Modular home and building manufacturer Skyline Champion (NYSE:SKY) reported Q2 CY2024 results topping analysts' expectations, with revenue up 35.1% year on year to $627.8 million. It made a non-GAAP profit of $0.91 per share, improving from its profit of $0.89 per share in the same quarter last year.

Is now the time to buy Skyline Champion? Find out by accessing our full research report, it's free.

Skyline Champion (SKY) Q2 CY2024 Highlights:

- Revenue: $627.8 million vs analyst estimates of $600.3 million (4.6% beat)

- EPS (non-GAAP): $0.91 vs analyst estimates of $0.73 (25.5% beat)

- Gross Margin (GAAP): 26.2%, down from 27.9% in the same quarter last year

- Adjusted EBITDA Margin: 11.9%, down from 14.4% in the same quarter last year

- Free Cash Flow of $73.9 million is up from -$7.84 million in the previous quarter

- Sales Volumes rose 35.7% year on year (-29.3% in the same quarter last year)

- Market Capitalization: $4.27 billion

“I am excited to announce that our shareholders approved our corporate Company name change to Champion Homes, Inc. during our annual meeting this year. The name change aligns with our previously launched Champion Homes flagship brand supporting a unified Company, our purpose of championing home attainability and the customer experience, as well as the Company’s direct-to-consumer marketing and digital expansion,” said Mark Yost, Champion Homes’ President, and Chief Executive Officer.

Founded in 1951, Skyline Champion (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

