Project management software maker Smartsheet (NYSE:SMAR) reported Q1 FY2022 results topping analyst expectations, with revenue up 36.9% year on year to $117 million. Smartsheet made a GAAP loss of $37 million, down on its loss of $27.7 million, in the same quarter last year.

What do these results signal for the future of Smartsheet? Get early access our full analysis here

Smartsheet (NYSE:SMAR) Q1 FY2022 Highlights:

- Revenue: $117 million vs analyst estimates of $114.7 million (2.02% beat)

- EPS (GAAP): -$0.30

- Revenue guidance for Q2 2022 is $125.5 million at the midpoint, above analyst estimates of $122.5 million

- The company lifted revenue guidance for the full year, from $502.5 million to $512.5 million at the midpoint, a 1.99% increase

- Free cash flow was negative -$8.2 million, down from positive free cash flow of $9.9 million in previous quarter

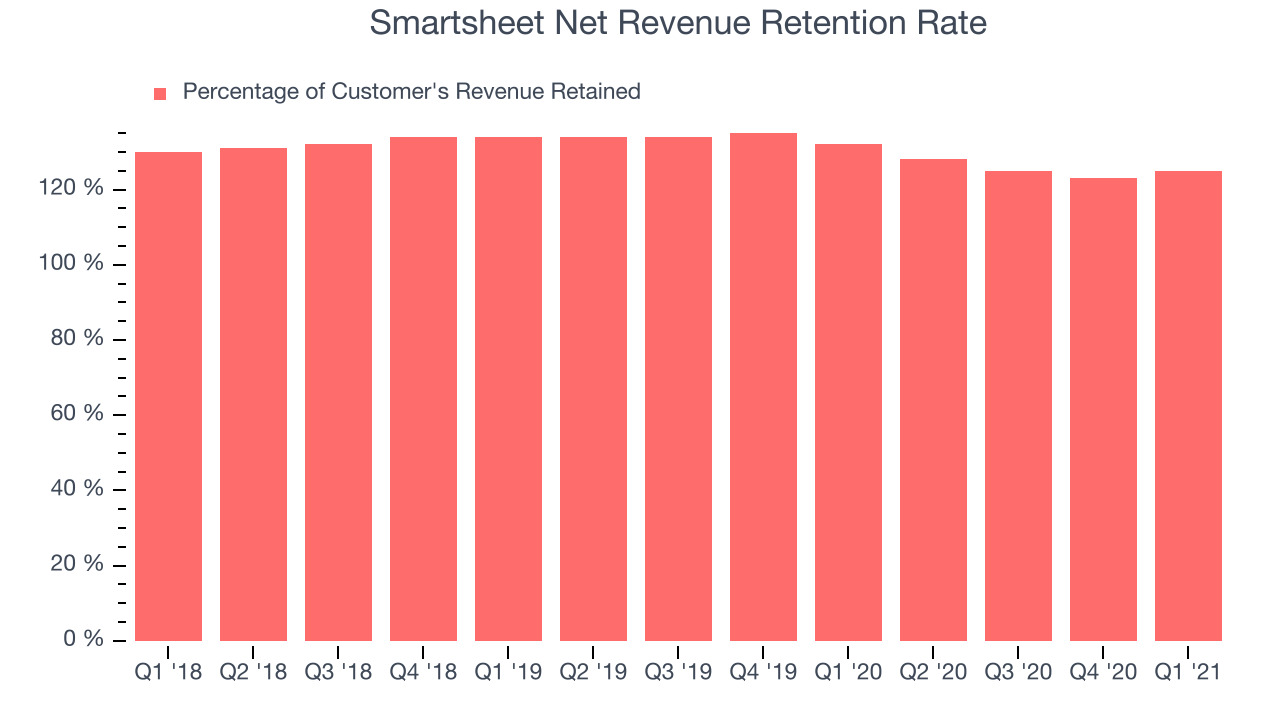

- Net Revenue Retention Rate: 125%, in line with previous quarter

- Customers: 12,655 customers paying more than $5,000 annually

- Gross Margin (GAAP): 77.3%, in line with previous quarter

- Updated valuation: Smartsheet is up at $61.8 and accounting for the revenue added in Q1 it now trades at 17.9x price-to-sales (LTM), compared to 19.2x just before the results.

“We’re very pleased with our strong start to the year, bolstered by our continued traction in the enterprise,” said Mark Mader, President and CEO of Smartsheet.

