Social network Snapchat (NYSE: SNAP) fell short of analysts' expectations in Q4 FY2023, with revenue up 4.7% year on year to $1.36 billion. The company also expects next quarter's revenue to be around $1.12 billion, slightly below analysts' estimates. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.14 per share in the same quarter last year.

Is now the time to buy Snap? Find out by accessing our full research report, it's free.

Snap (SNAP) Q4 FY2023 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.38 billion (1.5% miss)

- EPS (non-GAAP): $0.08 vs analyst estimates of $0.06 (25.7% beat)

- Revenue Guidance for Q1 2024 is $1.12 billion at the midpoint, below analyst estimates of $1.12 billion

- Adjusted EBITDA Guidance for Q1 2024 is ($75) million at the midpoint, well below analyst estimates of ($28) million

- Free Cash Flow of $110.9 million is up from -$60.65 million in the previous quarter

- Gross Margin (GAAP): 54.3%, down from 63.4% in the same quarter last year

- Daily Active Users: 414 million, up 39 million year on year

- Market Capitalization: $27.58 billion

“2023 was a pivotal year for Snap, as we transformed our advertising business and continued to expand our global community, reaching 414 million daily active users,” said Evan Spiegel, CEO.

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

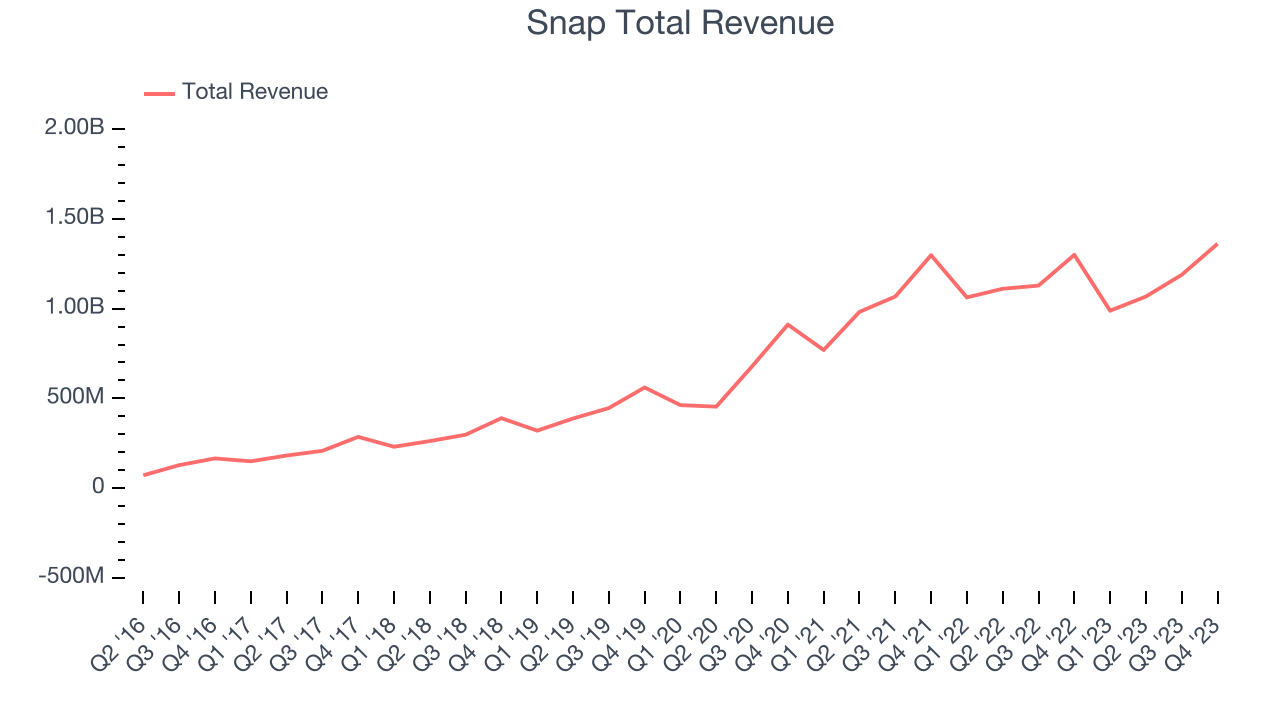

Sales Growth

Snap's revenue growth over the last three years has been strong, averaging 28.2% annually. This quarter, Snap reported rather lacklustre 4.7% year-on-year revenue growth, missing analysts' expectations.

Guidance for the next quarter indicates Snap is expecting revenue to grow 12.8% year on year to $1.12 billion, improving on the 7% year-on-year decline it recorded in the same quarter last year.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

