Looking back on data and analytics software stocks' Q2 earnings, we examine this quarters’ best and worst performers, including Snowflake (NYSE:SNOW) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is growing at an accelerating pace. Hand in hand is growing the importance of storing in a scalable and efficient format, especially as the diversity of the data and associated use cases expand from accessing simple, structured data to high-scale processing of unstructured data, images, audio and video.

The 8 data and analytics software stocks we track reported a a strong Q2; on average, revenues beat analyst consensus estimates by 8.51%, while on average next quarter revenue guidance was 4.85% above consensus. The market rewarded the results with the average return the day after earnings coming in at 6.08%.

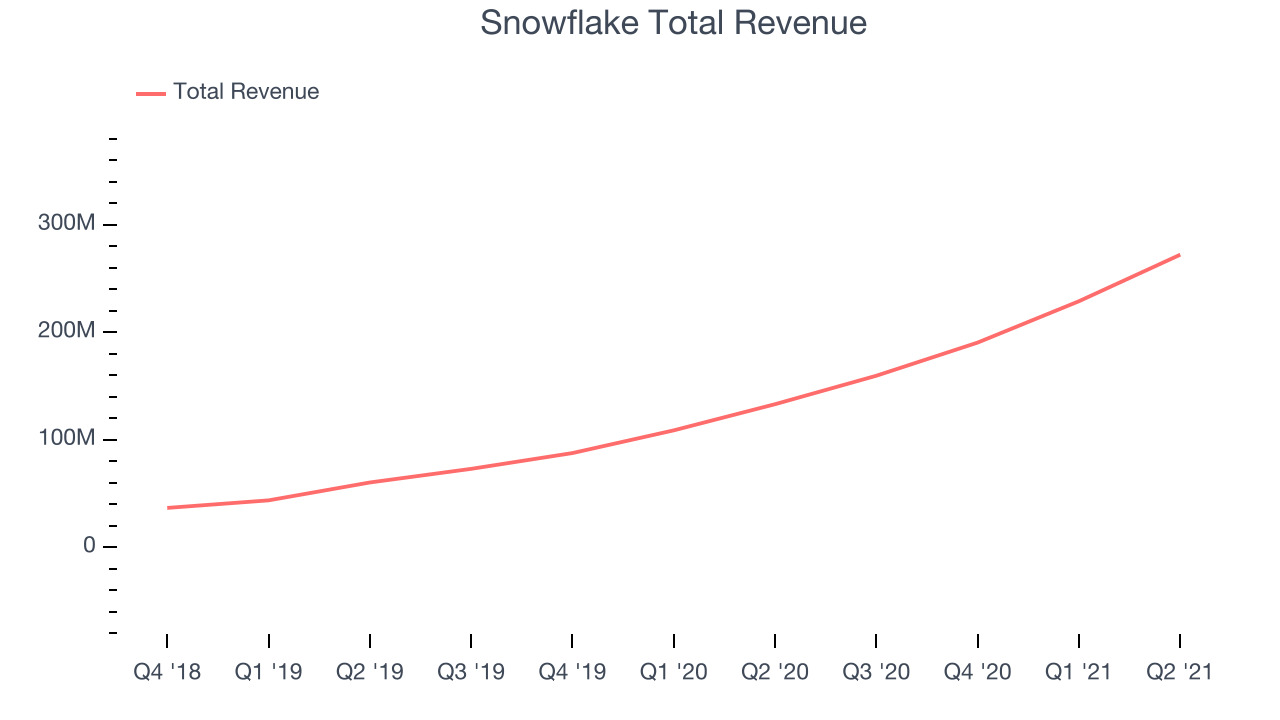

Snowflake (NYSE:SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $272.1 million, up 104% year on year, beating analyst expectations by 6.01%. It was a very strong quarter for the company, with an exceptional revenue growth and a significant improvement in gross margin.

“Snowflake saw continued momentum in Q2 with triple-digit growth in product revenue, reflecting strength in customer consumption,” said Snowflake Chairman and CEO Frank Slootman.

Snowflake achieved the fastest revenue growth and highest full year guidance raise of the whole group. The company added 12 enterprise customers paying more than $1m annually to a total of 116. The stock is up 7.63% since the results and currently trades at $293.06.

Read our full, actionable report on Snowflake here, it's free.