Central Hub For Work

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work. It offers a collaborative spreadsheet interface where users can assign tasks to others and create visual dashboards that track the progress of work across projects. Similarly to its competitors in this space like Asana (ASAN) or Atlassian (TEAM), Smartsheet integrates with a large number of other services like Slack, Salesforce or cloud storage and aims to become a company’s the central hub for everything related to work planning.

Project management software typically replaces a combination of manual processes, in-person meetings and things like whiteboards and email. And while the trend of collaborative work management has been strong for a while, the Covid pandemic has definitely accelerated the demand for tools that allow work to be done remotely.

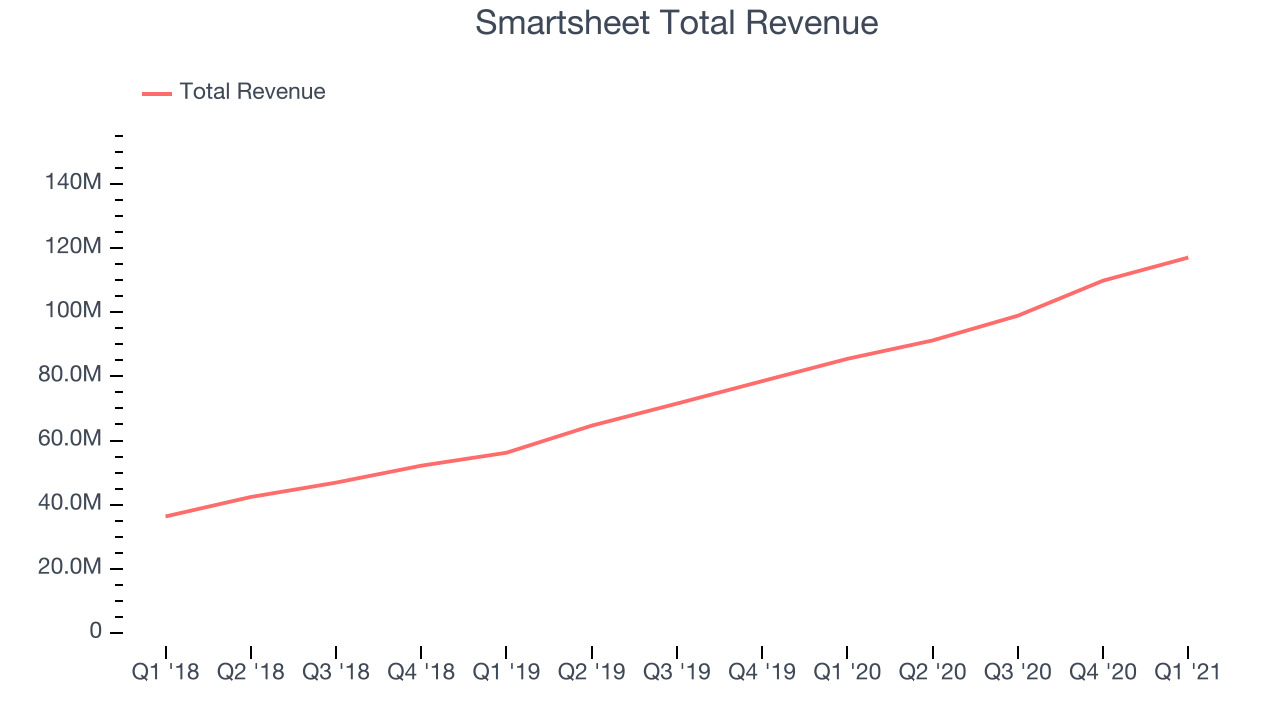

As you can see below, Smartsheet's revenue growth has been impressive over the last twelve months, growing from $85.4 million to $117 million.

And unsurprisingly, this was another great quarter for Smartsheet with revenue up an absolutely stunning 36.9% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $7.21 million in Q1, compared to $10.9 million in Q4 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Shared Success

A great thing about software as a service businesses is that customers tend to spend more with the company over time. Project management software has the inherent potential to be viral, as managers often need to invite other collaborators into the projects.

Smartsheet's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 125% in Q1. That means even if they didn't win any new customers, Smartsheet would have grown its revenue 25% year on year. Significantly up from the last quarter, this a good retention rate and a proof that Smartsheet's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Smartsheet's Q1 Results

With market capitalisation of $7.33 billion Smartsheet is among smaller companies, but its more than $439.6 million in cash and the fact it is operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We enjoyed seeing Smartsheet’s impressive revenue growth this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Overall, we think this was a strong quarter, that should leave shareholders feeling very positive. Therefore, we think Smartsheet will continue to stand out as a compelling growth stock, arguably even more so than before.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.