Project management software maker Smartsheet (NYSE:SMAR) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 21% year on year to $256.9 million. On the other hand, next quarter's revenue guidance of $258 million was less impressive, coming in 2.1% below analysts' estimates. It made a non-GAAP profit of $0.34 per share, improving from its profit of $0.07 per share in the same quarter last year.

Smartsheet (SMAR) Q4 FY2024 Highlights:

- Revenue: $256.9 million vs analyst estimates of $255.9 million (small beat)

- EPS (non-GAAP): $0.34 vs analyst estimates of $0.18 ($0.16 beat)

- Revenue Guidance for Q1 2025 is $258 million at the midpoint, below analyst estimates of $263.7 million

- Management's revenue guidance for the upcoming financial year 2025 is $1.12 billion at the midpoint, missing analyst estimates by 2.4% and implying 16.4% growth (vs 25.3% in FY2024)

- Gross Margin (GAAP): 81.9%, up from 78.9% in the same quarter last year

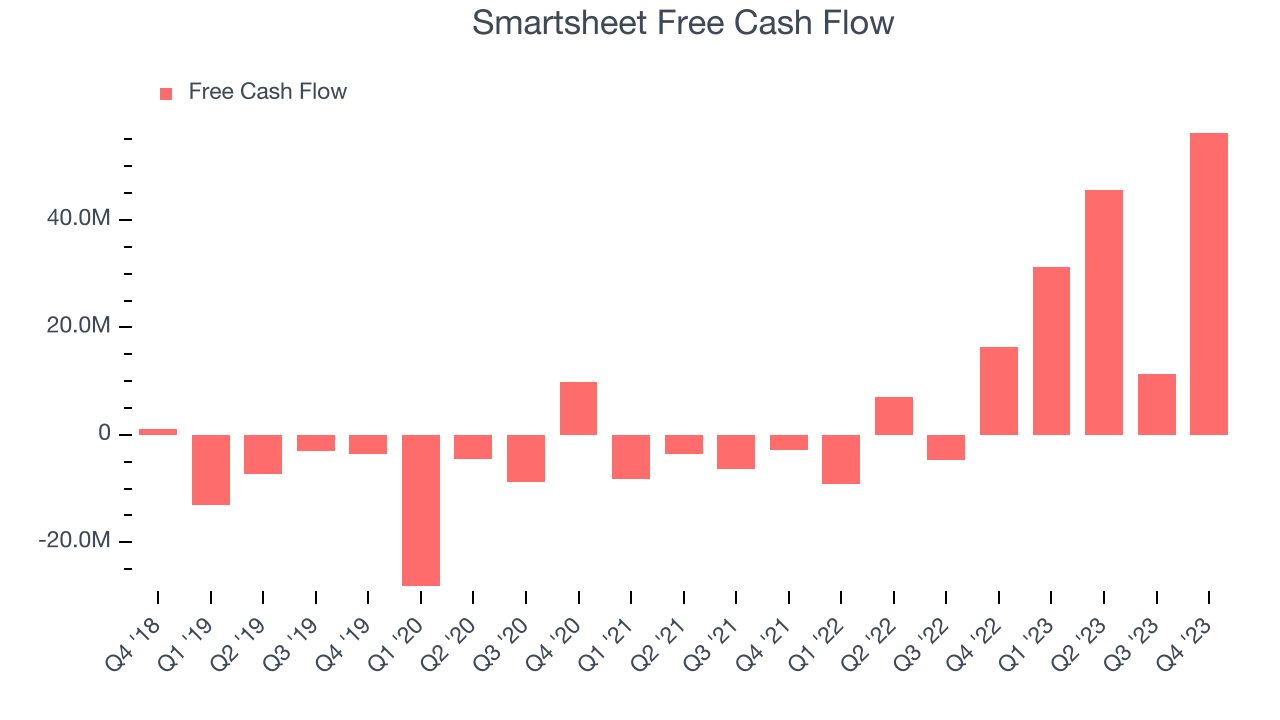

- Free Cash Flow of $56.28 million, up from $11.41 million in the previous quarter

- Net Revenue Retention Rate: 116%, in line with the previous quarter

- Customers: 19,818 customers paying more than $5,000 annually

- Market Capitalization: $5.62 billion

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

The software offers a collaborative spreadsheet interface where users can assign tasks to others and create visual dashboards that track the progress of work across projects.

