Project management software maker Smartsheet (NYSE:SMAR) reported Q3 FY2024 results topping analysts' expectations, with revenue up 23.2% year on year to $245.9 million. Revenue guidance for the full year also exceeded analysts' estimates but next quarter's guidance of $255 million was less impressive, coming in 0% below expectations. It made a GAAP loss of $0.24 per share, improving from its loss of $0.31 per share in the same quarter last year.

Is now the time to buy Smartsheet? Find out by accessing our full research report, it's free.

Smartsheet (SMAR) Q3 FY2024 Highlights:

- Revenue: $245.9 million vs analyst estimates of $241.3 million (1.9% beat)

- Billings: $268.5 million vs analyst estimates of $257.5 million (4.3% beat)

- EPS (non-GAAP): $0.16 vs analyst estimates of $0.09 ($0.07 beat)

- Revenue Guidance for Q4 2024 is $255 million at the midpoint, roughly in line with what analysts were expecting

- Full year guidance raised for revenue (slight raise) and for non-GAAP operating income (large raise)

- Free Cash Flow of $11.41 million, down 74.9% from the previous quarter

- Net Revenue Retention Rate: 118%, down from 121% in the previous quarter

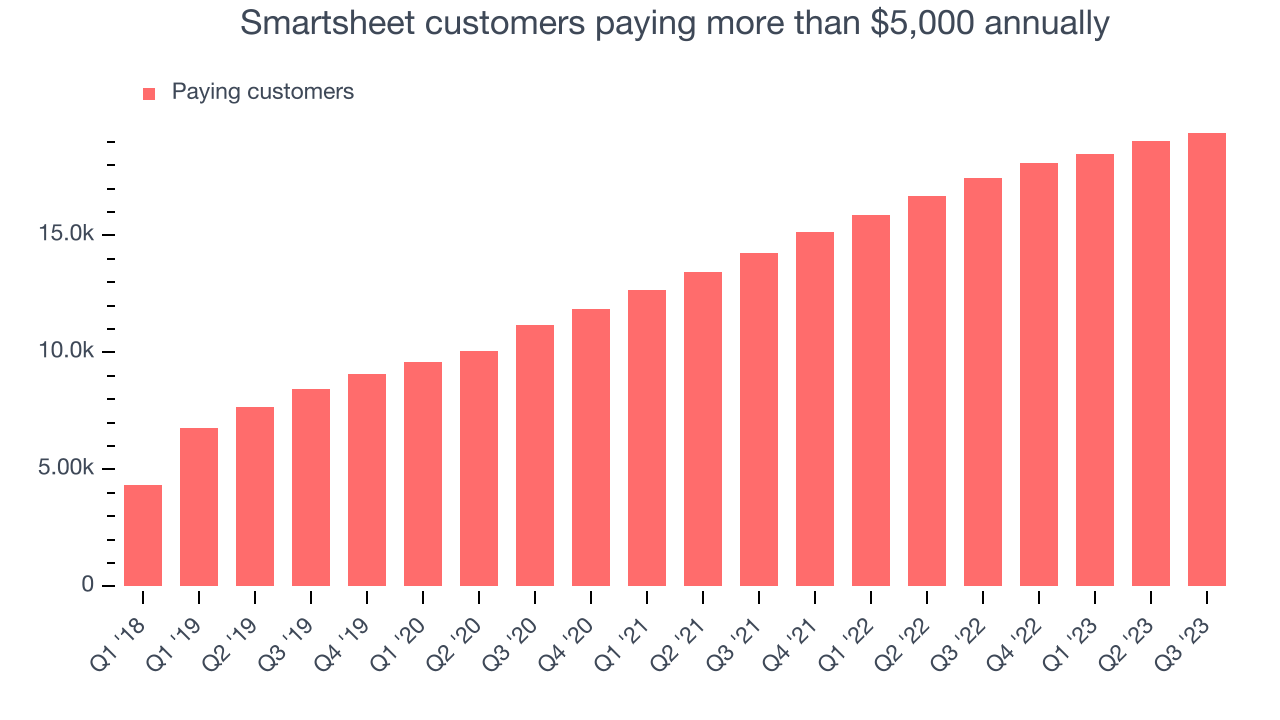

- Customers: 19,389 customers paying more than $5,000 annually

- Gross Margin (GAAP): 80.9%, up from 78.5% in the same quarter last year

“We exceeded expectations on the top and bottom lines this quarter,” said Mark Mader, CEO of Smartsheet.