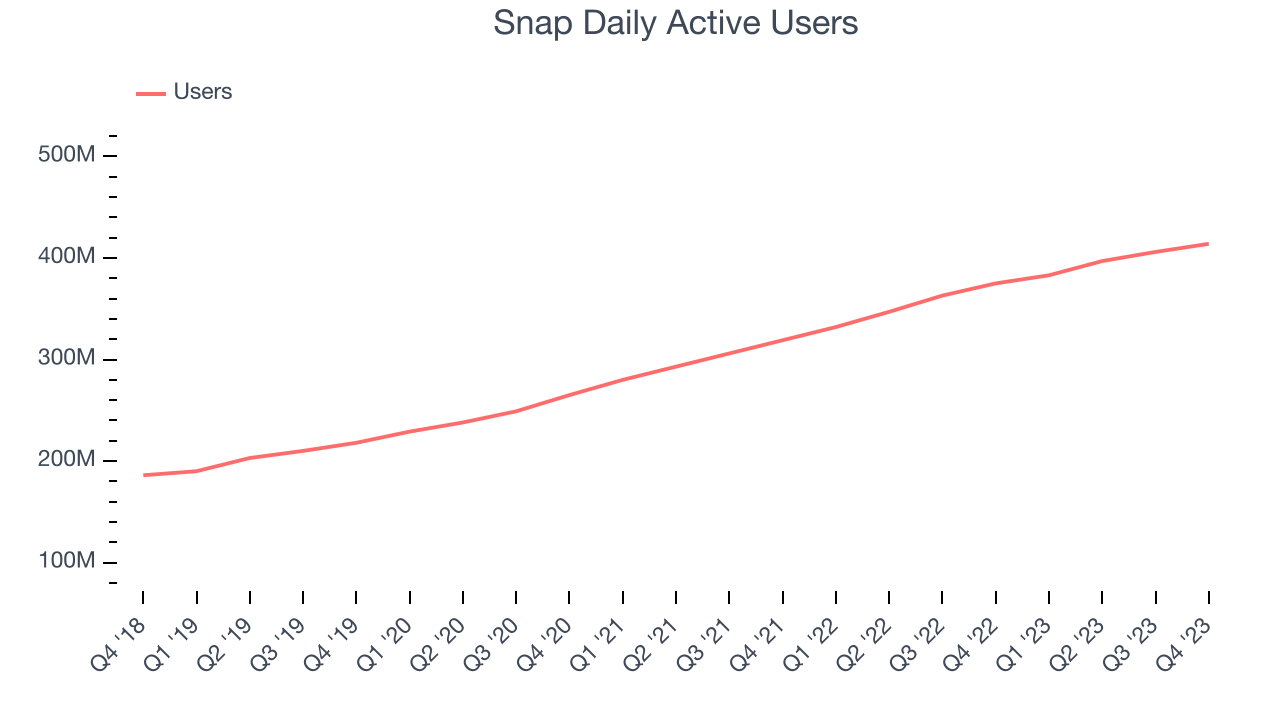

Usage Growth

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Snap's daily active users, a key performance metric for the company, grew 15.7% annually to 414 million. This is solid growth for a consumer internet company.

In Q4, Snap added 39 million daily active users, translating into 10.4% year-on-year growth.

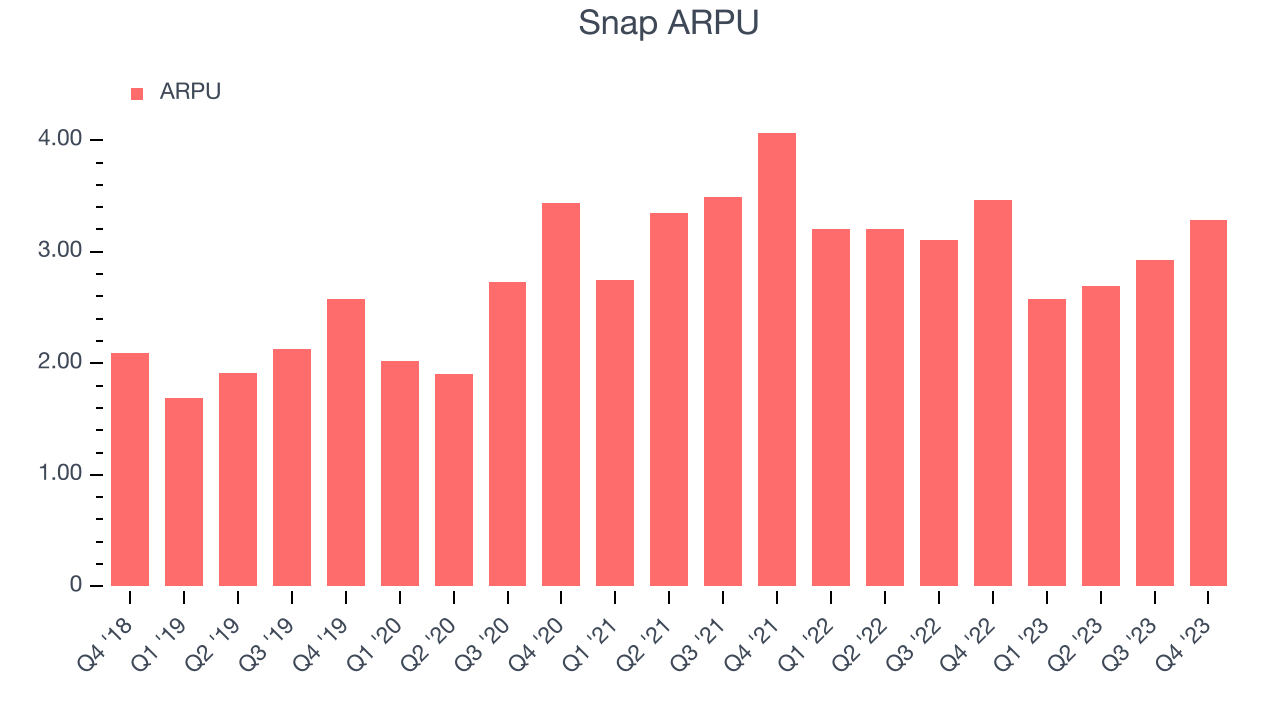

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Snap because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap's audience and its ad-targeting capabilities.

Snap's ARPU has declined over the last two years, averaging 7.5%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU declined 5.1% year on year to $3.29 per user.

Key Takeaways from Snap's Q4 Results

It was good to see Snap add new users this quarter and beat DAU expectations. On the other hand, its revenue unfortunately missed analysts' expectations and its revenue growth was quite weak. While next quarter's revenue guidance was in line, adjusted EBITDA guidance was well below. This shows that Snap's growth is coming at higher costs or less efficiency than expected. Overall, this was a mediocre quarter for Snap. The company is down 31.4% on the results and currently trades at $11.98 per share.

Snap may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.