Mobile game developer Skillz (NYSE:SKLZ) missed analysts' expectations in Q4 FY2023, with revenue down 37.8% year on year to $29.14 million. It made a GAAP loss of $1.04 per share, improving from its loss of $7.36 per share in the same quarter last year.

Skillz (SKLZ) Q4 FY2023 Highlights:

- Revenue: $29.14 million vs analyst estimates of $38.09 million (23.5% miss)

- EPS: -$1.04 vs analyst estimates of -$1.41 (26.4% beat)

- Guidance: Management said "positive Adjusted EBITDA on a run-rate basis by the fourth quarter of this year" (better than expectations of roughly breakeven)

- Gross Margin (GAAP): 88.1%, down from 89.6% in the same quarter last year

- Free Cash Flow was -$13.43 million compared to -$24.49 million in the previous quarter

- Paying Monthly Active Users (PMAU): 137,000, down 98,000 year on year

- Market Capitalization: $152.7 million

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Having gone public via SPAC in December 2020, Skillz provides a mobile gaming platform for developers to create and distribute games where users can pay fees to compete for real cash prizes. The company maintains that because winning is based on skill and not on chance, its games are not traditional casino gambling. However, some argue there is potential legal risk as the lines can sometimes be blurred.

Developers can use Skillz's software development kit (SDK) to add competitive multiplayer functionality and cash prize tournaments to their games, while players can compete against each other for real money. Skillz generates revenue by taking a percentage of the entry fees and cash prizes of each tournament. Game developers themselves can monetize their games through advertisements and in-app purchases. As a result of this dynamic, Skillz and game developers are incentivized to make games addictive to keep player engagement–which drives revenue–high.

Solitaire Cube is an example of a popular game on the Skillz platform. This game resembles the classic solitaire card game, but players can compete head-to-head or in tournaments against others for real money.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Competitors offering casual digital games that may feature casino-like activities include Skillz (NYSE:SKLZ), PLAYSTUDIOS (NASDAQ:MYPS), and Huuuge (WSE:HUG).Sales Growth

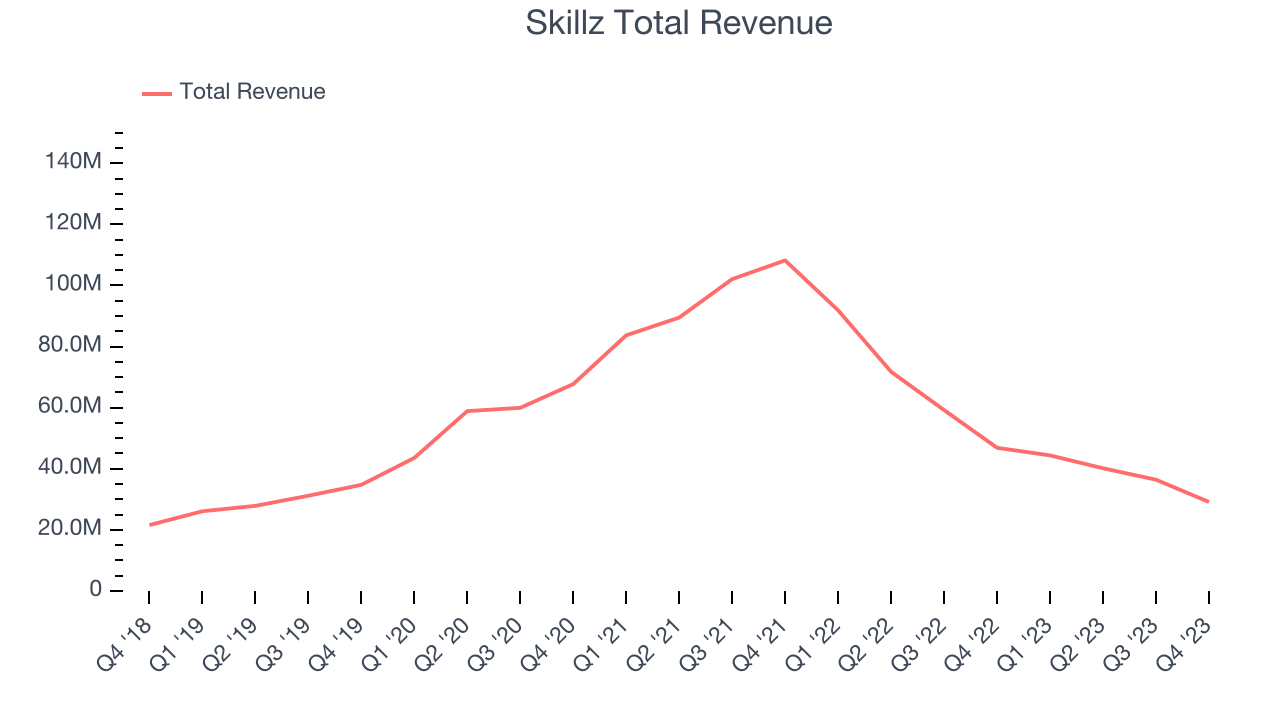

Skillz's revenue has been declining over the last three years, dropping on average by 0.6% annually. This quarter, Skillz reported a year on year revenue decline of 37.8%, missing analysts' expectations.

