was driven by better-than-expected gross merchandise volume ($75.1 billion vs estimates of $71.6 billion) and gross payments volume ($45.1 billion vs estimates of $42.1 billion), which led to outperformance in its merchant and subscription solutions segments.

Some product highlights for 2023 include the launch of Magic and Sidekick. Both features use AI to make it easier for merchants to run their businesses and increase productivity. For example, one video showed the AI identifying which of the merchant's inventories were growing stale and automatically ran discounted promotions.

Looking ahead at Q1 2024, Shopify's revenue outlook topped Wall Street's forecasts as it expects to grow in the low 20% range (this growth would be in the mid-to-high 20% adjusting for its May 2023 sale of Deliverr, its old logistics business).

Zooming out, we think this was a good quarter, showing that the company is staying on track. With the stock trading at nearly 15x sales going into earnings, however, the market was likely expecting more. The stock is down 8.3% after reporting and trades at $81.75 per share.

So should you invest in Shopify right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.