The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the project management software stocks have fared in Q4, starting with Smartsheet (NYSE:SMAR).

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

The 4 project management software stocks we track reported a very strong Q4; on average, revenues beat analyst consensus estimates by 6.56%, while on average next quarter revenue guidance was 4.34% above consensus. The technology sell-off has been putting pressure on stocks since November , but project management software stocks held their ground better than others, with the share price up 3.44% since earnings, on average.

Smartsheet (NYSE:SMAR)

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

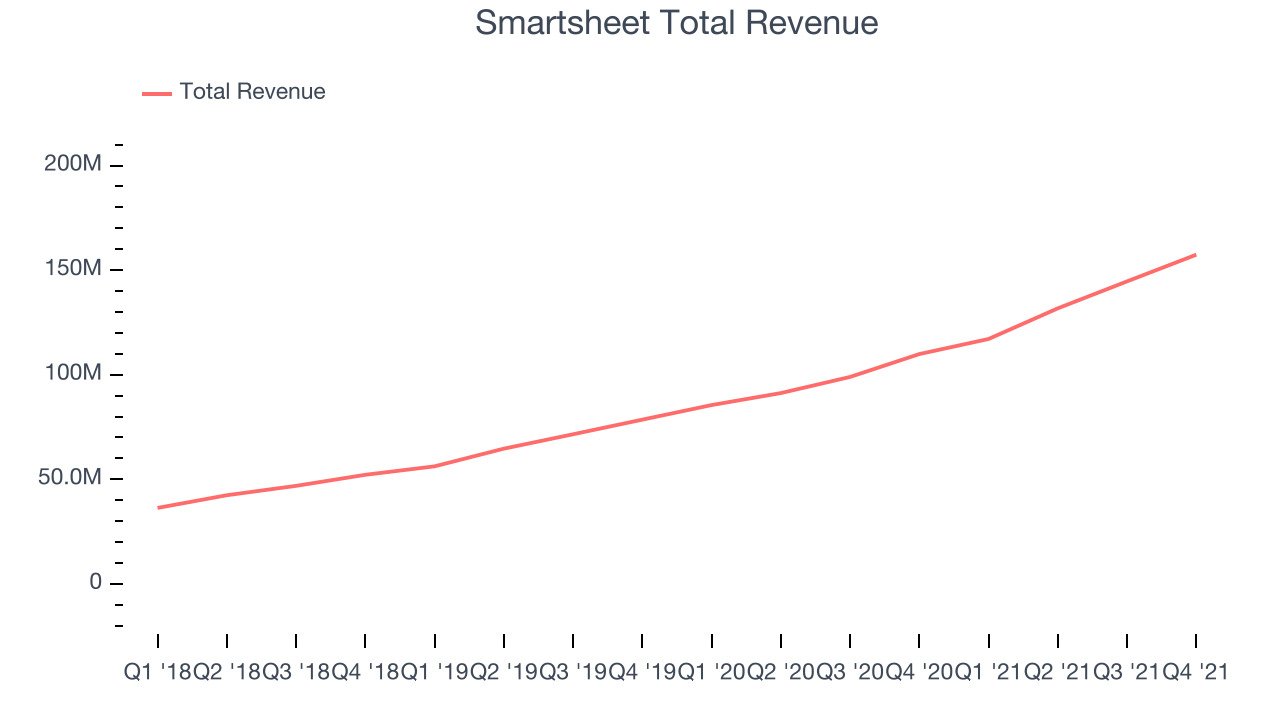

Smartsheet reported revenues of $157.3 million, up 43.2% year on year, beating analyst expectations by 3.81%. It was a strong quarter for the company, with an exceptional revenue growth and accelerating growth in large customers.

Smartsheet delivered the weakest performance against analyst estimates and weakest full year guidance update of the whole group. The company added 922 enterprise customers paying more than $5,000 annually to a total of 15,150. The stock is up 29% since the results and currently trades at $56.12.

We think Smartsheet is a good business, but is it a buy today? Read our full report here, it's free.