Usage Growth

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

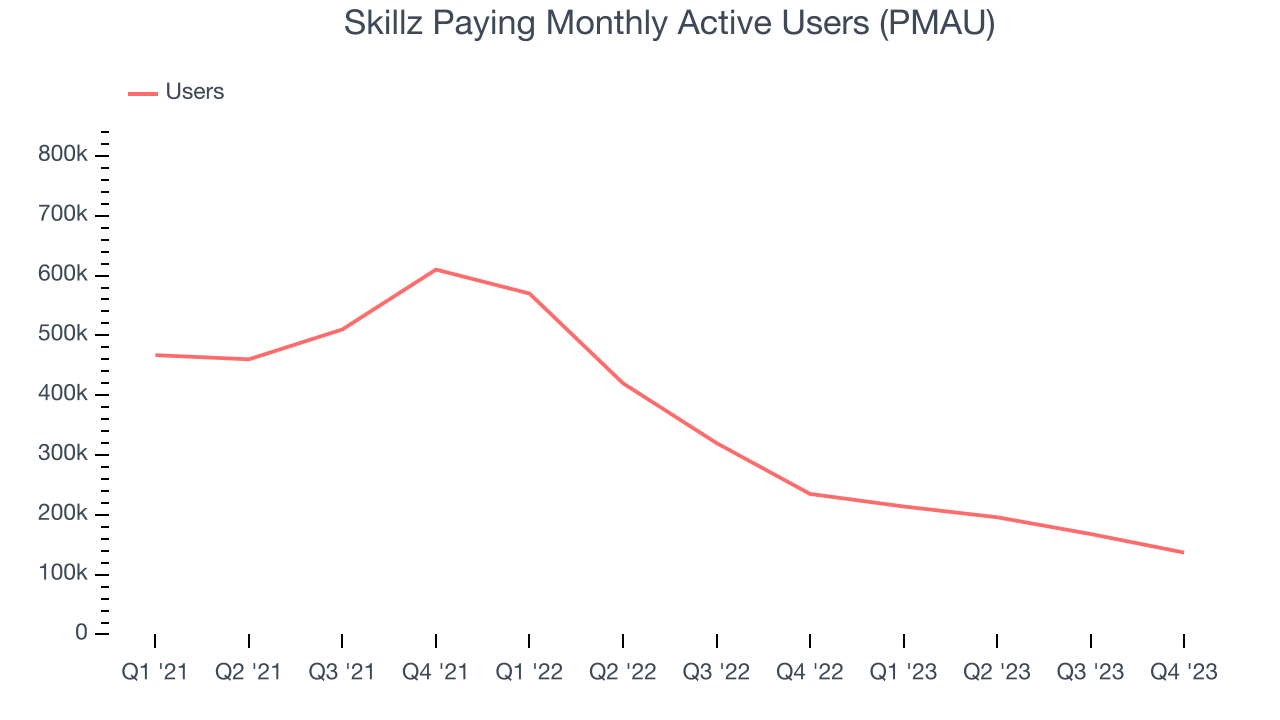

Skillz has been struggling to grow its monthly active users, a key performance metric for the company. Over the last two years, its users have declined 36.3% annually to 137,000. This is one of the lowest rates of growth in the consumer internet sector.

In Q4, Skillz's monthly active users decreased by 98,000, a 41.7% drop since last year.

