The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the consumer internet stocks have fared in Q3, starting with Snap (NYSE:SNAP).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 1.41%, while on average next quarter revenue guidance was 3.9% under consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but consumer internet stocks held their ground better than others, with the share prices up 2.62% since the previous earnings results, on average.

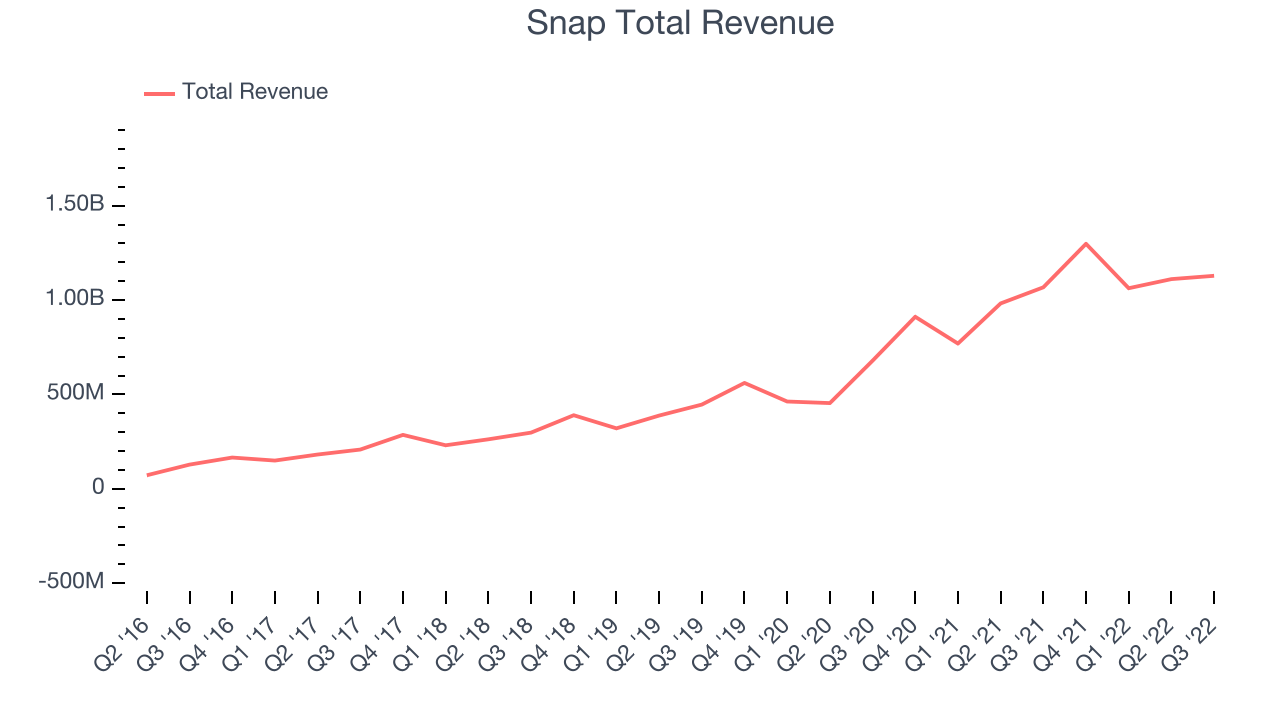

Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.12 billion, up 5.71% year on year, missing analyst expectations by 0.91%. It was a weak quarter for the company, with a miss of the top line analyst estimates and slow revenue growth.

"This quarter we took action to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, reaccelerating and diversifying our revenue growth, and investing in augmented reality," said Evan Spiegel, CEO.

The company reported 363 million daily active users, up 18.6% year on year. The stock is down 13% since the results and currently trades at $9.40.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it's free.

