Social network Snapchat (NYSE: SNAP) beat analysts' expectations in Q1 CY2024, with revenue up 20.9% year on year to $1.19 billion. Guidance for next quarter's revenue was also optimistic at $1.24 billion at the midpoint, 2.1% above analysts' estimates. It made a non-GAAP profit of $0.03 per share, improving from its profit of $0.01 per share in the same quarter last year.

Snap (SNAP) Q1 CY2024 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.12 billion (6.6% beat)

- EPS (non-GAAP): $0.03 vs analyst estimates of -$0.05 ($0.08 beat)

- Revenue Guidance for Q2 CY2024 is $1.24 billion at the midpoint, above analyst estimates of $1.21 billion

- Gross Margin (GAAP): 51.9%, down from 55.5% in the same quarter last year

- Free Cash Flow of $37.9 million, down 65.8% from the previous quarter

- Daily Active Users: 422 million, up 39 million year on year

- Market Capitalization: $18.29 billion

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snapchat differentiates itself from other social networks through product innovation around Augmented Reality (AR), demographics, and the ephemeral nature of its messaging and Stories. Snapchat is a mobile first, camera centric image messaging app whose disappearing messages are meant to emphasize personal expression and living in the moment. The Snapchat platform has 5 distinct features: the main Camera tab, where users send snaps to friends, Communication (messaging/video calls), Snap Map (personalized map that shows friends and local businesses), Stories (content from users, news, and professionally generated content), and Spotlight (sort of a TikTok-like never ending spool of content Snapchat tailors to a user’s likes).

More so than other social networks, Snapchat is geared to digital natives, specifically 13-34 year olds. This is what makes the platform appealing to advertisers - its unique ability to address a hard to reach demographic at scale. The majority of under 35s in the US, Australia, and Western Europe use Snapchat. Originally built only for iOS, Snapchat introduced a version for Android in 2019, which is why rest of world adoption is still in its early stages. The reason advertisers have flocked to Snapchat is the very high ROI for advertisers: the cost of advertising on Snap remains low.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Snapchat (NYSE: SNAP) competes with fellow social media advertising platforms like Google (NASDAQ: GOOGL), Meta Platforms (NASDAQ:FB), Twitter (NYSE: TWTR), and Pinterest (NASDAQ: PINS)

