Project management software maker Smartsheet (SMAR) beat analyst expectations in Q4 FY2021 quarter, with revenue up 39.93% year on year to $109.9 million. Smartsheet made a GAAP loss of $28.67 million, down on its loss of $28.16 million, in the same quarter last year.

Smartsheet (SMAR) Q4 FY2021 Highlights:

- Revenue: $109.9 million vs analyst estimates of $102.7 million (7.0% beat)

- EPS (GAAP): -$0.23

- Revenue guidance for Q1 2022 is $111.5 million at the midpoint, above analyst estimates of $109.0 million

- Management's revenue guidance for FY2022 of $502.5 million at the midpoint, predicting 30.35% growth (vs 47.74% in FY2021)

- Free cash flow of $9.900 million, up from negative free cash flow of -$8.81 million in previous quarter

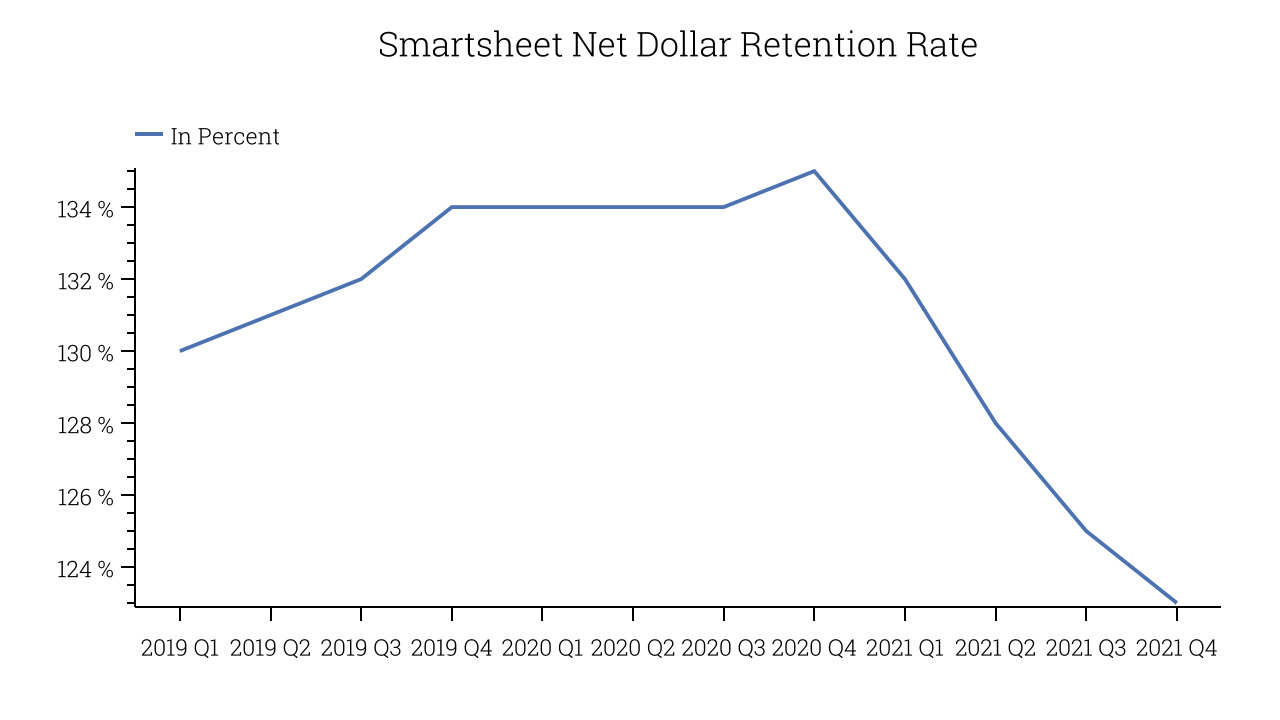

- Net Dollar Retention Rate: 123%, in line with previous quarter

- 11,874 customers paying annually more than $5,000

- Gross Margin (GAAP): 77.84%, up from 76.01% previous quarter

"We continue to see positive market direction and growth, which contributed to a strong close to FY21," said Mark Mader, President and CEO of Smartsheet. "This past year provided many learnings about how enterprises can invest to excel in a world where the future of work is defined by hybrid work. We look forward to innovating for our customers and providing the leading dynamic platform to empower teams and achieve better business outcomes."

Central Hub For Work

Founded in 2005, Smartsheet is a software as a service platform that helps companies plan, manage and report on work. It offers a collaborative spreadsheet interface where users can assign tasks to others and create visual dashboards that track the progress of work across projects. Similarly to its competitors in this space like Asana (ASAN) or Atlassian (TEAM), Smartsheet integrates with a large number of other services like Slack, Salesforce or cloud storage and aims to become a company’s the central hub for everything related to work planning.