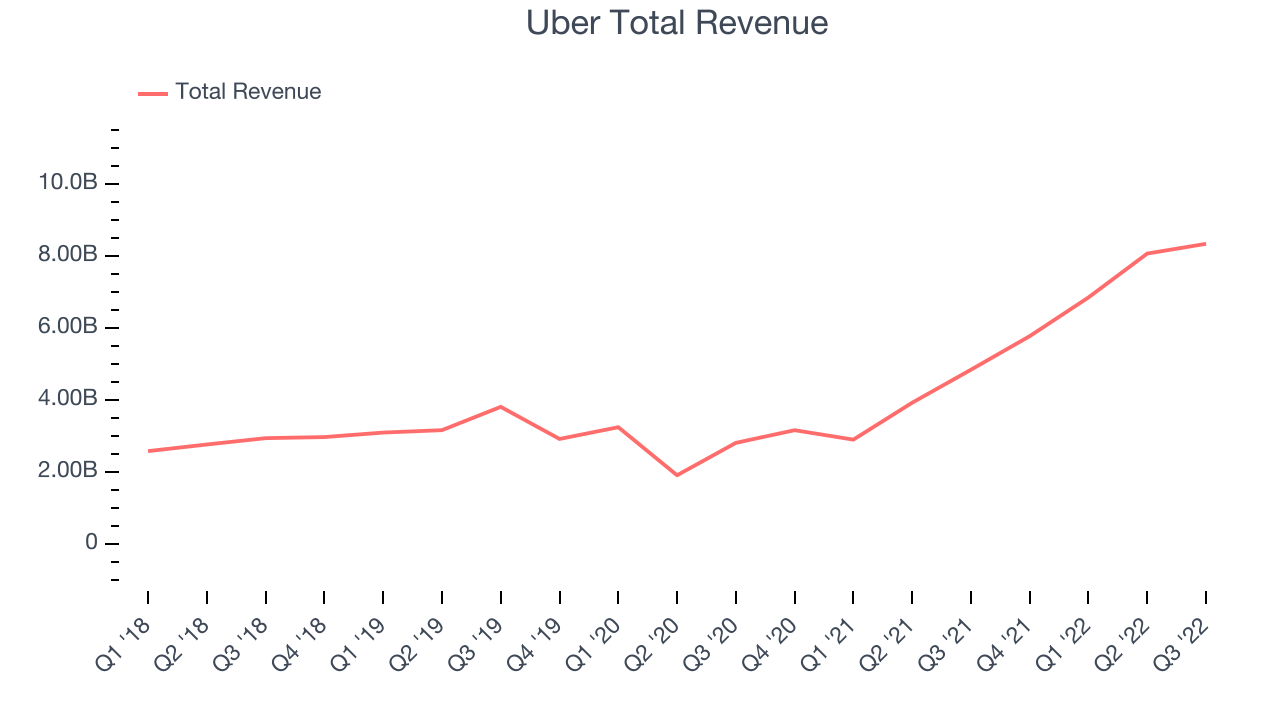

Best Q3: Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

Uber reported revenues of $8.34 billion, up 72.1% year on year, beating analyst expectations by 3.52%. It was a very strong quarter for the company, with exceptional revenue growth and a decent beat of analyst estimates.

Uber delivered the fastest revenue growth among its peers. The company reported 124 million paying users, up 13.7% year on year. The stock is up 5.68% since the results and currently trades at $28.09.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $460.2 million, down 33.2% year on year, missing analyst expectations by 2.66%. It was a weak quarter for the company, with declining number of users and slow revenue growth.

The company reported 5.8 million active buyers, down 33.3% year on year. The stock is down 21.5% since the results and currently trades at $20.10.

Read our full analysis of Overstock's results here.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ: ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $594.4 million, up 11.6% year on year, beating analyst expectations by 5.4%. It was a mixed quarter for the company, with a solid beat of analyst estimates but slow revenue growth.

The company reported 94.1 million active buyers, up 5.31% year on year. The stock is up 46.3% since the results and currently trades at $128.00.

Read our full, actionable report on Etsy here, it's free.

Meta (NASDAQ:META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META ) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Facebook Reality Labs.

Meta reported revenues of $27.7 billion, down 4.46% year on year, beating analyst expectations by 1.14%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

The company reported 3.71 billion monthly active users, up 3.63% year on year. The stock is up 2.1% since the results and currently trades at $132.60.

Read our full, actionable report on Meta here, it's free.

The author has no position in any of the stocks mentioned