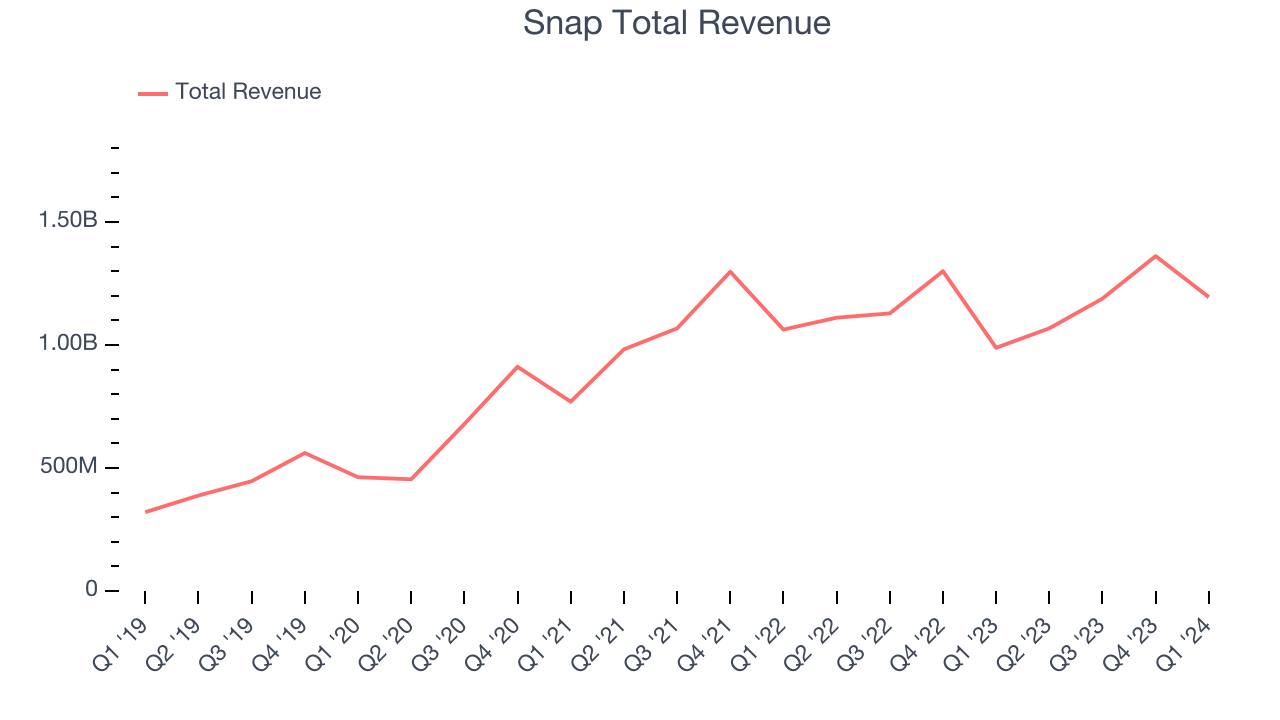

Sales Growth

Snap's revenue growth over the last three years has been strong, averaging 24.4% annually. This quarter, Snap beat analysts' estimates and reported decent 20.9% year-on-year revenue growth.

Guidance for the next quarter indicates Snap is expecting revenue to grow 16.1% year on year to $1.24 billion, improving from the 3.9% year-on-year decline it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 11.6% over the next 12 months.