Project management software typically replaces a combination of manual processes, in-person meetings and things like whiteboards and email. And while the trend of collaborative work management has been strong for a while, the Covid pandemic has definitely accelerated the demand for tools that allow work to be done remotely.

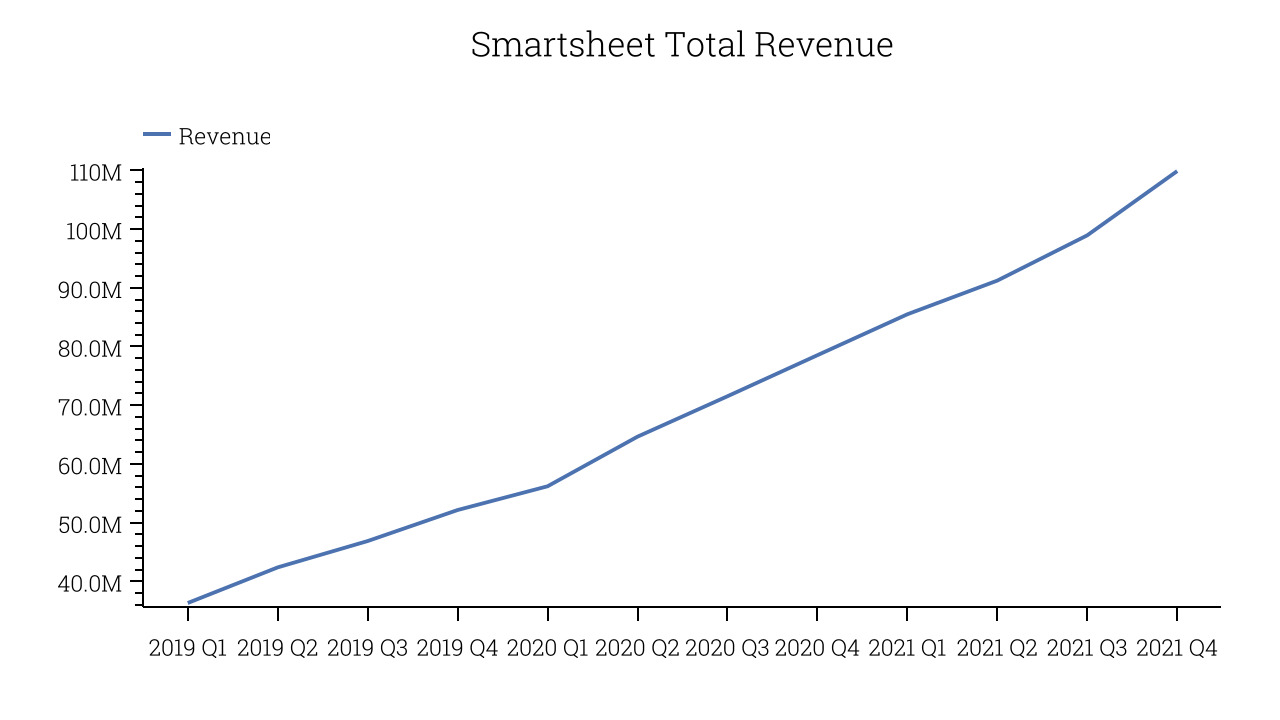

As you can see below, Smartsheet's revenue growth has been impressive over the last twelve months, growing from $78.52 million to $109.9 million.

And unsurprisingly, this was another great quarter for Smartsheet with revenue up an absolutely stunning 39.93% year on year. On top of that, revenue increased $10.94 million quarter on quarter, a very strong improvement on the $7.711 million increase in Q3 2021, and a sign of re-acceleration of growth.

Shared Success

A great thing about software as a service businesses is that customers tend to spend more with the company over time. Project management software has the inherent potential to be viral, as managers often need to invite other collaborators into the projects.

Smartsheet's net dollar retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 123% in Q4. That means even if they didn't win any new customers, Smartsheet would have grown its revenue 23% year on year. Despite it going down over the last year this is still a good retention rate and a proof that Smartsheet's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Smartsheet's Q4 Results

With market capitalisation of $8.287 billion Smartsheet is among smaller companies, but its more than $442.2 million in cash and operating close to free cash flow break-even put it in a robust financial position to invest in growth.

We were impressed by how strongly Smartsheet outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing that the revenue guidance for next year indicated slowdown and that the revenue retention rate deteriorated a little. Overall, this quarter's results still seemed pretty positive and shareholders can feel optimistic. Therefore, we think Smartsheet will continue to stand out as a decent growth stock, arguably even more so than before.

The author has no position in any of the stocks mentioned.