Revenue Per User

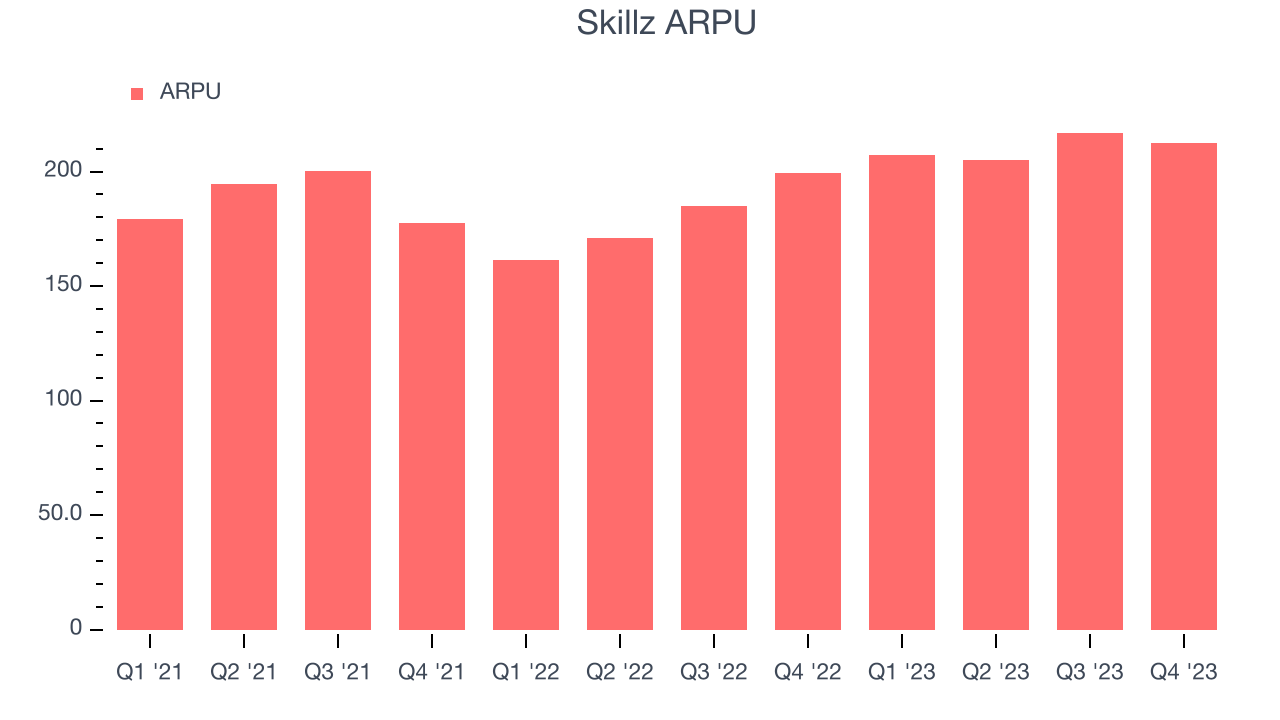

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Skillz because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Skillz's ARPU growth has been decent over the last two years, averaging 6.9%. Although its monthly active users have shrunk during this time, the company's ability to increase prices demonstrates its platform's value for existing users. This quarter, ARPU grew 6.6% year on year to $212.69 per user.