Project management software typically replaces a combination of manual processes, in-person meetings and things like whiteboards and email. Smartsheet integrates with a large number of other services like Slack, Salesforce or cloud storage and aims to become a company's central hub for everything related to work planning.

For example a company can be using Smartsheet to track progress across their portfolio of products to help them ensure that new features are delivered on time and within budget. While every product manager is focused on reporting their own status, the higher level management is able to aggregate this information and zoom out to see the summaries across business units, and compare it with their business plan. To prepare for the weekly C-suite level meeting, the company used to have a large number of employees just focused on gathering updates from all the different departments, but now all the information is automatically updated in real time.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Smartsheet’s competitors include Monday.com (NASDAQ:MNDY), Asana (NYSE:ASAN) and Atlassian (NASDAQ:TEAM).

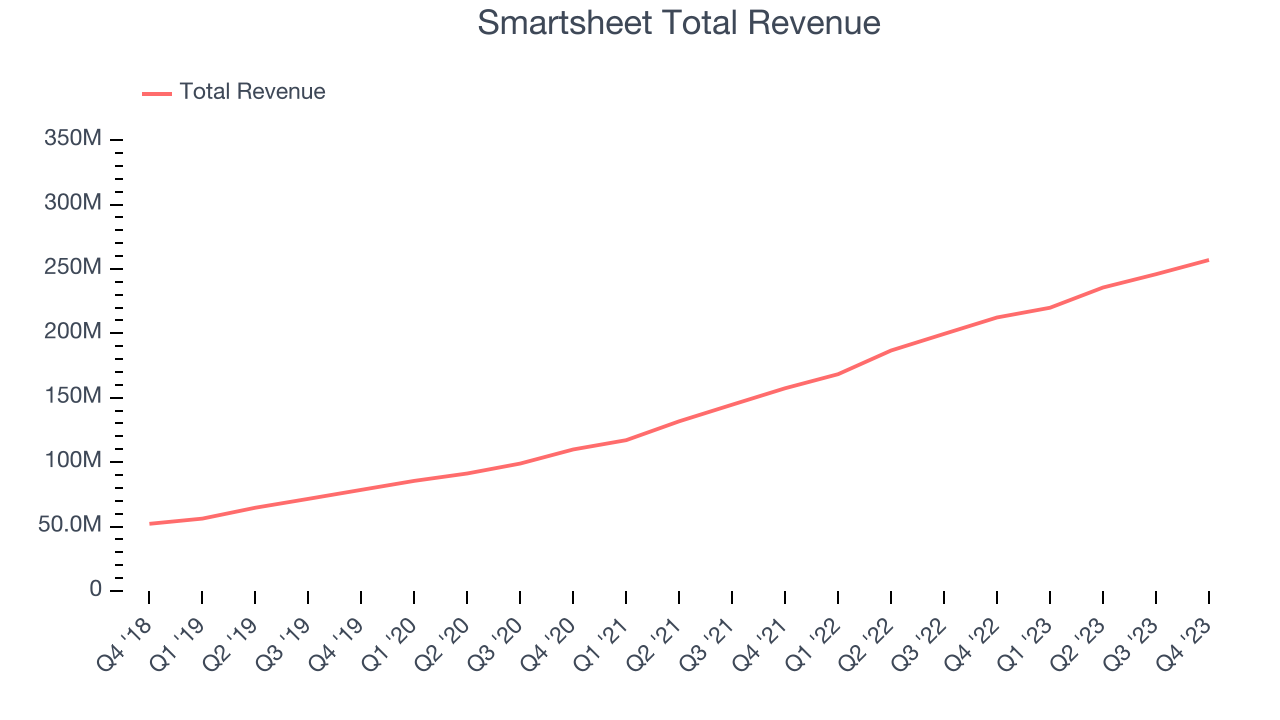

Sales Growth

As you can see below, Smartsheet's revenue growth has been very strong over the last three years, growing from $109.9 million in Q4 2021 to $256.9 million this quarter.