Sales Growth

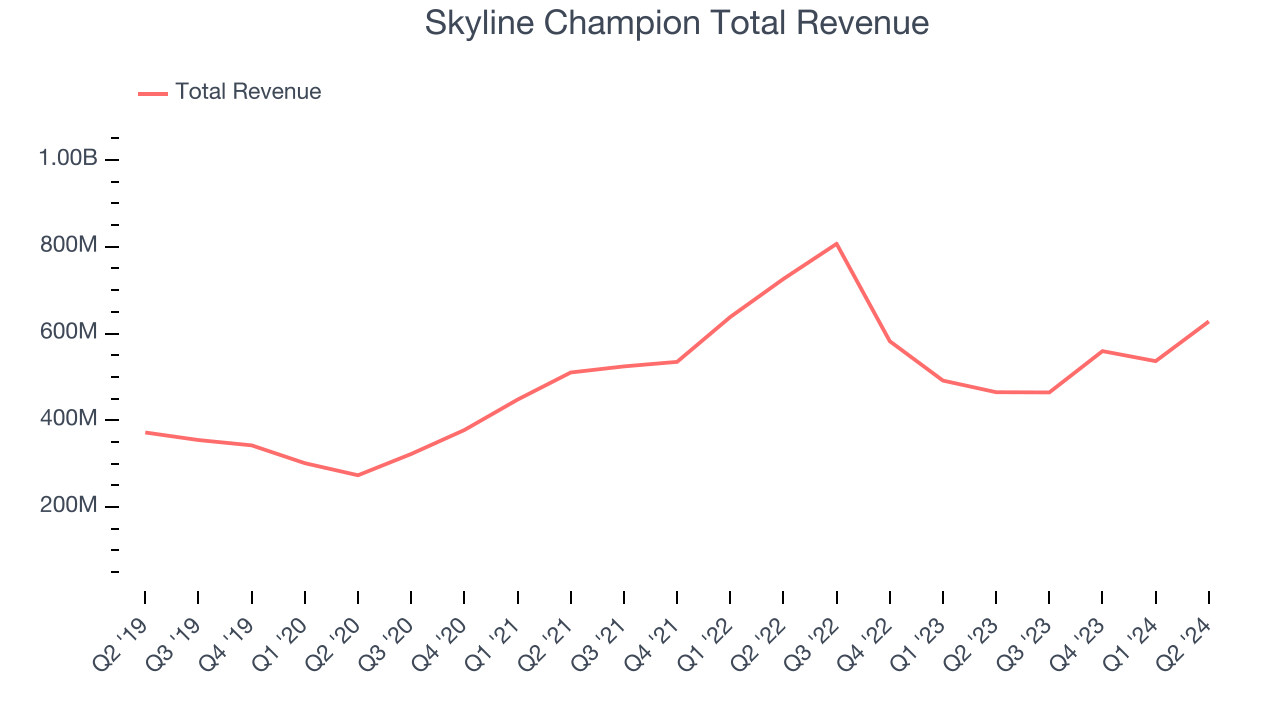

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Luckily, Skyline Champion's sales grew at a solid 9.2% compounded annual growth rate over the last five years. This shows it was successful in expanding, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Skyline Champion's recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5% over the last two years.

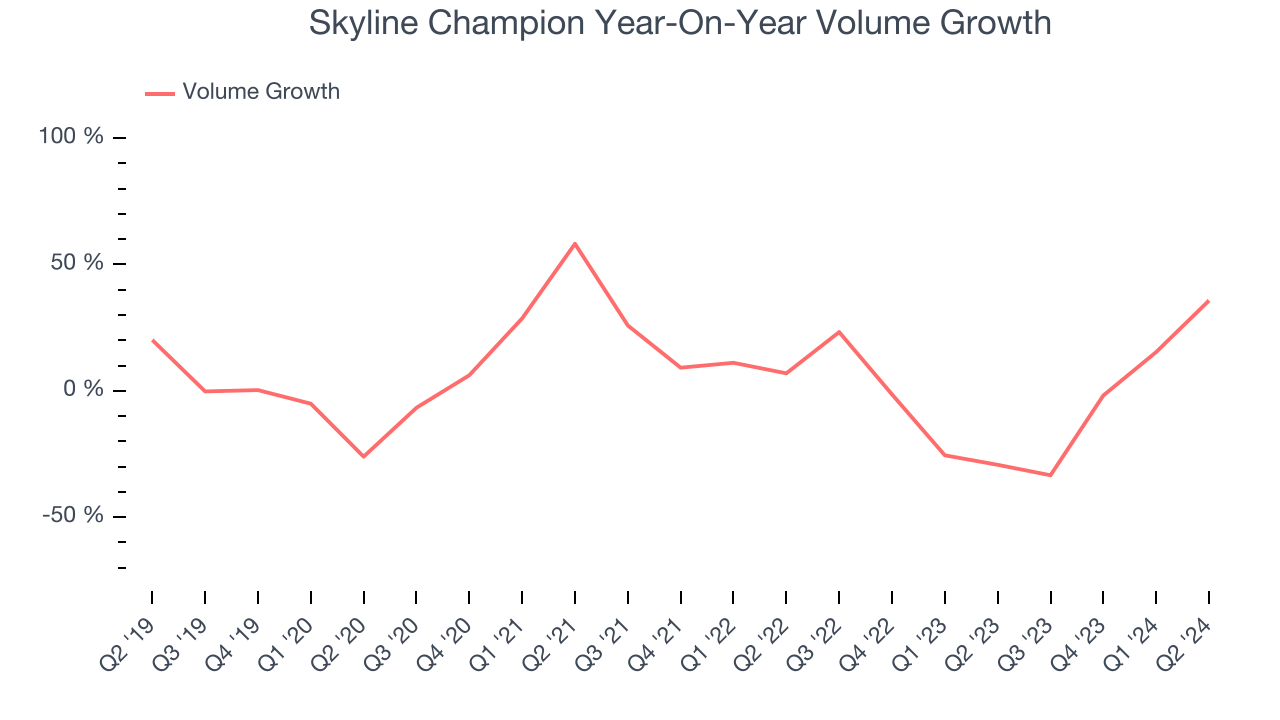

We can dig further into the company's revenue dynamics by analyzing its sales volumes, which reached 6,538 in the latest quarter. Over the last two years, Skyline Champion's sales volumes averaged 2.2% year-on-year declines. Because this number is better than its revenue growth, we can see the company's average selling price decreased.