Pricing Power

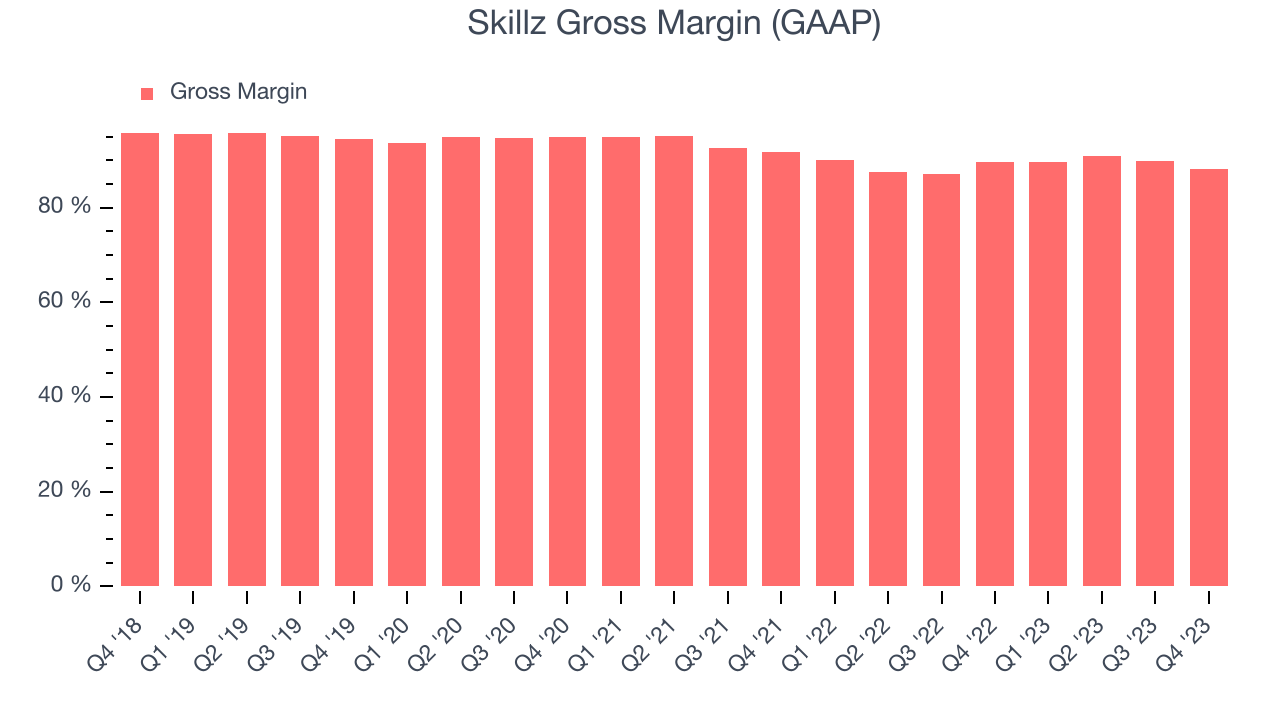

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Skillz's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 88.1% this quarter, down 1.5 percentage points year on year.

For gaming businesses like Skillz, these aforementioned costs typically include royalties to sports leagues or celebrities featured in games, fees paid to Alphabet or Apple for games downloaded in their digital app stores, and data center and bandwidth expenses associated with delivering games over the internet. After paying for these expenses, Skillz had $0.88 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Gross margins have been trending up over the last 12 months, averaging 89.8%. Skillz's margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Consumer internet businesses like Skillz grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It's very expensive for Skillz to acquire new users as the company has spent 91.1% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Skillz and its peers.

Profitability & Free Cash Flow

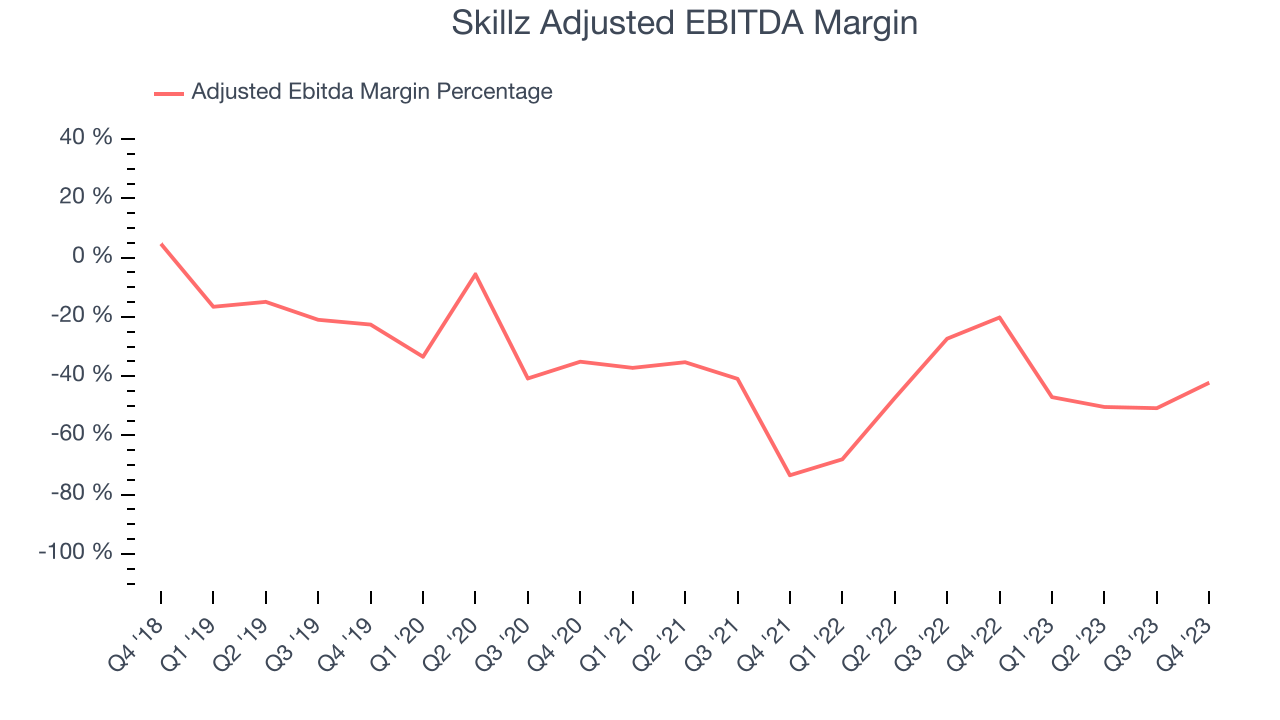

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

This quarter, Skillz's EBITDA came in at negative $12.3 million, resulting in a negative 42.2% margin. It pains us to say this company is one of the worst performing consumer internet businesses from a profitability standpoint, averaging negative 47.9% EBITDA margins over the last four quarters.