This quarter, Smartsheet's quarterly revenue was once again up a very solid 21% year on year. On top of that, its revenue increased $11.03 million quarter on quarter, a solid improvement from the $10.33 million increase in Q3 2024. Thankfully, that's a slight acceleration of growth.

Next quarter's guidance suggests that Smartsheet is expecting revenue to grow 17.3% year on year to $258 million, slowing down from the 30.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.12 billion at the midpoint, growing 16.4% year on year compared to the 25% increase in FY2024.

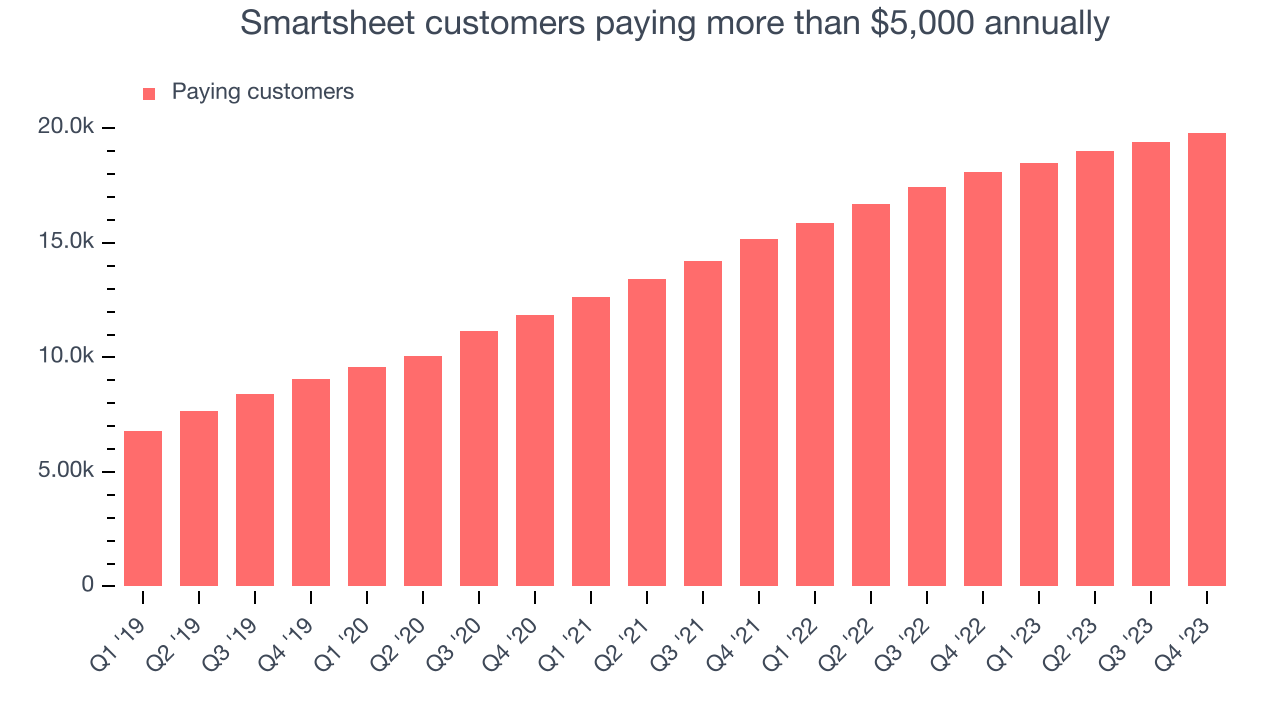

Large Customers Growth

This quarter, Smartsheet reported 19,818 enterprise customers paying more than $5,000 annually, an increase of 429 from the previous quarter. That's quite a bit more contract wins than last quarter but also quite a bit below what we've typically observed over the last year, suggesting that the company may be reinvigorating growth.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