This quarter, Skyline Champion reported wonderful year-on-year revenue growth of 35.1%, and its $627.8 million of revenue exceeded Wall Street's estimates by 4.6%. Looking ahead, Wall Street expects sales to grow 7.6% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

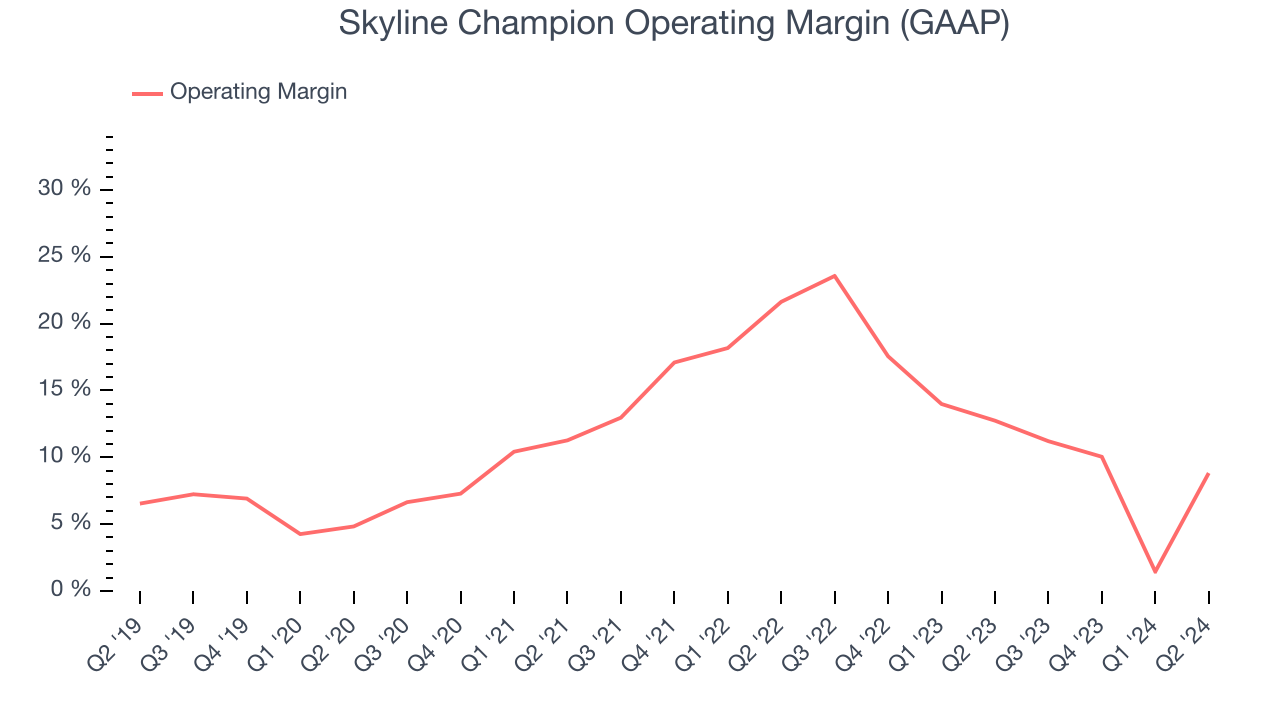

Operating Margin

Skyline Champion has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it's a show of well-managed operations if they're high when gross margins are low.

Analyzing the trend in its profitability, Skyline Champion's annual operating margin rose by 1.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Skyline Champion generated an operating profit margin of 8.8%, down 3.9 percentage points year on year. Since Skyline Champion's operating margin decreased more than its gross margin, we can assume the company was recently less efficient because expenses such as sales, marketing, R&D, and administrative overhead increased.