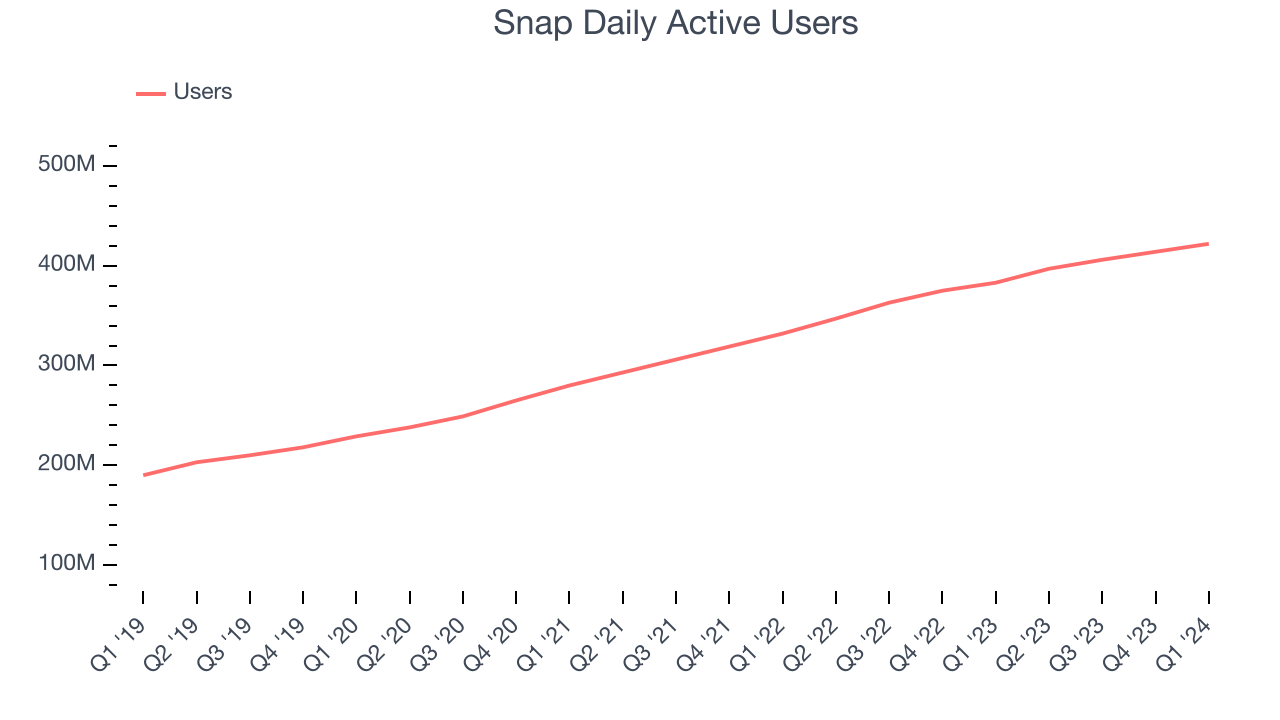

Usage Growth

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Snap's daily active users, a key performance metric for the company, grew 14.6% annually to 422 million. This is solid growth for a consumer internet company.

In Q1, Snap added 39 million daily active users, translating into 10.2% year-on-year growth.

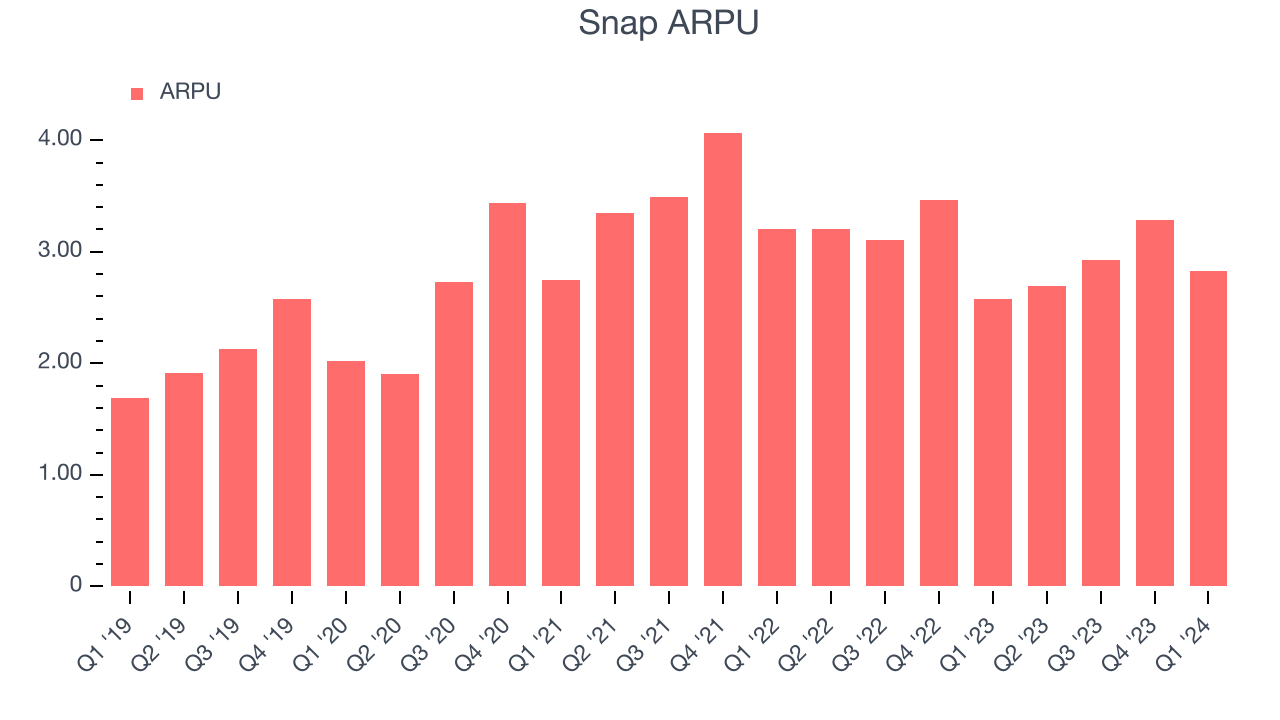

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Snap because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap's audience and its ad-targeting capabilities.