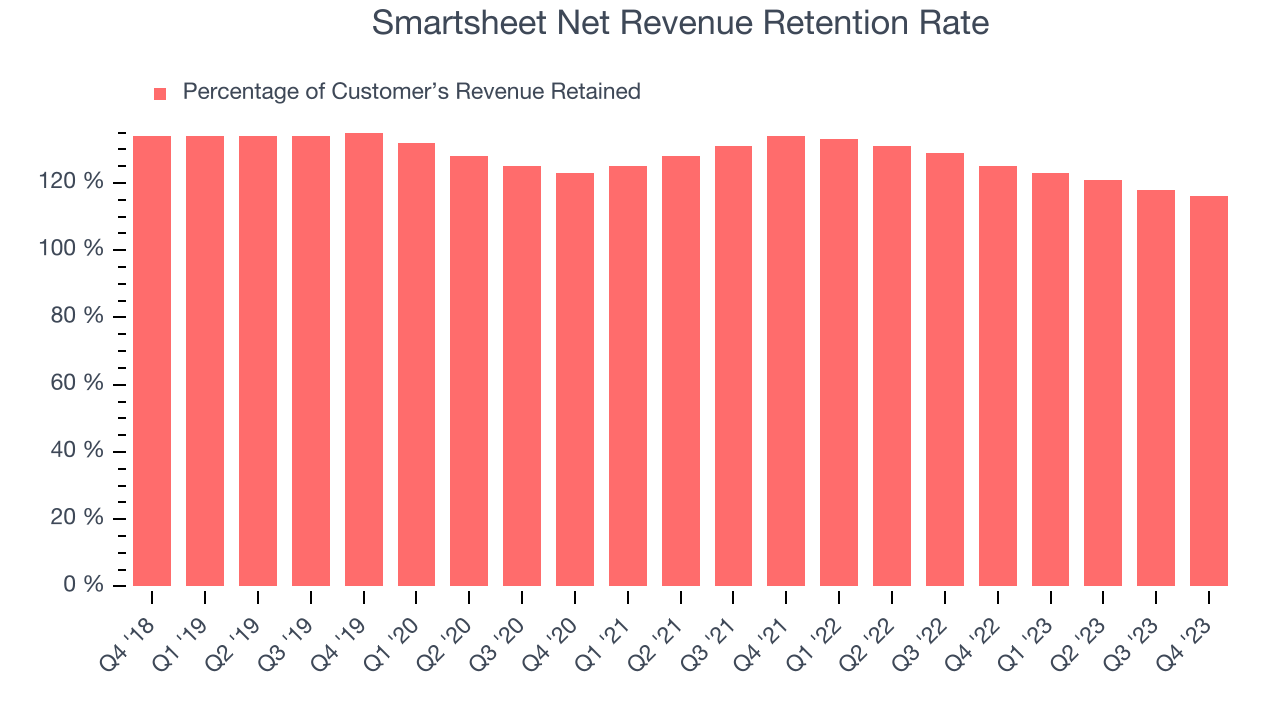

Smartsheet's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 116% in Q4. This means that even if Smartsheet didn't win any new customers over the last 12 months, it would've grown its revenue by 16%.