Best Q4: Atlassian (NASDAQ:TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

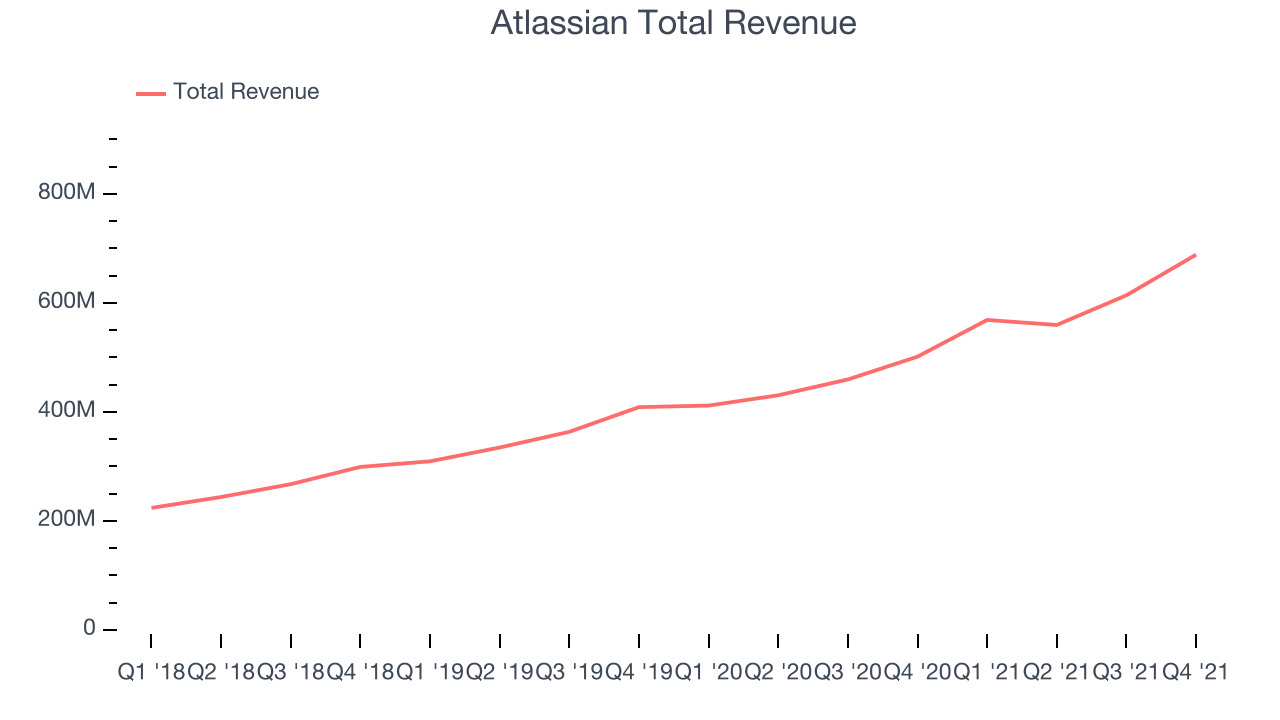

Atlassian reported revenues of $688.5 million, up 37.3% year on year, beating analyst expectations by 7.16%. It was an impressive quarter for the company, with accelerating customer growth and a very optimistic guidance for the next quarter.

Atlassian had the slowest revenue growth among its peers. The company added 10,021 customers to a total of 226,521. The stock is up 5.37% since the results and currently trades at $306.

Is now the time to buy Atlassian? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Asana (NYSE:ASAN)

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Asana reported revenues of $111.9 million, up 63.7% year on year, beating analyst expectations by 6.43%. It was a mixed quarter for the company, with an impressive guidance for the next year but a deceleration in customer growth.

The stock is down 13.9% since the results and currently trades at $42.

Read our full analysis of Asana's results here.

monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

monday.com reported revenues of $95.5 million, up 90.5% year on year, beating analyst expectations by 8.82%. It was a very strong quarter for the company, with a very optimistic guidance for the next quarter.

monday.com achieved the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among the peers. The company added 180 enterprise customers paying more than $50,000 annually to a total of 793. The stock is down 6.65% since the results and currently trades at $165.43.

Read our full, actionable report on monday.com here, it's free.

The author has no position in any of the stocks mentioned