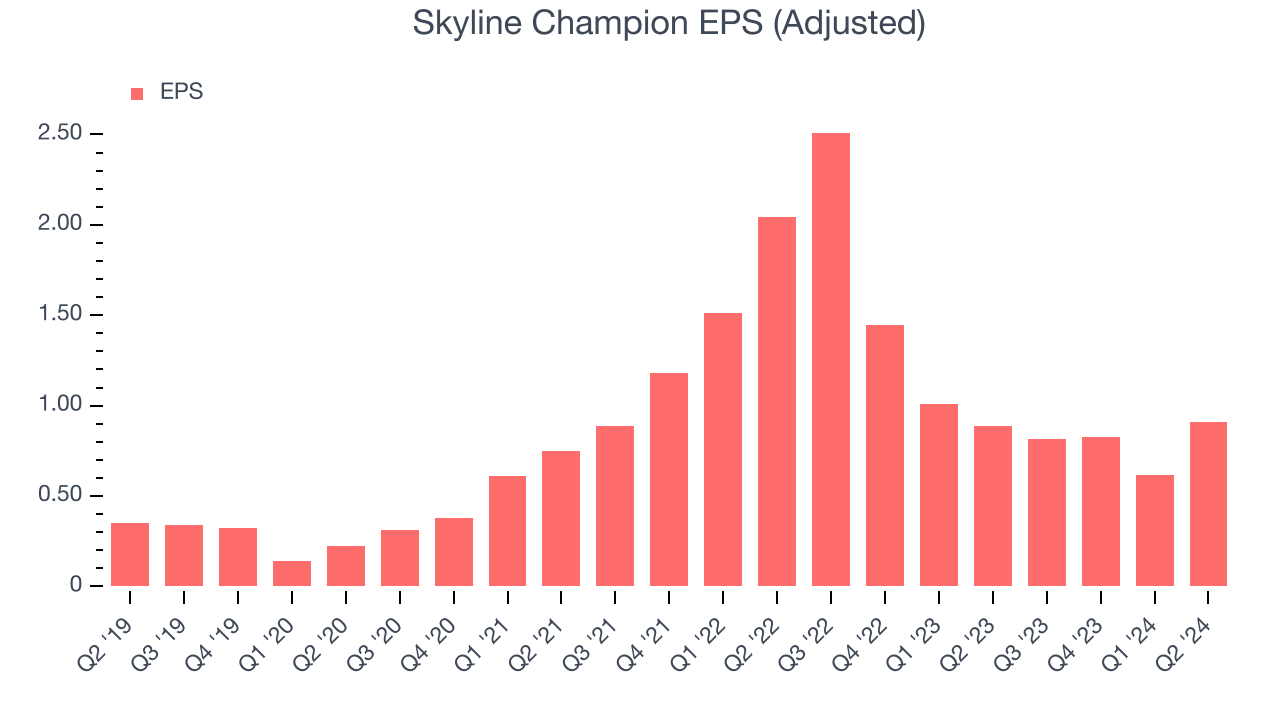

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Skyline Champion's EPS grew at an astounding 24% compounded annual growth rate over the last five years, higher than its 9.2% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Skyline Champion's earnings can give us a better understanding of its performance. As we mentioned earlier, Skyline Champion's operating margin declined this quarter but expanded by 1.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Skyline Champion, its two-year annual EPS declines of 24.9% show its recent history was to blame for its underperformance over the last five years. We hope Skyline Champion can return to earnings growth in the future.

In Q2, Skyline Champion reported EPS at $0.91, up from $0.89 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Skyline Champion to grow its earnings. Analysts are projecting its EPS of $3.17 in the last year to climb by 2.1% to $3.23.

Key Takeaways from Skyline Champion's Q2 Results

We were impressed by how significantly Skyline Champion blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock remained flat at $74.45 immediately after reporting.

Skyline Champion may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.