Despite falling over the last year, Smartsheet still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Profitability

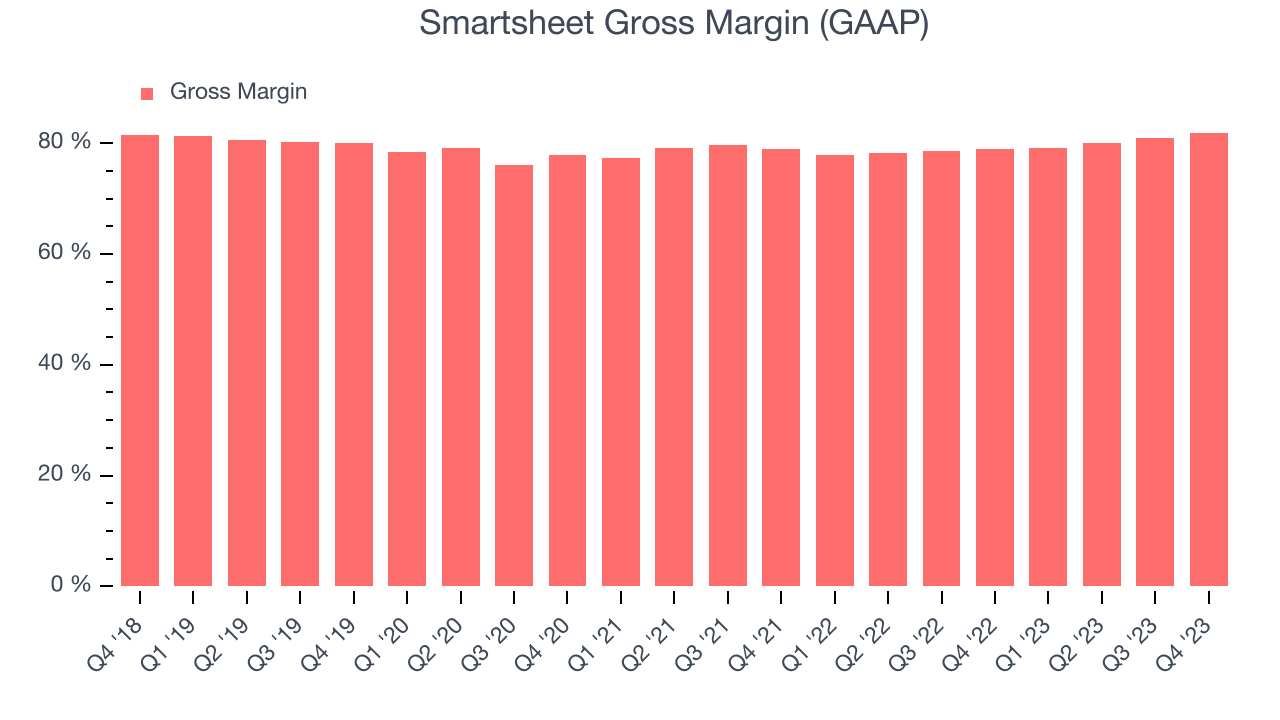

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Smartsheet's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 81.9% in Q4.

That means that for every $1 in revenue the company had $0.82 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Smartsheet's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Smartsheet's free cash flow came in at $56.28 million in Q4, up 243% year on year.

Smartsheet has generated $144.5 million in free cash flow over the last 12 months, a solid 15.1% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Smartsheet's Q4 Results

We enjoyed seeing Smartsheet exceed analysts' billings expectations this quarter. We were also glad its gross margin improved. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand. Overall, the results could have been better. The company is down 6% on the results and currently trades at $37.89 per share.

Is Now The Time?

When considering an investment in Smartsheet, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think Smartsheet is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been exceptional over the last three years. Additionally, its customers are increasing their spending quite quickly, suggesting they love the product, and its impressive gross margins indicate excellent business economics.

Smartsheet's price-to-sales ratio based on the next 12 months is 4.8x, suggesting the market is expecting more measured growth relative to the hottest tech stocks. We'd argue that its often wise to hold on to quality businesses like Smartsheet for the long term, but we do recognize there is a lot of optimism priced in at the moment.

Wall Street analysts covering the company had a one-year price target of $55.74 right before these results (compared to the current share price of $37.89).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.