Snap's ARPU has declined over the last two years, averaging 8.4%. Although the company's users have continued to grow, it's lost its pricing power and will have to make improvements soon. This quarter, ARPU grew 9.7% year on year to $2.83 per user.

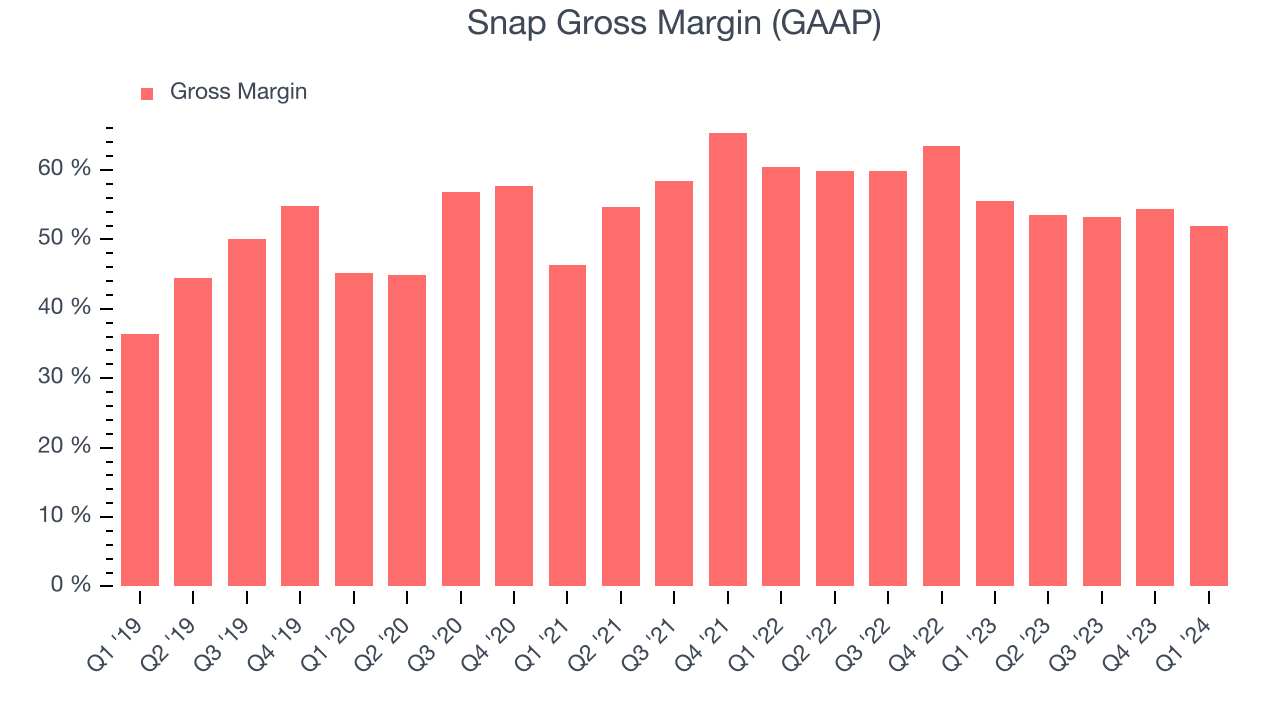

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Snap's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 51.9% this quarter, down 3.6 percentage points year on year.

For social network businesses like Snap, these aforementioned costs typically include customer service, data center, and other infrastructure expenses. After paying for these expenses, Snap had $0.52 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Snap's gross margins have been trending down over the past year, averaging 53.3%. This weakness isn't great as Snap's margins are already slightly below other consumer internet companies and falling margins point to potentially deteriorating pricing power.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Snap grow from a combination of product virality, paid advertisement, and incentives.

Snap is efficient at acquiring new users, spending 44.4% of its gross profit on sales and marketing expenses over the last year. This level of efficiency indicates relatively solid competitive positioning, giving Snap the freedom to invest its resources into new growth initiatives.