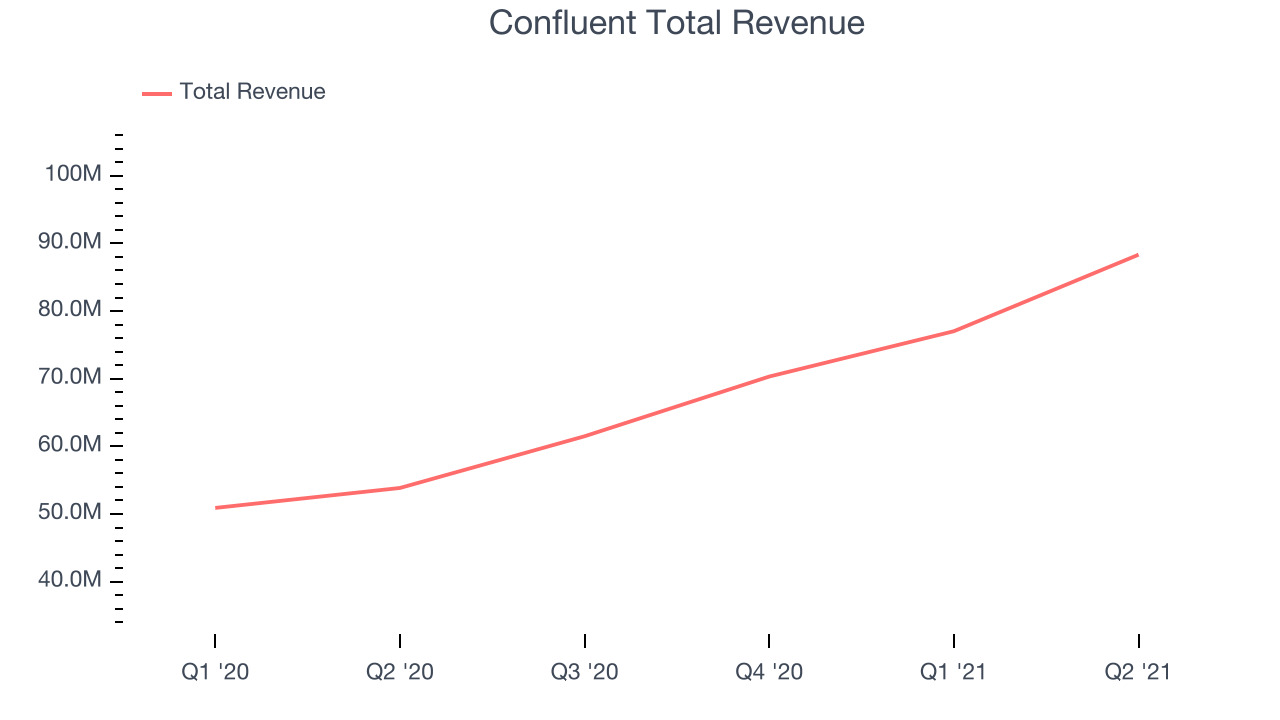

Best Q2: Confluent (NASDAQ:CFLT)

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Confluent reported revenues of $88.3 million, up 64% year on year, beating analyst expectations by 14.9%. It was an impressive quarter for the company, with a strong beat of analyst estimates and an exceptional revenue growth.

Confluent delivered the strongest analyst estimates beat among its peers. The stock is up 10.1% since the results and currently trades at $58.11.

Is now the time to buy Confluent? Access our full analysis of the earnings results here, it's free.

Weakest Q2: C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $52.4 million, up 29.4% year on year, beating analyst expectations by 2.21%. It was a decent quarter for the company, with a strong top line growth but a decline in gross margin.

C3.ai had the weakest performance against analyst estimates in the group. The stock is down 10.3% since the results and currently trades at $43.01.

Read our full analysis of C3.ai's results here.

MongoDB (NASDAQ:MDB)

Started in 2007 by the team behind Google’s ad platform DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $198.7 million, up 43.7% year on year, beating analyst expectations by 7.9%. It was a strong quarter for the company, with an exceptional revenue growth.

MongoDB had the weakest full year guidance update among the peers. The company added 69 enterprise customers paying more than $100,000 annually to a total of 1,126. The stock is up 26.1% since the results and currently trades at $452.21.

Read our full, actionable report on MongoDB here, it's free.

Elastic (NYSE:ESTC)

Founded in 2012 in the Netherlands, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Elastic reported revenues of $193 million, up 49.8% year on year, beating analyst expectations by 11.4%. It was a strong quarter for the company, with an impressive beat of analyst estimates.

The company added 50 enterprise customers paying more than $100,000 annually to a total of 780. The stock is down 3.18% since the results and currently trades at $144.16.

Read our full, actionable report on Elastic here, it's free.

The author has no position in any of the stocks mentioned