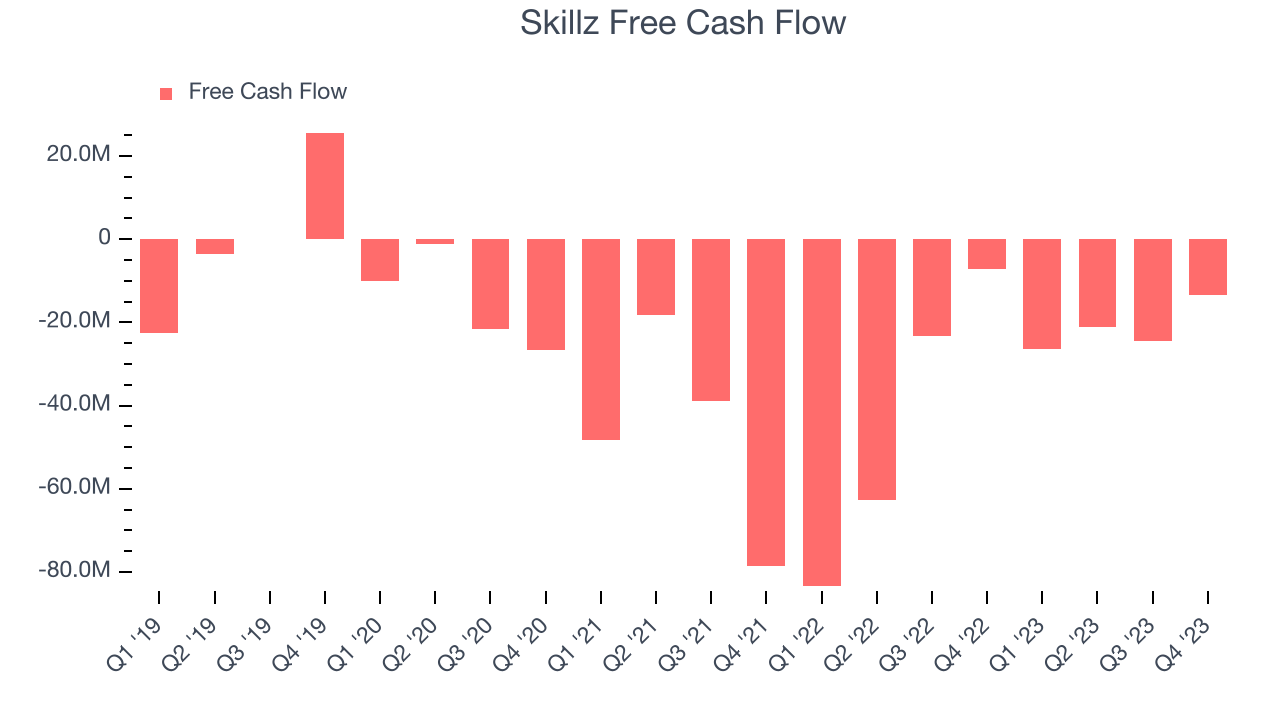

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Skillz burned through $13.43 million in Q4,

Skillz has burned through $85.42 million of cash over the last 12 months, resulting in an uninspiring negative 56.9% free cash flow margin. This poor FCF margin stems from Skillz's capital-intensive business model and desire to maintain market relevance.

Key Takeaways from Skillz's Q4 Results

The company's user base fell and its revenue growth was quite weak in the quarter. However, the bright spot was management saying that Skillz will achieve "positive Adjusted EBITDA on a run-rate basis by the fourth quarter of this year", which is above expectations of roughly breakeven by that time. The stock is up 4.7% after reporting and currently trades at $6.7 per share.

Is Now The Time?

When considering an investment in Skillz, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of Skillz, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. And while its impressive gross margins are a wonderful starting point for the overall profitability of the business, the downside is its sales and marketing spend is very high compared to other consumer internet businesses. On top of that, its growth in monthly active users has been lackluster.

There's no doubt that the market is optimistic about Skillz's growth prospects, as its price/gross profit ratio based on the next 12 months of 0.8x would suggest. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $10.83 per share right before these results (compared to the current share price of $6.70).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.