Profitability & Free Cash Flow

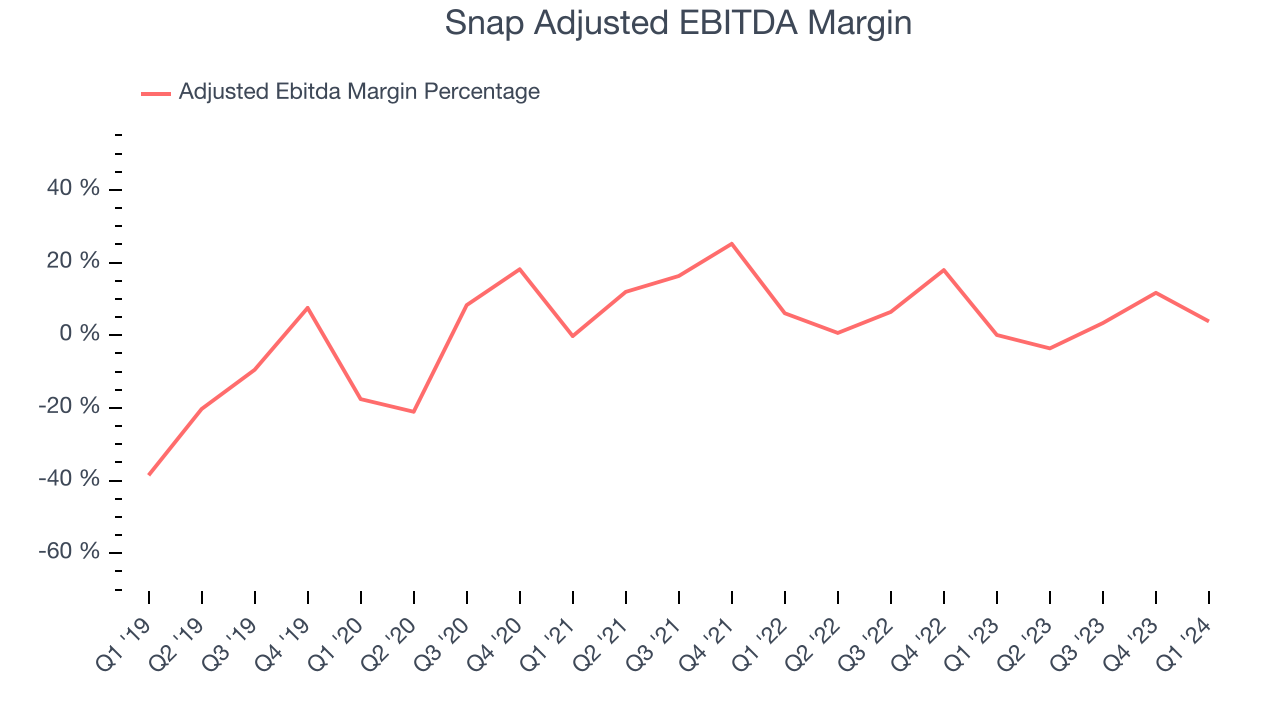

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Snap's EBITDA was $45.66 million this quarter, translating into a 3.8% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 4.3%.