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Sales Growth

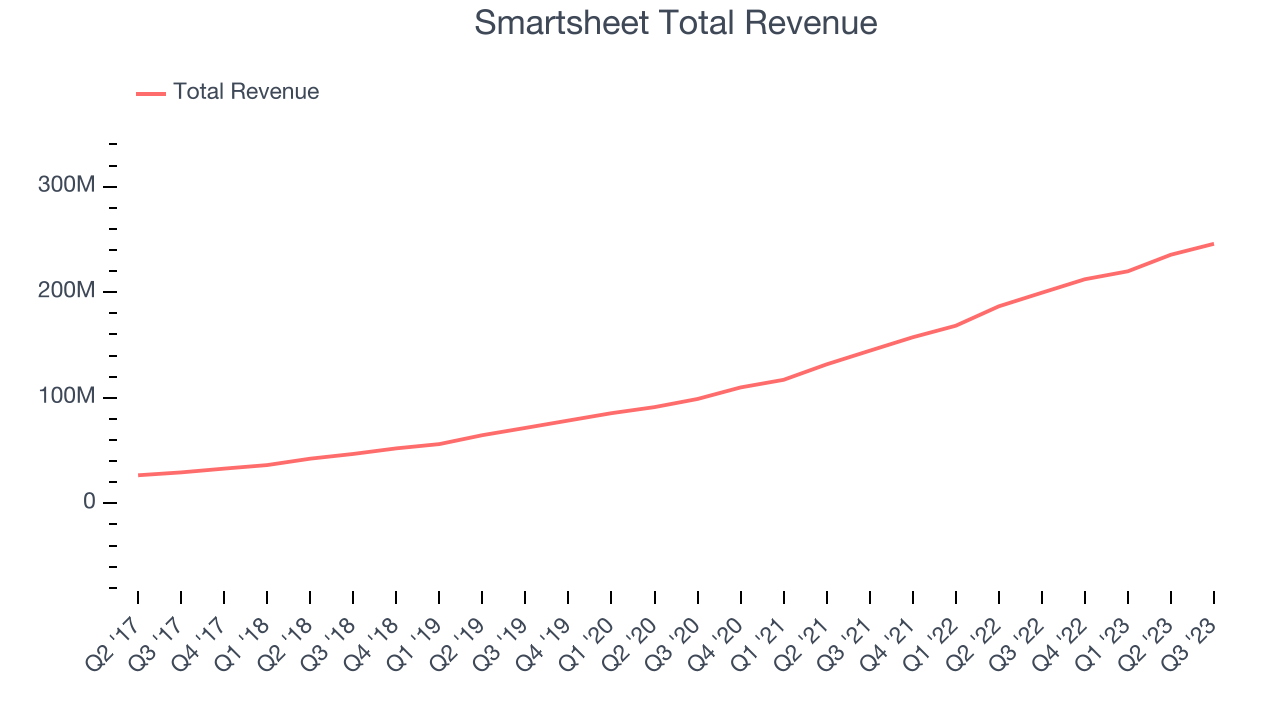

As you can see below, Smartsheet's revenue growth has been very strong over the last two years, growing from $144.6 million in Q3 FY2022 to $245.9 million this quarter.

This quarter, Smartsheet's quarterly revenue was once again up a very solid 23.2% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $10.33 million in Q3 compared to $15.7 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, Smartsheet is guiding for a 16.7% year-on-year revenue decline to $255 million, a further deceleration from the 34.9% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 19.6% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Large Customers Growth

This quarter, Smartsheet reported 19,389 enterprise customers paying more than $5,000 annually, an increase of 358 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from Smartsheet's Q3 Results

Sporting a market capitalization of $6.05 billion, Smartsheet is among smaller companies, but its more than $568.7 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

It was great to see how many new large contracts Smartsheet won this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates while billings outperformed more convincingly. Non-GAAP operating profit also outperformed nicely, showing that there is not only topline strength but operating efficiency and expense leverage. Lastly, guidance was solid, with full year guidance raised from the previous outlook. Zooming out, we think this was a decent quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $44.5 per share.

So should you invest in Smartsheet right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.