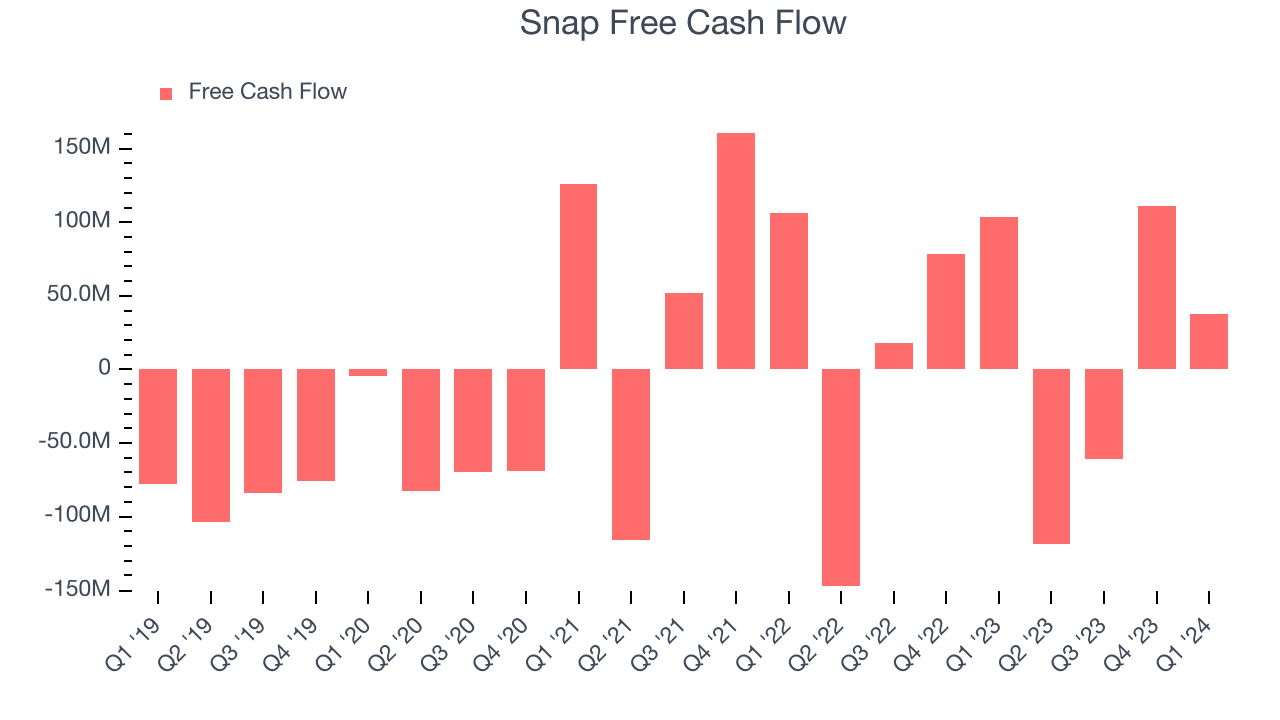

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Snap's free cash flow came in at $37.9 million in Q1, down 63.4% year on year.

Snap broke even from a free cash flow perspective over the last 12 months. This below-average FCF margin stems from Snap's need to reinvest in its business to penetrate the market.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Snap reported $2.91 billion of cash and $3.89 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $206.4 million of EBITDA over the last 12 months, we view Snap's 4.8x net-debt-to-EBITDA ratio as safe. We also see its $149.5 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Snap's Q1 Results

We enjoyed seeing Snap exceed analysts' revenue expectations this quarter, driven by better-than-expected daily active users. Its revenue growth and higher operational efficiency also enabled it to post positive EBITDA and free cash flow, beating Wall Street's pessimistic estimates.

The company noted strong momentum in its Snap Star program, which seeks to bring social media influencers into its platform to drive engagement. This helped contribute to a tripling of Snapchat+ subscribers and 125% year-on-year growth in total time spent watching Snapchat Spotlight content. The number of small- and medium-sized businesses advertising on Snapchat also grew 85% year on year.

Lastly, next quarter's revenue, EBITDA, and daily active users guidance surpassed estimates. It expects to have 431 million daily active users.

Overall, we think this was a strong quarter that should satisfy shareholders. The stock is up 24.6% after reporting and currently trades at $14.2 per share.

Is Now The Time?

Snap may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although Snap isn't a bad business, it probably wouldn't be one of our picks. Although its revenue growth has been good over the last three years and its growth over the next 12 months is expected to be higher, its ARPU has declined over the last two years.

At the moment, Snap trades at 48.4x next 12 months EV-to-EBITDA. We can find things to like about Snap and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder whether there might be better opportunities elsewhere.

Wall Street analysts covering the company had a one-year price target of $13.58 per share right before these results (compared to the current share price of $14.20), implying they didn't see much short-term potential in the Snap.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.